Basic Stats

| Institutional Owners | 20 total, 18 long only, 0 short only, 2 long/short - change of 0.00% MRQ |

| Average Portfolio Allocation | 0.0049 % - change of -16.44% MRQ |

| Institutional Shares (Long) | 208,070 (ex 13D/G) - change of 0.01MM shares 22.80% MRQ |

| Institutional Value (Long) | $ 6,793 USD ($1000) |

Institutional Ownership and Shareholders

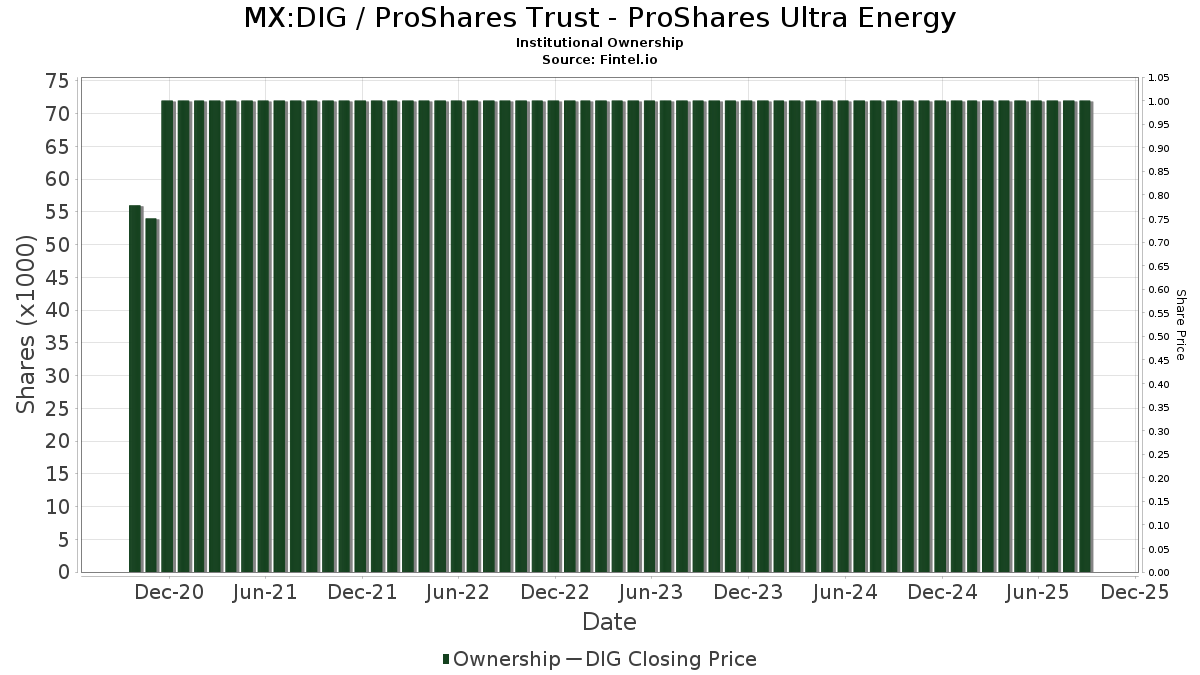

ProShares Trust - ProShares Ultra Energy (MX:DIG) has 20 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). These institutions hold a total of 208,070 shares. Largest shareholders include Citadel Advisors Llc, Susquehanna International Group, Llp, Susquehanna International Group, Llp, Jane Street Group, Llc, Tower Research Capital LLC (TRC), Citadel Advisors Llc, Susquehanna International Group, Llp, SMIFX - Sound Mind Investing Fund, SMILX - SMI 50/40/10 Fund, and Dale Q Rice Investment Management Ltd .

ProShares Trust - ProShares Ultra Energy (BMV:DIG) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest changes in position size. Major shareholders can include individual investors, mutual funds, hedge funds, or institutions. The Schedule 13D indicates that the investor holds (or held) more than 5% of the company and intends (or intended) to actively pursue a change in business strategy. Schedule 13G indicates a passive investment of over 5%.

Fund Sentiment Score

The Fund Sentiment Score (fka Ownership Accumulation Score) finds the stocks that are being most bought by funds. It is the result of a sophisticated, multi-factor quantitative model that identifies companies with the highest levels of institutional accumulation. The scoring model uses a combination of the total increase in disclosed owners, the changes in portfolio allocations in those owners and other metrics. The number ranges from 0 to 100, with higher numbers indicating a higher level of accumulation to its peers, and 50 being the average.

Update Frequency: Daily

See Ownership Explorer, which provides a list of highest-ranking companies.

13F and NPORT Filings

Detail on 13F filings are free. Detail on NP filings require a premium membership. Green rows indicate new positions. Red rows indicate closed positions. Click the link icon to see the full transaction history.

Upgrade

to unlock premium data and export to Excel ![]() .

.

| File Date | Source | Investor | Type | Avg Price (Est) |

Shares | Δ Shares (%) |

Reported Value ($1000) |

Δ Value (%) |

Port Alloc (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 452 | -14.23 | 15 | -31.82 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | 14,612 | 486 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 60,700 | 294.16 | 2,020 | 211.25 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | 21,001 | -46.15 | 699 | -57.57 | ||||

| 2025-06-30 | NP | SMIFX - Sound Mind Investing Fund | 17,850 | 539 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 6,900 | 122.58 | 230 | 76.15 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | 997 | 33 | ||||||

| 2025-07-10 | 13F | PMV Capital Advisers, LLC | 13,090 | 383.92 | 436 | 281.58 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 26,205 | 789.21 | 872 | 603.23 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1 | 0 | ||||||

| 2025-05-07 | 13F | Pin Oak Investment Advisors Inc | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 30,709 | 179.17 | 1,022 | 120.04 | ||||

| 2025-07-09 | 13F | Reyes Financial Architecture, Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-11 | 13F | VSM Wealth Advisory, LLC | 8 | 0.00 | 0 | |||||

| 2025-08-12 | 13F | MAI Capital Management | 338 | 0.00 | 11 | -21.43 | ||||

| 2025-08-14 | 13F | UBS Group AG | 226 | 162.79 | 8 | 133.33 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 232 | 0.00 | 8 | -22.22 | ||||

| 2025-06-30 | NP | SMILX - SMI 50/40/10 Fund | 17,850 | 539 | ||||||

| 2025-05-05 | 13F | Csenge Advisory Group | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 0 | -100.00 | 0 | |||||

| 2025-05-09 | 13F | Fairfield Financial Advisors, LTD | 0 | -100.00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | -100.00 | 0 | |||||

| 2025-07-25 | 13F | Hazlett, Burt & Watson, Inc. | 862 | 0.00 | 0 | |||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 0 | -100.00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 2,411 | -41.18 | 80 | -53.49 | ||||

| 2025-05-15 | 13F | Bank Of America Corp /de/ | 0 | -100.00 | 0 | |||||

| 2025-08-07 | 13F | Runnymede Capital Advisors, Inc. | 0 | -100.00 | 0 | |||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-05-06 | 13F | AE Wealth Management LLC | 0 | -100.00 | 0 | |||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 11,811 | 393 | ||||||

| 2025-07-29 | 13F | Dale Q Rice Investment Management Ltd | 15,536 | -50.00 | 531 | -59.54 | ||||

| 2025-04-07 | 13F | GoalVest Advisory LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 0 | -100.00 | 0 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 33,695 | 22.78 | 1,121 | -3.11 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 57,800 | 28.44 | 1,924 | 1.32 | |||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 20,300 | 676 | |||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 184 | 0.55 | 6 | -14.29 |

Other Listings

| US:DIG | $34.71 |