Basic Stats

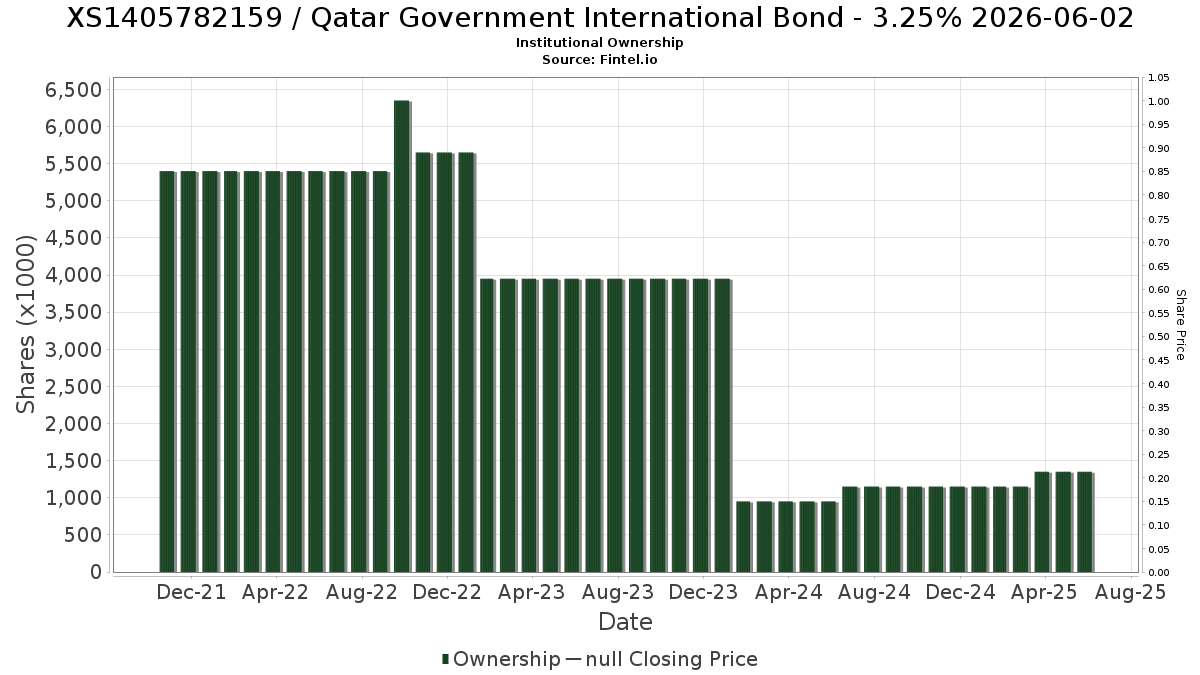

| Institutional Owners | 0 total, 0 long only, 0 short only, 0 long/short - change of -16.67% MRQ |

| Average Portfolio Allocation | 0.2308 % - change of 13.11% MRQ |

Institutional Ownership and Shareholders

Qatar Government International Bond (QA:XS1405782159) has 0 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). Largest shareholders include .

Qatar Government International Bond (XS1405782159) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest changes in position size. Major shareholders can include individual investors, mutual funds, hedge funds, or institutions. The Schedule 13D indicates that the investor holds (or held) more than 5% of the company and intends (or intended) to actively pursue a change in business strategy. Schedule 13G indicates a passive investment of over 5%.

13F and NPORT Filings

Detail on 13F filings are free. Detail on NP filings require a premium membership. Green rows indicate new positions. Red rows indicate closed positions. Click the link icon to see the full transaction history.

Upgrade

to unlock premium data and export to Excel ![]() .

.