Basic Stats

| Institutional Owners | 8 total, 8 long only, 0 short only, 0 long/short - change of -27.27% MRQ |

| Average Portfolio Allocation | 0.0169 % - change of 10.56% MRQ |

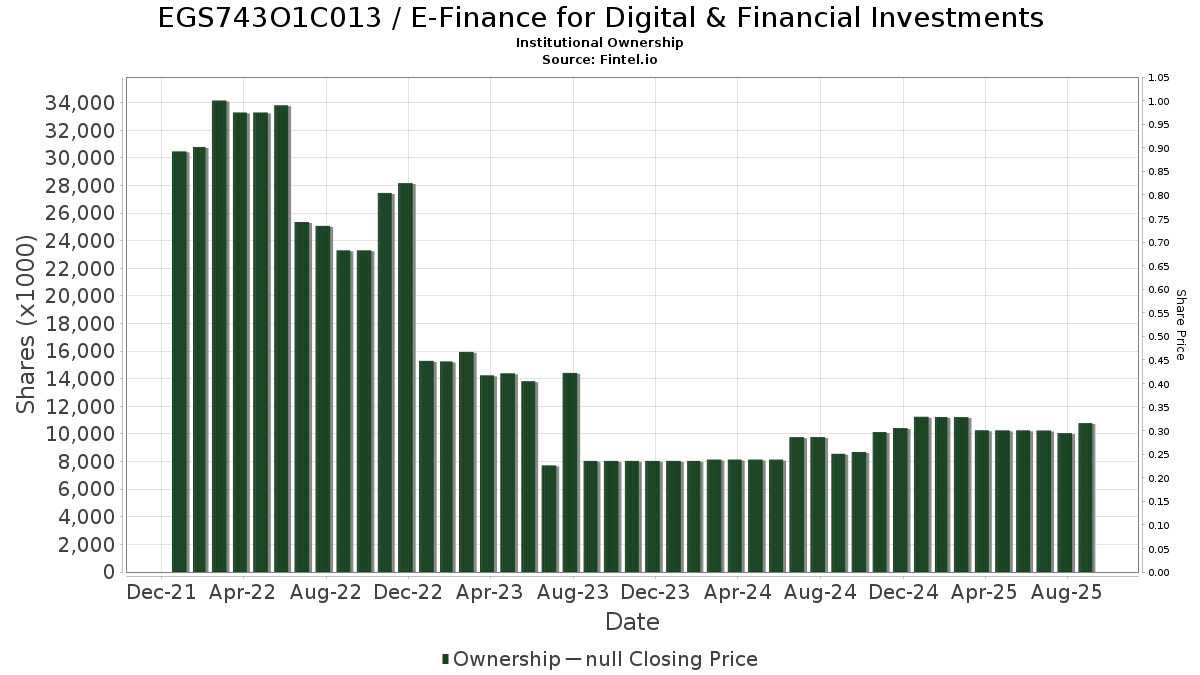

| Institutional Shares (Long) | 10,788,277 (ex 13D/G) - change of 0.53MM shares 5.15% MRQ |

| Institutional Value (Long) | $ 3,846 USD ($1000) |

Institutional Ownership and Shareholders

E-Finance for Digital & Financial Investments (EG:EGS743O1C013) has 8 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). These institutions hold a total of 10,788,277 shares. Largest shareholders include IEMG - iShares Core MSCI Emerging Markets ETF, Global Macro Capital Opportunities Portfolio - Global Macro Capital Opportunities Portfolio, QCSTRX - Stock Account Class R1, EITEX - Parametric Tax-Managed Emerging Markets Fund Institutional Class, EWX - SPDR(R) S&P(R) EMERGING MARKETS SMALL CAP ETF, EAEMX - Parametric Emerging Markets Fund Investor Class, SSGVX - State Street Global Equity ex-U.S. Index Portfolio State Street Global All Cap Equity ex-U.S. Index Portfolio, and TLTE - FlexShares Morningstar Emerging Markets Factor Tilt Index Fund .

E-Finance for Digital & Financial Investments (EGS743O1C013) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest changes in position size. Major shareholders can include individual investors, mutual funds, hedge funds, or institutions. The Schedule 13D indicates that the investor holds (or held) more than 5% of the company and intends (or intended) to actively pursue a change in business strategy. Schedule 13G indicates a passive investment of over 5%.

13F and NPORT Filings

Detail on 13F filings are free. Detail on NP filings require a premium membership. Green rows indicate new positions. Red rows indicate closed positions. Click the link icon to see the full transaction history.

Upgrade

to unlock premium data and export to Excel ![]() .

.