Basic Stats

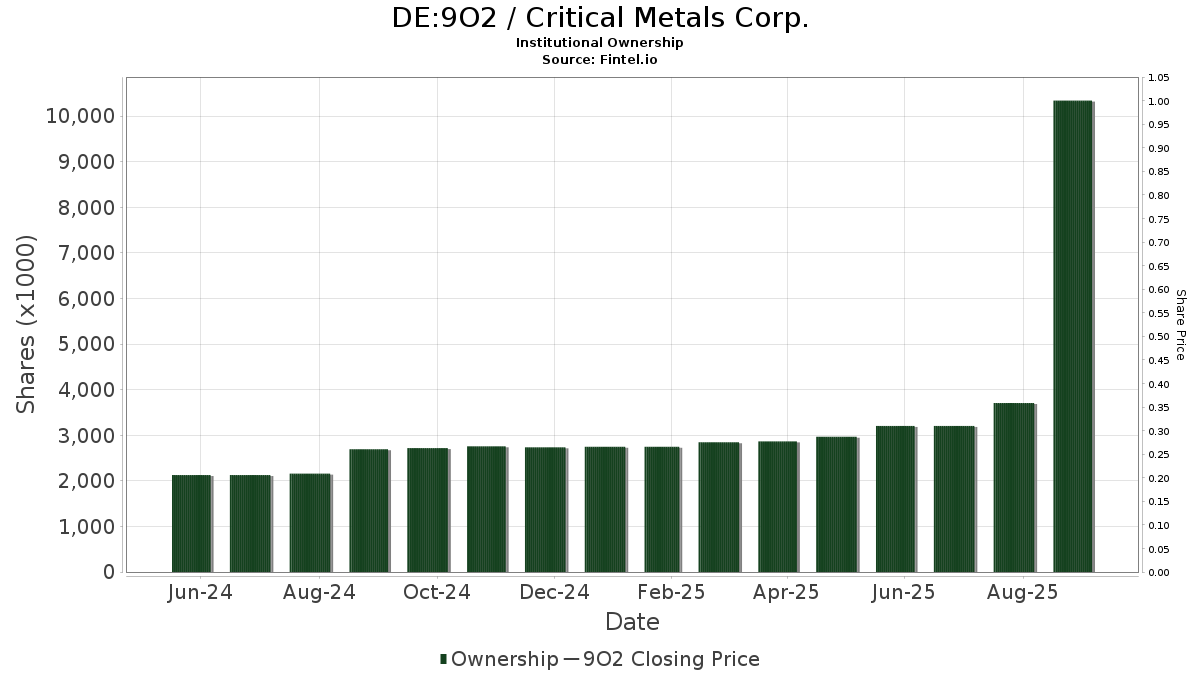

| Institutional Shares (Long) | 10,341,630 - 9.98% (ex 13D/G) - change of 7.14MM shares 222.71% MRQ |

| Institutional Value (Long) | $ 34,412 USD ($1000) |

Institutional Ownership and Shareholders

Critical Metals Corp. (DE:9O2) has 88 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). These institutions hold a total of 10,341,630 shares. Largest shareholders include Crcm Lp, BlackRock, Inc., UBS Group AG, Linden Advisors Lp, Geode Capital Management, Llc, Aqr Capital Management Llc, Saba Capital Management, L.P., FNY Investment Advisers, LLC, Shay Capital LLC, and Cantor Fitzgerald, L. P. .

Critical Metals Corp. (DB:9O2) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest changes in position size. Major shareholders can include individual investors, mutual funds, hedge funds, or institutions. The Schedule 13D indicates that the investor holds (or held) more than 5% of the company and intends (or intended) to actively pursue a change in business strategy. Schedule 13G indicates a passive investment of over 5%.

Fund Sentiment Score

The Fund Sentiment Score (fka Ownership Accumulation Score) finds the stocks that are being most bought by funds. It is the result of a sophisticated, multi-factor quantitative model that identifies companies with the highest levels of institutional accumulation. The scoring model uses a combination of the total increase in disclosed owners, the changes in portfolio allocations in those owners and other metrics. The number ranges from 0 to 100, with higher numbers indicating a higher level of accumulation to its peers, and 50 being the average.

Update Frequency: Daily

See Ownership Explorer, which provides a list of highest-ranking companies.

13F and NPORT Filings

Detail on 13F filings are free. Detail on NP filings require a premium membership. Green rows indicate new positions. Red rows indicate closed positions. Click the link icon to see the full transaction history.

Upgrade

to unlock premium data and export to Excel ![]() .

.

| File Date | Source | Investor | Type | Avg Price (Est) |

Shares | Δ Shares (%) |

Reported Value ($1000) |

Δ Value (%) |

Port Alloc (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Polar Asset Management Partners Inc. | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 3,567 | 13 | ||||||

| 2025-08-08 | 13F | Police & Firemen's Retirement System of New Jersey | 9,158 | 33 | ||||||

| 2025-08-11 | 13F | Vanguard Group Inc | 207,879 | 276.91 | 744 | 878.95 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 3,267 | -92.61 | 12 | -81.97 | ||||

| 2025-08-26 | NP | NSIDX - Northern Small Cap Index Fund | 15,038 | 294.39 | 54 | 960.00 | ||||

| 2025-08-27 | NP | BBVSX - Bridge Builder Small/Mid Cap Value Fund | 8,484 | 30 | ||||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-08-12 | 13F | Virtu Financial LLC | 52,399 | 0 | ||||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 982 | 59.42 | 4 | |||||

| 2025-08-14 | 13F | Point72 Asia (Singapore) Pte. Ltd. | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Cantor Fitzgerald, L. P. | 248,796 | 54.41 | 891 | 299.10 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 92 | 0 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 248,188 | 250.97 | 889 | 806.12 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 17,166 | 196.48 | 61 | 662.50 | ||||

| 2025-06-23 | NP | PPNMX - SmallCap Growth Fund I R-3 | 902 | 0.00 | 1 | -83.33 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 1,096 | 258.17 | 4 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 13,258 | 121.78 | 47 | 487.50 | ||||

| 2025-08-14 | 13F | Linden Advisors Lp | 625,000 | 0.00 | 2,238 | 179.97 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 129 | 4,200.00 | 0 | |||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 16,520 | 57 | ||||||

| 2025-08-25 | NP | SPROTT FUNDS TRUST - Sprott Lithium Miners ETF | 39,674 | 7.81 | 142 | 178.43 | ||||

| 2025-08-27 | NP | BBGSX - Bridge Builder Small/Mid Cap Growth Fund | 1,542 | 0.00 | 6 | 150.00 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 1,648,773 | 600.13 | 5,903 | 1,704.89 | ||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 17,592 | 288.26 | 63 | 933.33 | ||||

| 2025-08-08 | 13F | Intech Investment Management Llc | 17,444 | 62 | ||||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 295,976 | 1 | ||||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 0 | -100.00 | 0 | |||||

| 2025-08-14 | 13F | State Street Corp | 145,592 | 151.85 | 521 | 551.25 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 443,855 | 789.67 | 1,589 | 2,202.90 | ||||

| 2025-08-05 | 13F | Next Capital Management LLC | 19,982 | 0.00 | 72 | 162.96 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 25,966 | 89.80 | 93 | 384.21 | ||||

| 2025-08-22 | NP | Columbia Funds Variable Series Trust II - Variable Portfolio - Partners Small Cap Growth Fund Class 1 | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 80,067 | 287 | ||||||

| 2025-08-04 | 13F | Amalgamated Bank | 253 | 0.00 | 0 | |||||

| 2025-08-19 | 13F/A | Pitcairn Co | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 13,443 | 48 | ||||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 145,920 | 522 | ||||||

| 2025-08-06 | 13F | True Wealth Design, LLC | 1,759 | 14,558.33 | 6 | |||||

| 2025-07-14 | 13F | Abacus Wealth Partners, LLC | 50,000 | 179 | ||||||

| 2025-08-04 | 13F | Canton Hathaway, LLC | 86,000 | 0 | ||||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 72,246 | 539.80 | 259 | 1,620.00 | ||||

| 2025-08-14 | 13F | Saba Capital Management, L.P. | 300,000 | 0.00 | 1,074 | 240.95 | ||||

| 2025-08-14 | 13F | Shay Capital LLC | 275,000 | 984 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 33,751 | 121 | ||||||

| 2025-08-13 | 13F | Cerity Partners LLC | 63,000 | 226 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 31,284 | 456.56 | 0 | |||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 2,000 | 7 | ||||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 8,700 | 0.00 | 0 | |||||

| 2025-07-31 | 13F | Nisa Investment Advisors, Llc | 149 | 0.00 | 1 | |||||

| 2025-08-18 | 13F/A | Hudson Bay Capital Management LP | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 455,006 | 272.56 | 1,629 | 863.31 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 40 | -93.33 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 544 | 9.90 | 2 | |||||

| 2025-08-26 | NP | Profunds - Profund Vp Small-cap | 74 | 311.11 | 0 | |||||

| 2025-07-09 | 13F | Pallas Capital Advisors LLC | 12,481 | 45 | ||||||

| 2025-08-14 | 13F/A | Barclays Plc | 177,673 | 478.04 | 1 | |||||

| 2025-08-14 | 13F | Toronto Dominion Bank | 5,000 | -75.00 | 18 | -37.04 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 101,742 | 65.57 | 364 | 328.24 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 0 | -100.00 | 0 | |||||

| 2025-08-11 | 13F | Alps Advisors Inc | 39,674 | 7.81 | 142 | 178.43 | ||||

| 2025-08-14 | 13F | Peak6 Llc | 224,422 | 25.08 | 803 | 222.49 | ||||

| 2025-07-22 | NP | DSMFX - Destinations Small-Mid Cap Equity Fund Class I | 438 | 0.00 | 1 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 38,955 | 139 | ||||||

| 2025-08-12 | 13F | Nuveen, LLC | 44,232 | 158 | ||||||

| 2025-06-23 | NP | UAPIX - Ultrasmall-cap Profund Investor Class | 81 | -31.93 | 0 | |||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 29,612 | 106 | ||||||

| 2025-08-13 | 13F | Northern Trust Corp | 173,878 | 622 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | California State Teachers Retirement System | 2,009 | 279.06 | 7 | |||||

| 2025-06-23 | NP | SLPIX - Small-cap Profund Investor Class | 8 | -20.00 | 0 | |||||

| 2025-08-08 | 13F/A | Sterling Capital Management LLC | 565 | 6,962.50 | 2 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 26,585 | -38.24 | 95 | 61.02 | ||||

| 2025-07-29 | NP | VRTGX - Vanguard Russell 2000 Growth Index Fund Institutional Shares | 7,446 | -1.51 | 10 | -28.57 | ||||

| 2025-06-26 | NP | TISBX - TIAA-CREF Small-Cap Blend Index Fund Institutional Class | 9,649 | 0.00 | 16 | -79.73 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 0 | -100.00 | 0 | |||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 100,000 | 358 | ||||||

| 2025-08-14 | 13F | Scientech Research LLC | 86,662 | 310 | ||||||

| 2025-08-12 | 13F | LPL Financial LLC | 34,375 | 123 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 37,332 | 134 | ||||||

| 2025-08-26 | NP | Profunds - Profund Vp Ultrasmall-cap | 112 | 286.21 | 0 | |||||

| 2025-08-14 | 13F | Fmr Llc | 2,300 | -71.45 | 8 | -27.27 | ||||

| 2025-08-11 | 13F | Blue Owl Capital Holdings LP | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | UBS Group AG | 984,497 | 868.07 | 3,524 | 2,399.29 | ||||

| 2025-07-29 | NP | VRTTX - Vanguard Russell 3000 Index Fund Institutional Shares | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-14 | 13F | Price T Rowe Associates Inc /md/ | 16,260 | 0 | ||||||

| 2025-08-11 | 13F | Covestor Ltd | 29 | 222.22 | 0 | |||||

| 2025-07-29 | NP | VRTIX - Vanguard Russell 2000 Index Fund Institutional Shares | 41,543 | 8.88 | 57 | -20.83 | ||||

| 2025-08-12 | 13F | Corebridge Financial, Inc. | 0 | -100.00 | 0 | |||||

| 2025-06-27 | NP | RSSL - Global X Russell 2000 ETF | 4,582 | 6.48 | 7 | -78.79 | ||||

| 2025-08-12 | 13F | Ameritas Investment Partners, Inc. | 3,287 | 359.08 | 12 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 40,000 | -4.76 | 0 | |||||

| 2025-08-04 | 13F | Strs Ohio | 1,400 | 0.00 | 5 | 400.00 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 3,107 | 287.41 | 11 | 1,000.00 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | -100.00 | 0 | -100.00 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 80,841 | 367.13 | 289 | 1,104.17 | ||||

| 2025-08-13 | 13F | Crcm Lp | 2,039,358 | 7,301 | ||||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 54,773 | 196 | ||||||

| 2025-08-13 | 13F | MYDA Advisors LLC | 170,000 | 609 | ||||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 10,210 | 37 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 33,039 | 142.56 | 118 | 555.56 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | -100.00 | 0 | |||||

| 2025-07-28 | NP | MSSM - Morgan Stanley Pathway Small-Mid Cap Equity ETF | 4,909 | 773.49 | 7 | 500.00 |

Other Listings

| US:CRML | 5,81 US$ |