Basic Stats

| Short Interest | 10,718,021 shares |

| Short Interest Ratio | 3.46 Days to Cover |

| Short Interest % Float | 0.62 % |

Introduction

This short interest tracker provides a variety of short interest related data, sourced from a variety of partners. The data is organized by frequency of updates, with intraday data at the top (short shares availability, short borrow fee rate), daily data (short volume, fails-to-deliver) in the middle, and the slowest updated data (short interest) at the bottom. Note that short interest is published twice-monthly, on a schedule set by FINRA.

Short Squeeze Score

The Short Squeeze Score is the result of a sophisticated, multi-factor quantitative model that identifies companies that have the highest risk of experiencing a short squeeze. The scoring model uses a combination of short interest, float, short borrow fee rates, and other metrics. The number ranges from 0 to 100, with higher numbers indicating a higher risk of a short squeeze relative to its peers, and 50 being the average.

Update Frequency: Intraday

See our Short Squeeze Leaderboards for US, Canada, Australia and Hong Kong

Short Borrow Fee Rates

QUB / Qube Holdings Limited short borrow fee rates are shown in the following table. This table shows the interest rate that must be paid by a short seller of AU:QUB to the lender of that security. This fee is shown as an annual percentage rate (APR). Lenders are funds or individuals that own the security that have indicated to the broker that they are willing to lend it out. Dividends paid to a shorted security go to the owner/lender of the security, not to the borrower.

- Start, Min, Max, Latest (Borrow Rates)

- These represent borrow rates for the day, with the rate at the start of the day, the end of the day (or the latest for the current day), the minimum rate in the day, and the maximum rate for the day. Unlike the Options Implied Borrow Rates, our source for this data always presents them as positive numbers, and they represent an annualized interest rate that is paid by the borrower for the shares.

Update Frequency: Intraday every 30 minutes.

| Date | Start | Min | Max | Latest |

|---|---|---|---|---|

| 2025-09-05 | 1.62 | 1.62 | 1.62 | 1.62 |

| 2025-09-04 | 0.92 | 0.92 | 1.62 | 1.62 |

| 2025-09-03 | 0.89 | 0.89 | 0.92 | 0.92 |

| 2025-09-02 | 2.10 | 0.89 | 2.10 | 0.89 |

| 2025-09-01 | 2.10 | 2.10 | 2.10 | 2.10 |

| 2025-08-29 | 0.94 | 0.94 | 2.10 | 2.10 |

| 2025-08-28 | 0.93 | 0.93 | 0.94 | 0.94 |

| 2025-08-27 | 1.62 | 0.93 | 1.62 | 0.93 |

| 2025-08-26 | 1.67 | 1.62 | 1.67 | 1.62 |

| 2025-08-25 | 1.67 | 1.67 | 1.67 | 1.67 |

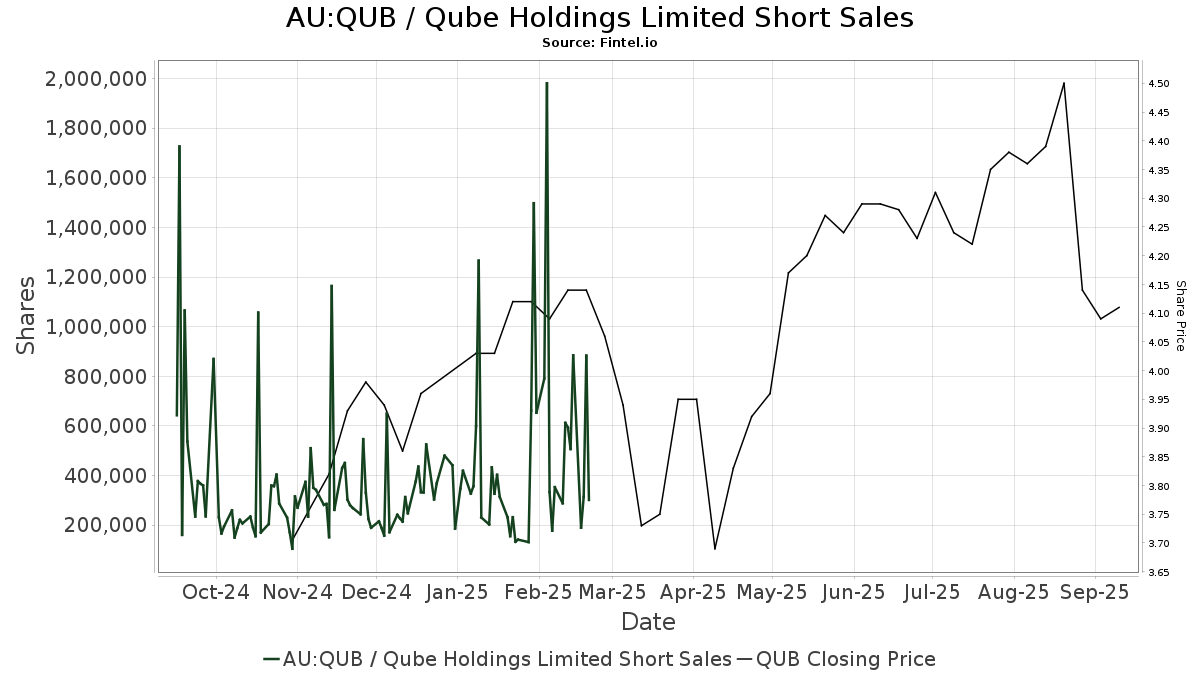

Short Sales (Official ASX Data)

This table shows the daily short sale activity as reported by the Australian Stock Exchange (ASX)

Update Frequency: Daily

| Date | Short Sales | Issued Capital (MM) | Percent Short |

|---|---|---|---|

| 2025-02-20 | 301,612 | 1,768.81 | 0.01 |

| 2025-02-19 | 883,322 | 1,768.81 | 0.05 |

| 2025-02-18 | 314,071 | 1,768.81 | 0.01 |

| 2025-02-17 | 190,203 | 1,768.81 | 0.01 |

| 2025-02-14 | 884,365 | 1,768.81 | 0.05 |

| 2025-02-13 | 507,007 | 1,768.81 | 0.02 |

| 2025-02-12 | 593,652 | 1,768.81 | 0.03 |

| 2025-02-11 | 612,330 | 1,768.81 | 0.03 |

| 2025-02-10 | 288,345 | 1,768.81 | 0.01 |

| 2025-02-07 | 353,326 | 1,768.81 | 0.02 |

| 2025-02-06 | 177,786 | 1,768.81 | 0.01 |

| 2025-02-05 | 333,458 | 1,768.81 | 0.01 |

| 2025-02-04 | 1,980,838 | 1,768.81 | 0.11 |

| 2025-02-03 | 791,376 | 1,768.81 | 0.04 |

| 2025-01-31 | 653,223 | 1,768.81 | 0.03 |

| 2025-01-30 | 1,497,550 | 1,768.81 | 0.08 |

| 2025-01-29 | 662,128 | 1,768.81 | 0.03 |

| 2025-01-28 | 131,956 | 1,768.81 | 0.00 |

| 2025-01-24 | 141,902 | 1,768.81 | 0.00 |

| 2025-01-23 | 133,326 | 1,768.81 | 0.00 |

Short Interest - Official Agency Data

Short Interest is the total number of open short positions of a security. A Short Squeeze is when a company with a high degree of short interest increases in price, which forces short sellers to "cover" their short interest by purchasing actual shares, which in turn drives the price up even further.

Update Frequency: Daily