Basic Stats

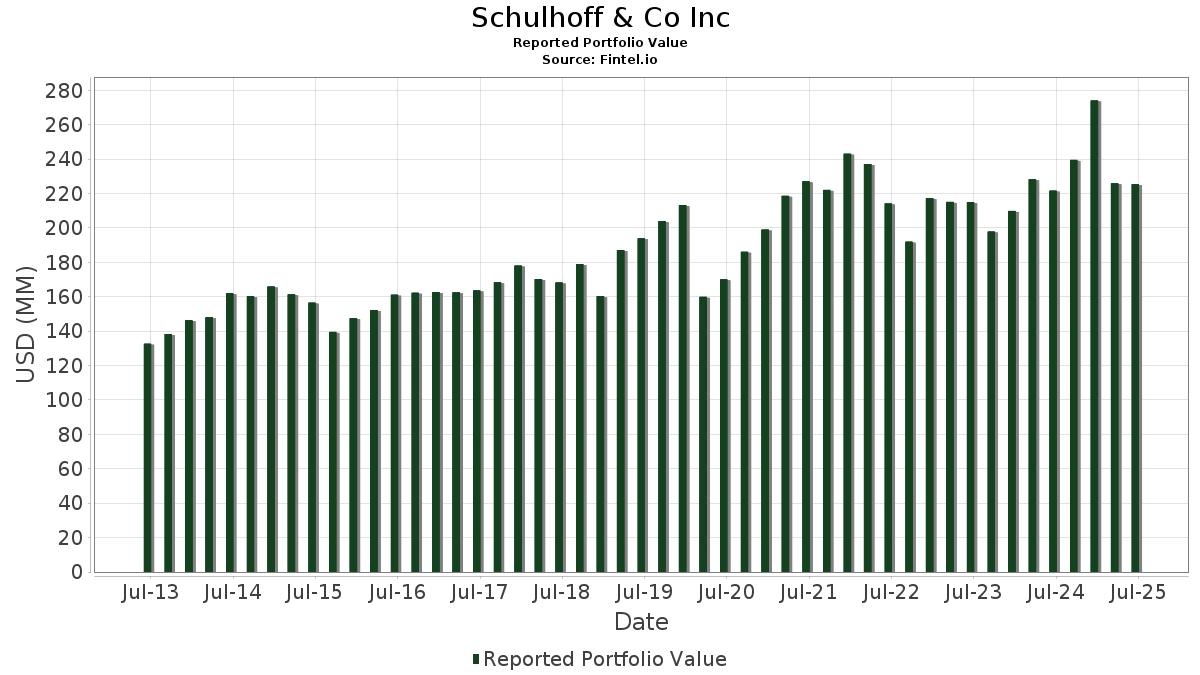

| Portfolio Value | $ 225,367,968 |

| Current Positions | 135 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Schulhoff & Co Inc has disclosed 135 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 225,367,968 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Schulhoff & Co Inc’s top holdings are Strats Trust For Procter & Gambel Security - Preferred Security (US:GJR) , JPMorgan Chase & Co. (US:JPM) , Exxon Mobil Corporation (US:XOM) , Berkshire Hathaway Inc. (US:BRK.A) , and Cincinnati Financial Corporation (US:CINF) . Schulhoff & Co Inc’s new positions include The Hershey Company (US:HSY) , Avadel Pharmaceuticals plc (US:AVDL) , Ituran Location and Control Ltd. (US:ITRN) , Alphabet Inc. (US:GOOG) , and Sprott Physical Silver Trust (US:PSLV) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 13.09 | 5.8080 | 0.8266 | |

| 0.01 | 5.93 | 2.6300 | 0.6616 | |

| 0.00 | 2.44 | 1.0822 | 0.3716 | |

| 0.01 | 3.13 | 1.3890 | 0.2226 | |

| 0.02 | 2.96 | 1.3135 | 0.2142 | |

| 0.04 | 2.73 | 1.2120 | 0.1935 | |

| 0.00 | 0.90 | 0.3975 | 0.1609 | |

| 0.01 | 2.58 | 1.1468 | 0.1437 | |

| 0.09 | 4.27 | 1.8935 | 0.1397 | |

| 0.00 | 0.28 | 0.1258 | 0.1258 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.16 | 25.20 | 11.1824 | -1.0532 | |

| 0.04 | 5.35 | 2.3749 | -0.3972 | |

| 0.08 | 8.54 | 3.7883 | -0.3592 | |

| 0.00 | 8.02 | 3.5572 | -0.3222 | |

| 0.04 | 6.47 | 2.8730 | -0.2748 | |

| 0.03 | 5.15 | 2.2873 | -0.2708 | |

| 0.02 | 3.60 | 1.5970 | -0.2640 | |

| 0.01 | 3.49 | 1.5488 | -0.2320 | |

| 0.02 | 2.91 | 1.2919 | -0.1682 | |

| 0.04 | 1.00 | 0.4416 | -0.1564 |

13F and Fund Filings

This form was filed on 2025-07-30 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.16 | -2.68 | 25.20 | -9.02 | 11.1824 | -1.0532 | |||

| JPM / JPMorgan Chase & Co. | 0.05 | -1.79 | 13.09 | 16.07 | 5.8080 | 0.8266 | |||

| XOM / Exxon Mobil Corporation | 0.08 | 0.31 | 8.54 | -9.07 | 3.7883 | -0.3592 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 8.02 | -8.72 | 3.5572 | -0.3222 | |||

| CINF / Cincinnati Financial Corporation | 0.05 | -0.25 | 8.00 | 0.57 | 3.5507 | 0.0357 | |||

| LMT / Lockheed Martin Corporation | 0.02 | -2.16 | 7.18 | 1.44 | 3.1864 | 0.0595 | |||

| JNJ / Johnson & Johnson | 0.04 | -1.36 | 6.47 | -9.15 | 2.8730 | -0.2748 | |||

| MSFT / Microsoft Corporation | 0.01 | 0.38 | 5.93 | 33.01 | 2.6300 | 0.6616 | |||

| KO / The Coca-Cola Company | 0.08 | -0.56 | 5.43 | -1.76 | 2.4083 | -0.0321 | |||

| CVX / Chevron Corporation | 0.04 | -0.37 | 5.35 | -14.71 | 2.3749 | -0.3972 | |||

| ABBV / AbbVie Inc. | 0.03 | 0.47 | 5.15 | -11.00 | 2.2873 | -0.2708 | |||

| USB / U.S. Bancorp | 0.09 | 0.28 | 4.27 | 7.48 | 1.8935 | 0.1397 | |||

| AAPL / Apple Inc. | 0.02 | 0.23 | 3.86 | -7.43 | 1.7148 | -0.1290 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 3.77 | -5.63 | 1.6748 | -0.0916 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.02 | -3.28 | 3.60 | -14.57 | 1.5970 | -0.2640 | |||

| ACN / Accenture plc | 0.01 | -9.61 | 3.49 | -13.42 | 1.5488 | -0.2320 | |||

| GD / General Dynamics Corporation | 0.01 | -2.35 | 3.31 | 4.48 | 1.4683 | 0.0694 | |||

| ABT / Abbott Laboratories | 0.02 | -2.85 | 3.25 | -0.37 | 1.4421 | 0.0010 | |||

| IBM / International Business Machines Corporation | 0.01 | 0.00 | 3.13 | 18.56 | 1.3890 | 0.2226 | |||

| EMR / Emerson Electric Co. | 0.02 | -2.19 | 2.96 | 18.97 | 1.3135 | 0.2142 | |||

| PEP / PepsiCo, Inc. | 0.02 | 0.02 | 2.91 | -11.92 | 1.2919 | -0.1682 | |||

| SMG / The Scotts Miracle-Gro Company | 0.04 | -1.42 | 2.73 | 18.48 | 1.2120 | 0.1935 | |||

| MMM / 3M Company | 0.02 | -2.80 | 2.63 | 0.77 | 1.1682 | 0.0141 | |||

| GOOGL / Alphabet Inc. | 0.01 | -0.13 | 2.58 | 13.83 | 1.1468 | 0.1437 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 17.01 | 2.44 | 51.62 | 1.0822 | 0.3716 | |||

| MDLZ / Mondelez International, Inc. | 0.04 | 1.14 | 2.39 | 0.51 | 1.0590 | 0.0104 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | -0.03 | 2.34 | 3.63 | 1.0400 | 0.0411 | |||

| T / AT&T Inc. | 0.08 | 0.00 | 2.29 | 2.32 | 1.0178 | 0.0277 | |||

| WM / Waste Management, Inc. | 0.01 | 0.04 | 2.22 | -1.11 | 0.9843 | -0.0066 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.01 | 1.41 | 2.17 | 7.58 | 0.9639 | 0.0718 | |||

| CSCO / Cisco Systems, Inc. | 0.03 | -4.29 | 2.17 | 7.60 | 0.9613 | 0.0720 | |||

| HON / Honeywell International Inc. | 0.01 | -2.19 | 2.05 | 7.55 | 0.9103 | 0.0679 | |||

| UPS / United Parcel Service, Inc. | 0.02 | -6.10 | 2.00 | -13.85 | 0.8891 | -0.1379 | |||

| VZ / Verizon Communications Inc. | 0.05 | -0.54 | 2.00 | -5.12 | 0.8887 | -0.0437 | |||

| NOC / Northrop Grumman Corporation | 0.00 | 0.00 | 1.95 | -2.35 | 0.8654 | -0.0168 | |||

| MCD / McDonald's Corporation | 0.01 | 1.59 | 1.77 | -4.99 | 0.7854 | -0.0374 | |||

| HSY / The Hershey Company | 0.01 | 1.72 | 0.0000 | ||||||

| BAC / Bank of America Corporation | 0.04 | -4.45 | 1.70 | 8.36 | 0.7538 | 0.0613 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | 0.05 | 1.67 | -9.27 | 0.7425 | -0.0724 | |||

| MKC / McCormick & Company, Incorporated | 0.02 | 0.04 | 1.54 | -7.84 | 0.6836 | -0.0549 | |||

| COST / Costco Wholesale Corporation | 0.00 | -0.42 | 1.40 | 4.24 | 0.6213 | 0.0281 | |||

| AXP / American Express Company | 0.00 | 0.00 | 1.37 | 18.60 | 0.6086 | 0.0976 | |||

| WSBC / WesBanco, Inc. | 0.04 | 0.00 | 1.31 | 2.18 | 0.5829 | 0.0149 | |||

| DUKH / Northern Lights Fund Trust - Ocean Park High Income ETF | 0.01 | 2.05 | 1.23 | -1.28 | 0.5463 | -0.0045 | |||

| AVDL / Avadel Pharmaceuticals plc | 0.14 | 1.22 | 0.0000 | ||||||

| PFE / Pfizer Inc. | 0.05 | 6.95 | 1.20 | 2.31 | 0.5315 | 0.0144 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 4.52 | 1.15 | -0.52 | 0.5121 | -0.0006 | |||

| MDT / Medtronic plc | 0.01 | -4.63 | 1.08 | -7.47 | 0.4785 | -0.0363 | |||

| BK / The Bank of New York Mellon Corporation | 0.01 | 0.03 | 1.08 | 8.68 | 0.4782 | 0.0401 | |||

| BMY / Bristol-Myers Squibb Company | 0.02 | 0.00 | 1.04 | -24.14 | 0.4604 | -0.1435 | |||

| BFB / Brown-Forman Corp. - Class B | 0.04 | -7.29 | 1.00 | -26.51 | 0.4416 | -0.1564 | |||

| MRK / Merck & Co., Inc. | 0.01 | 2.51 | 0.97 | -9.60 | 0.4307 | -0.0436 | |||

| SYY / Sysco Corporation | 0.01 | 3.04 | 0.94 | 3.97 | 0.4181 | 0.0179 | |||

| NSC / Norfolk Southern Corporation | 0.00 | 0.00 | 0.93 | 8.11 | 0.4140 | 0.0327 | |||

| EL / The Estée Lauder Companies Inc. | 0.01 | 0.12 | 0.91 | 22.64 | 0.4041 | 0.0759 | |||

| FUN / Six Flags Entertainment Corporation | 0.03 | 0.00 | 0.90 | -14.75 | 0.3979 | -0.0664 | |||

| GEV / GE Vernova Inc. | 0.00 | -3.53 | 0.90 | 67.29 | 0.3975 | 0.1609 | |||

| BFA / Brown-Forman Corp. - Class A | 0.03 | 0.00 | 0.89 | -17.98 | 0.3931 | -0.0837 | |||

| TJX / The TJX Companies, Inc. | 0.01 | 0.10 | 0.86 | 1.42 | 0.3820 | 0.0073 | |||

| ED / Consolidated Edison, Inc. | 0.01 | 0.00 | 0.84 | -9.25 | 0.3747 | -0.0364 | |||

| RYN / Rayonier Inc. | 0.04 | 0.03 | 0.82 | -20.39 | 0.3640 | -0.0913 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.01 | 4.36 | 0.82 | 0.25 | 0.3625 | 0.0026 | |||

| HUBB / Hubbell Incorporated | 0.00 | 0.00 | 0.81 | 23.44 | 0.3603 | 0.0697 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.05 | 0.77 | 14.90 | 0.3422 | 0.0455 | |||

| SPRY / ARS Pharmaceuticals, Inc. | 0.04 | 7.41 | 0.76 | 49.12 | 0.3368 | 0.1118 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.01 | 0.07 | 0.73 | 8.75 | 0.3253 | 0.0272 | |||

| DIS / The Walt Disney Company | 0.01 | -9.57 | 0.70 | 13.75 | 0.3120 | 0.0386 | |||

| HSY / The Hershey Company | 0.00 | 0.00 | 0.69 | -3.08 | 0.3079 | -0.0080 | |||

| CTVA / Corteva, Inc. | 0.01 | -2.63 | 0.69 | 15.41 | 0.3059 | 0.0418 | |||

| NEE / NextEra Energy, Inc. | 0.01 | 0.00 | 0.69 | -2.00 | 0.3049 | -0.0050 | |||

| MEDP / Medpace Holdings, Inc. | 0.00 | -18.40 | 0.69 | -15.93 | 0.3046 | -0.0561 | |||

| OGE / OGE Energy Corp. | 0.01 | 0.00 | 0.66 | -3.52 | 0.2919 | -0.0090 | |||

| LHX / L3Harris Technologies, Inc. | 0.00 | 17.81 | 0.62 | 41.36 | 0.2760 | 0.0814 | |||

| DD / DuPont de Nemours, Inc. | 0.01 | -2.95 | 0.61 | -10.93 | 0.2715 | -0.0317 | |||

| NEM / Newmont Corporation | 0.01 | 0.00 | 0.61 | 20.63 | 0.2701 | 0.0473 | |||

| PLTR / Palantir Technologies Inc. | 0.00 | 0.00 | 0.59 | 61.31 | 0.2631 | 0.1010 | |||

| SPG / Simon Property Group, Inc. | 0.00 | 4.85 | 0.57 | 1.42 | 0.2542 | 0.0049 | |||

| WMB / The Williams Companies, Inc. | 0.01 | -22.11 | 0.56 | -31.66 | 0.2475 | -0.1129 | |||

| SO / The Southern Company | 0.01 | 0.00 | 0.54 | -0.19 | 0.2394 | 0.0008 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.01 | -7.08 | 0.52 | -8.77 | 0.2308 | -0.0213 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 0.51 | 17.67 | 0.2248 | 0.0347 | |||

| WFC / Wells Fargo & Company | 0.01 | -7.32 | 0.51 | 3.48 | 0.2242 | 0.0084 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.03 | 11.36 | 0.50 | 8.62 | 0.2240 | 0.0187 | |||

| PEYUF / Peyto Exploration & Development Corp. | 0.03 | 0.00 | 0.49 | 12.53 | 0.2154 | 0.0249 | |||

| CL / Colgate-Palmolive Company | 0.01 | 0.00 | 0.48 | -3.01 | 0.2151 | -0.0056 | |||

| INTC / Intel Corporation | 0.02 | -8.76 | 0.47 | -10.04 | 0.2070 | -0.0220 | |||

| WY / Weyerhaeuser Company | 0.02 | 0.00 | 0.47 | -12.26 | 0.2064 | -0.0278 | |||

| PIPR / Piper Sandler Companies | 0.00 | 0.00 | 0.46 | 12.41 | 0.2051 | 0.0232 | |||

| RTX / RTX Corporation | 0.00 | -6.00 | 0.46 | 3.63 | 0.2032 | 0.0080 | |||

| CHDN / Churchill Downs Incorporated | 0.00 | 18.62 | 0.45 | 7.91 | 0.1999 | 0.0154 | |||

| FDX / FedEx Corporation | 0.00 | 14.03 | 0.43 | 6.37 | 0.1926 | 0.0123 | |||

| AMP / Ameriprise Financial, Inc. | 0.00 | 0.00 | 0.43 | 10.08 | 0.1895 | 0.0184 | |||

| CPT / Camden Property Trust | 0.00 | 0.00 | 0.40 | -7.80 | 0.1786 | -0.0144 | |||

| EVRG / Evergy, Inc. | 0.01 | 0.00 | 0.38 | 0.00 | 0.1682 | 0.0007 | |||

| WDFC / WD-40 Company | 0.00 | 0.00 | 0.34 | -6.52 | 0.1528 | -0.0099 | |||

| KIM / Kimco Realty Corporation | 0.02 | 8.30 | 0.34 | 7.21 | 0.1521 | 0.0108 | |||

| SJM / The J. M. Smucker Company | 0.00 | 0.00 | 0.34 | -17.03 | 0.1515 | -0.0304 | |||

| SLV / iShares Silver Trust | 0.01 | 0.00 | 0.34 | 5.90 | 0.1514 | 0.0090 | |||

| KVUE / Kenvue Inc. | 0.02 | -1.23 | 0.34 | -13.66 | 0.1488 | -0.0230 | |||

| ENB / Enbridge Inc. | 0.01 | 0.00 | 0.33 | 2.52 | 0.1447 | 0.0039 | |||

| UNM / Unum Group | 0.00 | 0.00 | 0.32 | -0.62 | 0.1433 | -0.0006 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 2.31 | 0.32 | -6.67 | 0.1429 | -0.0095 | |||

| V / Visa Inc. | 0.00 | 0.00 | 0.32 | 1.27 | 0.1418 | 0.0025 | |||

| CTAS / Cintas Corporation | 0.00 | 0.00 | 0.32 | 8.62 | 0.1398 | 0.0115 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | 0.00 | 0.31 | 0.00 | 0.1385 | 0.0002 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.00 | 0.31 | 10.28 | 0.1383 | 0.0137 | |||

| CLX / The Clorox Company | 0.00 | 0.00 | 0.31 | -18.52 | 0.1368 | -0.0302 | |||

| KMI / Kinder Morgan, Inc. | 0.01 | -0.95 | 0.31 | 2.34 | 0.1358 | 0.0034 | |||

| VODAFONE GROUP PLC ADR / (92857T107) | 0.03 | 0.30 | 0.0000 | ||||||

| PYXS / Pyxis Oncology, Inc. | 0.28 | 125.41 | 0.30 | 153.78 | 0.1342 | 0.0814 | |||

| SOLV / Solventum Corporation | 0.00 | -3.11 | 0.30 | -3.28 | 0.1311 | -0.0039 | |||

| DIAMONDS TRUST UNIT SERIES 1 / (252787106) | 0.00 | 0.29 | 0.0000 | ||||||

| SLB / Schlumberger Limited | 0.01 | 35.90 | 0.29 | 10.00 | 0.1272 | 0.0120 | |||

| JCI / Johnson Controls International plc | 0.00 | 0.28 | 0.1258 | 0.1258 | |||||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 0.28 | 10.76 | 0.1234 | 0.0122 | |||

| FITB / Fifth Third Bancorp | 0.01 | 0.00 | 0.28 | 4.92 | 0.1232 | 0.0063 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.28 | 22.67 | 0.1227 | 0.0233 | |||

| AEP / American Electric Power Company, Inc. | 0.00 | 0.00 | 0.27 | -4.95 | 0.1195 | -0.0058 | |||

| LAMR / Lamar Advertising Company | 0.00 | 24.01 | 0.27 | 32.34 | 0.1182 | 0.0292 | |||

| MPLX / MPLX LP - Limited Partnership | 0.01 | 0.00 | 0.26 | -3.75 | 0.1143 | -0.0039 | |||

| SHW / The Sherwin-Williams Company | 0.00 | 0.00 | 0.25 | -1.95 | 0.1121 | -0.0014 | |||

| ITRN / Ituran Location and Control Ltd. | 0.01 | 0.24 | 0.1078 | 0.1078 | |||||

| AMGN / Amgen Inc. | 0.00 | 3.58 | 0.24 | -7.28 | 0.1077 | -0.0078 | |||

| GOOG / Alphabet Inc. | 0.00 | 0.24 | 0.1059 | 0.1059 | |||||

| DOW / Dow Inc. | 0.01 | -3.02 | 0.23 | -26.52 | 0.1022 | -0.0361 | |||

| KHC / The Kraft Heinz Company | 0.01 | 0.51 | 0.23 | -14.66 | 0.1009 | -0.0169 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.22 | 0.00 | 0.0992 | 0.0005 | |||

| EW / Edwards Lifesciences Corporation | 0.00 | 0.00 | 0.22 | 7.73 | 0.0991 | 0.0077 | |||

| MAC / The Macerich Company | 0.01 | 0.00 | 0.22 | -5.51 | 0.0991 | -0.0056 | |||

| TGNA / TEGNA Inc. | 0.01 | 0.00 | 0.22 | -7.98 | 0.0974 | -0.0080 | |||

| COP / ConocoPhillips | 0.00 | 0.00 | 0.22 | -14.34 | 0.0955 | -0.0158 | |||

| ACAZF / Acadian Timber Corp. | 0.01 | 0.00 | 0.17 | 8.13 | 0.0770 | 0.0060 | |||

| PSLV / Sprott Physical Silver Trust | 0.01 | 0.15 | 0.0652 | 0.0652 | |||||

| WU / The Western Union Company | 0.01 | -16.81 | 0.13 | -33.51 | 0.0555 | -0.0279 | |||

| ASRV / AmeriServ Financial, Inc. | 0.01 | 0.00 | 0.04 | 25.81 | 0.0175 | 0.0036 |