Basic Stats

| Portfolio Value | $ 116,094,320 |

| Current Positions | 54 |

Latest Holdings, Performance, AUM (from 13F, 13D)

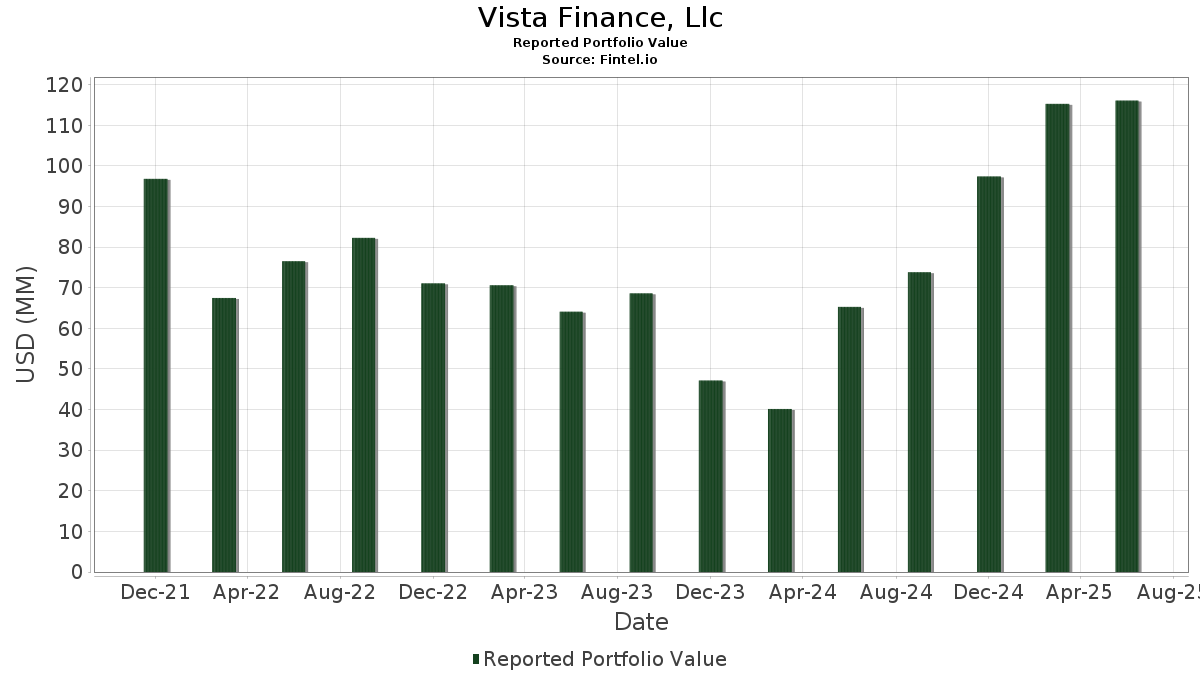

Vista Finance, Llc has disclosed 54 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 116,094,320 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Vista Finance, Llc’s top holdings are SPDR Gold Trust (US:GLD) , FS Credit Opportunities Corp. (US:FSCO) , Ares Capital Corporation (US:ARCC) , ALPS ETF Trust - Alerian MLP ETF (US:AMLP) , and iShares, Inc. - iShares MSCI Emerging Markets ETF (US:EEM) . Vista Finance, Llc’s new positions include General Electric Company (US:GE) , Alamo Group Inc. (US:ALG) , APi Group Corporation (US:APG) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 25.00 | 21.5339 | 3.9112 | |

| 2.05 | 14.92 | 12.8493 | 0.8888 | |

| 0.22 | 4.66 | 4.0139 | 0.6664 | |

| 0.58 | 12.82 | 11.0430 | 0.5055 | |

| 0.17 | 8.36 | 7.2041 | 0.4513 | |

| 0.03 | 1.83 | 1.5757 | 0.3622 | |

| 0.01 | 2.72 | 2.3394 | 0.3415 | |

| 0.01 | 1.13 | 0.9694 | 0.3077 | |

| 0.01 | 0.58 | 0.4964 | 0.2809 | |

| 0.00 | 0.26 | 0.2226 | 0.2226 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.21 | 10.35 | 8.9142 | -0.8285 | |

| 0.01 | 0.37 | 0.3215 | -0.7875 | |

| 0.00 | 1.29 | 1.1140 | -0.2302 | |

| 0.01 | 1.18 | 1.0183 | -0.0918 | |

| 0.05 | 3.66 | 3.1502 | -0.0900 | |

| 0.16 | 5.31 | 4.5735 | -0.0457 | |

| 0.00 | 0.26 | 0.2264 | -0.0267 | |

| 0.00 | 0.34 | 0.2896 | -0.0222 | |

| 0.01 | 0.27 | 0.2350 | -0.0206 | |

| 0.00 | 0.21 | 0.1837 | -0.0125 |

13F and Fund Filings

This form was filed on 2025-07-29 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GLD / SPDR Gold Trust | 0.08 | 16.31 | 25.00 | 23.05 | 21.5339 | 3.9112 | |||

| FSCO / FS Credit Opportunities Corp. | 2.05 | 5.06 | 14.92 | 8.19 | 12.8493 | 0.8888 | |||

| ARCC / Ares Capital Corporation | 0.58 | 6.50 | 12.82 | 5.54 | 11.0430 | 0.5055 | |||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 0.21 | -2.05 | 10.35 | -7.86 | 8.9142 | -0.8285 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.17 | -2.68 | 8.36 | 7.44 | 7.2041 | 0.4513 | |||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.08 | -1.64 | 6.34 | 1.86 | 5.4589 | 0.0623 | |||

| AMID / EA Series Trust - Argent Mid Cap ETF | 0.16 | -5.60 | 5.31 | -0.30 | 4.5735 | -0.0457 | |||

| FSK / FS KKR Capital Corp. | 0.22 | 21.91 | 4.66 | 20.73 | 4.0139 | 0.6664 | |||

| XLP / The Select Sector SPDR Trust - The Consumer Staples Select Sector SPDR Fund | 0.05 | -1.25 | 3.66 | -2.09 | 3.1502 | -0.0900 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.01 | -3.85 | 2.72 | 17.89 | 2.3394 | 0.3415 | |||

| IBIT / iShares Bitcoin Trust ETF | 0.03 | 0.00 | 1.83 | 30.83 | 1.5757 | 0.3622 | |||

| ICSH / iShares U.S. ETF Trust - iShares Ultra Short Duration Bond Active ETF | 0.03 | 0.33 | 1.47 | 0.34 | 1.2679 | -0.0045 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -24.47 | 1.29 | -16.53 | 1.1140 | -0.2302 | |||

| AAPL / Apple Inc. | 0.01 | 0.00 | 1.18 | -7.58 | 1.0183 | -0.0918 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 27.93 | 1.13 | 47.64 | 0.9694 | 0.3077 | |||

| TSLA / Tesla, Inc. | 0.00 | 0.00 | 1.12 | 22.60 | 0.9675 | 0.1726 | |||

| GBTC / Grayscale Bitcoin Trust (BTC) | 0.01 | -0.01 | 1.10 | 30.14 | 0.9489 | 0.2148 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | -5.88 | 0.89 | 1.84 | 0.7643 | 0.0084 | |||

| FFIN / First Financial Bankshares, Inc. | 0.02 | 0.00 | 0.70 | 0.14 | 0.6043 | -0.0032 | |||

| FBTC / Fidelity Wise Origin Bitcoin Fund | 0.01 | 77.66 | 0.58 | 132.26 | 0.4964 | 0.2809 | |||

| MSFT / Microsoft Corporation | 0.00 | -2.16 | 0.50 | 29.92 | 0.4266 | 0.0956 | |||

| DFAC / Dimensional ETF Trust - Dimensional U.S. Core Equity 2 ETF | 0.01 | 0.00 | 0.43 | 8.61 | 0.3702 | 0.0270 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 26.57 | 0.42 | 39.93 | 0.3654 | 0.1022 | |||

| MSTR / Strategy Inc | 0.00 | 0.00 | 0.42 | 40.40 | 0.3597 | 0.1014 | |||

| VCTR / Victory Capital Holdings, Inc. | 0.01 | 4.06 | 0.42 | 14.60 | 0.3587 | 0.0432 | |||

| OMF / OneMain Holdings, Inc. | 0.01 | 4.11 | 0.40 | 21.39 | 0.3473 | 0.0592 | |||

| CIGI / Colliers International Group Inc. | 0.00 | 4.06 | 0.40 | 12.01 | 0.3455 | 0.0348 | |||

| HLI / Houlihan Lokey, Inc. | 0.00 | 4.06 | 0.40 | 15.94 | 0.3453 | 0.0454 | |||

| TBIL / The RBB Fund, Inc. - F/m US Treasury 3 Month Bill ETF | 0.01 | -70.80 | 0.37 | -70.81 | 0.3215 | -0.7875 | |||

| HLNE / Hamilton Lane Incorporated | 0.00 | 4.05 | 0.36 | -0.55 | 0.3144 | -0.0039 | |||

| MEDP / Medpace Holdings, Inc. | 0.00 | 4.04 | 0.36 | 7.08 | 0.3131 | 0.0189 | |||

| FSV / FirstService Corporation | 0.00 | 4.05 | 0.36 | 9.67 | 0.3130 | 0.0251 | |||

| ADUS / Addus HomeCare Corporation | 0.00 | 4.04 | 0.36 | 20.95 | 0.3091 | 0.0522 | |||

| RBC / RBC Bearings Incorporated | 0.00 | 4.10 | 0.35 | 24.82 | 0.3033 | 0.0579 | |||

| PLUS / ePlus inc. | 0.00 | 4.08 | 0.35 | 22.78 | 0.2977 | 0.0539 | |||

| RLI / RLI Corp. | 0.00 | 4.05 | 0.34 | -6.41 | 0.2896 | -0.0222 | |||

| DSGX / The Descartes Systems Group Inc. | 0.00 | 4.04 | 0.33 | 4.78 | 0.2841 | 0.0113 | |||

| GRBK / Green Brick Partners, Inc. | 0.01 | 4.07 | 0.33 | 12.37 | 0.2822 | 0.0290 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.31 | 13.97 | 0.2672 | 0.0311 | |||

| CBZ / CBIZ, Inc. | 0.00 | 4.05 | 0.28 | -1.78 | 0.2382 | -0.0057 | |||

| MGY / Magnolia Oil & Gas Corporation | 0.01 | 4.04 | 0.27 | -7.48 | 0.2350 | -0.0206 | |||

| UFPI / UFP Industries, Inc. | 0.00 | 4.05 | 0.27 | -3.28 | 0.2286 | -0.0097 | |||

| MUSA / Murphy USA Inc. | 0.00 | 4.03 | 0.26 | -9.97 | 0.2264 | -0.0267 | |||

| NVDA / NVIDIA Corporation | 0.00 | 0.26 | 0.2226 | 0.2226 | |||||

| NPO / Enpro Inc. | 0.00 | 4.10 | 0.25 | 23.53 | 0.2176 | 0.0398 | |||

| ABG / Asbury Automotive Group, Inc. | 0.00 | 4.07 | 0.24 | 12.50 | 0.2100 | 0.0219 | |||

| GE / General Electric Company | 0.00 | 0.23 | 0.1971 | 0.1971 | |||||

| BCPC / Balchem Corporation | 0.00 | 4.01 | 0.22 | 0.00 | 0.1921 | -0.0018 | |||

| ALG / Alamo Group Inc. | 0.00 | 0.22 | 0.1907 | 0.1907 | |||||

| HRI / Herc Holdings Inc. | 0.00 | 4.03 | 0.22 | 1.88 | 0.1876 | 0.0024 | |||

| PAYX / Paychex, Inc. | 0.00 | 0.00 | 0.21 | -5.75 | 0.1837 | -0.0125 | |||

| APG / APi Group Corporation | 0.00 | 0.21 | 0.1766 | 0.1766 | |||||

| SEM / Select Medical Holdings Corporation | 0.01 | 4.05 | 0.17 | -5.46 | 0.1492 | -0.0097 | |||

| TSLA / Tesla, Inc. | Call | 0.00 | 0.14 | 0.1234 | 0.1234 | ||||

| EPHE / iShares Trust - iShares MSCI Philippines ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BRBR / BellRing Brands, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EWM / iShares, Inc. - iShares MSCI Malaysia ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SKY / Champion Homes, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |