Basic Stats

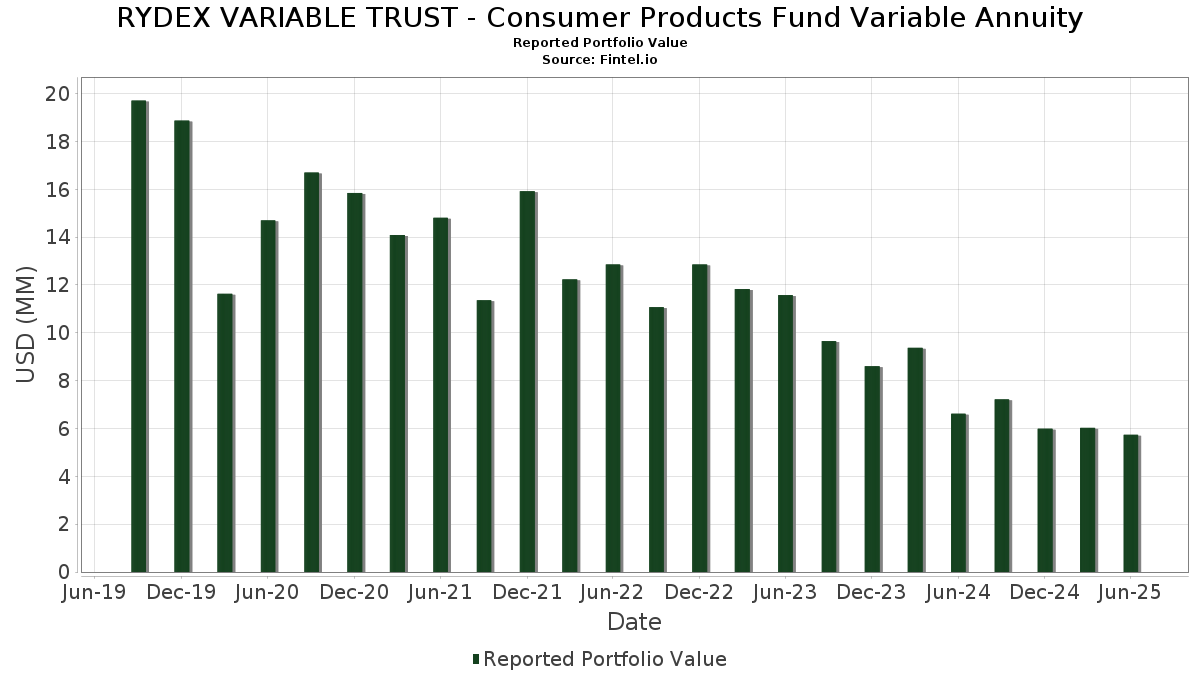

| Portfolio Value | $ 5,736,125 |

| Current Positions | 69 |

Latest Holdings, Performance, AUM (from 13F, 13D)

RYDEX VARIABLE TRUST - Consumer Products Fund Variable Annuity has disclosed 69 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 5,736,125 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). RYDEX VARIABLE TRUST - Consumer Products Fund Variable Annuity’s top holdings are The Procter & Gamble Company (US:PG) , Philip Morris International Inc. (US:PM) , The Coca-Cola Company (US:KO) , PepsiCo, Inc. (US:PEP) , and Altria Group, Inc. (US:MO) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 0.05 | 0.8712 | 0.8712 | |

| 0.02 | 0.3664 | 0.3664 | ||

| 0.00 | 0.11 | 1.8705 | 0.3480 | |

| 0.00 | 0.05 | 0.8393 | 0.2564 | |

| 0.00 | 0.05 | 0.8631 | 0.2531 | |

| 0.00 | 0.31 | 5.5276 | 0.2185 | |

| 0.00 | 0.14 | 2.3967 | 0.1878 | |

| 0.00 | 0.10 | 1.7756 | 0.1826 | |

| 0.00 | 0.06 | 1.0674 | 0.1664 | |

| 0.01 | 0.1581 | 0.1581 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.24 | 4.2747 | -0.4739 | |

| 0.00 | 0.36 | 6.2853 | -0.3487 | |

| 0.00 | 0.29 | 5.1526 | -0.1926 | |

| 0.00 | 0.02 | 0.3975 | -0.1657 | |

| 0.01 | 0.12 | 2.1230 | -0.1617 | |

| 0.00 | 0.05 | 0.9250 | -0.1533 | |

| 0.00 | 0.06 | 1.0425 | -0.1525 | |

| 0.00 | 0.02 | 0.3051 | -0.1487 | |

| 0.00 | 0.05 | 0.8185 | -0.1295 | |

| 0.00 | 0.06 | 0.9888 | -0.1272 |

13F and Fund Filings

This form was filed on 2025-08-27 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PG / The Procter & Gamble Company | 0.00 | -4.39 | 0.36 | -10.53 | 6.2853 | -0.3487 | |||

| PM / Philip Morris International Inc. | 0.00 | -14.40 | 0.31 | -1.88 | 5.5276 | 0.2185 | |||

| KO / The Coca-Cola Company | 0.00 | -7.94 | 0.29 | -9.03 | 5.1526 | -0.1926 | |||

| PEP / PepsiCo, Inc. | 0.00 | -3.57 | 0.24 | -15.09 | 4.2747 | -0.4739 | |||

| MO / Altria Group, Inc. | 0.00 | -1.75 | 0.19 | -3.96 | 3.4184 | 0.0583 | |||

| MDLZ / Mondelez International, Inc. | 0.00 | -3.89 | 0.18 | -4.74 | 3.2008 | 0.0401 | |||

| CL / Colgate-Palmolive Company | 0.00 | -2.40 | 0.17 | -5.14 | 2.9300 | 0.0108 | |||

| KR / The Kroger Co. | 0.00 | -3.41 | 0.14 | 2.26 | 2.3967 | 0.1878 | |||

| KDP / Keurig Dr Pepper Inc. | 0.00 | 0.44 | 0.13 | -3.03 | 2.2581 | 0.0628 | |||

| MNST / Monster Beverage Corporation | 0.00 | -9.13 | 0.13 | -3.05 | 2.2507 | 0.0679 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | 1.25 | 0.13 | -8.09 | 2.2128 | -0.0617 | |||

| KVUE / Kenvue Inc. | 0.01 | 0.44 | 0.12 | -12.41 | 2.1230 | -0.1617 | |||

| SYY / Sysco Corporation | 0.00 | -3.87 | 0.12 | -3.28 | 2.0867 | 0.0579 | |||

| HSY / The Hershey Company | 0.00 | -0.45 | 0.11 | -3.48 | 1.9603 | 0.0459 | |||

| EL / The Estée Lauder Companies Inc. | 0.00 | -5.33 | 0.11 | 16.48 | 1.8705 | 0.3480 | |||

| GIS / General Mills, Inc. | 0.00 | 3.48 | 0.10 | -10.62 | 1.7877 | -0.0930 | |||

| CCEP / COCA COLA EUROPACIFIC COMPANY GUAR REGS 11/27 1.5 | 0.00 | -3.12 | 0.10 | 3.09 | 1.7759 | 0.1528 | |||

| ADM / Archer-Daniels-Midland Company | 0.00 | -4.35 | 0.10 | 5.26 | 1.7756 | 0.1826 | |||

| CHD / Church & Dwight Co., Inc. | 0.00 | 3.71 | 0.09 | -9.71 | 1.6547 | -0.0694 | |||

| K / Kellanova | 0.00 | 1.04 | 0.09 | -2.13 | 1.6269 | 0.0515 | |||

| STZ / Constellation Brands, Inc. | 0.00 | -0.53 | 0.09 | -12.50 | 1.6181 | -0.1131 | |||

| KHC / The Kraft Heinz Company | 0.00 | 5.50 | 0.09 | -10.00 | 1.5872 | -0.0855 | |||

| MKC / McCormick & Company, Incorporated | 0.00 | 0.60 | 0.09 | -7.37 | 1.5550 | -0.0279 | |||

| TSN / Tyson Foods, Inc. | 0.00 | 2.42 | 0.09 | -10.31 | 1.5392 | -0.0779 | |||

| USFD / US Foods Holding Corp. | 0.00 | -10.81 | 0.08 | 5.13 | 1.4547 | 0.1469 | |||

| SFM / Sprouts Farmers Market, Inc. | 0.00 | -9.51 | 0.08 | -2.41 | 1.4347 | 0.0481 | |||

| CASY / Casey's General Stores, Inc. | 0.00 | -18.46 | 0.08 | -3.57 | 1.4283 | 0.0227 | |||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 0.00 | -13.51 | 0.07 | -1.33 | 1.3173 | 0.0614 | |||

| CLX / The Clorox Company | 0.00 | 5.38 | 0.07 | -14.29 | 1.2830 | -0.1255 | |||

| PFGC / Performance Food Group Company | 0.00 | -10.09 | 0.07 | 0.00 | 1.2627 | 0.0718 | |||

| BFB / Brown-Forman Corp. - Class B | 0.00 | 15.27 | 0.07 | -8.00 | 1.2227 | -0.0393 | |||

| CH1300646267 / Bunge Global SA | 0.00 | -4.02 | 0.07 | 1.56 | 1.1476 | 0.0739 | |||

| BUD / Anheuser-Busch InBev SA/NV - Depositary Receipt (Common Stock) | 0.00 | -14.66 | 0.06 | -5.88 | 1.1408 | 0.0111 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.00 | -10.63 | 0.06 | -8.57 | 1.1404 | -0.0315 | |||

| SJM / The J. M. Smucker Company | 0.00 | 6.54 | 0.06 | -11.43 | 1.0977 | -0.0743 | |||

| CELH / Celsius Holdings, Inc. | 0.00 | -14.18 | 0.06 | 11.11 | 1.0674 | 0.1664 | |||

| HLN / Haleon plc - Depositary Receipt (Common Stock) | 0.01 | -6.67 | 0.06 | -6.35 | 1.0501 | -0.0031 | |||

| CAG / Conagra Brands, Inc. | 0.00 | 7.23 | 0.06 | -16.90 | 1.0425 | -0.1525 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.00 | -3.34 | 0.06 | -6.45 | 1.0261 | -0.0146 | |||

| CART / Maplebear Inc. | 0.00 | -4.17 | 0.06 | 9.43 | 1.0258 | 0.1354 | |||

| HRL / Hormel Foods Corporation | 0.00 | -3.85 | 0.06 | -6.56 | 1.0107 | -0.0036 | |||

| FMX / Fomento Económico Mexicano, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.00 | -11.31 | 0.06 | -6.67 | 0.9953 | -0.0078 | |||

| TAP / Molson Coors Beverage Company | 0.00 | 5.80 | 0.06 | -16.42 | 0.9888 | -0.1272 | |||

| INGR / Ingredion Incorporated | 0.00 | -5.95 | 0.06 | -6.78 | 0.9813 | -0.0000 | |||

| PRMB / Primo Brands Corporation | 0.00 | 11.93 | 0.05 | -6.90 | 0.9589 | -0.0094 | |||

| ACI / Albertsons Companies, Inc. | 0.00 | -2.00 | 0.05 | -5.45 | 0.9289 | 0.0148 | |||

| BRBR / BellRing Brands, Inc. | 0.00 | 4.01 | 0.05 | -18.75 | 0.9250 | -0.1533 | |||

| LW / Lamb Weston Holdings, Inc. | 0.00 | -8.69 | 0.05 | -12.28 | 0.8918 | -0.0553 | |||

| DAR / Darling Ingredients Inc. | 0.00 | -14.17 | 0.05 | 4.26 | 0.8736 | 0.0830 | |||

| First American Government Obligations Fund - Class X / STIV (N/A) | 0.05 | 0.05 | 0.8712 | 0.8712 | |||||

| ELF / e.l.f. Beauty, Inc. | 0.00 | -32.65 | 0.05 | 36.11 | 0.8631 | 0.2531 | |||

| COKE / Coca-Cola Consolidated, Inc. | 0.00 | 1,542.31 | 0.05 | 34.29 | 0.8393 | 0.2564 | |||

| CPB / The Campbell's Company | 0.00 | 6.08 | 0.05 | -19.30 | 0.8185 | -0.1295 | |||

| POST / Post Holdings, Inc. | 0.00 | -3.79 | 0.04 | -10.20 | 0.7793 | -0.0362 | |||

| CALM / Cal-Maine Foods, Inc. | 0.00 | -6.38 | 0.04 | 2.38 | 0.7717 | 0.0622 | |||

| FLO / Flowers Foods, Inc. | 0.00 | 5.34 | 0.03 | -10.53 | 0.6051 | -0.0396 | |||

| FRPT / Freshpet, Inc. | 0.00 | 2.33 | 0.03 | -17.95 | 0.5779 | -0.0741 | |||

| SMPL / The Simply Good Foods Company | 0.00 | -1.43 | 0.03 | -11.11 | 0.5739 | -0.0258 | |||

| PPC / Pilgrim's Pride Corporation | 0.00 | 2.25 | 0.03 | -16.13 | 0.4672 | -0.0552 | |||

| VITL / Vital Farms, Inc. | 0.00 | -5.87 | 0.02 | 20.00 | 0.4238 | 0.0878 | |||

| WDFC / WD-40 Company | 0.00 | -28.78 | 0.02 | -33.33 | 0.3975 | -0.1657 | |||

| SPB / Spectrum Brands Holdings, Inc. | 0.00 | 8.73 | 0.02 | -22.22 | 0.3835 | -0.0657 | |||

| REYN / Reynolds Consumer Products Inc. | 0.00 | 1.66 | 0.02 | -13.04 | 0.3695 | -0.0124 | |||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.02 | 0.3664 | 0.3664 | ||||||

| GO / Grocery Outlet Holding Corp. | 0.00 | -7.46 | 0.02 | -16.67 | 0.3608 | -0.0532 | |||

| MZTI / The Marzetti Company | 0.00 | 51.39 | 0.02 | 50.00 | 0.3315 | 0.1223 | |||

| IPAR / Interparfums, Inc. | 0.00 | -45.00 | 0.02 | -37.04 | 0.3051 | -0.1487 | |||

| Barclays Capital, Inc. / RA (N/A) | 0.01 | 0.1581 | 0.1581 | ||||||

| BofA Securities, Inc. / RA (N/A) | 0.01 | 0.1527 | 0.1527 |