Basic Stats

| Portfolio Value | $ 99,971,775 |

| Current Positions | 72 |

Latest Holdings, Performance, AUM (from 13F, 13D)

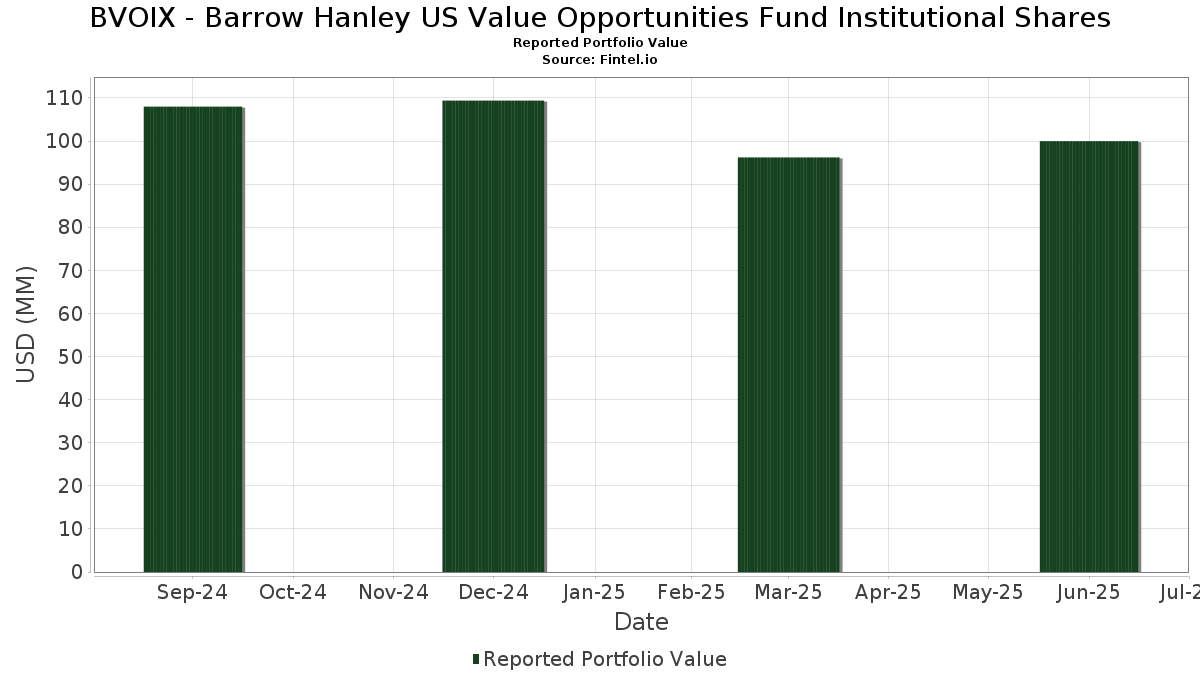

BVOIX - Barrow Hanley US Value Opportunities Fund Institutional Shares has disclosed 72 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 99,971,775 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). BVOIX - Barrow Hanley US Value Opportunities Fund Institutional Shares’s top holdings are Carnival Corporation & plc (US:CCL) , Bank of America Corporation (US:BAC) , Johnson Controls International plc (US:JCI) , Wells Fargo & Company (US:WFC) , and CACI International Inc (US:CACI) . BVOIX - Barrow Hanley US Value Opportunities Fund Institutional Shares’s new positions include Capital One Financial Corporation (US:COF) , Chevron Corporation (US:CVX) , WESCO International, Inc. (US:WCC) , TopBuild Corp. (US:BLD) , and Ralliant Corporation (US:RAL) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 1.84 | 1.8378 | 1.8378 | |

| 0.01 | 1.45 | 1.4461 | 1.4461 | |

| 0.02 | 1.03 | 1.0309 | 1.0309 | |

| 0.01 | 1.02 | 1.0173 | 1.0173 | |

| 0.02 | 1.57 | 1.5734 | 0.8495 | |

| 0.05 | 2.35 | 2.3475 | 0.8249 | |

| 0.00 | 0.80 | 0.7994 | 0.7994 | |

| 0.02 | 1.96 | 1.9543 | 0.7853 | |

| 0.03 | 1.85 | 1.8486 | 0.7005 | |

| 0.02 | 1.33 | 1.3261 | 0.6631 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.85 | 0.85 | 0.8506 | -1.3380 | |

| 0.00 | 1.33 | 1.3337 | -1.0480 | |

| 0.00 | 1.09 | 1.0903 | -0.7901 | |

| 0.08 | 1.04 | 1.0355 | -0.4349 | |

| 0.00 | 0.91 | 0.9075 | -0.4190 | |

| 0.01 | 0.93 | 0.9278 | -0.4052 | |

| 0.02 | 1.95 | 1.9443 | -0.3376 | |

| 0.09 | 1.15 | 1.1526 | -0.3240 | |

| 0.02 | 1.44 | 1.4356 | -0.2961 | |

| 0.03 | 1.30 | 1.2968 | -0.2869 |

13F and Fund Filings

This form was filed on 2025-08-26 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| CCL / Carnival Corporation & plc | 0.09 | -2.27 | 2.42 | 40.73 | 2.4203 | 0.6321 | |||

| BAC / Bank of America Corporation | 0.05 | 41.35 | 2.35 | 60.34 | 2.3475 | 0.8249 | |||

| JCI / Johnson Controls International plc | 0.02 | -2.27 | 2.07 | 28.82 | 2.0733 | 0.4005 | |||

| WFC / Wells Fargo & Company | 0.03 | -2.27 | 2.03 | 9.09 | 2.0278 | 0.0949 | |||

| CACI / CACI International Inc | 0.00 | -2.26 | 1.96 | 27.01 | 1.9602 | 0.3554 | |||

| VRT / Vertiv Holdings Co | 0.02 | -2.27 | 1.96 | 73.78 | 1.9543 | 0.7853 | |||

| XOM / Exxon Mobil Corporation | 0.02 | -2.27 | 1.95 | -11.43 | 1.9443 | -0.3376 | |||

| ECG / Everus Construction Group, Inc. | 0.03 | -2.27 | 1.85 | 67.33 | 1.8486 | 0.7005 | |||

| COF / Capital One Financial Corporation | 0.01 | 1.84 | 1.8378 | 1.8378 | |||||

| FIS / Fidelity National Information Services, Inc. | 0.02 | -2.27 | 1.77 | 6.57 | 1.7678 | 0.0426 | |||

| SLM / SLM Corporation | 0.05 | -2.27 | 1.76 | 9.13 | 1.7560 | 0.0829 | |||

| ETR / Entergy Corporation | 0.02 | -2.27 | 1.73 | -4.99 | 1.7329 | -0.1632 | |||

| PM / Philip Morris International Inc. | 0.01 | -2.26 | 1.73 | 12.11 | 1.7305 | 0.1262 | |||

| AXP / American Express Company | 0.01 | 26.90 | 1.70 | 50.44 | 1.6964 | 0.5241 | |||

| NICE / NICE Ltd. - Depositary Receipt (Common Stock) | 0.01 | -2.26 | 1.69 | 7.11 | 1.6871 | 0.0492 | |||

| MDT / Medtronic plc | 0.02 | -2.27 | 1.69 | -5.17 | 1.6849 | -0.1628 | |||

| KDP / Keurig Dr Pepper Inc. | 0.05 | -2.27 | 1.68 | -5.61 | 1.6828 | -0.1702 | |||

| ORCL / Oracle Corporation | 0.01 | -18.17 | 1.64 | 27.95 | 1.6388 | 0.3073 | |||

| CNP / CenterPoint Energy, Inc. | 0.04 | -2.27 | 1.63 | -0.85 | 1.6319 | -0.0800 | |||

| ACM / AECOM | 0.01 | 11.30 | 1.61 | 35.52 | 1.6133 | 0.3751 | |||

| XEL / Xcel Energy Inc. | 0.02 | -2.27 | 1.58 | -6.02 | 1.5756 | -0.1668 | |||

| MCHP / Microchip Technology Incorporated | 0.02 | 55.45 | 1.57 | 126.15 | 1.5734 | 0.8495 | |||

| WTW / Willis Towers Watson Public Limited Company | 0.01 | -2.26 | 1.54 | -11.34 | 1.5394 | -0.2660 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | 17.67 | 1.54 | 21.97 | 1.5378 | 0.2273 | |||

| PNW / Pinnacle West Capital Corporation | 0.02 | -2.27 | 1.54 | -8.18 | 1.5360 | -0.2036 | |||

| PLD / Prologis, Inc. | 0.01 | -2.27 | 1.53 | -8.12 | 1.5277 | -0.2006 | |||

| WYNN / Wynn Resorts, Limited | 0.02 | -2.27 | 1.51 | 9.68 | 1.5061 | 0.0778 | |||

| CIEN / Ciena Corporation | 0.02 | -8.00 | 1.50 | 23.79 | 1.5038 | 0.2411 | |||

| MDU / MDU Resources Group, Inc. | 0.09 | -2.27 | 1.49 | -3.69 | 1.4867 | -0.1176 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | 7.49 | 1.49 | 2.84 | 1.4840 | -0.0167 | |||

| VICI / VICI Properties Inc. | 0.05 | -2.27 | 1.47 | -2.33 | 1.4661 | -0.0945 | |||

| BWXT / BWX Technologies, Inc. | 0.01 | -16.58 | 1.46 | 21.80 | 1.4636 | 0.2145 | |||

| CVX / Chevron Corporation | 0.01 | 1.45 | 1.4461 | 1.4461 | |||||

| MRK / Merck & Co., Inc. | 0.02 | -2.27 | 1.44 | -13.81 | 1.4356 | -0.2961 | |||

| GOOG / Alphabet Inc. | 0.01 | -2.26 | 1.38 | 11.02 | 1.3793 | 0.0871 | |||

| PSX / Phillips 66 | 0.01 | -2.27 | 1.38 | -5.56 | 1.3742 | -0.1389 | |||

| AIG / American International Group, Inc. | 0.02 | -2.27 | 1.37 | -3.80 | 1.3676 | -0.1103 | |||

| WAL / Western Alliance Bancorporation | 0.02 | -2.27 | 1.34 | -0.74 | 1.3421 | -0.0646 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -2.26 | 1.33 | -41.80 | 1.3337 | -1.0480 | |||

| ENTG / Entegris, Inc. | 0.02 | 125.55 | 1.33 | 107.99 | 1.3261 | 0.6631 | |||

| CMA / Comerica Incorporated | 0.02 | -2.27 | 1.31 | -1.28 | 1.3068 | -0.0696 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.03 | -2.27 | 1.30 | -14.90 | 1.2968 | -0.2869 | |||

| WMG / Warner Music Group Corp. | 0.05 | -2.27 | 1.28 | -15.09 | 1.2766 | -0.2863 | |||

| EA / Electronic Arts Inc. | 0.01 | -2.28 | 1.25 | 7.97 | 1.2467 | 0.0464 | |||

| PSA / Public Storage | 0.00 | -2.26 | 1.24 | -4.24 | 1.2429 | -0.1056 | |||

| ELAN / Elanco Animal Health Incorporated | 0.09 | -2.27 | 1.24 | 32.98 | 1.2377 | 0.2696 | |||

| CB / Chubb Limited | 0.00 | -2.27 | 1.24 | -6.22 | 1.2362 | -0.1345 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.02 | -2.27 | 1.23 | -0.32 | 1.2276 | -0.0527 | |||

| CRH / CRH plc | 0.01 | -18.18 | 1.23 | -14.62 | 1.2253 | -0.2666 | |||

| APTV / Aptiv PLC | 0.02 | -2.27 | 1.20 | 12.10 | 1.2032 | 0.0868 | |||

| PRKS / United Parks & Resorts Inc. | 0.03 | -2.27 | 1.20 | 1.35 | 1.2027 | -0.0309 | |||

| AXTA / Axalta Coating Systems Ltd. | 0.04 | -2.27 | 1.18 | -12.51 | 1.1817 | -0.2227 | |||

| AVTR / Avantor, Inc. | 0.09 | -2.27 | 1.15 | -18.86 | 1.1526 | -0.3240 | |||

| JEF / Jefferies Financial Group Inc. | 0.02 | -2.27 | 1.14 | -0.26 | 1.1387 | -0.0479 | |||

| ELV / Elevance Health, Inc. | 0.00 | -32.59 | 1.09 | -39.69 | 1.0903 | -0.7901 | |||

| LFUS / Littelfuse, Inc. | 0.00 | 32.20 | 1.09 | 52.38 | 1.0882 | 0.3456 | |||

| SBAC / SBA Communications Corporation | 0.00 | -2.25 | 1.07 | 4.39 | 1.0704 | 0.0038 | |||

| ENB / Enbridge Inc. | 0.02 | -2.27 | 1.05 | -0.09 | 1.0531 | -0.0422 | |||

| PR / Permian Resources Corporation | 0.08 | -25.55 | 1.04 | -26.78 | 1.0355 | -0.4349 | |||

| DD / DuPont de Nemours, Inc. | 0.02 | 1.03 | 1.0309 | 1.0309 | |||||

| LEN / Lennar Corporation | 0.01 | 14.67 | 1.02 | 10.53 | 1.0177 | 0.0602 | |||

| WCC / WESCO International, Inc. | 0.01 | 1.02 | 1.0173 | 1.0173 | |||||

| PAGP / Plains GP Holdings, L.P. - Limited Partnership | 0.05 | -2.27 | 0.99 | -11.11 | 0.9918 | -0.1681 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.01 | -2.28 | 0.97 | -13.70 | 0.9700 | -0.1984 | |||

| KNF / Knife River Corporation | 0.01 | -20.04 | 0.93 | -27.67 | 0.9278 | -0.4052 | |||

| ALL / The Allstate Corporation | 0.00 | -26.84 | 0.91 | -28.84 | 0.9075 | -0.4190 | |||

| NTPXX / Northern Institutional Funds - Northern Institutional Treasury Portfolio Premier Shares | 0.85 | -59.59 | 0.85 | -59.59 | 0.8506 | -1.3380 | |||

| FTV / Fortive Corporation | 0.02 | 27.03 | 0.83 | -9.47 | 0.8318 | -0.1239 | |||

| BLD / TopBuild Corp. | 0.00 | 0.80 | 0.7994 | 0.7994 | |||||

| HAL / Halliburton Company | 0.04 | -2.27 | 0.80 | -21.50 | 0.7960 | -0.2581 | |||

| JBHT / J.B. Hunt Transport Services, Inc. | 0.01 | -2.29 | 0.75 | -5.20 | 0.7482 | -0.0720 | |||

| RAL / Ralliant Corporation | 0.01 | 0.26 | 0.2579 | 0.2579 |