Basic Stats

| Portfolio Value | $ 887,850,643 |

| Current Positions | 76 |

Latest Holdings, Performance, AUM (from 13F, 13D)

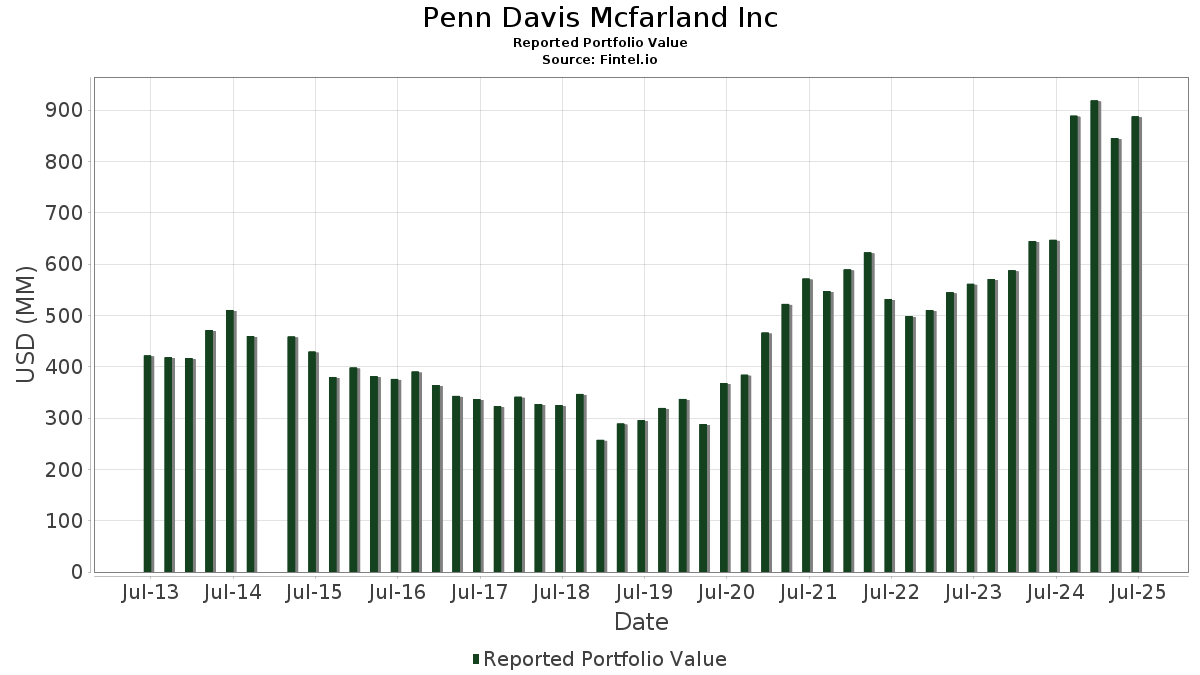

Penn Davis Mcfarland Inc has disclosed 76 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 887,850,643 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Penn Davis Mcfarland Inc’s top holdings are Alphabet Inc. (US:GOOG) , NVIDIA Corporation (US:NVDA) , Kinder Morgan, Inc. (US:KMI) , PayPal Holdings, Inc. (US:PYPL) , and UnitedHealth Group Incorporated (US:UNH) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.54 | 85.73 | 9.6559 | 2.2416 | |

| 0.48 | 85.86 | 9.6701 | 0.6341 | |

| 0.64 | 47.84 | 5.3884 | 0.5596 | |

| 0.13 | 41.96 | 4.7262 | 0.3469 | |

| 0.03 | 14.26 | 1.6057 | 0.3312 | |

| 0.17 | 30.46 | 3.4311 | 0.2576 | |

| 0.47 | 32.00 | 3.6043 | 0.1766 | |

| 0.41 | 17.77 | 2.0012 | 0.1137 | |

| 0.20 | 28.69 | 3.2317 | 0.1101 | |

| 1.69 | 19.06 | 2.1473 | 0.1096 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.36 | 16.51 | 1.8593 | -0.7220 | |

| 1.19 | 36.84 | 4.1497 | -0.6926 | |

| 1.85 | 24.22 | 2.7282 | -0.6346 | |

| 0.18 | 37.57 | 4.2316 | -0.6175 | |

| 0.00 | 0.00 | -0.4412 | ||

| 0.51 | 35.64 | 4.0141 | -0.4002 | |

| 0.12 | 27.36 | 3.0818 | -0.2850 | |

| 1.74 | 51.30 | 5.7775 | -0.2131 | |

| 0.48 | 14.94 | 1.6829 | -0.1232 | |

| 0.03 | 5.66 | 0.6379 | -0.1196 |

13F and Fund Filings

This form was filed on 2025-07-15 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GOOG / Alphabet Inc. | 0.48 | -1.01 | 85.86 | 12.39 | 9.6701 | 0.6341 | |||

| NVDA / NVIDIA Corporation | 0.54 | -6.17 | 85.73 | 36.78 | 9.6559 | 2.2416 | |||

| KMI / Kinder Morgan, Inc. | 1.74 | -1.71 | 51.30 | 1.29 | 5.7775 | -0.2131 | |||

| PYPL / PayPal Holdings, Inc. | 0.64 | 2.89 | 47.84 | 17.19 | 5.3884 | 0.5596 | |||

| UNH / UnitedHealth Group Incorporated | 0.13 | 90.29 | 41.96 | 13.34 | 4.7262 | 0.3469 | |||

| AAPL / Apple Inc. | 0.18 | -0.77 | 37.57 | -8.35 | 4.2316 | -0.6175 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 1.19 | -0.91 | 36.84 | -10.00 | 4.1497 | -0.6926 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.51 | -0.60 | 35.64 | -4.50 | 4.0141 | -0.4002 | |||

| BUD / Anheuser-Busch InBev SA/NV - Depositary Receipt (Common Stock) | 0.47 | -1.07 | 32.00 | 10.44 | 3.6043 | 0.1766 | |||

| GOOGL / Alphabet Inc. | 0.17 | -0.36 | 30.46 | 13.55 | 3.4311 | 0.2576 | |||

| QCOM / QUALCOMM Incorporated | 0.19 | -0.28 | 30.42 | 3.38 | 3.4259 | -0.0543 | |||

| RTX / RTX Corporation | 0.20 | -1.37 | 28.69 | 8.73 | 3.2317 | 0.1101 | |||

| SFM / Sprouts Farmers Market, Inc. | 0.17 | -1.82 | 28.34 | 5.90 | 3.1920 | 0.0263 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.12 | -0.97 | 27.36 | -3.86 | 3.0818 | -0.2850 | |||

| BSM / Black Stone Minerals, L.P. - Limited Partnership | 1.85 | -0.53 | 24.22 | -14.80 | 2.7282 | -0.6346 | |||

| LMT / Lockheed Martin Corporation | 0.05 | -0.91 | 22.44 | 2.73 | 2.5276 | -0.0563 | |||

| ROIV / Roivant Sciences Ltd. | 1.69 | -0.91 | 19.06 | 10.68 | 2.1473 | 0.1096 | |||

| LVS / Las Vegas Sands Corp. | 0.41 | -1.14 | 17.77 | 11.35 | 2.0012 | 0.1137 | |||

| BMY / Bristol-Myers Squibb Company | 0.36 | -0.33 | 16.51 | -24.35 | 1.8593 | -0.7220 | |||

| SIRI / Sirius XM Holdings Inc. | 0.65 | -1.09 | 14.97 | 0.78 | 1.6866 | -0.0711 | |||

| MTCH / Match Group, Inc. | 0.48 | -1.16 | 14.94 | -2.14 | 1.6829 | -0.1232 | |||

| MSFT / Microsoft Corporation | 0.03 | -0.14 | 14.26 | 32.32 | 1.6057 | 0.3312 | |||

| WM / Waste Management, Inc. | 0.06 | -0.28 | 13.02 | -1.44 | 1.4662 | -0.0961 | |||

| XYL / Xylem Inc. | 0.10 | -0.31 | 12.48 | 7.95 | 1.4061 | 0.0381 | |||

| TXN / Texas Instruments Incorporated | 0.04 | -0.06 | 8.64 | 15.47 | 0.9727 | 0.0880 | |||

| ACN / Accenture plc | 0.03 | -0.35 | 7.73 | -4.56 | 0.8709 | -0.0873 | |||

| JNJ / Johnson & Johnson | 0.04 | 0.49 | 6.35 | -7.44 | 0.7147 | -0.0962 | |||

| MCD / McDonald's Corporation | 0.02 | -0.15 | 6.16 | -6.61 | 0.6937 | -0.0864 | |||

| KO / The Coca-Cola Company | 0.08 | -0.40 | 5.93 | -1.61 | 0.6676 | -0.0450 | |||

| ABBV / AbbVie Inc. | 0.03 | -0.16 | 5.66 | -11.54 | 0.6379 | -0.1196 | |||

| AMGN / Amgen Inc. | 0.02 | -0.66 | 5.26 | -10.97 | 0.5922 | -0.1064 | |||

| NKE / NIKE, Inc. | 0.06 | 0.51 | 4.41 | 12.47 | 0.4966 | 0.0329 | |||

| ABT / Abbott Laboratories | 0.03 | -0.16 | 4.25 | 2.36 | 0.4791 | -0.0124 | |||

| PG / The Procter & Gamble Company | 0.03 | 0.02 | 4.22 | -6.49 | 0.4756 | -0.0586 | |||

| VZ / Verizon Communications Inc. | 0.09 | 4.92 | 4.09 | 0.07 | 0.4607 | -0.0227 | |||

| UPS / United Parcel Service, Inc. | 0.04 | 19.29 | 3.90 | 9.47 | 0.4389 | 0.0178 | |||

| PEP / PepsiCo, Inc. | 0.03 | 0.14 | 3.86 | -11.82 | 0.4345 | -0.0830 | |||

| MTD / Mettler-Toledo International Inc. | 0.00 | -0.19 | 3.79 | -0.73 | 0.4271 | -0.0247 | |||

| AXP / American Express Company | 0.01 | 0.00 | 3.37 | 18.55 | 0.3801 | 0.0434 | |||

| PFE / Pfizer Inc. | 0.12 | 20.28 | 2.92 | 15.07 | 0.3286 | 0.0287 | |||

| CL / Colgate-Palmolive Company | 0.03 | 0.00 | 2.75 | -3.00 | 0.3100 | -0.0256 | |||

| HON / Honeywell International Inc. | 0.01 | 0.00 | 2.71 | 9.99 | 0.3052 | 0.0137 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 0.00 | 2.69 | 15.33 | 0.3026 | 0.0270 | |||

| SBUX / Starbucks Corporation | 0.03 | 2.96 | 2.68 | -3.81 | 0.3013 | -0.0277 | |||

| BDX / Becton, Dickinson and Company | 0.01 | 81.35 | 2.54 | 36.37 | 0.2863 | 0.0658 | |||

| GLD / SPDR Gold Trust | 0.01 | 0.00 | 2.51 | 5.81 | 0.2830 | 0.0021 | |||

| USPH / U.S. Physical Therapy, Inc. | 0.03 | 0.00 | 2.35 | 8.04 | 0.2650 | 0.0075 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 2.14 | -5.64 | 0.2414 | -0.0272 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | 0.06 | 1.77 | -9.31 | 0.1998 | -0.0316 | |||

| CSCO / Cisco Systems, Inc. | 0.02 | 0.00 | 1.44 | 12.42 | 0.1621 | 0.0107 | |||

| MTDR / Matador Resources Company | 0.03 | 0.00 | 1.43 | -6.59 | 0.1612 | -0.0201 | |||

| V / Visa Inc. | 0.00 | -1.23 | 1.20 | 0.00 | 0.1347 | -0.0067 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 0.00 | 1.03 | -9.34 | 0.1159 | -0.0184 | |||

| FCFS / FirstCash Holdings, Inc. | 0.01 | 0.00 | 1.00 | 12.33 | 0.1129 | 0.0073 | |||

| PAYX / Paychex, Inc. | 0.01 | 0.00 | 0.86 | -5.73 | 0.0964 | -0.0110 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 0.00 | 0.80 | 10.50 | 0.0902 | 0.0045 | |||

| CAT / Caterpillar Inc. | 0.00 | 25.00 | 0.78 | 47.25 | 0.0874 | 0.0250 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.00 | 0.75 | 18.20 | 0.0842 | 0.0094 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 0.68 | 10.57 | 0.0766 | 0.0038 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.58 | 28.10 | 0.0653 | 0.0117 | |||

| MA / Mastercard Incorporated | 0.00 | -2.57 | 0.53 | 0.00 | 0.0599 | -0.0031 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | -4.88 | 0.41 | 21.79 | 0.0460 | 0.0062 | |||

| TSLA / Tesla, Inc. | 0.00 | 0.00 | 0.39 | 22.61 | 0.0435 | 0.0062 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.38 | 0.00 | 0.0433 | -0.0022 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.00 | 0.35 | 43.32 | 0.0400 | 0.0107 | |||

| ITOT / iShares Trust - iShares Core S&P Total U.S. Stock Market ETF | 0.00 | 0.00 | 0.34 | 10.49 | 0.0380 | 0.0019 | |||

| TOST / Toast, Inc. | 0.01 | 0.00 | 0.33 | 33.87 | 0.0374 | 0.0080 | |||

| DMLP / Dorchester Minerals, L.P. - Limited Partnership | 0.01 | 0.00 | 0.32 | -7.43 | 0.0366 | -0.0049 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.31 | -8.75 | 0.0353 | -0.0053 | |||

| ORCL / Oracle Corporation | 0.00 | 0.28 | 0.0318 | 0.0318 | |||||

| WMT / Walmart Inc. | 0.00 | 0.00 | 0.27 | 11.34 | 0.0300 | 0.0017 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.26 | 0.0296 | 0.0296 | |||||

| TRV / The Travelers Companies, Inc. | 0.00 | 0.00 | 0.25 | 1.22 | 0.0281 | -0.0011 | |||

| GSLC / Goldman Sachs ETF Trust - Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF | 0.00 | 0.00 | 0.24 | 10.00 | 0.0273 | 0.0013 | |||

| DIS / The Walt Disney Company | 0.00 | 0.22 | 0.0247 | 0.0247 | |||||

| CLNN / Clene Inc. | 0.01 | 0.00 | 0.04 | 30.30 | 0.0048 | 0.0008 | |||

| DESP / Despegar.com, Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4412 |