Basic Stats

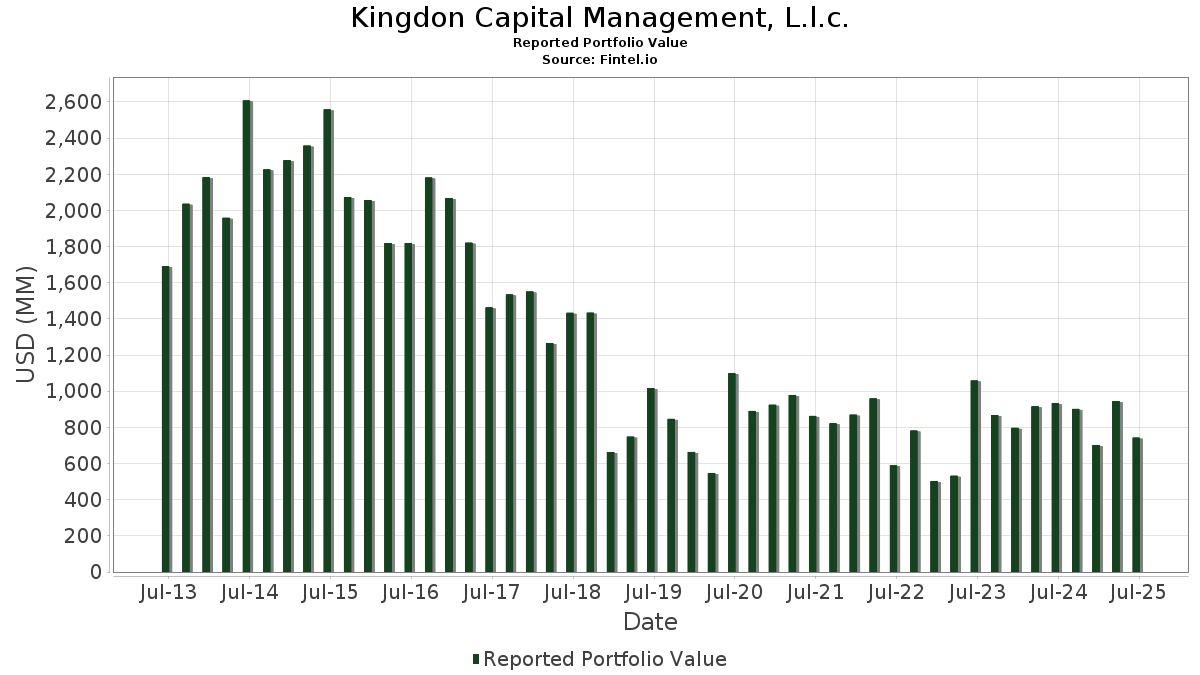

| Insider Profile | KINGDON CAPITAL MANAGEMENT, L.L.C. |

| Portfolio Value | $ 742,524,992 |

| Current Positions | 67 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Kingdon Capital Management, L.l.c. has disclosed 67 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 742,524,992 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Kingdon Capital Management, L.l.c.’s top holdings are SPDR Series Trust - SPDR S&P Regional Banking ETF (US:KRE) , iShares Trust - iShares Russell 2000 ETF (US:IWM) , KKR & Co. Inc. (US:KKR) , SPDR S&P 500 ETF (US:SPY) , and iShares, Inc. - iShares MSCI Japan ETF (US:EWJ) . Kingdon Capital Management, L.l.c.’s new positions include iShares, Inc. - iShares MSCI Japan ETF (US:EWJ) , Sandisk Corporation (US:SNDK) , Toll Brothers, Inc. (US:TOL) , iShares, Inc. - iShares MSCI South Korea ETF (US:EWY) , and Upstart Holdings, Inc. (US:UPST) . Kingdon Capital Management, L.l.c.’s top industries are "Building Construction General Contractors And Operative Builders" (sic 15) , "Paper And Allied Products" (sic 26) , and "Petroleum Refining And Related Industries" (sic 29) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.00 | 59.39 | 7.9984 | 7.9984 | |

| 0.15 | 32.37 | 4.3592 | 4.3592 | |

| 0.20 | 26.61 | 3.5832 | 3.5832 | |

| 0.30 | 22.49 | 3.0290 | 3.0290 | |

| 0.37 | 16.78 | 2.2598 | 2.2598 | |

| 0.14 | 15.41 | 2.0750 | 2.0750 | |

| 0.13 | 14.99 | 2.0194 | 2.0194 | |

| 0.04 | 14.41 | 1.9401 | 1.9401 | |

| 0.20 | 14.36 | 1.9334 | 1.9334 | |

| 0.20 | 12.94 | 1.7422 | 1.7422 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 24.71 | 3.3284 | -29.2314 | |

| 0.04 | 6.65 | 0.8960 | -1.1324 | |

| 0.18 | 5.56 | 0.7488 | -0.4068 | |

| 2.24 | 1.51 | 0.2033 | -0.0221 | |

| 0.94 | 0.16 | 0.0217 | -0.0053 |

13D/G Filings

This is a list of 13D and 13G filings made in the last year (if any). Click the link icon to see the full transaction history. Green rows indicate new positions. Red rows indicate closed positions.

| File Date | Form | Security | Prev Shares |

Current Shares |

ΔShares % | % Ownership |

% ΔOwnership | |

|---|---|---|---|---|---|---|---|---|

| 2025-07-11 | JSPR / Jasper Therapeutics, Inc. | 765,000 | 5.10 | |||||

| 2025-04-14 | OPTN / OptiNose, Inc. | 520,485 | 5.10 | |||||

| 2024-11-13 | CRIS / Curis, Inc. | 345,730 | 90,000 | -73.97 | 1.50 | -74.58 |

13F and Fund Filings

This form was filed on 2025-08-14 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| KRE / SPDR Series Trust - SPDR S&P Regional Banking ETF | Call | 1.00 | 59.39 | 7.9984 | 7.9984 | ||||

| IWM / iShares Trust - iShares Russell 2000 ETF | Put | 0.15 | 32.37 | 4.3592 | 4.3592 | ||||

| KKR / KKR & Co. Inc. | Call | 0.20 | 26.61 | 3.5832 | 3.5832 | ||||

| SPY / SPDR S&P 500 ETF | Put | 0.04 | -92.73 | 24.71 | -91.97 | 3.3284 | -29.2314 | ||

| EWJ / iShares, Inc. - iShares MSCI Japan ETF | Put | 0.30 | 22.49 | 3.0290 | 3.0290 | ||||

| NVDA / NVIDIA Corporation | 0.14 | -9.00 | 21.57 | 32.65 | 2.9044 | 1.1839 | |||

| SNDX / Syndax Pharmaceuticals, Inc. | 2.10 | 5.00 | 19.67 | -19.96 | 2.6486 | 0.0484 | |||

| CRH / CRH plc | 0.20 | -9.09 | 18.36 | -5.13 | 2.4726 | 0.4245 | |||

| SNDK / Sandisk Corporation | 0.37 | 16.78 | 2.2598 | 2.2598 | |||||

| SMH / VanEck ETF Trust - VanEck Semiconductor ETF | Put | 0.06 | -4.76 | 16.73 | 25.60 | 2.2535 | 0.8436 | ||

| WM / Waste Management, Inc. | 0.07 | 40.00 | 16.02 | 38.38 | 2.1572 | 0.9321 | |||

| HUM / Humana Inc. | 0.06 | 54.58 | 15.79 | 42.82 | 2.1270 | 0.9567 | |||

| TOL / Toll Brothers, Inc. | 0.14 | 15.41 | 2.0750 | 2.0750 | |||||

| MMM / 3M Company | 0.10 | -16.67 | 15.22 | -13.61 | 2.0503 | 0.1853 | |||

| BLDR / Builders FirstSource, Inc. | 0.13 | 14.99 | 2.0194 | 2.0194 | |||||

| CART / Maplebear Inc. | 0.32 | -3.03 | 14.48 | 9.97 | 1.9497 | 0.5566 | |||

| AJG / Arthur J. Gallagher & Co. | 0.04 | 14.41 | 1.9401 | 1.9401 | |||||

| EWY / iShares, Inc. - iShares MSCI South Korea ETF | 0.20 | 14.36 | 1.9334 | 1.9334 | |||||

| NXE / NexGen Energy Ltd. | 1.98 | 5.33 | 13.73 | 62.80 | 1.8486 | 0.9563 | |||

| PKG / Packaging Corporation of America | 0.07 | 40.00 | 13.19 | 33.23 | 1.7766 | 0.7288 | |||

| HEI / HEICO Corporation | 0.04 | -11.11 | 13.12 | 9.12 | 1.7669 | 0.4945 | |||

| UPST / Upstart Holdings, Inc. | Put | 0.20 | 12.94 | 1.7422 | 1.7422 | ||||

| ECG / Everus Construction Group, Inc. | 0.20 | -20.00 | 12.71 | 37.04 | 1.7112 | 0.7299 | |||

| LOAR / Loar Holdings Inc. | 0.14 | 45.00 | 12.49 | 76.84 | 1.6827 | 0.9350 | |||

| FLEX / Flex Ltd. | 0.24 | -11.11 | 11.98 | 34.14 | 1.6135 | 0.6683 | |||

| TAP / Molson Coors Beverage Company | 0.24 | 0.00 | 11.55 | -20.99 | 1.5557 | 0.0083 | |||

| APG / APi Group Corporation | 0.23 | -18.18 | 11.49 | 16.80 | 1.5469 | 0.5062 | |||

| TTEK / Tetra Tech, Inc. | 0.32 | 11.33 | 1.5255 | 1.5255 | |||||

| SRAD / Sportradar Group AG | 0.40 | 11.23 | 1.5127 | 1.5127 | |||||

| JPM / JPMorgan Chase & Co. | 0.04 | 10.15 | 1.3665 | 1.3665 | |||||

| GMED / Globus Medical, Inc. | 0.17 | 12.36 | 10.03 | -9.41 | 1.3513 | 0.1792 | |||

| OKTA / Okta, Inc. | 0.10 | 81.82 | 10.00 | 72.75 | 1.3464 | 0.7339 | |||

| RDNT / RadNet, Inc. | 0.17 | 124.68 | 9.85 | 157.18 | 1.3259 | 0.9208 | |||

| WMT / Walmart Inc. | 0.10 | 0.00 | 9.78 | 11.38 | 1.3169 | 0.3878 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.04 | -19.05 | 9.63 | 10.44 | 1.2964 | 0.3741 | |||

| WWW / Wolverine World Wide, Inc. | 0.52 | -16.01 | 9.49 | 9.17 | 1.2776 | 0.3580 | |||

| IMAX / IMAX Corporation | 0.34 | -24.66 | 9.47 | -20.06 | 1.2752 | 0.0217 | |||

| MIR / Mirion Technologies, Inc. | 0.42 | -5.56 | 9.15 | 40.23 | 1.2323 | 0.5418 | |||

| CW / Curtiss-Wright Corporation | 0.02 | -41.67 | 8.55 | -10.18 | 1.1514 | 0.1441 | |||

| WELL / Welltower Inc. | 0.06 | 8.46 | 1.1387 | 1.1387 | |||||

| ULS / UL Solutions Inc. | 0.12 | 8.38 | 1.1284 | 1.1284 | |||||

| WDC / Western Digital Corporation | 0.13 | -13.33 | 8.32 | 37.17 | 1.1203 | 0.4785 | |||

| SNDK / Sandisk Corporation | Put | 0.16 | 7.26 | 0.9772 | 0.9772 | ||||

| EW / Edwards Lifesciences Corporation | 0.09 | 7.14 | 0.9617 | 0.9617 | |||||

| PCT / PureCycle Technologies, Inc. | 0.49 | 6.73 | 0.9059 | 0.9059 | |||||

| THC / Tenet Healthcare Corporation | 0.04 | -73.47 | 6.65 | -65.29 | 0.8960 | -1.1324 | |||

| ALIT / Alight, Inc. | 1.10 | 69.23 | 6.23 | 61.55 | 0.8385 | 0.4306 | |||

| WNS / WNS (Holdings) Limited | 0.10 | 46.15 | 6.01 | 50.33 | 0.8091 | 0.3861 | |||

| ENPH / Enphase Energy, Inc. | Put | 0.15 | 100.00 | 5.95 | 27.81 | 0.8010 | 0.3085 | ||

| VST / Vistra Corp. | 0.03 | 5.81 | 0.7830 | 0.7830 | |||||

| FSLR / First Solar, Inc. | Call | 0.04 | 5.79 | 0.7803 | 0.7803 | ||||

| MTCH / Match Group, Inc. | 0.18 | -48.57 | 5.56 | -49.08 | 0.7488 | -0.4068 | |||

| HCI / HCI Group, Inc. | 0.04 | 34.61 | 5.33 | 37.29 | 0.7174 | 0.3068 | |||

| ALDX / Aldeyra Therapeutics, Inc. | 1.33 | 70.96 | 5.10 | 13.86 | 0.6869 | 0.2129 | |||

| ALIT / Alight, Inc. | Call | 0.75 | 4.25 | 0.5717 | 0.5717 | ||||

| ZVRA / Zevra Therapeutics, Inc. | 0.45 | 3.96 | 0.5339 | 0.5339 | |||||

| JSPR / Jasper Therapeutics, Inc. | 0.68 | 39.74 | 3.80 | 80.35 | 0.5118 | 0.2888 | |||

| NVNO / enVVeno Medical Corporation | 0.86 | 0.00 | 3.43 | 51.75 | 0.4617 | 0.2226 | |||

| AI / C3.ai, Inc. | Call | 0.13 | 3.19 | 0.4302 | 0.4302 | ||||

| AMRC / Ameresco, Inc. | 0.20 | 3.04 | 0.4091 | 0.4091 | |||||

| EBAY / eBay Inc. | Put | 0.04 | 2.98 | 0.4011 | 0.4011 | ||||

| GEG / Great Elm Group, Inc. | 1.27 | 0.00 | 2.63 | 9.51 | 0.3538 | 0.1000 | |||

| SCPH / scPharmaceuticals Inc. | 0.66 | -34.03 | 2.51 | -4.45 | 0.3385 | 0.0602 | |||

| SCYX / SCYNEXIS, Inc. | 2.24 | 0.00 | 1.51 | -29.12 | 0.2033 | -0.0221 | |||

| NB / NioCorp Developments Ltd. | 0.31 | 0.00 | 0.73 | 18.26 | 0.0987 | 0.0331 | |||

| XFOR / X4 Pharmaceuticals, Inc. | 0.23 | 0.44 | 0.0597 | 0.0597 | |||||

| XAIR / Beyond Air, Inc. | 0.94 | 0.00 | 0.16 | -36.86 | 0.0217 | -0.0053 | |||

| TNDM / Tandem Diabetes Care, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GEHC / GE HealthCare Technologies Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| INSM / Insmed Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HOOD / Robinhood Markets, Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| META / Meta Platforms, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XRT / SPDR Series Trust - SPDR S&P Retail ETF | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| AL / Air Lease Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SMCI / Super Micro Computer, Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| CFLT / Confluent, Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| ACHC / Acadia Healthcare Company, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KRE / SPDR Series Trust - SPDR S&P Regional Banking ETF | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| VST / Vistra Corp. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| QQQ / Invesco QQQ Trust, Series 1 | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GEV / GE Vernova Inc. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| IP / International Paper Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CVNA / Carvana Co. | Call | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| PPL / PPL Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XFOR / X4 Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GKOS / Glaukos Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ALNY / Alnylam Pharmaceuticals, Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| SYK / Stryker Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| OPTN / OptiNose, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RH / RH | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HAS / Hasbro, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |