Basic Stats

| Manager | Carl Icahn |

| Insider Profile | ICAHN CARL C |

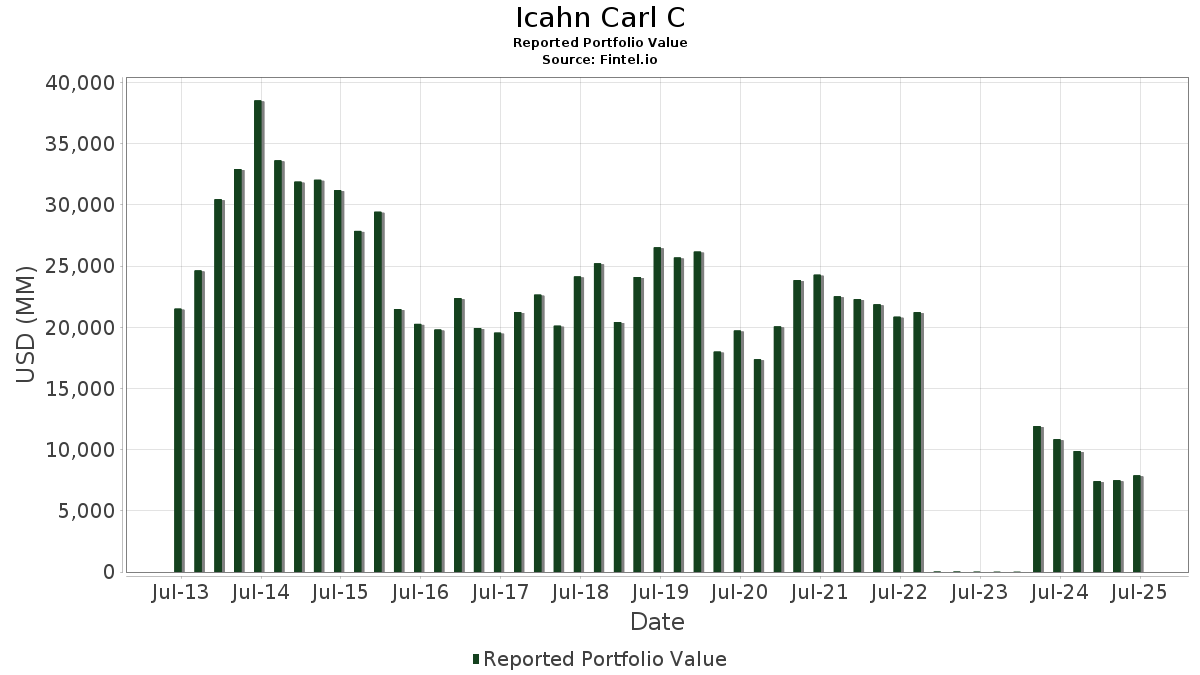

| Portfolio Value | $ 7,886,564,146 |

| Current Positions | 12 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Icahn Carl C has disclosed 12 total holdings in their latest SEC filings. Portfolio manager(s) are listed as Carl Icahn. Most recent portfolio value is calculated to be $ 7,886,564,146 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Icahn Carl C’s top holdings are Icahn Enterprises L.P. (US:IEP) , CVR Energy, Inc. (US:CVI) , Southwest Gas Holdings, Inc. (US:SWX) , CVR Partners, LP - Limited Partnership (US:UAN) , and International Flavors & Fragrances Inc. (US:IFF) . Icahn Carl C’s top industries are "Chemicals And Allied Products" (sic 28) , "Industrial And Commercial Machinery And Computer Equipment" (sic 35) , and "Automotive Repair, Services, And Parking" (sic 75) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 70.42 | 1,890.74 | 23.9741 | 6.2171 | |

| 6.40 | 143.70 | 1.8221 | 1.2778 | |

| 4.16 | 369.95 | 4.6909 | 0.5757 | |

| 2.44 | 69.27 | 0.8784 | 0.0637 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 7.53 | 560.35 | 2.4373 | -4.7859 | |

| 494.78 | 3,980.53 | 50.4723 | -4.0734 | |

| 1.21 | 125.06 | 0.5440 | -1.2150 | |

| 4.82 | 52.14 | 0.2268 | -0.5082 | |

| 3.75 | 275.81 | 3.4972 | -0.3897 | |

| 33.62 | 142.22 | 1.8033 | -0.3610 | |

| 0.00 | 0.00 | -0.2331 | ||

| 3.50 | 45.53 | 0.5774 | -0.1004 | |

| 34.72 | 231.24 | 2.9321 | -0.0681 |

13D/G Filings

This is a list of 13D and 13G filings made in the last year (if any). Click the link icon to see the full transaction history. Green rows indicate new positions. Red rows indicate closed positions.

| File Date | Form | Security | Prev Shares |

Current Shares |

ΔShares % | % Ownership |

% ΔOwnership | |

|---|---|---|---|---|---|---|---|---|

| 2025-09-05 | CTRI / Centuri Holdings, Inc. | 7,977,377 | 10,847,672 | 35.98 | 12.24 | 36.00 | ||

| 2025-07-22 | SD / SandRidge Energy, Inc. | 4,818,832 | 13.13 | |||||

| 2025-06-23 | ENZN / Enzon Pharmaceuticals, Inc. | 36,056,636 | 36,056,636 | 0.00 | 48.60 | 0.00 | ||

| 2025-03-26 | EDR / Endeavor Group Holdings, Inc. | 0 | 0.00 | |||||

| 2024-11-20 | SWX / Southwest Gas Holdings, Inc. | 9,632,604 | 13.43 | |||||

| 2024-11-08 | CVI / CVR Energy, Inc. | |||||||

| 2024-11-08 | UAN / CVR Partners, LP - Limited Partnership | 3,947,552 | 37.40 | |||||

| 2024-09-27 | IEP / Icahn Enterprises L.P. | 433,206,933 | 86.24 |

13F and Fund Filings

This form was filed on 2025-08-14 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IEP / Icahn Enterprises L.P. | 494.78 | 9.76 | 3,980.53 | -2.54 | 50.4723 | -4.0734 | |||

| CVI / CVR Energy, Inc. | 70.42 | 2.75 | 1,890.74 | 42.21 | 23.9741 | 6.2171 | |||

| SWX / Southwest Gas Holdings, Inc. | 7.53 | 0.00 | 560.35 | 3.61 | 2.4373 | -4.7859 | |||

| UAN / CVR Partners, LP - Limited Partnership | 4.16 | 1.59 | 369.95 | 20.06 | 4.6909 | 0.5757 | |||

| IFF / International Flavors & Fragrances Inc. | 3.75 | 0.00 | 275.81 | -5.23 | 3.4972 | -0.3897 | |||

| BHC / Bausch Health Companies Inc. | 34.72 | 0.00 | 231.24 | 2.94 | 2.9321 | -0.0681 | |||

| CTRI / Centuri Holdings, Inc. | 6.40 | 157.55 | 143.70 | 252.62 | 1.8221 | 1.2778 | |||

| JBLU / JetBlue Airways Corporation | 33.62 | 0.00 | 142.22 | -12.24 | 1.8033 | -0.3610 | |||

| AEP / American Electric Power Company, Inc. | 1.21 | 0.00 | 125.06 | -5.04 | 0.5440 | -1.2150 | |||

| CZR / Caesars Entertainment, Inc. | 2.44 | 0.00 | 69.27 | 13.56 | 0.8784 | 0.0637 | |||

| SD / SandRidge Energy, Inc. | 4.82 | 0.00 | 52.14 | -5.26 | 0.2268 | -0.5082 | |||

| BLCO / Bausch + Lomb Corporation | 3.50 | 0.00 | 45.53 | -10.28 | 0.5774 | -0.1004 | |||

| ILMN / Illumina, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2331 | ||||

| DAN / Dana Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 |