Basic Stats

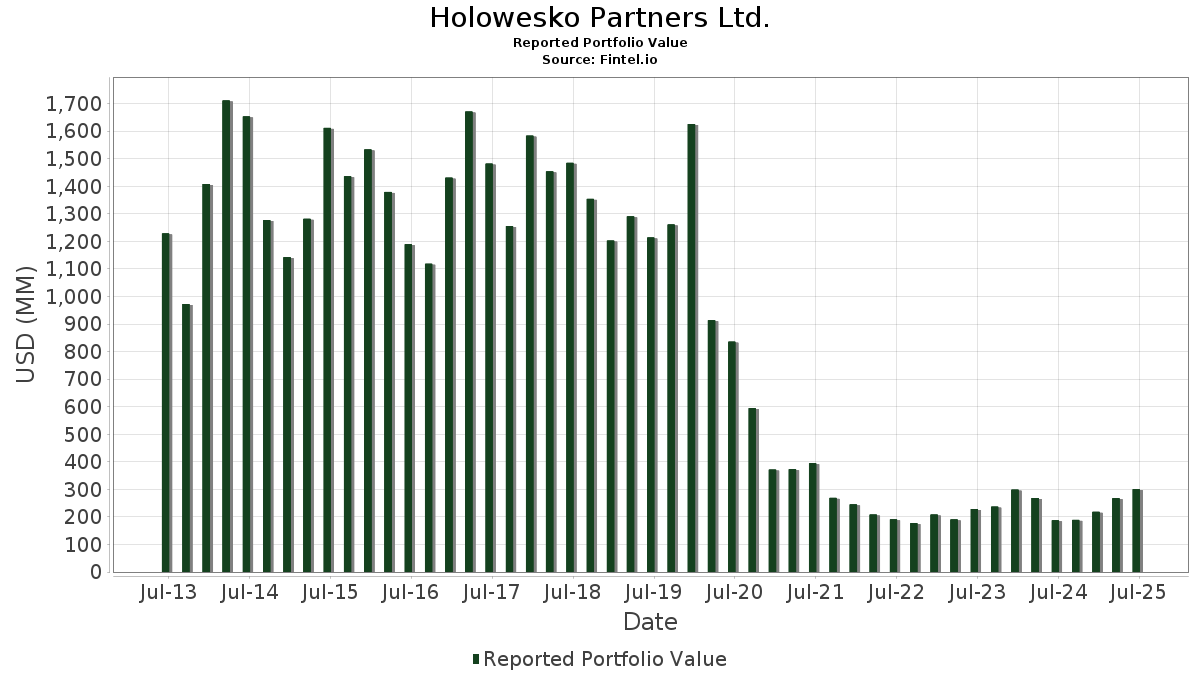

| Portfolio Value | $ 300,469,213 |

| Current Positions | 29 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Holowesko Partners Ltd. has disclosed 29 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 300,469,213 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Holowesko Partners Ltd.’s top holdings are iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF (US:HYG) , Barrick Mining Corporation (US:B) , Alphabet Inc. (US:GOOGL) , Kimberly-Clark Corporation (US:KMB) , and QUALCOMM Incorporated (US:QCOM) . Holowesko Partners Ltd.’s new positions include Barrick Mining Corporation (US:B) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.40 | 32.26 | 10.7365 | 10.7365 | |

| 1.32 | 27.47 | 9.1410 | 9.1410 | |

| 0.14 | 24.23 | 8.0646 | 0.5581 | |

| 0.01 | 6.45 | 2.1470 | 0.1166 | |

| 0.01 | 1.45 | 0.4824 | 0.0241 | |

| 0.00 | 0.48 | 0.1592 | 0.0084 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.60 | 20.40 | 6.7888 | -2.6379 | |

| 0.39 | 17.64 | 5.8702 | -1.8045 | |

| 0.10 | 10.79 | 3.5895 | -1.1097 | |

| 0.12 | 13.22 | 4.3985 | -1.0501 | |

| 0.15 | 23.63 | 7.8658 | -0.6527 | |

| 0.20 | 5.19 | 1.7272 | -0.5584 | |

| 0.12 | 5.20 | 1.7295 | -0.5522 | |

| 0.19 | 24.20 | 8.0535 | -0.5136 | |

| 0.20 | 11.68 | 3.8866 | -0.3962 | |

| 0.08 | 22.70 | 7.5538 | -0.3729 |

13F and Fund Filings

This form was filed on 2025-08-12 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | Put | 0.40 | 32.26 | 10.7365 | 10.7365 | ||||

| B / Barrick Mining Corporation | 1.32 | 27.47 | 9.1410 | 9.1410 | |||||

| GOOGL / Alphabet Inc. | 0.14 | 5.85 | 24.23 | 20.63 | 8.0646 | 0.5581 | |||

| KMB / Kimberly-Clark Corporation | 0.19 | 16.44 | 24.20 | 5.55 | 8.0535 | -0.5136 | |||

| QCOM / QUALCOMM Incorporated | 0.15 | 0.00 | 23.63 | 3.68 | 7.8658 | -0.6527 | |||

| GD / General Dynamics Corporation | 0.08 | 0.00 | 22.70 | 7.00 | 7.5538 | -0.3729 | |||

| SLB / Schlumberger Limited | 0.60 | 0.00 | 20.40 | -19.14 | 6.7888 | -2.6379 | |||

| YUMC / Yum China Holdings, Inc. | 0.39 | 0.00 | 17.64 | -14.12 | 5.8702 | -1.8045 | |||

| TOL / Toll Brothers, Inc. | 0.12 | 0.00 | 13.36 | 8.09 | 4.4479 | -0.1726 | |||

| XOM / Exxon Mobil Corporation | 0.12 | 0.00 | 13.22 | -9.36 | 4.3985 | -1.0501 | |||

| RYAAY / Ryanair Holdings plc - Depositary Receipt (Common Stock) | 0.20 | -25.14 | 11.68 | 1.89 | 3.8866 | -0.3962 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.10 | 0.00 | 10.79 | -14.23 | 3.5895 | -1.1097 | |||

| EXE / Expand Energy Corporation | 0.08 | 0.00 | 8.93 | 5.06 | 2.9734 | -0.2047 | |||

| MDLZ / Mondelez International, Inc. | 0.12 | 6.81 | 7.93 | 6.16 | 2.6395 | -0.1520 | |||

| PHM / PulteGroup, Inc. | 0.07 | 0.00 | 6.96 | 2.59 | 2.3165 | -0.2189 | |||

| SEE / Sealed Air Corporation | 0.22 | 0.00 | 6.83 | 7.37 | 2.2730 | -0.1040 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.01 | -1.83 | 6.45 | 18.74 | 2.1470 | 0.1166 | |||

| OXY / Occidental Petroleum Corporation | 0.12 | 0.00 | 5.20 | -14.89 | 1.7295 | -0.5522 | |||

| KHC / The Kraft Heinz Company | 0.20 | 0.00 | 5.19 | -15.16 | 1.7272 | -0.5584 | |||

| BHP / BHP Group Limited - Depositary Receipt (Common Stock) | 0.09 | 0.00 | 4.42 | -0.92 | 1.4709 | -0.1961 | |||

| GLD / SPDR Gold Trust | 0.00 | 0.00 | 1.49 | 5.81 | 0.4971 | -0.0305 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 0.00 | 1.45 | 18.19 | 0.4824 | 0.0241 | |||

| RTX / RTX Corporation | 0.01 | 0.00 | 1.02 | 10.25 | 0.3402 | -0.0063 | |||

| OTIS / Otis Worldwide Corporation | 0.01 | 0.00 | 0.89 | -3.99 | 0.2966 | -0.0505 | |||

| INTC / Intel Corporation | 0.03 | 0.00 | 0.56 | -1.23 | 0.1864 | -0.0258 | |||

| AXP / American Express Company | 0.00 | 0.00 | 0.48 | 18.61 | 0.1592 | 0.0084 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.46 | -0.86 | 0.1534 | -0.0204 | |||

| HAL / Halliburton Company | 0.02 | 0.00 | 0.41 | -19.72 | 0.1357 | -0.0540 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.23 | -8.91 | 0.0752 | -0.0174 | |||

| EMF / Templeton Emerging Markets Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GOLD / Barrick Mining Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |