Basic Stats

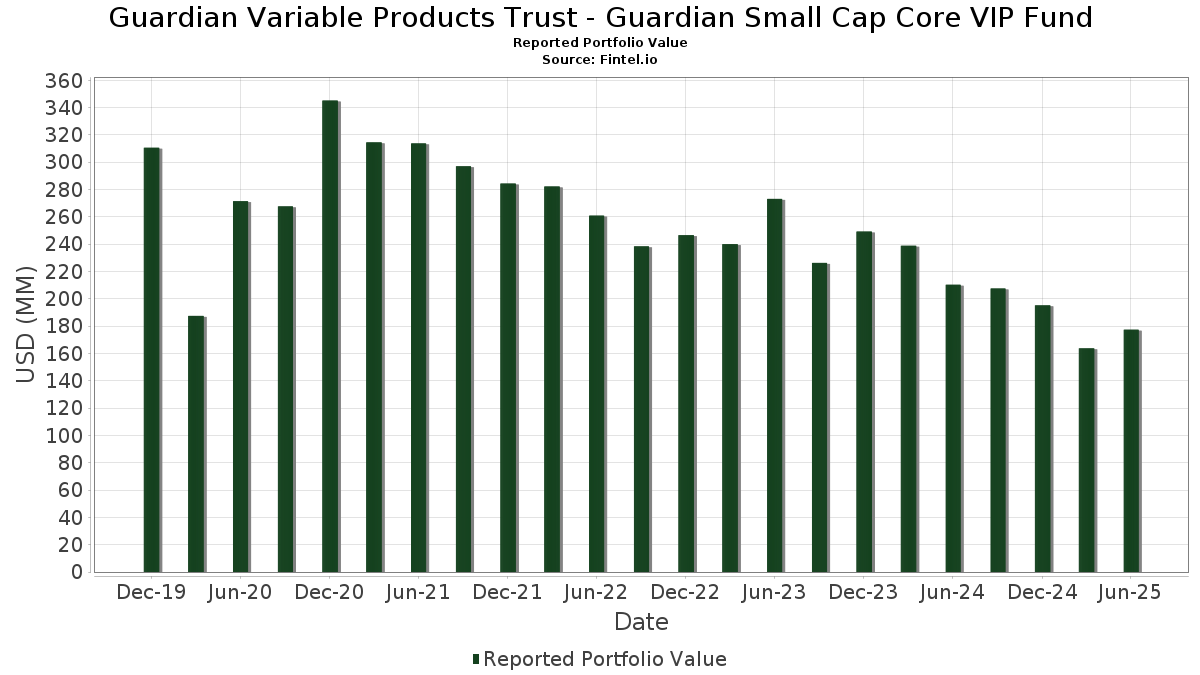

| Portfolio Value | $ 177,366,146 |

| Current Positions | 94 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Guardian Variable Products Trust - Guardian Small Cap Core VIP Fund has disclosed 94 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 177,366,146 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Guardian Variable Products Trust - Guardian Small Cap Core VIP Fund’s top holdings are Silicon Motion Technology Corporation - Depositary Receipt (Common Stock) (US:SIMO) , BGC Group, Inc. (US:BGC) , Kemper Corporation (US:KMPR) , BrightView Holdings, Inc. (US:BV) , and Brixmor Property Group Inc. (US:BRX) . Guardian Variable Products Trust - Guardian Small Cap Core VIP Fund’s new positions include Silicon Motion Technology Corporation - Depositary Receipt (Common Stock) (US:SIMO) , BGC Group, Inc. (US:BGC) , Kemper Corporation (US:KMPR) , BrightView Holdings, Inc. (US:BV) , and Brixmor Property Group Inc. (US:BRX) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.07 | 5.07 | 2.8582 | 2.8582 | |

| 0.41 | 4.22 | 2.3779 | 2.3779 | |

| 0.07 | 4.20 | 2.3680 | 2.3680 | |

| 3.91 | 2.2023 | 2.2023 | ||

| 0.23 | 3.84 | 2.1654 | 2.1654 | |

| 0.14 | 3.59 | 2.0254 | 2.0254 | |

| 0.03 | 3.43 | 1.9335 | 1.9335 | |

| 0.06 | 3.36 | 1.8948 | 1.8948 | |

| 0.02 | 3.35 | 1.8881 | 1.8881 | |

| 0.11 | 3.35 | 1.8873 | 1.8873 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 0.85 | 0.4769 | -1.2685 | |

| 0.00 | 0.00 | -1.1303 | ||

| 0.00 | 0.00 | -0.9105 | ||

| 0.03 | 0.35 | 0.1999 | -0.8134 | |

| 0.00 | 0.00 | -0.7390 | ||

| 0.00 | 0.00 | -0.6576 | ||

| 0.00 | 0.00 | -0.6100 | ||

| 0.00 | 0.00 | -0.4860 | ||

| 0.22 | 1.61 | 0.9050 | -0.4177 | |

| 0.00 | 0.00 | -0.4117 |

13F and Fund Filings

This form was filed on 2025-08-15 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SIMO / Silicon Motion Technology Corporation - Depositary Receipt (Common Stock) | 0.07 | 5.07 | 2.8582 | 2.8582 | |||||

| BGC / BGC Group, Inc. | 0.41 | 4.22 | 2.3779 | 2.3779 | |||||

| KMPR / Kemper Corporation | 0.07 | 4.20 | 2.3680 | 2.3680 | |||||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 3.91 | 2.2023 | 2.2023 | ||||||

| BV / BrightView Holdings, Inc. | 0.23 | 3.84 | 2.1654 | 2.1654 | |||||

| BRX / Brixmor Property Group Inc. | 0.14 | 3.59 | 2.0254 | 2.0254 | |||||

| TFX / Teleflex Incorporated | 0.03 | 3.43 | 1.9335 | 1.9335 | |||||

| EFSC / Enterprise Financial Services Corp | 0.06 | 3.36 | 1.8948 | 1.8948 | |||||

| THG / The Hanover Insurance Group, Inc. | 0.02 | 3.35 | 1.8881 | 1.8881 | |||||

| ENOV / Enovis Corporation | 0.11 | 3.35 | 1.8873 | 1.8873 | |||||

| AL / Air Lease Corporation | 0.06 | 3.35 | 1.8860 | 1.8860 | |||||

| WBS / Webster Financial Corporation | 0.06 | 3.30 | 1.8604 | 1.8604 | |||||

| GTY / Getty Realty Corp. | 0.11 | 3.08 | 1.7369 | 1.7369 | |||||

| NCR / NCR Corp. | 0.26 | 130.13 | 3.05 | 113.82 | 1.7174 | 1.1205 | |||

| GXO / GXO Logistics, Inc. | 0.06 | 3.00 | 1.6929 | 1.6929 | |||||

| POR / Portland General Electric Company | 0.07 | 16.81 | 2.93 | 6.42 | 1.6531 | -0.0304 | |||

| PB / Prosperity Bancshares, Inc. | 0.04 | -16.63 | 2.78 | 3.69 | 1.5677 | 0.5906 | |||

| ABM / ABM Industries Incorporated | 0.06 | 2.72 | 1.5334 | 1.5334 | |||||

| STNG / Scorpio Tankers Inc. | 0.07 | 2.67 | 1.5074 | 1.5074 | |||||

| GIL / Gildan Activewear Inc. | 0.05 | 2.61 | 1.4727 | 1.4727 | |||||

| CARG / CarGurus, Inc. | 0.08 | 2.58 | 1.4536 | 1.4536 | |||||

| SR / Spire Inc. | 0.03 | 2.52 | 1.4216 | 1.4216 | |||||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.06 | 2.47 | 1.3930 | 1.3930 | |||||

| BKV / BKV Corporation | 0.10 | 2.43 | 1.3713 | 1.3713 | |||||

| NBHC / National Bank Holdings Corporation | 0.06 | 2.28 | 1.2832 | 1.2832 | |||||

| FCF / First Commonwealth Financial Corporation | 0.14 | 2.27 | 1.2775 | 1.2775 | |||||

| CXT / Crane NXT, Co. | 0.04 | 64.53 | 2.26 | 72.60 | 1.2745 | 0.4740 | |||

| CSCCF / Capstone Copper Corp. | 0.36 | 2.23 | 1.2581 | 1.2581 | |||||

| HCC / Warrior Met Coal, Inc. | 0.05 | 120.50 | 2.20 | 111.83 | 1.2416 | 0.6063 | |||

| DRVN / Driven Brands Holdings Inc. | 0.13 | 2.20 | 1.2405 | 1.2405 | |||||

| BNL / Broadstone Net Lease, Inc. | 0.14 | 2.20 | 1.2405 | 1.2405 | |||||

| NWE / NorthWestern Energy Group, Inc. | 0.04 | 2.19 | 1.2346 | 1.2346 | |||||

| CSTM / Constellium SE | 0.16 | 25.38 | 2.14 | -11.57 | 1.2071 | 0.0556 | |||

| BPOP / Popular, Inc. | 0.02 | 2.10 | 1.1835 | 1.1835 | |||||

| 19P / Phreesia, Inc. | 0.07 | 2.09 | 1.1796 | 1.1796 | |||||

| TDC / Teradata Corporation | 0.09 | 2.07 | 1.1684 | 1.1684 | |||||

| BKH / Black Hills Corporation | 0.04 | 28.90 | 2.05 | 20.02 | 1.1558 | 0.5334 | |||

| MYRG / MYR Group Inc. | 0.01 | 2.02 | 1.1358 | 1.1358 | |||||

| VRNT / Verint Systems Inc. | 0.10 | 1.95 | 1.0990 | 1.0990 | |||||

| COHR / Coherent Corp. | 0.02 | 1.92 | 1.0811 | 1.0811 | |||||

| ERO / Ero Copper Corp. | 0.11 | 1.90 | 1.0728 | 1.0728 | |||||

| CNO / CNO Financial Group, Inc. | 0.05 | 1.88 | 1.0591 | 1.0591 | |||||

| DRS / Leonardo DRS, Inc. | 0.04 | 1.84 | 1.0345 | 1.0345 | |||||

| TSEM / Tower Semiconductor Ltd. | 0.04 | -56.90 | 1.81 | -33.38 | 1.0214 | 0.1418 | |||

| SLM / SLM Corporation | 0.05 | 1.77 | 0.9956 | 0.9956 | |||||

| AXS / AXIS Capital Holdings Limited | 0.02 | 1.73 | 0.9739 | 0.9739 | |||||

| WSBC / WesBanco, Inc. | 0.05 | -43.25 | 1.72 | -29.90 | 0.9675 | 0.0756 | |||

| FBP / First BanCorp. | 0.08 | 1.71 | 0.9655 | 0.9655 | |||||

| MTZ / MasTec, Inc. | 0.01 | 1.69 | 0.9550 | 0.9550 | |||||

| 541 / ADT Inc. | 0.20 | 1.68 | 0.9467 | 0.9467 | |||||

| MMS / Maximus, Inc. | 0.02 | 1.67 | 0.9413 | 0.9413 | |||||

| TKA / thyssenkrupp AG | 0.16 | 1.67 | 0.9392 | 0.9392 | |||||

| DHT / DHT Holdings, Inc. | 0.15 | 1.66 | 0.9361 | 0.9361 | |||||

| NMRK / Newmark Group, Inc. | 0.14 | 1.66 | 0.9355 | 0.9355 | |||||

| ACA / Arcosa, Inc. | 0.02 | 1.66 | 0.9337 | 0.9337 | |||||

| INR / Infinity Natural Resources, Inc. | 0.09 | 1.64 | 0.9255 | 0.9255 | |||||

| SBLK / Star Bulk Carriers Corp. | 0.09 | 1.63 | 0.9159 | 0.9159 | |||||

| BBWI / Bath & Body Works, Inc. | 0.05 | 1.62 | 0.9120 | 0.9120 | |||||

| HLMN / Hillman Solutions Corp. | 0.22 | -8.72 | 1.61 | -25.87 | 0.9050 | -0.4177 | |||

| ASH / Ashland Inc. | 0.03 | 1.59 | 0.8989 | 0.8989 | |||||

| THC / Tenet Healthcare Corporation | 0.01 | 1.56 | 0.8798 | 0.8798 | |||||

| NOMD / Nomad Foods Limited | 0.09 | 1.56 | 0.8797 | 0.8797 | |||||

| KBR / KBR, Inc. | 0.03 | 1.55 | 0.8724 | 0.8724 | |||||

| AA / Alcoa Corporation | 0.05 | 1.46 | 0.8241 | 0.8241 | |||||

| CMC / Commercial Metals Company | 0.03 | -2.80 | 1.44 | 3.29 | 0.8137 | -0.0397 | |||

| HUN / Huntsman Corporation | 0.13 | 1.38 | 0.7756 | 0.7756 | |||||

| MOS / The Mosaic Company | 0.04 | 1.30 | 0.7324 | 0.7324 | |||||

| SM / SM Energy Company | 0.05 | 1.28 | 0.7230 | 0.7230 | |||||

| DIOD / Diodes Incorporated | 0.02 | 1.19 | 0.6698 | 0.6698 | |||||

| AAP / Advance Auto Parts, Inc. | 0.02 | 1.10 | 0.6206 | 0.6206 | |||||

| THRM / Gentherm Incorporated | 0.04 | 1.00 | 0.5644 | 0.5644 | |||||

| ALGT / Allegiant Travel Company | 0.02 | -38.04 | 0.95 | -34.09 | 0.5373 | -0.3460 | |||

| TKR / The Timken Company | 0.01 | 0.95 | 0.5366 | 0.5366 | |||||

| HALO / Halozyme Therapeutics, Inc. | 0.02 | 0.94 | 0.5283 | 0.5283 | |||||

| UFPI / UFP Industries, Inc. | 0.01 | 0.93 | 0.5261 | 0.5261 | |||||

| UA / Under Armour, Inc. | 0.14 | 0.91 | 0.5154 | 0.5154 | |||||

| FCFS / FirstCash Holdings, Inc. | 0.01 | 0.88 | 0.4942 | 0.4942 | |||||

| KGS / Kodiak Gas Services, Inc. | 0.03 | 0.87 | 0.4901 | 0.4901 | |||||

| XPRO / Expro Group Holdings N.V. | 0.10 | 0.86 | 0.4844 | 0.4844 | |||||

| CCS / Century Communities, Inc. | 0.02 | -66.57 | 0.85 | -76.94 | 0.4769 | -1.2685 | |||

| VNOM / Viper Energy, Inc. | 0.02 | 0.84 | 0.4713 | 0.4713 | |||||

| SLDE / Slide Insurance Holdings, Inc. | 0.04 | 0.76 | 0.4280 | 0.4280 | |||||

| WH / Wyndham Hotels & Resorts, Inc. | 0.01 | 0.74 | 0.4184 | 0.4184 | |||||

| GO / Grocery Outlet Holding Corp. | 0.06 | 0.73 | 0.4117 | 0.4117 | |||||

| FA / First Advantage Corporation | 0.04 | 0.72 | 0.4046 | 0.4046 | |||||

| LBRT / Liberty Energy Inc. | 0.06 | 0.64 | 0.3584 | 0.3584 | |||||

| PLAY / Dave & Buster's Entertainment, Inc. | 0.02 | 0.62 | 0.3520 | 0.3520 | |||||

| BB / BlackBerry Limited | 0.11 | 0.52 | 0.2928 | 0.2928 | |||||

| CALX / Calix, Inc. | 0.01 | 0.51 | 0.2902 | 0.2902 | |||||

| CHYM / Chime Financial, Inc. | 0.01 | 0.50 | 0.2819 | 0.2819 | |||||

| W / Wayfair Inc. | 0.01 | 0.47 | 0.2621 | 0.2621 | |||||

| NVEE / NV5 Global, Inc. | 0.02 | 0.43 | 0.2450 | 0.2450 | |||||

| PRI / Primerica, Inc. | 0.00 | 0.42 | 0.2383 | 0.2383 | |||||

| AESI / Atlas Energy Solutions Inc. | 0.03 | -71.48 | 0.35 | -78.66 | 0.1999 | -0.8134 | |||

| PRVA / Privia Health Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9105 | ||||

| COLB / Columbia Banking System, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1303 | ||||

| WULF / TeraWulf Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4860 | ||||

| GPRE / Green Plains Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4117 | ||||

| ZETA / Zeta Global Holdings Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6576 | ||||

| ARWR / Arrowhead Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6100 | ||||

| BBNX / Beta Bionics, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3672 | ||||

| ASGN / ASGN Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.7390 |