Basic Stats

| Portfolio Value | $ 400,373,837 |

| Current Positions | 76 |

Latest Holdings, Performance, AUM (from 13F, 13D)

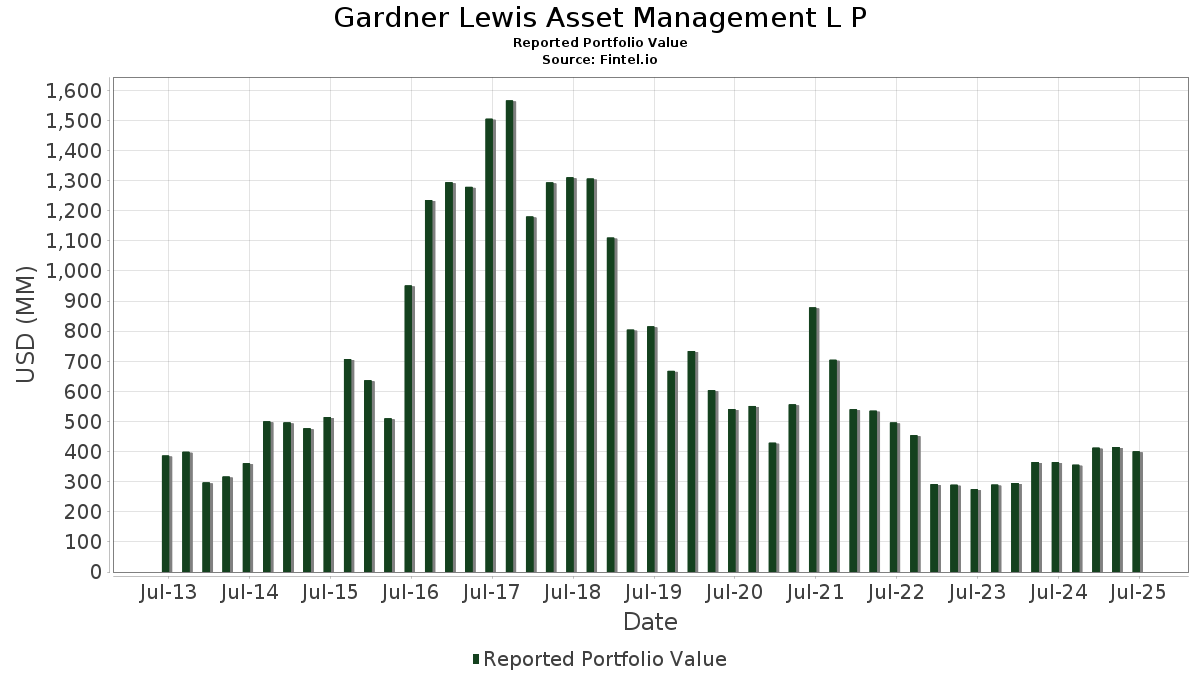

Gardner Lewis Asset Management L P has disclosed 76 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 400,373,837 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Gardner Lewis Asset Management L P’s top holdings are NVIDIA Corporation (US:NVDA) , Mastercard Incorporated (US:MA) , The Boeing Company (US:BA) , Microsoft Corporation (US:MSFT) , and Amazon.com, Inc. (US:AMZN) . Gardner Lewis Asset Management L P’s new positions include Everi Holdings Inc. (US:EVRI) , Redfin Corporation (US:RDFN) , Frontier Communications Parent, Inc. (US:FYBR) , Enstar Group Limited (US:ESGR) , and Servotronics, Inc. (US:SVT) . Gardner Lewis Asset Management L P’s top industries are "Railroad Transportation" (sic 40) , "Electric, Gas, And Sanitary Services " (sic 49) , and "Restaurants, Dining, Eating And Drinking Places" (sic 58) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.85 | 12.16 | 3.0360 | 3.0360 | |

| 0.25 | 39.42 | 9.8461 | 2.9117 | |

| 1.17 | 10.64 | 2.6583 | 2.6583 | |

| 0.37 | 11.11 | 2.7756 | 2.5944 | |

| 0.87 | 9.76 | 2.4381 | 2.4381 | |

| 0.22 | 8.15 | 2.0351 | 2.0351 | |

| 0.02 | 6.20 | 1.5482 | 1.5482 | |

| 0.36 | 7.00 | 1.7488 | 1.3489 | |

| 0.11 | 5.39 | 1.3472 | 1.3472 | |

| 0.05 | 5.13 | 1.2803 | 1.2803 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.15 | 6.12 | 1.5281 | -1.1458 | |

| 0.04 | 3.93 | 0.9822 | -0.5328 | |

| 0.32 | 7.86 | 1.9642 | -0.3086 | |

| 0.12 | 9.20 | 2.2979 | -0.2310 | |

| 0.01 | 1.70 | 0.4250 | -0.1363 | |

| 0.05 | 11.27 | 2.8148 | -0.1352 | |

| 0.05 | 1.40 | 0.3486 | -0.1049 | |

| 0.01 | 1.53 | 0.3824 | -0.0807 | |

| 0.01 | 0.90 | 0.2248 | -0.0275 | |

| 0.01 | 0.90 | 0.2249 | -0.0252 |

13D/G Filings

This is a list of 13D and 13G filings made in the last year (if any). Click the link icon to see the full transaction history. Green rows indicate new positions. Red rows indicate closed positions.

| File Date | Form | Security | Prev Shares |

Current Shares |

ΔShares % | % Ownership |

% ΔOwnership | |

|---|---|---|---|---|---|---|---|---|

| 2025-04-23 | EMKR / Emcore Corporation | 585,958 | 0 | -100.00 | 0.00 | -100.00 | ||

| 2025-04-23 | ICCH / ICC Holdings, Inc. | 164,866 | 0 | -100.00 | 0.00 | -100.00 | ||

| 2025-04-22 | MNTX / Manitex International, Inc. | 1,779,816 | 0 | -100.00 | 0.00 | -100.00 | ||

| 2025-04-17 | SCWX / SecureWorks Corp. | 1,276,021 | 0 | -100.00 | 0.00 | -100.00 |

13F and Fund Filings

This form was filed on 2025-08-12 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.25 | -6.05 | 39.42 | 36.95 | 9.8461 | 2.9117 | |||

| MA / Mastercard Incorporated | 0.03 | -0.54 | 15.60 | 1.97 | 3.8975 | 0.2110 | |||

| BA / The Boeing Company | 0.07 | -0.26 | 14.21 | 22.55 | 3.5503 | 0.7559 | |||

| MSFT / Microsoft Corporation | 0.03 | -3.97 | 13.71 | 27.24 | 3.4251 | 0.8289 | |||

| AMZN / Amazon.com, Inc. | 0.06 | 0.18 | 13.69 | 15.53 | 3.4191 | 0.5645 | |||

| UBS / UBS Group AG | 0.37 | -0.54 | 12.47 | 9.82 | 3.1144 | 0.3791 | |||

| EVRI / Everi Holdings Inc. | 0.85 | 12.16 | 3.0360 | 3.0360 | |||||

| TDG / TransDigm Group Incorporated | 0.01 | -0.66 | 11.50 | 9.21 | 2.8728 | 0.3356 | |||

| AAPL / Apple Inc. | 0.05 | -0.36 | 11.27 | -7.97 | 2.8148 | -0.1352 | |||

| PWOD / Penns Woods Bancorp, Inc. | 0.37 | 1,257.86 | 11.11 | 1,377.66 | 2.7756 | 2.5944 | |||

| AGS / AGS LLC | 0.88 | 13.29 | 11.02 | 16.84 | 2.7518 | 0.4803 | |||

| DNB / Dun & Bradstreet Holdings, Inc. | 1.17 | 10.64 | 2.6583 | 2.6583 | |||||

| META / Meta Platforms, Inc. | 0.01 | -1.47 | 10.20 | 26.17 | 2.5468 | 0.6000 | |||

| C / Citigroup Inc. | 0.12 | -0.51 | 10.06 | 19.30 | 2.5115 | 0.4810 | |||

| RDFN / Redfin Corporation | 0.87 | 9.76 | 2.4381 | 2.4381 | |||||

| GOOG / Alphabet Inc. | 0.05 | 0.00 | 9.42 | 13.55 | 2.3534 | 0.3543 | |||

| K / Kellanova | 0.12 | -9.10 | 9.20 | -12.36 | 2.2979 | -0.2310 | |||

| NFLX / Netflix, Inc. | 0.01 | -2.51 | 8.31 | 39.99 | 2.0751 | 0.6454 | |||

| FYBR / Frontier Communications Parent, Inc. | 0.22 | 8.15 | 2.0351 | 2.0351 | |||||

| CHX / ChampionX Corporation | 0.32 | 0.00 | 7.86 | -16.64 | 1.9642 | -0.3086 | |||

| ESSA / ESSA Bancorp, Inc. | 0.36 | 309.85 | 7.00 | 322.00 | 1.7488 | 1.3489 | |||

| TJX / The TJX Companies, Inc. | 0.05 | 2.76 | 6.63 | 4.19 | 1.6565 | 0.1231 | |||

| BRDG / Bridge Investment Group Holdings Inc. | 0.65 | 19.81 | 6.51 | 25.17 | 1.6259 | 0.3732 | |||

| ESGR / Enstar Group Limited | 0.02 | 6.20 | 1.5482 | 1.5482 | |||||

| JNPR / Juniper Networks, Inc. | 0.15 | -50.04 | 6.12 | -44.88 | 1.5281 | -1.1458 | |||

| SPOT / Spotify Technology S.A. | 0.01 | -9.16 | 5.85 | 26.75 | 1.4604 | 0.3490 | |||

| NOW / ServiceNow, Inc. | 0.01 | -0.44 | 5.84 | 28.58 | 1.4575 | 0.3641 | |||

| SVT / Servotronics, Inc. | 0.11 | 5.39 | 1.3472 | 1.3472 | |||||

| AVGO / Broadcom Inc. | 0.02 | -2.97 | 5.38 | 59.79 | 1.3438 | 0.5325 | |||

| SNPS / Synopsys, Inc. | 0.01 | 4.00 | 5.20 | 24.33 | 1.2995 | 0.2914 | |||

| VMC / Vulcan Materials Company | 0.02 | -0.38 | 5.19 | 11.38 | 1.2960 | 0.1737 | |||

| AMED / Amedisys, Inc. | 0.05 | 5.13 | 1.2803 | 1.2803 | |||||

| ICAD / iCAD, Inc. | 1.33 | 5.07 | 1.2662 | 1.2662 | |||||

| INZY / Inozyme Pharma, Inc. | 1.26 | 5.03 | 1.2566 | 1.2566 | |||||

| XOM / Exxon Mobil Corporation | 0.04 | -31.01 | 3.93 | -37.48 | 0.9822 | -0.5328 | |||

| IT / Gartner, Inc. | 0.01 | -0.51 | 3.92 | -4.20 | 0.9803 | -0.0066 | |||

| LLY / Eli Lilly and Company | 0.00 | 2.99 | 3.89 | -2.80 | 0.9718 | 0.0076 | |||

| TOL / Toll Brothers, Inc. | 0.03 | -12.34 | 3.81 | -5.25 | 0.9514 | -0.0171 | |||

| EBTC / Enterprise Bancorp, Inc. | 0.09 | 31.25 | 3.68 | 33.65 | 0.9187 | 0.2557 | |||

| HEI / HEICO Corporation | 0.01 | -9.96 | 3.17 | 10.55 | 0.7906 | 0.1008 | |||

| SSBK / Southern States Bancshares, Inc. | 0.08 | 234.47 | 2.83 | 240.50 | 0.7077 | 0.5071 | |||

| HUM / Humana Inc. | 0.01 | 50.63 | 2.53 | 39.23 | 0.6313 | 0.1938 | |||

| MLM / Martin Marietta Materials, Inc. | 0.00 | -1.11 | 2.45 | 13.54 | 0.6117 | 0.0921 | |||

| STR / Sitio Royalties Corp. | 0.13 | 2.37 | 0.5922 | 0.5922 | |||||

| NDAQ / Nasdaq, Inc. | 0.02 | 0.00 | 2.15 | 17.91 | 0.5378 | 0.0978 | |||

| RACE / Ferrari N.V. | 0.00 | 12.32 | 2.15 | 28.81 | 0.5362 | 0.1348 | |||

| DECK / Deckers Outdoor Corporation | 0.02 | 1.99 | 0.4966 | 0.4966 | |||||

| DIS / The Walt Disney Company | 0.02 | 0.00 | 1.98 | 25.63 | 0.4946 | 0.1149 | |||

| APH / Amphenol Corporation | 0.02 | -18.35 | 1.98 | 22.89 | 0.4938 | 0.1064 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.01 | -14.38 | 1.92 | 16.84 | 0.4785 | 0.0834 | |||

| LHX / L3Harris Technologies, Inc. | 0.01 | -17.36 | 1.88 | -0.95 | 0.4689 | 0.0123 | |||

| LULU / lululemon athletica inc. | 0.01 | -12.99 | 1.70 | -26.96 | 0.4250 | -0.1363 | |||

| AZO / AutoZone, Inc. | 0.00 | 111.54 | 1.63 | 105.93 | 0.4080 | 0.2169 | |||

| IBKR / Interactive Brokers Group, Inc. | 0.03 | 211.71 | 1.55 | 4.31 | 0.3870 | 0.0291 | |||

| NXPI / NXP Semiconductors N.V. | 0.01 | -30.72 | 1.53 | -20.40 | 0.3824 | -0.0807 | |||

| CFSB / CFSB Bancorp, Inc. | 0.10 | 1.42 | 0.3547 | 0.3547 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.01 | 1.40 | 0.3490 | 0.3490 | |||||

| SRDX / Surmodics, Inc. | 0.05 | -23.81 | 1.40 | -25.88 | 0.3486 | -0.1049 | |||

| ANSS / ANSYS, Inc. | 0.00 | 63.99 | 1.26 | 82.08 | 0.3148 | 0.1479 | |||

| CRM / Salesforce, Inc. | 0.00 | 0.00 | 1.25 | 1.63 | 0.3116 | 0.0158 | |||

| SPR / Spirit AeroSystems Holdings, Inc. | 0.03 | 0.00 | 1.08 | 10.71 | 0.2687 | 0.0346 | |||

| HES / Hess Corporation | 0.01 | 0.00 | 0.90 | -13.29 | 0.2249 | -0.0252 | |||

| FANG / Diamondback Energy, Inc. | 0.01 | 0.00 | 0.90 | -14.14 | 0.2248 | -0.0275 | |||

| COOP / Mr. Cooper Group Inc. | 0.01 | 0.90 | 0.2236 | 0.2236 | |||||

| MNST / Monster Beverage Corporation | 0.01 | 0.00 | 0.89 | 6.97 | 0.2225 | 0.0220 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 82.78 | 0.72 | 100.84 | 0.1786 | 0.0927 | |||

| SHOP / Shopify Inc. | 0.01 | 0.00 | 0.64 | 20.83 | 0.1611 | 0.0325 | |||

| MELI / MercadoLibre, Inc. | 0.00 | 50.00 | 0.64 | 101.25 | 0.1606 | 0.0835 | |||

| CHTR / Charter Communications, Inc. | 0.00 | 0.59 | 0.1472 | 0.1472 | |||||

| PPBI / Pacific Premier Bancorp, Inc. | 0.03 | 0.57 | 0.1435 | 0.1435 | |||||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.57 | 0.1432 | 0.1432 | |||||

| CP / Canadian Pacific Kansas City Limited | 0.01 | 0.57 | 0.1428 | 0.1428 | |||||

| BLKB / Blackbaud, Inc. | 0.01 | 0.00 | 0.45 | 3.46 | 0.1123 | 0.0076 | |||

| DE / Deere & Company | 0.00 | 0.39 | 0.0984 | 0.0984 | |||||

| CAT / Caterpillar Inc. | 0.00 | 0.29 | 0.0729 | 0.0729 | |||||

| MCO / Moody's Corporation | 0.00 | 0.20 | 0.0507 | 0.0507 | |||||

| NVRO / Nevro Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IVAC / Intevac, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SASR / Sandy Spring Bancorp, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CMG / Chipotle Mexican Grill, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MUSA / Murphy USA Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MMLP / Martin Midstream Partners L.P. - Limited Partnership | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ATSG / Air Transport Services Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FLIC / The First of Long Island Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WMPN / William Penn Bancorporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MSI / Motorola Solutions, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PH / Parker-Hannifin Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PLYA / Playa Hotels & Resorts N.V. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VBFC / Village Bank and Trust Financial Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| JWN / Nordstrom, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KKR / KKR & Co. Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FBMS / The First Bancshares, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VOXX / VOXX International Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DESP / Despegar.com, Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ITCI / Intra-Cellular Therapies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BECN / Beacon Roofing Supply, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AMPS / Altus Power, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EVBN / Evans Bancorp, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SYK / Stryker Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CMRX / Chimerix, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TSVT / 2seventy bio, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |