Basic Stats

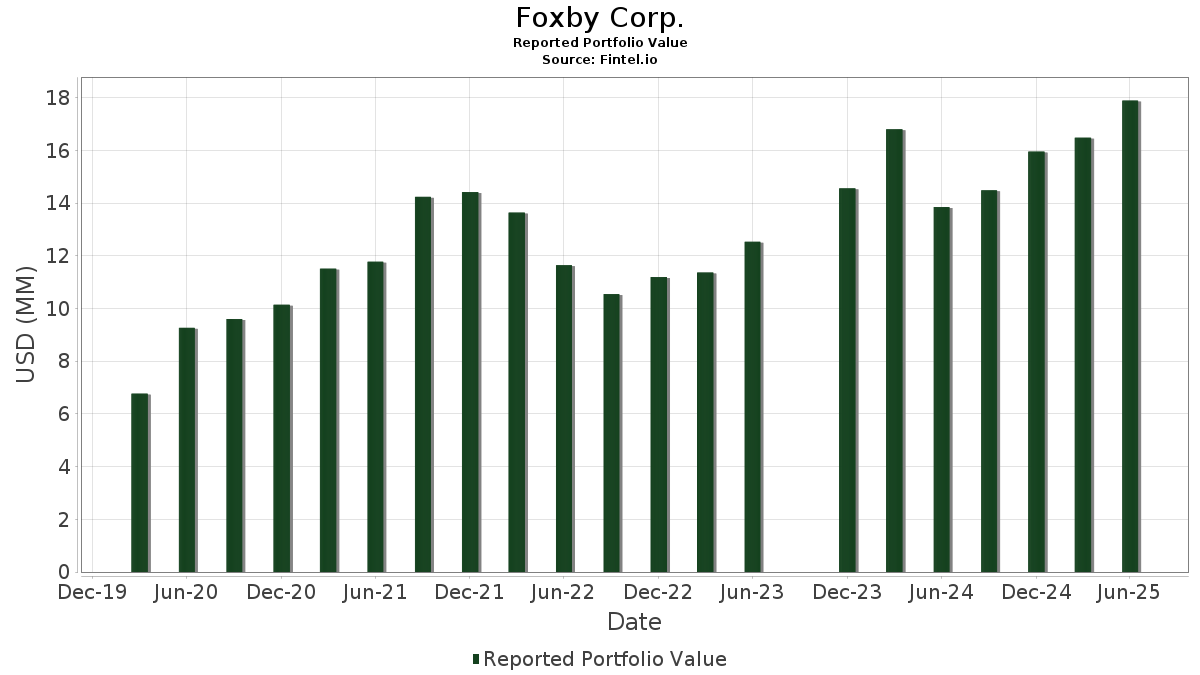

| Portfolio Value | $ 17,887,976 |

| Current Positions | 29 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Foxby Corp. has disclosed 29 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 17,887,976 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Foxby Corp.’s top holdings are Alphabet Inc. (US:GOOGL) , AutoZone, Inc. (US:AZO) , Steel Dynamics, Inc. (US:STLD) , Credit Acceptance Corporation (US:CACC) , and LPL Financial Holdings Inc. (US:LPLA) . Foxby Corp.’s new positions include IAMGOLD Corporation (US:IAG) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.06 | 0.41 | 2.7853 | 2.7853 | |

| 0.02 | 0.85 | 5.7569 | 1.1634 | |

| 0.02 | 0.86 | 5.8493 | 1.0124 | |

| 0.05 | 0.67 | 4.5527 | 0.9788 | |

| 0.00 | 0.85 | 5.7438 | 0.7795 | |

| 0.01 | 0.37 | 2.5031 | 0.5388 | |

| 0.04 | 0.67 | 4.5337 | 0.3910 | |

| 0.01 | 1.76 | 11.9254 | 0.3432 | |

| 0.00 | 0.55 | 3.7472 | 0.2972 | |

| 0.02 | 0.71 | 4.8161 | 0.2613 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.51 | 3.4305 | -2.9440 | |

| 0.00 | 1.24 | 8.4153 | -1.1512 | |

| 0.00 | 0.97 | 6.5498 | -0.7981 | |

| 0.01 | 1.01 | 6.8433 | -0.5576 | |

| 0.01 | 0.82 | 5.5276 | -0.3931 | |

| 0.01 | 0.28 | 1.8891 | -0.3494 | |

| 0.00 | 0.25 | 1.6809 | -0.3234 | |

| 0.01 | 0.88 | 5.9589 | -0.3096 | |

| 0.00 | 0.17 | 1.1581 | -0.2753 | |

| 0.01 | 0.63 | 4.2376 | -0.2561 |

13F and Fund Filings

This form was filed on 2025-08-28 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GOOGL / Alphabet Inc. | 0.01 | 0.00 | 1.76 | 13.97 | 11.9254 | 0.3432 | |||

| AZO / AutoZone, Inc. | 0.00 | 0.00 | 1.24 | -2.66 | 8.4153 | -1.1512 | |||

| STLD / Steel Dynamics, Inc. | 0.01 | 0.00 | 1.01 | 2.33 | 6.8433 | -0.5576 | |||

| CACC / Credit Acceptance Corporation | 0.00 | 0.00 | 0.97 | -1.43 | 6.5498 | -0.7981 | |||

| LPLA / LPL Financial Holdings Inc. | 0.00 | 0.00 | 0.88 | 14.51 | 5.9883 | 0.2058 | |||

| ESNT / Essent Group Ltd. | 0.01 | 0.00 | 0.88 | 5.26 | 5.9589 | -0.3096 | |||

| IBKR / Interactive Brokers Group, Inc. | 0.02 | 300.00 | 0.86 | 33.95 | 5.8493 | 1.0124 | |||

| BBW / Build-A-Bear Workshop, Inc. | 0.02 | 0.00 | 0.85 | 38.66 | 5.7569 | 1.1634 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.85 | 28.10 | 5.7438 | 0.7795 | |||

| WSM / Williams-Sonoma, Inc. | 0.01 | 0.00 | 0.82 | 3.29 | 5.5276 | -0.3931 | |||

| NMIH / NMI Holdings, Inc. | 0.02 | 0.00 | 0.71 | 16.94 | 4.8161 | 0.2613 | |||

| OCANF / OceanaGold Corporation | 0.05 | -66.67 | 0.67 | 40.88 | 4.5527 | 0.9788 | |||

| DPMLF / DPM Metals Inc. | 0.04 | 0.00 | 0.67 | 20.98 | 4.5337 | 0.3910 | |||

| WDOFF / Wesdome Gold Mines Ltd. | 0.04 | 0.00 | 0.63 | 16.98 | 4.2464 | 0.2304 | |||

| MLI / Mueller Industries, Inc. | 0.01 | 0.00 | 0.63 | 4.51 | 4.2376 | -0.2561 | |||

| URI / United Rentals, Inc. | 0.00 | 0.00 | 0.55 | 20.22 | 3.7472 | 0.2972 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.00 | 0.51 | -40.54 | 3.4305 | -2.9440 | |||

| DDS / Dillard's, Inc. | 0.00 | 0.00 | 0.41 | 16.67 | 2.7992 | 0.1437 | |||

| IAG / IAMGOLD Corporation | 0.06 | 0.41 | 2.7853 | 2.7853 | |||||

| NVR / NVR, Inc. | 0.00 | 0.00 | 0.41 | 2.01 | 2.7488 | -0.2354 | |||

| YOU / Clear Secure, Inc. | 0.01 | 0.00 | 0.39 | 7.14 | 2.6451 | -0.0874 | |||

| OTCM / OTC Markets Group Inc. | 0.01 | 0.00 | 0.38 | 20.00 | 2.6036 | 0.2047 | |||

| DFIN / Donnelley Financial Solutions, Inc. | 0.01 | 0.00 | 0.37 | 40.84 | 2.5031 | 0.5388 | |||

| MTDR / Matador Resources Company | 0.01 | 0.00 | 0.28 | -6.38 | 1.8891 | -0.3494 | |||

| UFPI / UFP Industries, Inc. | 0.00 | 0.00 | 0.25 | -7.12 | 1.6809 | -0.3234 | |||

| CROX / Crocs, Inc. | 0.00 | 0.00 | 0.21 | -4.52 | 1.4324 | -0.2300 | |||

| ELV / Elevance Health, Inc. | 0.00 | 0.00 | 0.17 | -10.47 | 1.1581 | -0.2753 | |||

| NMYSF / NamSys Inc. | 0.08 | 44.29 | 0.10 | 83.02 | 0.6625 | 0.2601 | |||

| Reich & Tang Deposit Account / STIV (N/A) | 0.00 | 0.0161 | 0.0161 |