Basic Stats

| Portfolio Value | $ 1,066,387,697 |

| Current Positions | 101 |

Latest Holdings, Performance, AUM (from 13F, 13D)

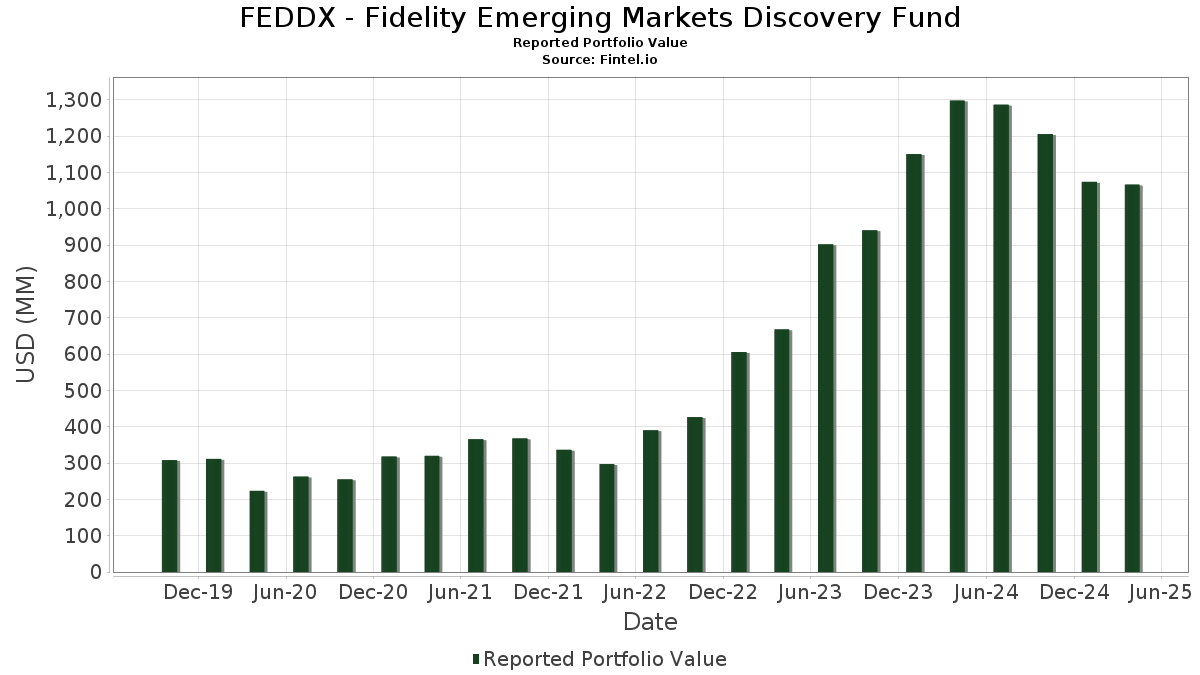

FEDDX - Fidelity Emerging Markets Discovery Fund has disclosed 101 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,066,387,697 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). FEDDX - Fidelity Emerging Markets Discovery Fund’s top holdings are Fidelity Cash Central Fund (US:US31635A1051) , Fidelity Securities Lending Cash Central Fund (US:US31635A3032) , Organization of Football Prognostics S.A. (GR:OPAP) , Localiza Rent a Car S.A. - Depositary Receipt (Common Stock) (US:LZRFY) , and Lion Finance Group PLC (DE:GEB) . FEDDX - Fidelity Emerging Markets Discovery Fund’s new positions include Korea Aerospace Industries, Ltd. (KR:047810) , Full Truck Alliance Co. Ltd. - Depositary Receipt (Common Stock) (US:YMM) , Acter Group Corporation Limited (TW:5536) , ASPEED Technology Inc. (TW:5274) , and Advantech Co., Ltd. (TW:2395) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 34.08 | 34.08 | 3.3206 | 3.1723 | |

| 0.20 | 11.95 | 1.1642 | 1.1642 | |

| 1.04 | 11.84 | 1.1536 | 1.1536 | |

| 0.94 | 11.82 | 1.1518 | 1.1518 | |

| 0.11 | 10.18 | 0.9915 | 0.9915 | |

| 0.91 | 9.56 | 0.9311 | 0.9311 | |

| 2.07 | 15.69 | 1.5285 | 0.8471 | |

| 64.59 | 11.11 | 1.0823 | 0.6691 | |

| 2.99 | 12.69 | 1.2364 | 0.5588 | |

| 0.13 | 10.71 | 1.0437 | 0.4863 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 3.47 | 1.81 | 0.1766 | -0.8993 | |

| 0.00 | 0.00 | -0.7673 | ||

| 0.57 | 4.28 | 0.4171 | -0.4530 | |

| 0.82 | 7.19 | 0.7009 | -0.3046 | |

| 0.33 | 10.44 | 1.0167 | -0.2971 | |

| 0.92 | 5.51 | 0.5372 | -0.2947 | |

| 0.74 | 10.65 | 1.0377 | -0.2188 | |

| 7.24 | 9.90 | 0.9642 | -0.1905 | |

| 3.02 | 8.19 | 0.7975 | -0.1900 | |

| 0.65 | 10.92 | 1.0636 | -0.1872 |

13F and Fund Filings

This form was filed on 2025-06-26 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US31635A1051 / Fidelity Cash Central Fund | 34.08 | 2,119.01 | 34.08 | 2,120.33 | 3.3206 | 3.1723 | |||

| US31635A3032 / Fidelity Securities Lending Cash Central Fund | 31.83 | -2.91 | 31.83 | -2.91 | 3.1014 | -0.0647 | |||

| OPAP / Organization of Football Prognostics S.A. | 0.77 | -6.10 | 17.07 | 21.18 | 1.6634 | 0.3029 | |||

| LZRFY / Localiza Rent a Car S.A. - Depositary Receipt (Common Stock) | 2.07 | 55.15 | 15.69 | 122.34 | 1.5285 | 0.8471 | |||

| GEB / Lion Finance Group PLC | 0.19 | -14.02 | 15.53 | 16.61 | 1.5127 | 0.2270 | |||

| 5Y2 / Dino Polska S.A. | 0.11 | -6.43 | 14.86 | 18.21 | 1.4477 | 0.2339 | |||

| MAXHEALT / Max Healthcare Institute Ltd | 1.07 | 79.73 | 13.87 | 370.24 | 1.3515 | 0.4654 | |||

| Q / Quálitas Controladora, S.A.B. de C.V. | 1.25 | -6.83 | 13.81 | 23.44 | 1.3458 | 0.2652 | |||

| INE066A01021 / Eicher Motors Ltd | 0.21 | -12.88 | 13.81 | -4.30 | 1.3453 | -0.0480 | |||

| EQTL3 / Equatorial S.A. | 2.09 | -6.65 | 13.55 | 17.37 | 1.3204 | 0.2053 | |||

| 511218 / Shriram Finance Limited | 1.86 | -13.37 | 13.49 | 0.15 | 1.3141 | 0.0136 | |||

| BCH / Banco de Chile - Depositary Receipt (Common Stock) | 0.45 | -6.65 | 13.31 | 11.38 | 1.2965 | 0.1429 | |||

| 531213 / Manappuram Finance Limited | 4.85 | -5.08 | 13.23 | 14.91 | 1.2889 | 0.1772 | |||

| 1308 / SITC International Holdings Company Limited | 4.73 | -3.55 | 13.08 | 11.75 | 1.2743 | 0.1441 | |||

| 300124 / Shenzhen Inovance Technology Co.,Ltd | 1.33 | -6.53 | 13.06 | 10.17 | 1.2720 | 0.1276 | |||

| HDFCLIFE / HDFC Life Insurance Company Limited | 1.48 | -1.85 | 12.96 | 17.27 | 1.2623 | 0.1954 | |||

| FCFS / FirstCash Holdings, Inc. | 0.10 | -3.69 | 12.95 | 18.20 | 1.2613 | 0.2037 | |||

| HYPE3 / Hypera S.A. | 2.99 | 33.09 | 12.69 | 80.85 | 1.2364 | 0.5588 | |||

| AFYA / Afya Limited | 0.66 | -3.53 | 12.63 | 13.50 | 1.2309 | 0.1560 | |||

| AL0 / Allegro.eu S.A. | 1.44 | -1.91 | 12.57 | 15.94 | 1.2246 | 0.1777 | |||

| 021240 / COWAY Co., Ltd. | 0.20 | -8.52 | 12.53 | 6.59 | 1.2207 | 0.0856 | |||

| INE066F01020 / Hindustan Aeronautics Ltd. | 0.23 | -2.26 | 12.16 | 14.38 | 1.1851 | 0.1581 | |||

| CXSE3 / Caixa Seguridade Participações S.A. | 4.19 | -3.61 | 12.07 | 10.62 | 1.1763 | 0.1223 | |||

| ORVR3 / Orizon Valorização de Resíduos S.A. | 1.39 | -1.93 | 11.97 | 19.50 | 1.1664 | 0.1990 | |||

| 047810 / Korea Aerospace Industries, Ltd. | 0.20 | 11.95 | 1.1642 | 1.1642 | |||||

| CHDRAUIB / Grupo Comercial Chedraui SA de CV | 1.83 | -3.63 | 11.86 | 8.14 | 1.1559 | 0.0965 | |||

| YMM / Full Truck Alliance Co. Ltd. - Depositary Receipt (Common Stock) | 1.04 | 11.84 | 1.1536 | 1.1536 | |||||

| 5536 / Acter Group Corporation Limited | 0.94 | 11.82 | 1.1518 | 1.1518 | |||||

| CRHKF / China Resources Beer (Holdings) Company Limited | 3.29 | -1.75 | 11.63 | 14.50 | 1.1326 | 0.1521 | |||

| RA / Regional SAB de CV | 1.66 | 14.94 | 11.62 | 23.20 | 1.1324 | 0.2214 | |||

| 2360 / Chroma ATE Inc. | 1.27 | 39.67 | 11.58 | 13.94 | 1.1280 | 0.1467 | |||

| RAIL3 / Rumo S.A. | 3.36 | -5.48 | 11.47 | 2.63 | 1.1178 | 0.0382 | |||

| CPA / Copa Holdings, S.A. | 0.12 | -6.96 | 11.29 | -8.41 | 1.0997 | -0.0904 | |||

| 1590 / Airtac International Group | 0.41 | -7.04 | 11.22 | -1.60 | 1.0932 | -0.0080 | |||

| 8464 / Nien Made Enterprise Co., LTD. | 0.92 | -7.92 | 11.22 | -13.69 | 1.0930 | -0.1621 | |||

| 3293 / International Games System Co.,Ltd. | 0.43 | 1.85 | 11.22 | -7.12 | 1.0928 | -0.0734 | |||

| BHE / Bharat Electronics Ltd | 3.00 | -2.22 | 11.16 | 8.08 | 1.0868 | 0.0901 | |||

| RIG2 / Richter Gedeon Vegyészeti Gyár Nyilvánosan Muködo Rt. | 0.37 | 0.00 | 11.12 | 16.89 | 1.0837 | 0.1648 | |||

| CAMS / Computer Age Management Services Limited | 0.24 | -2.15 | 11.11 | 8.86 | 1.0826 | 0.0968 | |||

| BRIS / Direxion Daily BRIC Bear 3X Shares | 64.59 | 170.10 | 11.11 | 159.65 | 1.0823 | 0.6691 | |||

| F6H / Far East Horizon Limited | 14.29 | -1.76 | 11.08 | 3.52 | 1.0792 | 0.0460 | |||

| 3037 / Unimicron Technology Corp. | 3.75 | 39.96 | 11.05 | -0.49 | 1.0770 | 0.0043 | |||

| 0WH / WH Group Limited | 12.31 | -1.91 | 11.01 | 12.68 | 1.0728 | 0.1291 | |||

| 270 / Guangdong Investment Limited | 13.57 | -1.87 | 10.98 | 5.30 | 1.0702 | 0.0629 | |||

| 3665 / Bizlink Holding Inc. | 0.65 | -6.24 | 10.92 | -15.72 | 1.0636 | -0.1872 | |||

| TRP / Torrent Pharmaceuticals Ltd | 0.28 | -2.05 | 10.88 | 2.02 | 1.0600 | 0.0302 | |||

| 005830 / DB Insurance Co., Ltd. | 0.17 | -6.70 | 10.88 | -9.56 | 1.0597 | -0.1017 | |||

| 8069 / E Ink Holdings Inc. | 1.54 | 9.63 | 10.76 | -8.31 | 1.0482 | -0.0849 | |||

| PRIO3 / Prio S.A. | 1.80 | 8.07 | 10.71 | -8.48 | 1.0437 | -0.0866 | |||

| 3529 / eMemory Technology Inc. | 0.13 | 319.71 | 10.71 | 477.47 | 1.0437 | 0.4863 | |||

| 033780 / KT&G Corporation | 0.13 | -2.10 | 10.71 | 4.32 | 1.0431 | 0.0520 | |||

| 2327 / Yageo Corporation | 0.74 | -7.80 | 10.65 | -18.15 | 1.0377 | -0.2188 | |||

| LREN3 / Lojas Renner S.A. | 4.10 | -2.46 | 10.55 | 7.51 | 1.0281 | 0.0802 | |||

| 5F1 / First Resources Limited | 9.11 | -1.99 | 10.54 | 6.49 | 1.0268 | 0.0711 | |||

| LNLB / Li Ning Company Limited | 5.51 | -5.00 | 10.44 | -12.41 | 1.0168 | -0.1339 | |||

| 6004 / CATRION Catering Holding Company | 0.33 | -13.66 | 10.44 | -23.30 | 1.0167 | -0.2971 | |||

| 168 / Tsingtao Brewery Company Limited | 1.47 | 26.53 | 10.37 | 46.01 | 1.0107 | 0.3246 | |||

| NQL1 / The Bidvest Group Limited | 0.81 | -6.87 | 10.19 | -13.76 | 0.9932 | -0.1484 | |||

| 5274 / ASPEED Technology Inc. | 0.11 | 10.18 | 0.9915 | 0.9915 | |||||

| FSRA / FirstRand Limited | 2.60 | -1.90 | 10.15 | -5.86 | 0.9894 | -0.0523 | |||

| AMRT / PT Sumber Alfaria Trijaya Tbk | 77.90 | 18.14 | 10.08 | -12.53 | 0.9825 | -0.1308 | |||

| ALDAR / Aldar Properties PJSC | 4.47 | -1.76 | 10.05 | 6.07 | 0.9793 | 0.0642 | |||

| 8210 / Bupa Arabia for Cooperative Insurance Company | 0.22 | -5.46 | 10.01 | -14.61 | 0.9752 | -0.1568 | |||

| UTY / PT United Tractors Tbk | 7.24 | -7.60 | 9.90 | -17.24 | 0.9642 | -0.1905 | |||

| 5904 / POYA International Co., Ltd. | 0.66 | -15.96 | 9.89 | -14.44 | 0.9640 | -0.1528 | |||

| 5289 / Innodisk Corporation | 1.35 | 9.92 | 9.83 | 30.10 | 0.9580 | 0.2281 | |||

| 2386 / SINOPEC Engineering (Group) Co., Ltd. | 13.55 | -3.64 | 9.66 | -13.92 | 0.9410 | -0.1425 | |||

| 2395 / Advantech Co., Ltd. | 0.91 | 9.56 | 0.9311 | 0.9311 | |||||

| 603605 / Proya Cosmetics Co.,Ltd. | 0.73 | 22.92 | 9.54 | 38.94 | 0.9293 | 0.2663 | |||

| ADNOCDRILL / ADNOC Drilling Company P.J.S.C. | 6.95 | -3.65 | 9.27 | -12.56 | 0.9031 | -0.1207 | |||

| 1477 / Makalot Industrial Co., Ltd. | 1.04 | -1.70 | 9.25 | -16.97 | 0.9013 | -0.1746 | |||

| 081660 / Misto Holdings Corp. | 0.35 | -2.07 | 9.18 | -5.30 | 0.8945 | -0.0417 | |||

| TME / Tencent Music Entertainment Group - Depositary Receipt (Common Stock) | 0.67 | -2.22 | 9.05 | 9.54 | 0.8818 | 0.0839 | |||

| 9O1 / Athens International Airport S.A. | 0.86 | -2.41 | 8.94 | 13.67 | 0.8710 | 0.1115 | |||

| 600690 / Haier Smart Home Co., Ltd. | 2.62 | -2.00 | 8.93 | -12.88 | 0.8705 | -0.1198 | |||

| LOGG3 / LOG Commercial Properties e Participações S.A. | 2.40 | -2.54 | 8.89 | 11.51 | 0.8666 | 0.0963 | |||

| 5871 / Chailease Holding Company Limited | 2.46 | -2.07 | 8.84 | 1.49 | 0.8616 | 0.0201 | |||

| 8422 / Cleanaway Company Limited | 1.55 | -17.33 | 8.76 | -13.61 | 0.8536 | -0.1257 | |||

| CRFB3 / Atacadão S.A. | 5.66 | 0.00 | 8.52 | 42.23 | 0.8302 | 0.2517 | |||

| 2449 / King Yuan Electronics Co., Ltd. | 3.02 | -1.98 | 8.19 | -19.95 | 0.7975 | -0.1900 | |||

| FIBRAMQ12 / Deutsche Bank, S.A., Institucion De Banca Multiple | 5.19 | 0.00 | 8.14 | 2.86 | 0.7927 | 0.0288 | |||

| FUNO 11 / Fibra UNO | 6.29 | 0.00 | 8.12 | 24.40 | 0.7908 | 0.1608 | |||

| 2408 / Nanya Technology Corporation | 7.15 | -2.29 | 8.06 | 23.31 | 0.7855 | 0.1541 | |||

| FSHUF / Fu Shou Yuan International Group Limited | 17.50 | -1.96 | 7.94 | -18.80 | 0.7738 | -0.1708 | |||

| RLC / Robinsons Land Corporation | 37.13 | -2.47 | 7.77 | -4.96 | 0.7574 | -0.0326 | |||

| MAVI / Mavi Giyim Sanayi ve Ticaret A.S. | 8.79 | 97.02 | 7.37 | -16.64 | 0.7179 | -0.1358 | |||

| TAL / TAL Education Group - Depositary Receipt (Common Stock) | 0.82 | -3.43 | 7.19 | -30.91 | 0.7009 | -0.3046 | |||

| A357780 / Soulbrain Co., Ltd. | 0.06 | 0.00 | 7.16 | 5.97 | 0.6972 | 0.0451 | |||

| 014680 / Hansol Chemical Co., Ltd. | 0.09 | 0.00 | 6.97 | 28.83 | 0.6787 | 0.1565 | |||

| 9899 / NetEase Cloud Music Inc. | 0.30 | 0.00 | 6.93 | 48.39 | 0.6752 | 0.2242 | |||

| 502137 / Deccan Cements Limited | 0.73 | 0.00 | 6.73 | 19.78 | 0.6561 | 0.1132 | |||

| FPT / FPT Corporation | 1.51 | 482.72 | 6.40 | 304.75 | 0.6231 | 0.4704 | |||

| 001450 / Hyundai Marine & Fire Insurance Co., Ltd. | 0.36 | 0.00 | 5.60 | -7.71 | 0.5460 | -0.0403 | |||

| 603338 / Zhejiang Dingli Machinery Co.,Ltd | 0.92 | 0.00 | 5.51 | -35.99 | 0.5372 | -0.2947 | |||

| 6100 / Tongdao Liepin Group | 11.27 | -2.46 | 5.30 | 22.92 | 0.5168 | 0.1001 | |||

| DOYU / DouYu International Holdings Limited - Depositary Receipt (Common Stock) | 0.57 | 0.00 | 4.28 | -52.49 | 0.4171 | -0.4530 | |||

| ARZZ3 / Arezzo Indústria e Comércio S.A. | 0.71 | 4.01 | 0.3902 | 0.3902 | |||||

| GRUMAB / Gruma SAB de CV | 0.17 | -0.89 | 3.18 | 9.26 | 0.3094 | 0.0288 | |||

| 552 / China Communications Services Corporation Limited | 3.47 | -82.33 | 1.81 | -83.74 | 0.1766 | -0.8993 | |||

| INE148O01028 / Delhivery Ltd., Pfd. | 0.33 | 1.20 | 0.1168 | 0.1168 | |||||

| SBSP3 / Companhia de Saneamento Básico do Estado de São Paulo - SABESP | 0.06 | 0.00 | 1.13 | 23.93 | 0.1101 | 0.0221 | |||

| EDU / New Oriental Education & Technology Group Inc. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.7673 | ||||

| TCS / TCS Group Holding PLC - Depositary Receipt (Common Stock) | 0.06 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| LSRG / PJSC LSR Group | 0.07 | 0.00 | 0.00 | 0.0000 | 0.0000 |