Basic Stats

| Portfolio Value | $ 1,754,648,164 |

| Current Positions | 109 |

Latest Holdings, Performance, AUM (from 13F, 13D)

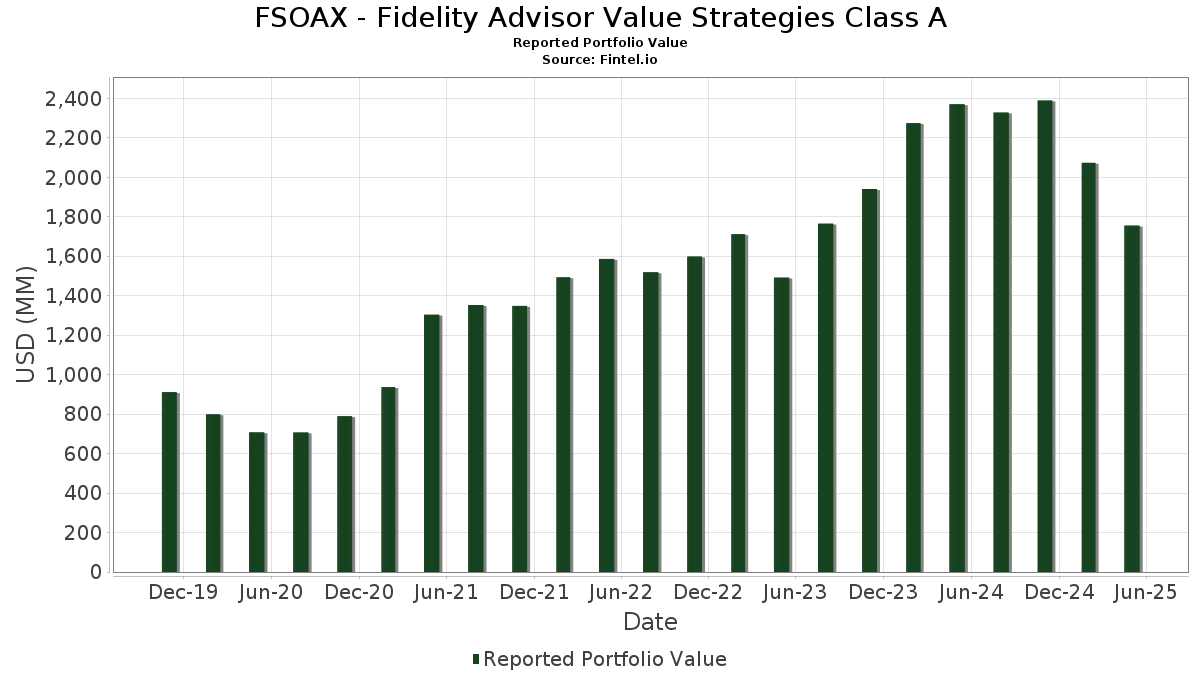

FSOAX - Fidelity Advisor Value Strategies Class A has disclosed 109 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,754,648,164 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). FSOAX - Fidelity Advisor Value Strategies Class A’s top holdings are Fidelity Securities Lending Cash Central Fund (US:US31635A3032) , First Citizens BancShares, Inc. (US:FCNCA) , East West Bancorp, Inc. (US:EWBC) , CVS Health Corporation (US:CVS) , and Molina Healthcare, Inc. (US:MOH) . FSOAX - Fidelity Advisor Value Strategies Class A’s new positions include Imperial Oil Limited (CA:IMO) , Phillips 66 (US:PSX) , Constellation Brands, Inc. (US:STZ) , Hasbro, Inc. (US:HAS) , and Patrick Industries, Inc. (US:PATK) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 101.78 | 101.79 | 6.1545 | 2.4770 | |

| 0.26 | 18.87 | 1.1409 | 1.1409 | |

| 0.15 | 16.53 | 0.9996 | 0.9996 | |

| 0.09 | 16.51 | 0.9982 | 0.9982 | |

| 0.21 | 14.32 | 0.8655 | 0.8655 | |

| 0.14 | 12.35 | 0.7465 | 0.7465 | |

| 0.04 | 12.22 | 0.7389 | 0.7389 | |

| 0.15 | 11.05 | 0.6683 | 0.6683 | |

| 0.56 | 19.84 | 1.1993 | 0.6647 | |

| 1.07 | 18.35 | 1.1092 | 0.6497 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 6.21 | 6.22 | 0.3758 | -0.7832 | |

| 0.23 | 17.68 | 1.0688 | -0.6588 | |

| 0.16 | 19.94 | 1.2053 | -0.3458 | |

| 0.11 | 16.42 | 0.9925 | -0.3434 | |

| 0.66 | 2.85 | 0.1725 | -0.3235 | |

| 1.35 | 12.85 | 0.7770 | -0.3144 | |

| 0.17 | 8.87 | 0.5364 | -0.2984 | |

| 0.37 | 23.69 | 1.4325 | -0.2815 | |

| 0.04 | 19.61 | 1.1854 | -0.2388 | |

| 0.13 | 9.14 | 0.5527 | -0.2145 |

13F and Fund Filings

This form was filed on 2025-07-24 for the reporting period 2025-05-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US31635A3032 / Fidelity Securities Lending Cash Central Fund | 101.78 | 38.43 | 101.79 | 38.43 | 6.1545 | 2.4770 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.02 | 15.65 | 31.43 | 4.40 | 1.9003 | 0.3946 | |||

| EWBC / East West Bancorp, Inc. | 0.29 | -12.15 | 26.30 | -15.16 | 1.5901 | 0.0398 | |||

| CVS / CVS Health Corporation | 0.38 | -25.38 | 24.12 | -27.29 | 1.4581 | -0.2007 | |||

| MOH / Molina Healthcare, Inc. | 0.08 | -25.64 | 24.07 | -24.67 | 1.4551 | -0.1427 | |||

| VTR / Ventas, Inc. | 0.37 | -25.60 | 23.69 | -30.87 | 1.4325 | -0.2815 | |||

| PLD / Prologis, Inc. | 0.21 | 15.71 | 23.11 | 1.41 | 1.3975 | 0.2575 | |||

| ALSN / Allison Transmission Holdings, Inc. | 0.21 | -8.69 | 21.64 | -7.11 | 1.3081 | 0.1433 | |||

| LPLA / LPL Financial Holdings Inc. | 0.06 | -24.35 | 21.53 | -21.21 | 1.3015 | -0.0650 | |||

| SLM / SLM Corporation | 0.66 | -2.12 | 21.41 | 4.95 | 1.2942 | 0.2741 | |||

| FSLR / First Solar, Inc. | 0.13 | -10.35 | 20.82 | 4.07 | 1.2587 | 0.2582 | |||

| CEG / Constellation Energy Corporation | 0.07 | 7.87 | 20.57 | 31.81 | 1.2439 | 0.4632 | |||

| PCG / PG&E Corporation | 1.21 | -17.05 | 20.42 | -14.31 | 1.2344 | 0.0428 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.10 | 0.00 | 20.34 | 0.30 | 1.2295 | 0.2155 | |||

| SUI / Sun Communities, Inc. | 0.16 | -29.10 | 19.94 | -35.72 | 1.2053 | -0.3458 | |||

| REXR / Rexford Industrial Realty, Inc. | 0.56 | 117.59 | 19.84 | 85.57 | 1.1993 | 0.6647 | |||

| GXO / GXO Logistics, Inc. | 0.48 | 54.22 | 19.68 | 60.95 | 1.1899 | 0.5784 | |||

| JBL / Jabil Inc. | 0.12 | -24.16 | 19.67 | -17.75 | 1.1895 | -0.0068 | |||

| OMF / OneMain Holdings, Inc. | 0.38 | -15.85 | 19.67 | -18.83 | 1.1894 | -0.0227 | |||

| AMP / Ameriprise Financial, Inc. | 0.04 | -27.36 | 19.61 | -31.15 | 1.1854 | -0.2388 | |||

| DLTR / Dollar Tree, Inc. | 0.22 | -3.64 | 19.60 | 19.38 | 1.1853 | 0.3640 | |||

| SMURFIT WESTROCK PLC / EC (IE00028FXN24) | 0.45 | 20.64 | 19.38 | 0.39 | 1.1715 | 0.2062 | |||

| SGI / Somnigroup International Inc. | 0.29 | -16.98 | 19.09 | -15.45 | 1.1541 | 0.0251 | |||

| ARW / Arrow Electronics, Inc. | 0.16 | -30.50 | 19.07 | -23.87 | 1.1530 | -0.0998 | |||

| APO / Apollo Global Management, Inc. | 0.15 | -11.50 | 19.02 | -22.51 | 1.1497 | -0.0776 | |||

| IMO / Imperial Oil Limited | 0.26 | 18.87 | 1.1409 | 1.1409 | |||||

| GTES / Gates Industrial Corporation plc | 0.88 | -19.70 | 18.55 | -21.52 | 1.1216 | -0.0606 | |||

| FA / First Advantage Corporation | 1.07 | 74.50 | 18.35 | 99.71 | 1.1092 | 0.6497 | |||

| SRE / Sempra | 0.23 | 8.99 | 18.20 | 19.68 | 1.1005 | 0.3398 | |||

| TRV / The Travelers Companies, Inc. | 0.07 | -12.83 | 17.98 | -7.03 | 1.0868 | 0.1198 | |||

| SIG / Signet Jewelers Limited | 0.27 | 51.27 | 17.85 | 92.48 | 1.0795 | 0.6155 | |||

| GPN / Global Payments Inc. | 0.23 | -28.74 | 17.68 | -48.82 | 1.0688 | -0.6588 | |||

| ON / ON Semiconductor Corporation | 0.42 | -19.94 | 17.61 | -28.50 | 1.0650 | -0.1671 | |||

| LAD / Lithia Motors, Inc. | 0.06 | -15.01 | 17.59 | -21.80 | 1.0634 | -0.0615 | |||

| WCC / WESCO International, Inc. | 0.10 | -14.43 | 17.53 | -20.39 | 1.0597 | -0.0414 | |||

| AIZ / Assurant, Inc. | 0.09 | -7.60 | 17.52 | -9.78 | 1.0591 | 0.0880 | |||

| LNG / Cheniere Energy, Inc. | 0.07 | -11.49 | 17.35 | -8.22 | 1.0488 | 0.1035 | |||

| CH1300646267 / Bunge Global SA | 0.22 | -15.79 | 17.30 | -11.29 | 1.0461 | 0.0706 | |||

| ES / Eversource Energy | 0.26 | -7.64 | 17.09 | -5.00 | 1.0333 | 0.1336 | |||

| HRI / Herc Holdings Inc. | 0.14 | 31.83 | 17.00 | 13.93 | 1.0278 | 0.2816 | |||

| WEX / WEX Inc. | 0.13 | -9.28 | 16.90 | -23.24 | 1.0215 | -0.0793 | |||

| WDC / Western Digital Corporation | 0.33 | 98.96 | 16.84 | 109.62 | 1.0182 | 0.6164 | |||

| US7587501039 / Regal-Beloit Corp. | 0.12 | -9.89 | 16.65 | -7.08 | 1.0069 | 0.1105 | |||

| PSX / Phillips 66 | 0.15 | 16.53 | 0.9996 | 0.9996 | |||||

| EIX / Edison International | 0.30 | -7.62 | 16.53 | -5.57 | 0.9993 | 0.1239 | |||

| STZ / Constellation Brands, Inc. | 0.09 | 16.51 | 0.9982 | 0.9982 | |||||

| KDP / Keurig Dr Pepper Inc. | 0.49 | -9.51 | 16.44 | -9.10 | 0.9940 | 0.0894 | |||

| WELL / Welltower Inc. | 0.11 | -38.85 | 16.42 | -38.54 | 0.9925 | -0.3434 | |||

| DAR / Darling Ingredients Inc. | 0.53 | -9.74 | 16.40 | -22.07 | 0.9914 | -0.0610 | |||

| CNR / Core Natural Resources, Inc. | 0.24 | -1.01 | 16.38 | -7.60 | 0.9901 | 0.1037 | |||

| HGV / Hilton Grand Vacations Inc. | 0.43 | -9.52 | 16.35 | -19.50 | 0.9886 | -0.0273 | |||

| CNH / CNH Industrial N.V. | 1.31 | -11.14 | 16.34 | -13.69 | 0.9880 | 0.0411 | |||

| NATL / NCR Atleos Corporation | 0.62 | 3.70 | 16.34 | -3.34 | 0.9876 | 0.1425 | |||

| IP / International Paper Company | 0.34 | -5.79 | 16.33 | -20.07 | 0.9871 | -0.0345 | |||

| AES / The AES Corporation | 1.59 | -18.30 | 16.00 | -28.87 | 0.9673 | -0.1576 | |||

| BPOP / Popular, Inc. | 0.15 | -2.77 | 16.00 | 0.23 | 0.9671 | 0.1690 | |||

| UHALB / U-Haul Holding Company - Series N | 0.28 | -5.79 | 15.69 | -12.69 | 0.9487 | 0.0499 | |||

| RJF / Raymond James Financial, Inc. | 0.11 | -5.84 | 15.65 | -10.52 | 0.9464 | 0.0715 | |||

| GMS / GMS Inc. | 0.20 | 0.00 | 15.42 | -4.87 | 0.9322 | 0.1216 | |||

| GIL / Gildan Activewear Inc. | 0.32 | -5.78 | 14.94 | -18.79 | 0.9034 | -0.0168 | |||

| UPBD / Upbound Group, Inc. | 0.65 | 6.03 | 14.92 | -5.80 | 0.9023 | 0.1100 | |||

| CLNX / Cellnex Telecom, S.A. | 0.39 | -37.99 | 14.81 | -33.26 | 0.8952 | -0.2144 | |||

| NXST / Nexstar Media Group, Inc. | 0.09 | 57.20 | 14.52 | 58.38 | 0.8779 | 0.4194 | |||

| TRGP / Targa Resources Corp. | 0.09 | -5.75 | 14.50 | -26.21 | 0.8765 | -0.1061 | |||

| DRVN / Driven Brands Holdings Inc. | 0.81 | 16.66 | 14.49 | 18.59 | 0.8759 | 0.2649 | |||

| ACHC / Acadia Healthcare Company, Inc. | 0.63 | 22.90 | 14.34 | -7.19 | 0.8669 | 0.0942 | |||

| HAS / Hasbro, Inc. | 0.21 | 14.32 | 0.8655 | 0.8655 | |||||

| BLDR / Builders FirstSource, Inc. | 0.13 | -5.80 | 14.16 | -27.03 | 0.8561 | -0.1143 | |||

| FQVLF / First Quantum Minerals Ltd. | 0.93 | 0.00 | 13.82 | 19.40 | 0.8358 | 0.2568 | |||

| PVH / PVH Corp. | 0.16 | -26.41 | 13.51 | -17.63 | 0.8169 | -0.0035 | |||

| CSTM / Constellium SE | 1.11 | -0.86 | 13.45 | 5.76 | 0.8133 | 0.1772 | |||

| XPRO / Expro Group Holdings N.V. | 1.62 | -5.80 | 13.45 | -34.08 | 0.8130 | -0.2072 | |||

| GTM / ZoomInfo Technologies Inc. | 1.35 | -28.10 | 12.85 | -41.11 | 0.7770 | -0.3144 | |||

| MEOH / Methanex Corporation | 0.39 | 17.21 | 12.79 | -13.13 | 0.7730 | 0.0369 | |||

| TEX / Terex Corporation | 0.28 | -1.01 | 12.73 | 9.47 | 0.7699 | 0.1881 | |||

| NCR / NCR Corp. | 1.14 | -5.80 | 12.66 | -7.39 | 0.7654 | 0.0818 | |||

| OSK / Oshkosh Corporation | 0.13 | -5.76 | 12.50 | -8.63 | 0.7556 | 0.0716 | |||

| R / Ryder System, Inc. | 0.08 | -5.77 | 12.49 | -15.70 | 0.7552 | 0.0141 | |||

| PATK / Patrick Industries, Inc. | 0.14 | 12.35 | 0.7465 | 0.7465 | |||||

| GLPEY / Galp Energia, SGPS, S.A. - Depositary Receipt (Common Stock) | 0.77 | -5.80 | 12.31 | -8.55 | 0.7441 | 0.0711 | |||

| BLD / TopBuild Corp. | 0.04 | 12.22 | 0.7389 | 0.7389 | |||||

| BCO / The Brink's Company | 0.15 | -5.79 | 12.02 | -17.79 | 0.7268 | -0.0045 | |||

| BBWI / Bath & Body Works, Inc. | 0.42 | 43.62 | 11.86 | 11.48 | 0.7171 | 0.1849 | |||

| FDX / FedEx Corporation | 0.05 | -5.74 | 11.82 | -21.80 | 0.7147 | -0.0413 | |||

| OI / O-I Glass, Inc. | 0.87 | -19.51 | 11.37 | -7.99 | 0.6874 | 0.0694 | |||

| XPO / XPO, Inc. | 0.10 | -5.78 | 11.31 | -12.78 | 0.6841 | 0.0353 | |||

| TKR / The Timken Company | 0.16 | -23.44 | 11.27 | -35.27 | 0.6816 | -0.1894 | |||

| CTRI / Centuri Holdings, Inc. | 0.54 | -5.79 | 11.24 | 13.37 | 0.6797 | 0.1838 | |||

| DOOO / BRP Inc. | 0.25 | 0.00 | 11.15 | 11.08 | 0.6740 | 0.1721 | |||

| LNTH / Lantheus Holdings, Inc. | 0.15 | 11.05 | 0.6683 | 0.6683 | |||||

| PFSI / PennyMac Financial Services, Inc. | 0.12 | -5.81 | 11.04 | -12.76 | 0.6675 | 0.0345 | |||

| PAG / Penske Automotive Group, Inc. | 0.07 | -5.77 | 10.98 | -8.31 | 0.6641 | 0.0649 | |||

| JAZZ / Jazz Pharmaceuticals plc | 0.10 | -5.82 | 10.49 | -29.09 | 0.6344 | -0.1056 | |||

| ACI / Albertsons Companies, Inc. | 0.46 | -28.93 | 10.29 | -24.91 | 0.6224 | -0.0632 | |||

| ICLR / ICON Public Limited Company | 0.08 | 20.00 | 10.08 | -17.73 | 0.6097 | -0.0033 | |||

| WSC / WillScot Holdings Corporation | 0.37 | -1.16 | 10.06 | -32.45 | 0.6083 | -0.0266 | |||

| UBSG / UBS Group AG | 0.32 | -5.80 | 10.03 | -12.39 | 0.6061 | 0.0338 | |||

| AHCO / AdaptHealth Corp. | 1.05 | -18.54 | 9.46 | -35.72 | 0.5719 | -0.1640 | |||

| WLK / Westlake Corporation | 0.13 | -5.78 | 9.14 | -40.41 | 0.5527 | -0.2145 | |||

| KBR / KBR, Inc. | 0.17 | -30.36 | 8.87 | -26.78 | 0.5364 | -0.2984 | |||

| FLR / Fluor Corporation | 0.21 | -5.82 | 8.61 | 2.98 | 0.5206 | 0.1024 | |||

| TFII / TFI International Inc. | 0.10 | -5.78 | 8.58 | -10.30 | 0.5189 | 0.0404 | |||

| MLKN / MillerKnoll, Inc. | 0.44 | 103.44 | 7.42 | 59.64 | 0.4485 | 0.2161 | |||

| VSTS / Vestis Corporation | 1.17 | 8.96 | 7.19 | -43.36 | 0.4346 | -0.2001 | |||

| SNDK / Sandisk Corporation | 0.19 | 245.37 | 7.12 | 177.85 | 0.4308 | 0.3025 | |||

| OLN / Olin Corporation | 0.34 | -5.79 | 6.66 | -27.98 | 0.4029 | -0.0598 | |||

| ASGN / ASGN Incorporated | 0.12 | -5.80 | 6.34 | -26.17 | 0.3835 | -0.0462 | |||

| US31635A1051 / Fidelity Cash Central Fund | 6.21 | -73.18 | 6.22 | -73.18 | 0.3758 | -0.7832 | |||

| FTRE / Fortrea Holdings Inc. | 0.66 | -7.35 | 2.85 | -71.23 | 0.1725 | -0.3235 |