Basic Stats

| Portfolio Value | $ 6,087,010 |

| Current Positions | 101 |

Latest Holdings, Performance, AUM (from 13F, 13D)

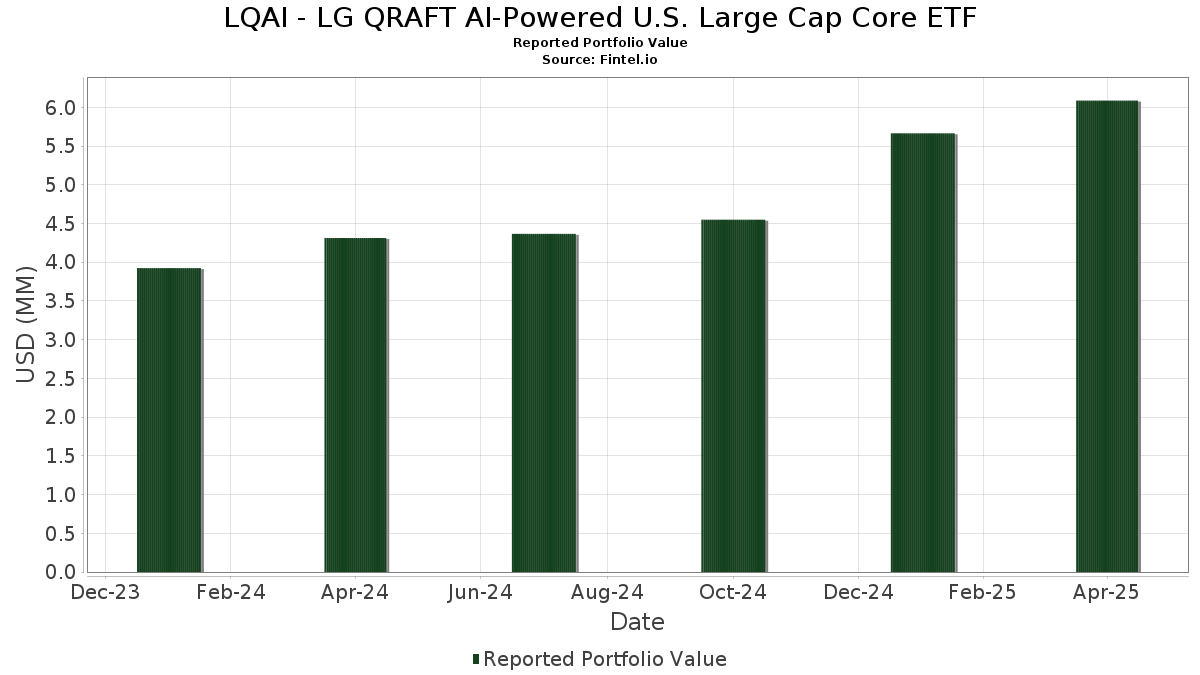

LQAI - LG QRAFT AI-Powered U.S. Large Cap Core ETF has disclosed 101 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 6,087,010 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). LQAI - LG QRAFT AI-Powered U.S. Large Cap Core ETF’s top holdings are Microsoft Corporation (US:MSFT) , Netflix, Inc. (US:NFLX) , NVIDIA Corporation (US:NVDA) , Amazon.com, Inc. (US:AMZN) , and Alphabet Inc. (US:GOOGL) . LQAI - LG QRAFT AI-Powered U.S. Large Cap Core ETF’s new positions include Berkshire Hathaway Inc. (US:BRK.B) , General Mills, Inc. (US:GIS) , McDonald's Corporation (US:MCD) , Rollins, Inc. (US:ROL) , and Mettler-Toledo International Inc. (US:MTD) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.32 | 5.2421 | 5.0010 | |

| 0.00 | 0.13 | 2.0671 | 2.0671 | |

| 0.00 | 0.12 | 2.0186 | 1.4552 | |

| 0.00 | 0.18 | 3.0002 | 1.0923 | |

| 0.00 | 0.11 | 1.7402 | 1.0678 | |

| 0.00 | 0.06 | 1.0324 | 1.0324 | |

| 0.00 | 0.08 | 1.3459 | 1.0091 | |

| 0.00 | 0.09 | 1.4068 | 0.9348 | |

| 0.00 | 0.09 | 1.4761 | 0.8840 | |

| 0.00 | 0.05 | 0.8450 | 0.8450 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.09 | 1.5387 | -4.2115 | |

| 0.00 | 0.02 | 0.2572 | -2.8913 | |

| 0.00 | 0.02 | 0.2953 | -2.8510 | |

| 0.00 | 0.01 | 0.1503 | -1.8410 | |

| 0.00 | 0.14 | 2.2544 | -1.7801 | |

| 0.00 | 0.01 | 0.0999 | -1.2485 | |

| 0.00 | 0.01 | 0.1151 | -1.1640 | |

| 0.00 | 0.01 | 0.1143 | -1.1579 | |

| 0.00 | 0.23 | 3.7713 | -1.0860 | |

| 0.00 | 0.02 | 0.3918 | -1.0824 |

13F and Fund Filings

This form was filed on 2025-06-26 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.00 | 8.15 | 0.40 | 3.11 | 6.5443 | -0.2767 | |||

| NFLX / Netflix, Inc. | 0.00 | 1,914.29 | 0.32 | 2,353.85 | 5.2421 | 5.0010 | |||

| NVDA / NVIDIA Corporation | 0.00 | 19.71 | 0.30 | 8.76 | 4.9003 | 0.0562 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 7.42 | 0.23 | -16.73 | 3.7713 | -1.0860 | |||

| GOOGL / Alphabet Inc. | 0.00 | 47.49 | 0.23 | 15.15 | 3.7508 | 0.2433 | |||

| AAPL / Apple Inc. | 0.00 | 21.22 | 0.20 | 9.34 | 3.2705 | 0.0538 | |||

| PLTR / Palantir Technologies Inc. | 0.00 | -37.42 | 0.19 | -10.14 | 3.0621 | -0.5960 | |||

| AVGO / Broadcom Inc. | 0.00 | 94.07 | 0.18 | 68.52 | 3.0002 | 1.0923 | |||

| META / Meta Platforms, Inc. | 0.00 | -24.70 | 0.14 | -39.91 | 2.2544 | -1.7801 | |||

| AMCR / Amcor plc | 0.01 | 74.07 | 0.13 | 64.47 | 2.0672 | 0.7203 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.13 | 2.0671 | 2.0671 | |||||

| CNP / CenterPoint Energy, Inc. | 0.00 | 223.04 | 0.12 | 293.55 | 2.0186 | 1.4552 | |||

| F / Ford Motor Company | 0.01 | 76.56 | 0.12 | 76.12 | 1.9502 | 0.7561 | |||

| COST / Costco Wholesale Corporation | 0.00 | 78.79 | 0.12 | 82.81 | 1.9275 | 0.7872 | |||

| WMT / Walmart Inc. | 0.00 | 28.52 | 0.11 | 26.97 | 1.8641 | 0.2926 | |||

| PCG / PG&E Corporation | 0.01 | 134.52 | 0.11 | 91.23 | 1.8028 | 0.5457 | |||

| JNPR / Juniper Networks, Inc. | 0.00 | 166.64 | 0.11 | 176.32 | 1.7402 | 1.0678 | |||

| T / AT&T Inc. | 0.00 | 3.60 | 0.11 | 20.69 | 1.7303 | 0.1943 | |||

| VTRS / Viatris Inc. | 0.01 | 81.66 | 0.10 | 32.43 | 1.6110 | -0.0213 | |||

| PPL / PPL Corporation | 0.00 | 27.42 | 0.10 | 38.57 | 1.5966 | 0.3583 | |||

| HST / Host Hotels & Resorts, Inc. | 0.01 | 41.50 | 0.10 | 15.66 | 1.5848 | -0.2422 | |||

| CAG / Conagra Brands, Inc. | 0.00 | 184.04 | 0.09 | 135.00 | 1.5460 | 0.6150 | |||

| TSLA / Tesla, Inc. | 0.00 | -58.81 | 0.09 | -71.47 | 1.5387 | -4.2115 | |||

| HRL / Hormel Foods Corporation | 0.00 | 146.24 | 0.09 | 142.11 | 1.5274 | 0.6806 | |||

| KDP / Keurig Dr Pepper Inc. | 0.00 | 148.37 | 0.09 | 169.70 | 1.4761 | 0.8840 | |||

| CPB / The Campbell's Company | 0.00 | 409.54 | 0.09 | 304.76 | 1.4068 | 0.9348 | |||

| KHC / The Kraft Heinz Company | 0.00 | 268.13 | 0.09 | 226.92 | 1.4024 | 0.8172 | |||

| KVUE / Kenvue Inc. | 0.00 | 3.68 | 0.08 | 15.28 | 1.3664 | 0.0901 | |||

| KIM / Kimco Realty Corporation | 0.00 | 533.85 | 0.08 | 440.00 | 1.3459 | 1.0091 | |||

| FE / FirstEnergy Corp. | 0.00 | 0.12 | 0.07 | 7.35 | 1.2086 | 0.0058 | |||

| VICI / VICI Properties Inc. | 0.00 | 7.01 | 0.07 | 7.81 | 1.1408 | -0.2720 | |||

| EXC / Exelon Corporation | 0.00 | 72.51 | 0.06 | 103.23 | 1.0392 | 0.4877 | |||

| LKQ / LKQ Corporation | 0.00 | 0.06 | 1.0324 | 1.0324 | |||||

| VZ / Verizon Communications Inc. | 0.00 | 42.45 | 0.06 | 56.76 | 0.9690 | 0.3162 | |||

| AON / Aon plc | 0.00 | 0.05 | 0.8450 | 0.8450 | |||||

| YUM / Yum! Brands, Inc. | 0.00 | 697.62 | 0.05 | 900.00 | 0.8278 | 0.7069 | |||

| MO / Altria Group, Inc. | 0.00 | -4.01 | 0.05 | 4.26 | 0.8132 | -0.2290 | |||

| BEN / Franklin Resources, Inc. | 0.00 | 15.62 | 0.05 | -2.04 | 0.7962 | -0.0802 | |||

| HBAN / Huntington Bancshares Incorporated | 0.00 | -27.40 | 0.05 | -39.19 | 0.7480 | -0.5613 | |||

| TXN / Texas Instruments Incorporated | 0.00 | 996.00 | 0.04 | 760.00 | 0.7203 | 0.6089 | |||

| CHTR / Charter Communications, Inc. | 0.00 | 18.48 | 0.04 | 23.53 | 0.7016 | -0.0983 | |||

| NWSA / News Corporation | 0.00 | -4.64 | 0.04 | -6.82 | 0.6771 | -0.1133 | |||

| NI / NiSource Inc. | 0.00 | 130.26 | 0.04 | 141.18 | 0.6745 | 0.3746 | |||

| MNST / Monster Beverage Corporation | 0.00 | 36.27 | 0.04 | 69.57 | 0.6567 | 0.2376 | |||

| GIS / General Mills, Inc. | 0.00 | 0.04 | 0.6496 | 0.6496 | |||||

| MCD / McDonald's Corporation | 0.00 | 0.04 | 0.6458 | 0.6458 | |||||

| CSX / CSX Corporation | 0.00 | -46.48 | 0.04 | -54.88 | 0.6169 | -0.8321 | |||

| ROL / Rollins, Inc. | 0.00 | 0.04 | 0.6071 | 0.6071 | |||||

| RMD / ResMed Inc. | 0.00 | 110.81 | 0.04 | 111.76 | 0.6062 | 0.2125 | |||

| XEL / Xcel Energy Inc. | 0.00 | 55.93 | 0.04 | 71.43 | 0.5957 | 0.1134 | |||

| NEM / Newmont Corporation | 0.00 | 0.04 | 0.5806 | 0.5806 | |||||

| MTD / Mettler-Toledo International Inc. | 0.00 | 0.04 | 0.5803 | 0.5803 | |||||

| TAP / Molson Coors Beverage Company | 0.00 | 59.89 | 0.03 | 78.95 | 0.5651 | 0.1125 | |||

| KO / The Coca-Cola Company | 0.00 | -3.31 | 0.03 | 10.00 | 0.5565 | 0.0159 | |||

| INVH / Invitation Homes Inc. | 0.00 | 46.21 | 0.03 | 57.14 | 0.5526 | 0.0887 | |||

| STZ / Constellation Brands, Inc. | 0.00 | 193.10 | 0.03 | 210.00 | 0.5237 | 0.3388 | |||

| PKI / Revvity Inc. | 0.00 | 28.92 | 0.03 | 16.00 | 0.4926 | -0.0987 | |||

| CVX / Chevron Corporation | 0.00 | 494.59 | 0.03 | 480.00 | 0.4917 | 0.3708 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 233.33 | 0.03 | 154.55 | 0.4731 | 0.2722 | |||

| AVY / Avery Dennison Corporation | 0.00 | 0.03 | 0.4553 | 0.4553 | |||||

| LHX / L3Harris Technologies, Inc. | 0.00 | 0.03 | 0.4481 | 0.4481 | |||||

| ARE / Alexandria Real Estate Equities, Inc. | 0.00 | 0.03 | 0.4452 | 0.4452 | |||||

| DLTR / Dollar Tree, Inc. | 0.00 | 428.33 | 0.03 | 257.14 | 0.4258 | 0.2261 | |||

| KMI / Kinder Morgan, Inc. | 0.00 | -70.23 | 0.02 | -64.06 | 0.3918 | -1.0824 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | 91.30 | 0.02 | 120.00 | 0.3682 | 0.1810 | |||

| ERIE / Erie Indemnity Company | 0.00 | 0.02 | 0.3593 | 0.3593 | |||||

| CME / CME Group Inc. | 0.00 | 0.02 | 0.3459 | 0.3459 | |||||

| BBH SWEEP VEHICLE / STIV (N/A) | 0.02 | 0.3166 | 0.3166 | ||||||

| LLY / Eli Lilly and Company | 0.00 | -90.91 | 0.02 | -90.45 | 0.2953 | -2.8510 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -90.42 | 0.02 | -91.57 | 0.2572 | -2.8913 | |||

| ABT / Abbott Laboratories | 0.00 | -59.04 | 0.01 | -53.33 | 0.2384 | -0.4359 | |||

| COR / Cencora, Inc. | 0.00 | 63.33 | 0.01 | 100.00 | 0.2356 | 0.1011 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.01 | 0.2354 | 0.2354 | |||||

| DG / Dollar General Corporation | 0.00 | 29.46 | 0.01 | -7.14 | 0.2231 | -0.1538 | |||

| V / Visa Inc. | 0.00 | 69.57 | 0.01 | 85.71 | 0.2213 | 0.0827 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.01 | 0.2139 | 0.2139 | |||||

| BAC / Bank of America Corporation | 0.00 | -66.36 | 0.01 | -67.50 | 0.2135 | -0.6758 | |||

| INTC / Intel Corporation | 0.00 | -77.68 | 0.01 | -77.78 | 0.2057 | -0.7505 | |||

| CMCSA / Comcast Corporation | 0.00 | -56.70 | 0.01 | -57.14 | 0.2050 | -0.2953 | |||

| MOH / Molina Healthcare, Inc. | 0.00 | 0.01 | 0.1934 | 0.1934 | |||||

| TGT / Target Corporation | 0.00 | 0.01 | 0.1906 | 0.1906 | |||||

| HUM / Humana Inc. | 0.00 | 144.44 | 0.01 | 83.33 | 0.1895 | 0.0161 | |||

| JNJ / Johnson & Johnson | 0.00 | 0.01 | 0.1874 | 0.1874 | |||||

| GILD / Gilead Sciences, Inc. | 0.00 | 25.88 | 0.01 | 37.50 | 0.1872 | 0.0416 | |||

| WRB / W. R. Berkley Corporation | 0.00 | -76.63 | 0.01 | -71.05 | 0.1813 | -0.5023 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.01 | 0.1776 | 0.1776 | |||||

| PEP / PepsiCo, Inc. | 0.00 | -1.43 | 0.01 | -18.18 | 0.1537 | -0.1015 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | -90.35 | 0.01 | -91.96 | 0.1503 | -1.8410 | |||

| MDLZ / Mondelez International, Inc. | 0.00 | 0.01 | 0.1466 | 0.1466 | |||||

| AWC / American Water Works Company, Inc. | 0.00 | 0.01 | 0.1449 | 0.1449 | |||||

| HPE / Hewlett Packard Enterprise Company | 0.00 | -27.78 | 0.01 | -46.15 | 0.1212 | -0.1142 | |||

| ON / ON Semiconductor Corporation | 0.00 | 0.01 | 0.1200 | 0.1200 | |||||

| MU / Micron Technology, Inc. | 0.00 | -43.29 | 0.01 | -50.00 | 0.1175 | -0.1463 | |||

| WBD / Warner Bros. Discovery, Inc. | 0.00 | -88.37 | 0.01 | -90.28 | 0.1151 | -1.1640 | |||

| KEY / KeyCorp | 0.00 | -88.31 | 0.01 | -91.67 | 0.1143 | -1.1579 | |||

| LULU / lululemon athletica inc. | 0.00 | 0.01 | 0.1112 | 0.1112 | |||||

| NKE / NIKE, Inc. | 0.00 | 0.01 | 0.1093 | 0.1093 | |||||

| LYB / LyondellBasell Industries N.V. | 0.00 | 0.01 | 0.1080 | 0.1080 | |||||

| SWK / Stanley Black & Decker, Inc. | 0.00 | 0.01 | 0.1075 | 0.1075 | |||||

| SMCI / Super Micro Computer, Inc. | 0.00 | -69.54 | 0.01 | -66.67 | 0.1015 | -0.2188 | |||

| KMX / CarMax, Inc. | 0.00 | -89.02 | 0.01 | -89.66 | 0.0999 | -1.2485 | |||

| FICO / Fair Isaac Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.4295 | ||||

| SCHW / The Charles Schwab Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.4813 | ||||

| BX / Blackstone Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8276 | ||||

| ADBE / Adobe Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2005 | ||||

| STX / Seagate Technology Holdings plc | 0.00 | -100.00 | 0.00 | -100.00 | -0.5454 | ||||

| RCL / Royal Caribbean Cruises Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1833 | ||||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5102 | ||||

| CPRT / Copart, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1205 | ||||

| DE / Deere & Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.4538 | ||||

| PCAR / PACCAR Inc | 0.00 | -100.00 | 0.00 | -100.00 | -0.1388 | ||||

| AME / AMETEK, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4849 | ||||

| CDW / CDW Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1580 | ||||

| NOW / ServiceNow, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1257 | ||||

| EPAM / EPAM Systems, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1657 | ||||

| AJG / Arthur J. Gallagher & Co. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1703 | ||||

| TSCO / Tractor Supply Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.1898 | ||||

| WYNN / Wynn Resorts, Limited | 0.00 | -100.00 | 0.00 | -100.00 | -0.6080 | ||||

| D / Dominion Energy, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6362 |