Basic Stats

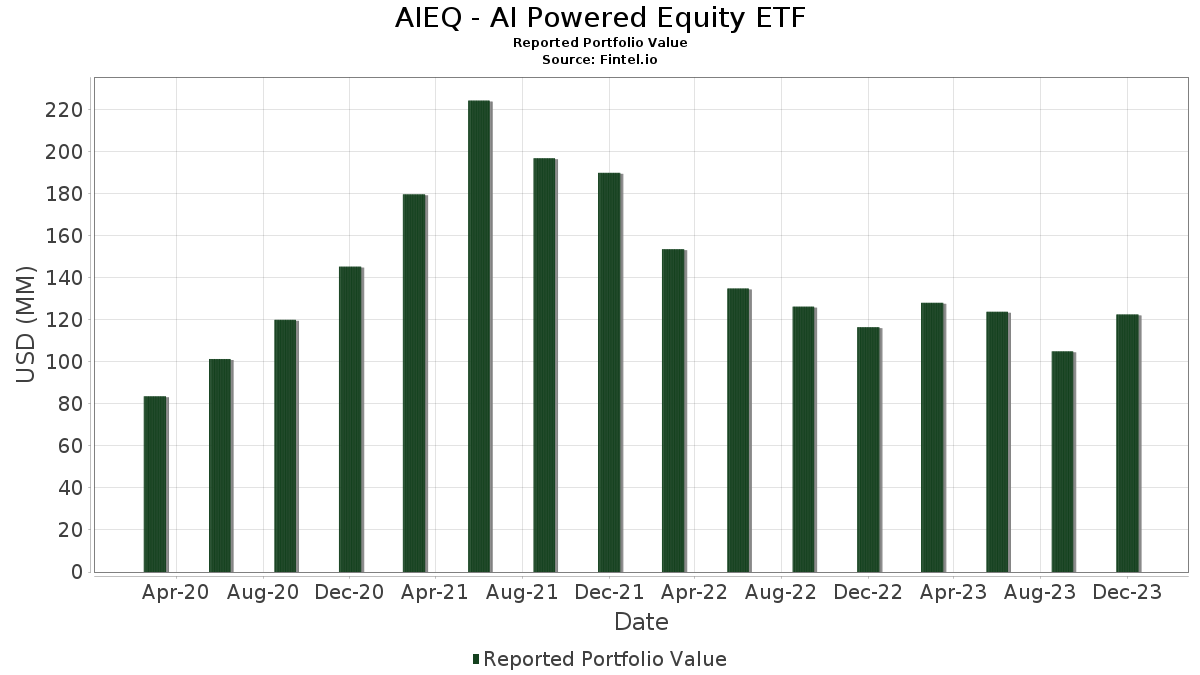

| Portfolio Value | $ 122,549,263 |

| Current Positions | 115 |

Latest Holdings, Performance, AUM (from 13F, 13D)

AIEQ - AI Powered Equity ETF has disclosed 115 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 122,549,263 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). AIEQ - AI Powered Equity ETF’s top holdings are Eli Lilly and Company (US:LLY) , Las Vegas Sands Corp. (US:LVS) , Constellation Brands, Inc. (US:STZ) , Air Products and Chemicals, Inc. (US:APD) , and EOG Resources, Inc. (US:EOG) . AIEQ - AI Powered Equity ETF’s new positions include Las Vegas Sands Corp. (US:LVS) , Weatherford International plc (US:WFRD) , Paycom Software, Inc. (US:PAYC) , Doximity, Inc. (US:DOCS) , and Polaris Inc. (US:PII) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 5.52 | 4.8053 | 4.8053 | |

| 7.63 | 7.63 | 6.6368 | 3.5972 | |

| 0.08 | 4.13 | 3.5963 | 3.5963 | |

| 0.04 | 3.91 | 3.4053 | 3.4053 | |

| 0.11 | 3.91 | 3.4020 | 3.4020 | |

| 0.03 | 3.95 | 3.4396 | 2.8874 | |

| 0.02 | 4.09 | 3.5582 | 2.6735 | |

| 0.01 | 2.96 | 2.5733 | 2.5733 | |

| 0.04 | 2.37 | 2.0595 | 2.0595 | |

| 0.07 | 1.84 | 1.5982 | 1.5982 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -4.6391 | ||

| 0.00 | 0.00 | -4.3583 | ||

| 0.00 | 0.73 | 0.6350 | -2.3092 | |

| 0.00 | 0.00 | -2.2757 | ||

| 0.00 | 1.16 | 1.0091 | -1.8994 | |

| 0.00 | 0.00 | -1.7356 | ||

| 0.00 | 0.00 | -1.6753 | ||

| 0.00 | 0.00 | -1.5856 | ||

| 0.00 | 0.00 | -1.5350 | ||

| 0.00 | 1.19 | 1.0321 | -1.5335 |

13F and Fund Filings

This form was filed on 2024-02-28 for the reporting period 2023-12-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Mount Vernon Liquid Assets Portfolio, LLC / STIV (N/A) | 7.63 | 146.11 | 7.63 | 146.16 | 6.6368 | 3.5972 | |||

| LLY / Eli Lilly and Company | 0.01 | 5.52 | 4.8053 | 4.8053 | |||||

| LVS / Las Vegas Sands Corp. | 0.08 | 4.13 | 3.5963 | 3.5963 | |||||

| STZ / Constellation Brands, Inc. | 0.02 | 183.89 | 4.09 | 173.44 | 3.5582 | 2.6735 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | 37.27 | 4.04 | 30.84 | 3.5189 | 0.7493 | |||

| EOG / EOG Resources, Inc. | 0.03 | 567.48 | 3.95 | 622.49 | 3.4396 | 2.8874 | |||

| WFRD / Weatherford International plc | 0.04 | 3.91 | 3.4053 | 3.4053 | |||||

| APA / APA Corporation | 0.11 | 3.91 | 3.4020 | 3.4020 | |||||

| TSLA / Tesla, Inc. | 0.02 | -17.81 | 3.86 | -1.56 | 3.3604 | -0.1554 | |||

| PAYC / Paycom Software, Inc. | 0.01 | 2.96 | 2.5733 | 2.5733 | |||||

| CELH / Celsius Holdings, Inc. | 0.04 | 2.37 | 2.0595 | 2.0595 | |||||

| CTLT / Catalent, Inc. | 0.05 | -5.07 | 2.20 | -1.66 | 1.9133 | -0.0275 | |||

| DOCS / Doximity, Inc. | 0.07 | 1.84 | 1.5982 | 1.5982 | |||||

| PCTY / Paylocity Holding Corporation | 0.01 | 42.57 | 1.73 | -0.52 | 1.5063 | 0.4771 | |||

| LTHM / Livent Corporation | 0.08 | 1.41 | 1.2284 | 1.2284 | |||||

| PII / Polaris Inc. | 0.01 | 1.37 | 1.1941 | 1.1941 | |||||

| VAC / Marriott Vacations Worldwide Corporation | 0.02 | 1.33 | 1.1606 | 1.1606 | |||||

| QDEL / QuidelOrtho Corporation | 0.02 | 1.33 | 1.1594 | 1.1594 | |||||

| AGL / agilon health, inc. | 0.10 | 1.30 | 1.1345 | 1.1345 | |||||

| FOXA / Fox Corporation | 0.04 | 1.25 | 1.0878 | 1.0878 | |||||

| HUM / Humana Inc. | 0.00 | 24.63 | 1.21 | 22.00 | 1.0521 | 0.1238 | |||

| AZO / AutoZone, Inc. | 0.00 | 38.74 | 1.19 | 43.86 | 1.0395 | 0.3186 | |||

| MNST / Monster Beverage Corporation | 0.02 | 1.19 | 1.0382 | 1.0382 | |||||

| MMC / Marsh & McLennan Companies, Inc. | 0.01 | 1.19 | 1.0369 | 1.0369 | |||||

| AON / Aon plc | 0.00 | 409.84 | 1.19 | 356.32 | 1.0368 | 0.8511 | |||

| KDP / Keurig Dr Pepper Inc. | 0.04 | 1.19 | 1.0352 | 1.0352 | |||||

| PG / The Procter & Gamble Company | 0.01 | 1.19 | 1.0348 | 1.0348 | |||||

| MO / Altria Group, Inc. | 0.03 | 0.68 | 1.19 | -3.41 | 1.0347 | -0.1729 | |||

| NVDA / NVIDIA Corporation | 0.00 | -60.17 | 1.19 | -54.65 | 1.0321 | -1.5335 | |||

| LBRDA / Liberty Broadband Corporation | 0.00 | 1.18 | 1.0228 | 1.0228 | |||||

| DKNG / DraftKings Inc. | 0.03 | 1.17 | 1.0209 | 1.0209 | |||||

| BKR / Baker Hughes Company | 0.03 | 1.17 | 1.0208 | 1.0208 | |||||

| UAL / United Airlines Holdings, Inc. | 0.03 | 1.17 | 1.0192 | 1.0192 | |||||

| FTNT / Fortinet, Inc. | 0.02 | 136.94 | 1.17 | 108.94 | 1.0166 | 0.5148 | |||

| HAL / Halliburton Company | 0.03 | -26.45 | 1.17 | -29.78 | 1.0156 | -0.1651 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 498.51 | 1.17 | 589.35 | 1.0138 | 0.8423 | |||

| KR / The Kroger Co. | 0.03 | 607.45 | 1.16 | 583.53 | 1.0119 | 0.8526 | |||

| WBD / Warner Bros. Discovery, Inc. | 0.10 | 1.16 | 1.0119 | 1.0119 | |||||

| SLB / Schlumberger Limited | 0.02 | 1.16 | 1.0118 | 1.0118 | |||||

| BDX / Becton, Dickinson and Company | 0.00 | -75.67 | 1.16 | -76.42 | 1.0091 | -1.8994 | |||

| MDB / MongoDB, Inc. | 0.00 | 1.16 | 1.0086 | 1.0086 | |||||

| OVV / Ovintiv Inc. | 0.03 | 1.16 | 1.0077 | 1.0077 | |||||

| FCNCA / First Citizens BancShares, Inc. | 0.00 | 531.01 | 1.16 | 548.88 | 1.0051 | 0.8305 | |||

| LCID / Lucid Group, Inc. | 0.27 | 1.15 | 1.0023 | 1.0023 | |||||

| MRO / Marathon Oil Corporation | 0.05 | -54.78 | 1.15 | -54.44 | 1.0015 | -1.2609 | |||

| TTD / The Trade Desk, Inc. | 0.02 | -62.33 | 1.15 | -64.96 | 1.0000 | -0.8937 | |||

| PLUG / Plug Power Inc. | 0.25 | 209.41 | 1.12 | 34.01 | 0.9703 | 0.2479 | |||

| BBY / Best Buy Co., Inc. | 0.01 | 1.02 | 0.8875 | 0.8875 | |||||

| NXST / Nexstar Media Group, Inc. | 0.01 | 347.86 | 0.95 | 391.24 | 0.8296 | 0.6386 | |||

| ROK / Rockwell Automation, Inc. | 0.00 | 0.93 | 0.8076 | 0.8076 | |||||

| HUN / Huntsman Corporation | 0.04 | 0.92 | 0.8012 | 0.8012 | |||||

| CFLT / Confluent, Inc. | 0.04 | 0.91 | 0.7926 | 0.7926 | |||||

| WTRG / Essential Utilities, Inc. | 0.02 | 419.13 | 0.89 | 387.91 | 0.7735 | 0.6146 | |||

| HES / Hess Corporation | 0.01 | 0.83 | 0.7232 | 0.7232 | |||||

| CHK / Chesapeake Energy Corporation | 0.01 | 54.43 | 0.82 | 42.07 | 0.7179 | 0.2134 | |||

| CIEN / Ciena Corporation | 0.02 | 817.07 | 0.79 | 942.11 | 0.6900 | 0.6080 | |||

| GLW / Corning Incorporated | 0.03 | 0.79 | 0.6835 | 0.6835 | |||||

| ALGN / Align Technology, Inc. | 0.00 | 53.57 | 0.75 | 37.75 | 0.6514 | 0.1186 | |||

| AFL / Aflac Incorporated | 0.01 | 0.73 | 0.6374 | 0.6374 | |||||

| AJG / Arthur J. Gallagher & Co. | 0.00 | -88.93 | 0.73 | -85.35 | 0.6350 | -2.3092 | |||

| BILL / BILL Holdings, Inc. | 0.01 | 0.72 | 0.6273 | 0.6273 | |||||

| OKE / ONEOK, Inc. | 0.01 | 24.21 | 0.71 | 41.32 | 0.6164 | 0.1812 | |||

| ACGL / Arch Capital Group Ltd. | 0.01 | 0.66 | 0.5734 | 0.5734 | |||||

| WEC / WEC Energy Group, Inc. | 0.01 | 0.64 | 0.5595 | 0.5595 | |||||

| KMX / CarMax, Inc. | 0.01 | 0.63 | 0.5493 | 0.5493 | |||||

| GM / General Motors Company | 0.02 | -56.68 | 0.60 | -52.82 | 0.5183 | -0.7194 | |||

| HP / Helmerich & Payne, Inc. | 0.02 | 0.59 | 0.5173 | 0.5173 | |||||

| LPLA / LPL Financial Holdings Inc. | 0.00 | 0.58 | 0.5017 | 0.5017 | |||||

| BIO / Bio-Rad Laboratories, Inc. | 0.00 | 0.55 | 0.4813 | 0.4813 | |||||

| MKC / McCormick & Company, Incorporated | 0.01 | 0.54 | 0.4701 | 0.4701 | |||||

| GPC / Genuine Parts Company | 0.00 | 0.53 | 0.4582 | 0.4582 | |||||

| LBRDK / Liberty Broadband Corporation | 0.01 | 42.10 | 0.51 | 43.18 | 0.4476 | 0.1352 | |||

| MHK / Mohawk Industries, Inc. | 0.00 | 40.28 | 0.50 | 40.78 | 0.4392 | 0.1278 | |||

| US4039491000 / HF Sinclair Corp. | 0.01 | 0.50 | 0.4332 | 0.4332 | |||||

| FOXF / Fox Factory Holding Corp. | 0.01 | 0.49 | 0.4304 | 0.4304 | |||||

| BMRN / BioMarin Pharmaceutical Inc. | 0.01 | 0.49 | 0.4256 | 0.4256 | |||||

| HAS / Hasbro, Inc. | 0.01 | 0.48 | 0.4220 | 0.4220 | |||||

| BFB / Brown-Forman Corp. - Class B | 0.01 | -58.90 | 0.44 | -66.59 | 0.3843 | -0.8516 | |||

| SJM / The J. M. Smucker Company | 0.00 | 0.43 | 0.3784 | 0.3784 | |||||

| NOV / NOV Inc. | 0.02 | 39.20 | 0.43 | 35.24 | 0.3707 | 0.0614 | |||

| AN / AutoNation, Inc. | 0.00 | 0.41 | 0.3563 | 0.3563 | |||||

| CROX / Crocs, Inc. | 0.00 | 63.67 | 0.40 | 36.15 | 0.3508 | 0.0934 | |||

| EG / Everest Group, Ltd. | 0.00 | 0.40 | 0.3486 | 0.3486 | |||||

| KNSL / Kinsale Capital Group, Inc. | 0.00 | 0.40 | 0.3459 | 0.3459 | |||||

| NVST / Envista Holdings Corporation | 0.02 | 0.37 | 0.3212 | 0.3212 | |||||

| DAR / Darling Ingredients Inc. | 0.01 | 75.66 | 0.36 | 37.02 | 0.3130 | 0.0854 | |||

| MAT / Mattel, Inc. | 0.02 | 0.34 | 0.2978 | 0.2978 | |||||

| PRGO / Perrigo Company plc | 0.01 | 50.09 | 0.33 | 42.13 | 0.2911 | 0.0869 | |||

| BRO / Brown & Brown, Inc. | 0.00 | 0.33 | 0.2890 | 0.2890 | |||||

| ACLS / Axcelis Technologies, Inc. | 0.00 | 0.32 | 0.2758 | 0.2758 | |||||

| WU / The Western Union Company | 0.03 | 0.31 | 0.2714 | 0.2714 | |||||

| EVRG / Evergy, Inc. | 0.01 | 0.30 | 0.2620 | 0.2620 | |||||

| BYD / Boyd Gaming Corporation | 0.00 | 0.29 | 0.2486 | 0.2486 | |||||

| RGLD / Royal Gold, Inc. | 0.00 | 28.91 | 0.28 | 47.15 | 0.2474 | 0.0572 | |||

| ST / Sensata Technologies Holding plc | 0.01 | 69.16 | 0.28 | 41.12 | 0.2423 | 0.0712 | |||

| BOX / Box, Inc. | 0.01 | 0.27 | 0.2373 | 0.2373 | |||||

| MUR / Murphy Oil Corporation | 0.01 | 0.26 | 0.2222 | 0.2222 | |||||

| FIVN / Five9, Inc. | 0.00 | 0.25 | 0.2167 | 0.2167 | |||||

| OGN / Organon & Co. | 0.02 | 0.23 | 0.2043 | 0.2043 | |||||

| NYCB / Flagstar Financial, Inc. | 0.02 | -78.28 | 0.23 | -82.74 | 0.2011 | -0.5976 | |||

| WEN / The Wendy's Company | 0.01 | 0.23 | 0.1979 | 0.1979 | |||||

| HQY / HealthEquity, Inc. | 0.00 | -78.51 | 0.22 | -76.86 | 0.1904 | -0.6918 | |||

| MSM / MSC Industrial Direct Co., Inc. | 0.00 | 0.22 | 0.1894 | 0.1894 | |||||

| OPCH / Option Care Health, Inc. | 0.01 | 0.19 | 0.1692 | 0.1692 | |||||

| SLAB / Silicon Laboratories Inc. | 0.00 | 0.18 | 0.1558 | 0.1558 | |||||

| FCN / FTI Consulting, Inc. | 0.00 | 0.16 | 0.1376 | 0.1376 | |||||

| VC / Visteon Corporation | 0.00 | 0.15 | 0.1316 | 0.1316 | |||||

| MDU / MDU Resources Group, Inc. | 0.01 | 0.14 | 0.1250 | 0.1250 | |||||

| CHH / Choice Hotels International, Inc. | 0.00 | 0.14 | 0.1227 | 0.1227 | |||||

| AXS / AXIS Capital Holdings Limited | 0.00 | 0.14 | 0.1210 | 0.1210 | |||||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 0.14 | -6.08 | 0.14 | -6.25 | 0.1180 | -0.0236 | |||

| DTM / DT Midstream, Inc. | 0.00 | 0.11 | 0.0976 | 0.0976 | |||||

| CW / Curtiss-Wright Corporation | 0.00 | 0.11 | 0.0962 | 0.0962 | |||||

| OGS / ONE Gas, Inc. | 0.00 | 72.07 | 0.10 | 42.86 | 0.0878 | 0.0264 | |||

| FLO / Flowers Foods, Inc. | 0.00 | 0.09 | 0.0772 | 0.0772 | |||||

| DVA / DaVita Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0537 | ||||

| SIGI / Selective Insurance Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9749 | ||||

| WH / Wyndham Hotels & Resorts, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1301 | ||||

| EQH / Equitable Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0299 | ||||

| MEDP / Medpace Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8467 | ||||

| TFC / Truist Financial Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.2395 | ||||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -1.2191 | ||||

| BK / The Bank of New York Mellon Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.7514 | ||||

| BRKR / Bruker Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1906 | ||||

| MSI / Motorola Solutions, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4697 | ||||

| PEG / Public Service Enterprise Group Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.7296 | ||||

| VALT / ETF Managers Trust - ETFMG Sit Ultra Short ETF | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| AGNC / AGNC Investment Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5856 | ||||

| SMAR / Smartsheet Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1403 | ||||

| WFC / Wells Fargo & Company | 0.00 | -100.00 | 0.00 | -100.00 | -4.6391 | ||||

| PEN / Penumbra, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1763 | ||||

| ALLY / Ally Financial Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4701 | ||||

| AXTA / Axalta Coating Systems Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1742 | ||||

| VST / Vistra Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3941 | ||||

| L / Loews Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1987 | ||||

| PH / Parker-Hannifin Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -4.3583 | ||||

| GLPI / Gaming and Leisure Properties, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3305 | ||||

| OLED / Universal Display Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.7659 | ||||

| CNP / CenterPoint Energy, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3742 | ||||

| ASGN / ASGN Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.4508 | ||||

| PB / Prosperity Bancshares, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1206 | ||||

| BWA / BorgWarner Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.6753 | ||||

| GNTX / Gentex Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1145 | ||||

| WTS / Watts Water Technologies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1066 | ||||

| INVH / Invitation Homes Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.7356 | ||||

| FITB / Fifth Third Bancorp | 0.00 | -100.00 | 0.00 | -100.00 | -0.6861 | ||||

| SYF / Synchrony Financial | 0.00 | -100.00 | 0.00 | -100.00 | -0.8617 | ||||

| ABBV / AbbVie Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.2757 | ||||

| PGR / The Progressive Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.1916 | ||||

| SSNC / SS&C Technologies Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2970 | ||||

| HD / The Home Depot, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.2152 | ||||

| ETR / Entergy Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.5350 | ||||

| POWI / Power Integrations, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1158 | ||||

| STAG / STAG Industrial, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1618 | ||||

| DT / Dynatrace, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2487 | ||||

| SEIC / SEI Investments Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.5610 | ||||

| CDAY / Ceridian HCM Holding Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1694 |