Basic Stats

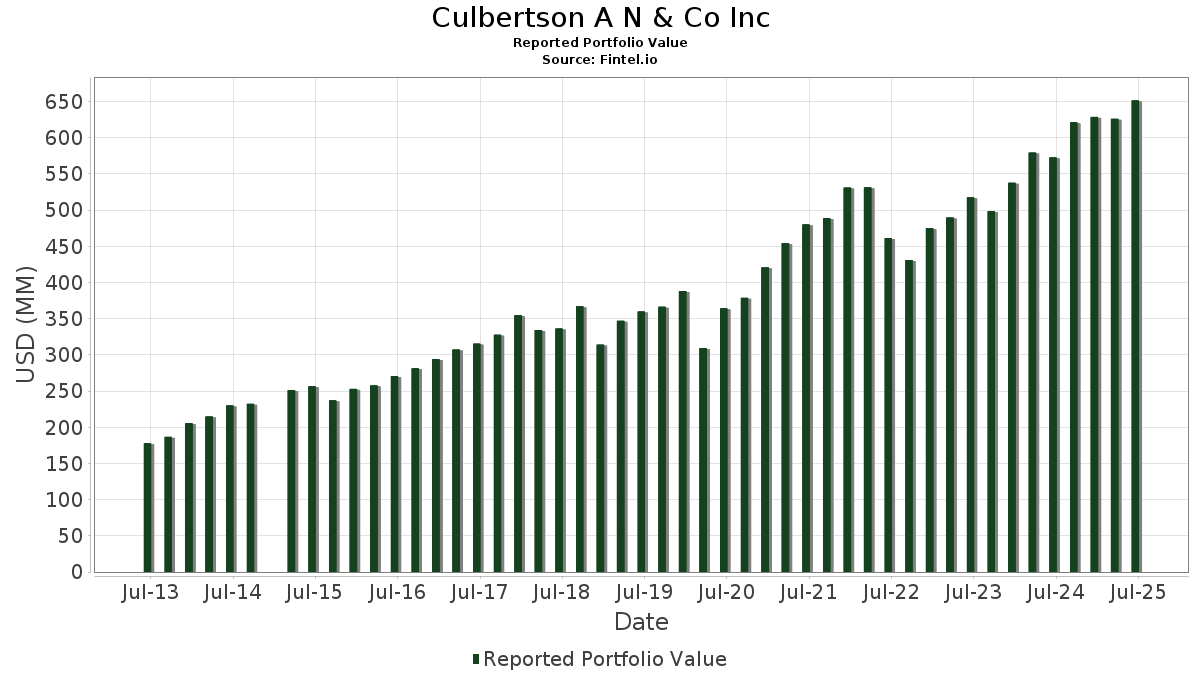

| Portfolio Value | $ 651,309,030 |

| Current Positions | 127 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Culbertson A N & Co Inc has disclosed 127 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 651,309,030 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Culbertson A N & Co Inc’s top holdings are Berkshire Hathaway Inc. (US:BRK.B) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , JPMorgan Chase & Co. (US:JPM) , and The Goldman Sachs Group, Inc. (US:GS) . Culbertson A N & Co Inc’s new positions include Orange County Bancorp, Inc. (US:OBT) , Liberty Media, Bond 4%, Due 11/15/2029 (US:US530715AG61) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 41.93 | 6.4375 | 1.2957 | |

| 0.08 | 16.99 | 2.6081 | 0.8556 | |

| 0.03 | 19.41 | 2.9806 | 0.5713 | |

| 0.12 | 33.60 | 5.1583 | 0.5390 | |

| 0.00 | 5.03 | 0.7725 | 0.3305 | |

| 0.04 | 15.96 | 2.4510 | 0.2515 | |

| 0.01 | 7.86 | 1.2072 | 0.1658 | |

| 0.10 | 5.95 | 0.9134 | 0.1515 | |

| 0.07 | 12.14 | 1.8647 | 0.1360 | |

| 0.12 | 5.45 | 0.8368 | 0.1097 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.11 | 53.51 | 8.2152 | -1.1274 | |

| 0.18 | 37.35 | 5.7353 | -0.8879 | |

| 0.01 | 2.03 | 0.3112 | -0.6763 | |

| 0.07 | 12.69 | 1.9481 | -0.4085 | |

| 0.01 | 1.51 | 0.2324 | -0.2925 | |

| 0.06 | 9.24 | 1.4181 | -0.2760 | |

| 0.01 | 0.50 | 0.0774 | -0.2444 | |

| 0.08 | 11.46 | 1.7590 | -0.2436 | |

| 0.07 | 9.06 | 1.3913 | -0.2324 | |

| 0.04 | 10.92 | 1.6763 | -0.2149 |

13F and Fund Filings

This form was filed on 2025-08-11 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BRK.B / Berkshire Hathaway Inc. | 0.11 | 0.30 | 53.51 | -8.52 | 8.2152 | -1.1274 | |||

| MSFT / Microsoft Corporation | 0.08 | -1.70 | 41.93 | 30.25 | 6.4375 | 1.2957 | |||

| AAPL / Apple Inc. | 0.18 | -2.46 | 37.35 | -9.91 | 5.7353 | -0.8879 | |||

| JPM / JPMorgan Chase & Co. | 0.12 | -1.70 | 33.60 | 16.18 | 5.1583 | 0.5390 | |||

| GS / The Goldman Sachs Group, Inc. | 0.03 | -0.66 | 19.41 | 28.71 | 2.9806 | 0.5713 | |||

| ORCL / Oracle Corporation | 0.08 | -0.99 | 16.99 | 54.83 | 2.6081 | 0.8556 | |||

| CAT / Caterpillar Inc. | 0.04 | -1.51 | 15.96 | 15.93 | 2.4510 | 0.2515 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.17 | -0.78 | 15.63 | 7.27 | 2.3993 | 0.0723 | |||

| MCK / McKesson Corporation | 0.02 | -0.21 | 15.40 | 8.65 | 2.3644 | 0.1004 | |||

| ABBV / AbbVie Inc. | 0.07 | -2.92 | 12.69 | -14.00 | 1.9481 | -0.4085 | |||

| ABT / Abbott Laboratories | 0.09 | -0.79 | 12.52 | 1.73 | 1.9219 | -0.0437 | |||

| DE / Deere & Company | 0.02 | -0.66 | 12.22 | 7.62 | 1.8757 | 0.0625 | |||

| GOOG / Alphabet Inc. | 0.07 | -1.16 | 12.14 | 12.23 | 1.8647 | 0.1360 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.04 | -1.43 | 12.09 | 9.01 | 1.8561 | 0.0845 | |||

| CMI / Cummins Inc. | 0.04 | -1.30 | 11.55 | 3.14 | 1.7726 | -0.0156 | |||

| JNJ / Johnson & Johnson | 0.08 | -0.79 | 11.46 | -8.62 | 1.7590 | -0.2436 | |||

| MCD / McDonald's Corporation | 0.04 | -1.41 | 10.92 | -7.79 | 1.6763 | -0.2149 | |||

| PG / The Procter & Gamble Company | 0.06 | -2.39 | 9.71 | -8.74 | 1.4904 | -0.2087 | |||

| CVX / Chevron Corporation | 0.06 | 1.75 | 9.24 | -12.91 | 1.4181 | -0.2760 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.04 | 0.05 | 9.22 | 6.92 | 1.4160 | 0.0382 | |||

| PEP / PepsiCo, Inc. | 0.07 | 1.23 | 9.06 | -10.86 | 1.3913 | -0.2324 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.04 | -1.12 | 8.36 | 6.96 | 1.2840 | 0.0351 | |||

| XOM / Exxon Mobil Corporation | 0.07 | 0.74 | 7.87 | -8.70 | 1.2088 | -0.1685 | |||

| VGT / Vanguard World Fund - Vanguard Information Technology ETF | 0.01 | -1.38 | 7.86 | 20.60 | 1.2072 | 0.1658 | |||

| BSV / Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF | 0.10 | -2.62 | 7.85 | -2.10 | 1.2051 | -0.0755 | |||

| ADP / Automatic Data Processing, Inc. | 0.02 | -1.48 | 7.56 | -0.57 | 1.1603 | -0.0536 | |||

| V / Visa Inc. | 0.02 | -1.36 | 7.49 | -0.05 | 1.1502 | -0.0472 | |||

| APD / Air Products and Chemicals, Inc. | 0.03 | -1.56 | 7.32 | -5.84 | 1.1234 | -0.1180 | |||

| CSCO / Cisco Systems, Inc. | 0.10 | -1.93 | 7.19 | 10.26 | 1.1038 | 0.0623 | |||

| FDX / FedEx Corporation | 0.03 | -2.57 | 7.05 | -9.15 | 1.0823 | -0.1572 | |||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0.02 | -0.21 | 6.57 | 7.97 | 1.0089 | 0.0368 | |||

| GOOGL / Alphabet Inc. | 0.04 | -1.40 | 6.31 | 12.36 | 0.9689 | 0.0718 | |||

| AMZN / Amazon.com, Inc. | 0.03 | 0.65 | 6.13 | 16.07 | 0.9417 | 0.0975 | |||

| WFC / Wells Fargo & Company | 0.08 | 5.36 | 6.02 | 17.59 | 0.9238 | 0.1064 | |||

| BN / Brookfield Corporation | 0.10 | 5.69 | 5.95 | 24.74 | 0.9134 | 0.1515 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.01 | -0.54 | 5.66 | 17.59 | 0.8692 | 0.1002 | |||

| OEF / iShares Trust - iShares S&P 100 ETF | 0.02 | -1.23 | 5.51 | 10.99 | 0.8466 | 0.0531 | |||

| USB / U.S. Bancorp | 0.12 | 11.71 | 5.45 | 19.73 | 0.8368 | 0.1097 | |||

| TRV / The Travelers Companies, Inc. | 0.02 | -2.09 | 5.40 | -0.94 | 0.8295 | -0.0417 | |||

| TXN / Texas Instruments Incorporated | 0.03 | -0.08 | 5.38 | 15.44 | 0.8264 | 0.0817 | |||

| MDLZ / Mondelez International, Inc. | 0.08 | -2.30 | 5.25 | -2.89 | 0.8057 | -0.0575 | |||

| MKL / Markel Group Inc. | 0.00 | 70.20 | 5.03 | 81.82 | 0.7725 | 0.3305 | |||

| VGSH / Vanguard Scottsdale Funds - Vanguard Short-Term Treasury ETF | 0.08 | 7.20 | 4.82 | 7.37 | 0.7407 | 0.0229 | |||

| GLW / Corning Incorporated | 0.09 | -0.97 | 4.74 | 13.78 | 0.7278 | 0.0622 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.02 | 1.27 | 4.23 | 3.60 | 0.6500 | -0.0027 | |||

| VBR / Vanguard Index Funds - Vanguard Small-Cap Value ETF | 0.02 | 5.26 | 4.07 | 10.18 | 0.6248 | 0.0349 | |||

| EOG / EOG Resources, Inc. | 0.03 | -0.17 | 3.88 | -6.88 | 0.5961 | -0.0699 | |||

| BAC / Bank of America Corporation | 0.08 | -3.93 | 3.76 | 8.94 | 0.5780 | 0.0260 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.03 | -0.53 | 3.72 | 2.82 | 0.5711 | -0.0068 | |||

| IBM / International Business Machines Corporation | 0.01 | 0.00 | 3.57 | 18.54 | 0.5479 | 0.0671 | |||

| MS / Morgan Stanley | 0.03 | -2.60 | 3.54 | 17.58 | 0.5433 | 0.0626 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.04 | 5.36 | 3.49 | 6.09 | 0.5352 | 0.0104 | |||

| C / Citigroup Inc. | 0.04 | 2.00 | 3.43 | 22.31 | 0.5263 | 0.0786 | |||

| MTB / M&T Bank Corporation | 0.02 | 12.01 | 3.33 | 21.58 | 0.5114 | 0.0737 | |||

| EES / WisdomTree Trust - WisdomTree U.S. SmallCap Fund | 0.06 | -1.45 | 3.18 | 2.81 | 0.4887 | -0.0058 | |||

| EZM / WisdomTree Trust - WisdomTree U.S. MidCap Fund | 0.05 | 0.10 | 2.87 | 3.73 | 0.4402 | -0.0013 | |||

| VOE / Vanguard Index Funds - Vanguard Mid-Cap Value ETF | 0.02 | 18.91 | 2.67 | 21.80 | 0.4093 | 0.0597 | |||

| HSY / The Hershey Company | 0.02 | -7.79 | 2.54 | -10.52 | 0.3892 | -0.0634 | |||

| VZ / Verizon Communications Inc. | 0.06 | 4.21 | 2.53 | -0.59 | 0.3889 | -0.0181 | |||

| MMM / 3M Company | 0.02 | -3.47 | 2.47 | 0.08 | 0.3794 | -0.0151 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.02 | 3.65 | 2.45 | 8.31 | 0.3765 | 0.0149 | |||

| COF / Capital One Financial Corporation | 0.01 | 0.44 | 2.42 | 19.23 | 0.3713 | 0.0472 | |||

| CVS / CVS Health Corporation | 0.03 | -1.77 | 2.41 | 0.00 | 0.3706 | -0.0149 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 13.52 | 2.37 | 25.46 | 0.3632 | 0.0621 | |||

| VXUS / Vanguard STAR Funds - Vanguard Total International Stock ETF | 0.03 | -0.57 | 2.24 | 10.59 | 0.3433 | 0.0204 | |||

| T / AT&T Inc. | 0.08 | 2.65 | 2.22 | 5.07 | 0.3406 | 0.0033 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | -44.95 | 2.03 | -67.21 | 0.3112 | -0.6763 | |||

| DIS / The Walt Disney Company | 0.02 | -27.32 | 1.89 | -8.66 | 0.2898 | -0.0404 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -0.97 | 1.83 | 9.43 | 0.2815 | 0.0138 | |||

| DLN / WisdomTree Trust - WisdomTree U.S. LargeCap Dividend Fund | 0.02 | -2.62 | 1.83 | 0.77 | 0.2807 | -0.0091 | |||

| VTEB / Vanguard Municipal Bond Funds - Vanguard Tax-Exempt Bond ETF | 0.04 | 11.62 | 1.79 | 10.30 | 0.2748 | 0.0156 | |||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0.02 | -11.35 | 1.79 | -11.13 | 0.2747 | -0.0469 | |||

| CLX / The Clorox Company | 0.01 | 4.72 | 1.79 | -14.59 | 0.2741 | -0.0599 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.02 | -0.89 | 1.77 | -0.62 | 0.2722 | -0.0127 | |||

| SBUX / Starbucks Corporation | 0.02 | -2.95 | 1.73 | -9.37 | 0.2659 | -0.0392 | |||

| GIS / General Mills, Inc. | 0.03 | -1.37 | 1.64 | -14.55 | 0.2525 | -0.0549 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 1.54 | 0.06 | 0.2365 | -0.0094 | |||

| MA / Mastercard Incorporated | 0.00 | -2.86 | 1.53 | -0.39 | 0.2342 | -0.0105 | |||

| UPS / United Parcel Service, Inc. | 0.01 | -49.82 | 1.51 | -53.96 | 0.2324 | -0.2925 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.02 | 6.29 | 1.44 | 12.93 | 0.2213 | 0.0175 | |||

| DON / WisdomTree Trust - WisdomTree U.S. MidCap Dividend Fund | 0.03 | -8.43 | 1.42 | -7.33 | 0.2174 | -0.0266 | |||

| JCI / Johnson Controls International plc | 0.01 | -0.03 | 1.38 | 31.81 | 0.2126 | 0.0448 | |||

| ERIE / Erie Indemnity Company | 0.00 | 0.00 | 1.30 | -17.26 | 0.2003 | -0.0515 | |||

| UNP / Union Pacific Corporation | 0.01 | 42.64 | 1.29 | 39.03 | 0.1985 | 0.0499 | |||

| DVN / Devon Energy Corporation | 0.04 | -0.75 | 1.26 | -15.55 | 0.1927 | -0.0448 | |||

| AXP / American Express Company | 0.00 | 0.00 | 1.25 | 18.63 | 0.1916 | 0.0235 | |||

| KO / The Coca-Cola Company | 0.02 | 0.00 | 1.23 | -1.20 | 0.1895 | -0.0101 | |||

| PFF / iShares Trust - iShares Preferred and Income Securities ETF | 0.03 | -7.41 | 1.03 | -7.60 | 0.1589 | -0.0199 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.01 | 5.24 | 0.98 | 10.40 | 0.1502 | 0.0087 | |||

| WMT / Walmart Inc. | 0.01 | 2.26 | 0.88 | 13.94 | 0.1357 | 0.0118 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 1.14 | 0.88 | 11.80 | 0.1354 | 0.0094 | |||

| STT / State Street Corporation | 0.01 | -3.56 | 0.86 | 14.61 | 0.1326 | 0.0122 | |||

| D / Dominion Energy, Inc. | 0.02 | -1.19 | 0.86 | -0.35 | 0.1316 | -0.0059 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | -10.61 | 0.82 | -14.99 | 0.1263 | -0.0282 | |||

| IWN / iShares Trust - iShares Russell 2000 Value ETF | 0.01 | 0.00 | 0.82 | 4.58 | 0.1262 | 0.0005 | |||

| BIL / SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF | 0.01 | 40.05 | 0.81 | 40.17 | 0.1249 | 0.0321 | |||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.01 | 0.00 | 0.81 | 18.57 | 0.1246 | 0.0153 | |||

| BAM / Brookfield Asset Management Ltd. | 0.01 | -2.81 | 0.76 | 10.83 | 0.1163 | 0.0072 | |||

| SJM / The J. M. Smucker Company | 0.01 | -19.65 | 0.74 | -33.39 | 0.1137 | -0.0638 | |||

| COST / Costco Wholesale Corporation | 0.00 | -2.82 | 0.68 | 1.79 | 0.1049 | -0.0024 | |||

| LLY / Eli Lilly and Company | 0.00 | 16.33 | 0.68 | 9.82 | 0.1048 | 0.0055 | |||

| ADBE / Adobe Inc. | 0.00 | 0.00 | 0.67 | 0.90 | 0.1029 | -0.0032 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.01 | -4.19 | 0.61 | 4.79 | 0.0941 | 0.0007 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.00 | 0.36 | 0.57 | 5.99 | 0.0870 | 0.0015 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.01 | 0.00 | 0.55 | -19.32 | 0.0840 | -0.0244 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.00 | 0.52 | 17.54 | 0.0794 | 0.0092 | |||

| TFC / Truist Financial Corporation | 0.01 | -76.05 | 0.50 | -74.98 | 0.0774 | -0.2444 | |||

| ITOT / iShares Trust - iShares Core S&P Total U.S. Stock Market ETF | 0.00 | 0.00 | 0.50 | 10.67 | 0.0766 | 0.0046 | |||

| AMGN / Amgen Inc. | 0.00 | -9.89 | 0.48 | -19.23 | 0.0742 | -0.0214 | |||

| K / Kellanova | 0.01 | -10.73 | 0.47 | -13.94 | 0.0721 | -0.0151 | |||

| VCIT / Vanguard Scottsdale Funds - Vanguard Intermediate-Term Corporate Bond ETF | 0.01 | 4.60 | 0.43 | 6.13 | 0.0666 | 0.0013 | |||

| SLB / Schlumberger Limited | 0.01 | -2.49 | 0.40 | -21.09 | 0.0621 | -0.0198 | |||

| PFE / Pfizer Inc. | 0.02 | -23.12 | 0.39 | -26.45 | 0.0602 | -0.0250 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.38 | 0.0585 | 0.0585 | |||||

| VUSB / Vanguard Bond Index Funds - Vanguard Ultra-Short Bond ETF | 0.01 | -4.00 | 0.36 | -4.02 | 0.0551 | -0.0046 | |||

| SCHB / Schwab Strategic Trust - Schwab U.S. Broad Market ETF | 0.01 | 0.00 | 0.36 | 10.87 | 0.0549 | 0.0033 | |||

| VOT / Vanguard Index Funds - Vanguard Mid-Cap Growth ETF | 0.00 | 0.00 | 0.34 | 16.15 | 0.0520 | 0.0055 | |||

| KVUE / Kenvue Inc. | 0.01 | -2.70 | 0.30 | -14.97 | 0.0463 | -0.0104 | |||

| BX / Blackstone Inc. | 0.00 | 0.00 | 0.27 | 7.17 | 0.0413 | 0.0011 | |||

| MOAT / VanEck ETF Trust - VanEck Morningstar Wide Moat ETF | 0.00 | 0.00 | 0.25 | 6.75 | 0.0389 | 0.0009 | |||

| MKC.V / McCormick & Company, Incorporated | 0.00 | 0.00 | 0.24 | -8.02 | 0.0371 | -0.0048 | |||

| LSTR / Landstar System, Inc. | 0.00 | 0.00 | 0.24 | -7.45 | 0.0363 | -0.0045 | |||

| DWM / WisdomTree Trust - WisdomTree International Equity Fund | 0.00 | 0.00 | 0.23 | 9.35 | 0.0361 | 0.0017 | |||

| SPLG / SPDR Series Trust - SPDR Portfolio S&P 500 ETF | 0.00 | 0.21 | 0.0321 | 0.0321 | |||||

| OBT / Orange County Bancorp, Inc. | 0.01 | 0.20 | 0.0309 | 0.0309 | |||||

| NKE / NIKE, Inc. | 0.00 | 0.20 | 0.0309 | 0.0309 | |||||

| US530715AG61 / Liberty Media, Bond 4%, Due 11/15/2029 | 0.00 | -70.00 | 0.0005 | -0.0012 | |||||

| KHC / The Kraft Heinz Company | 0.00 | -100.00 | 0.00 | 0.0000 |