Basic Stats

| Manager | Keith Meister |

| Insider Profile | Corvex Management LP |

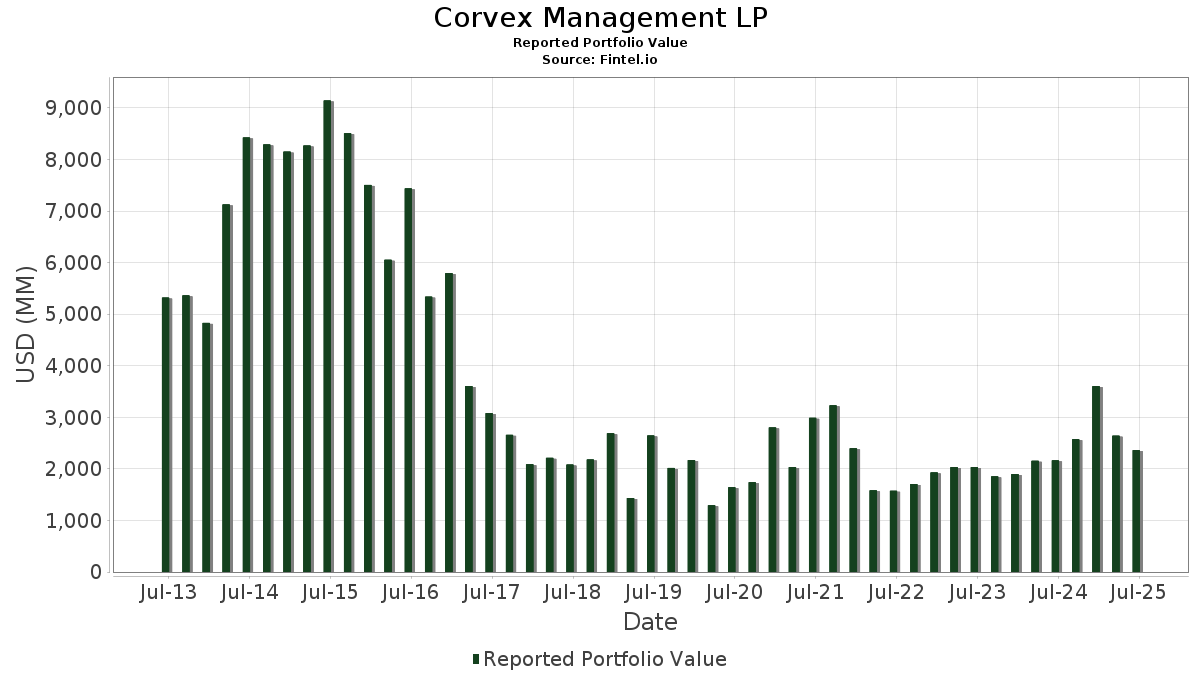

| Portfolio Value | $ 2,362,227,790 |

| Current Positions | 30 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Corvex Management LP has disclosed 30 total holdings in their latest SEC filings. Portfolio manager(s) are listed as Keith Meister. Most recent portfolio value is calculated to be $ 2,362,227,790 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Corvex Management LP’s top holdings are Southwest Gas Holdings, Inc. (US:SWX) , Illumina, Inc. (US:ILMN) , GeneDx Holdings Corp. (US:WGS) , MGM Resorts International (US:MGM) , and Amazon.com, Inc. (US:AMZN) . Corvex Management LP’s new positions include Restaurant Brands International Inc. (US:QSR) , Oracle Corporation (US:ORCL) , . Corvex Management LP’s top industries are "Tobacco Products" (sic 21) , "Electronic And Other Electrical Equipment And Components, Except Computer Equipment" (sic 36) , and "Wholesale Trade-durable Goods" (sic 50) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 3.83 | 365.38 | 15.4677 | 3.9690 | |

| 3.06 | 282.34 | 11.9524 | 3.6610 | |

| 5.03 | 374.22 | 15.8420 | 2.8832 | |

| 0.87 | 57.88 | 2.4504 | 2.4504 | |

| 0.68 | 148.09 | 6.2693 | 2.2009 | |

| 5.63 | 193.53 | 8.1926 | 1.8129 | |

| 0.17 | 86.38 | 3.6567 | 1.1896 | |

| 0.10 | 21.75 | 0.9209 | 0.9209 | |

| 1.01 | 79.91 | 3.3829 | 0.7844 | |

| 0.30 | 76.13 | 3.2229 | 0.5569 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.98 | 97.25 | 4.1168 | -5.0049 | |

| 0.23 | 39.78 | 1.6839 | -2.0804 | |

| 0.00 | 0.00 | -1.8874 | ||

| 18.80 | 107.75 | 4.5612 | -1.8110 | |

| 2.00 | 74.71 | 3.1629 | -1.0277 | |

| 4.18 | 69.73 | 2.9520 | -0.8056 | |

| 0.06 | 14.09 | 0.5965 | -0.6330 | |

| 4.51 | 22.27 | 0.9428 | -0.3357 | |

| 0.01 | 1.08 | 0.0457 | -0.0109 |

13D/G Filings

This is a list of 13D and 13G filings made in the last year (if any). Click the link icon to see the full transaction history. Green rows indicate new positions. Red rows indicate closed positions.

| File Date | Form | Security | Prev Shares |

Current Shares |

ΔShares % | % Ownership |

% ΔOwnership | |

|---|---|---|---|---|---|---|---|---|

| 2025-05-28 | SWX / Southwest Gas Holdings, Inc. | 4,153,717 | 5,028,975 | 21.07 | 7.00 | 20.69 | ||

| 2025-05-28 | VSTS / Vestis Corporation | 17,007,877 | 18,811,369 | 10.60 | 14.30 | 10.85 | ||

| 2025-05-15 | LLYVA / Liberty Live Group | 1,558,332 | 1,021,144 | -34.47 | 4.00 | -34.43 | ||

| 2024-11-01 | MDU / MDU Resources Group, Inc. | 10,147,041 | 10,147,041 | 0.00 | 4.98 | 0.00 |

13F and Fund Filings

This form was filed on 2025-08-14 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SWX / Southwest Gas Holdings, Inc. | 5.03 | 5.48 | 374.22 | 9.29 | 15.8420 | 2.8832 | |||

| ILMN / Illumina, Inc. | 3.83 | 0.00 | 365.38 | 20.25 | 15.4677 | 3.9690 | |||

| WGS / GeneDx Holdings Corp. | 3.06 | 23.64 | 282.34 | 28.87 | 11.9524 | 3.6610 | |||

| MGM / MGM Resorts International | 5.63 | -1.05 | 193.53 | 14.80 | 8.1926 | 1.8129 | |||

| AMZN / Amazon.com, Inc. | 0.68 | 19.47 | 148.09 | 37.76 | 6.2693 | 2.2009 | |||

| VSTS / Vestis Corporation | 18.80 | 10.56 | 107.75 | -36.01 | 4.5612 | -1.8110 | |||

| DLTR / Dollar Tree, Inc. | 0.98 | -69.42 | 97.25 | -59.65 | 4.1168 | -5.0049 | |||

| MSFT / Microsoft Corporation | 0.17 | 0.00 | 86.38 | 32.50 | 3.6567 | 1.1896 | |||

| SRE / Sempra | 1.06 | 0.00 | 80.02 | 6.18 | 3.3875 | 0.5354 | |||

| LLYVA / Liberty Live Group | 1.01 | -1.54 | 79.91 | 16.38 | 3.3829 | 0.7844 | |||

| NSC / Norfolk Southern Corporation | 0.30 | 0.00 | 76.13 | 8.07 | 3.2229 | 0.5569 | |||

| IAC / IAC Inc. | 2.00 | -16.99 | 74.71 | -32.53 | 3.1629 | -1.0277 | |||

| MDU / MDU Resources Group, Inc. | 4.18 | -28.76 | 69.73 | -29.77 | 2.9520 | -0.8056 | |||

| QSR / Restaurant Brands International Inc. | 0.87 | 57.88 | 2.4504 | 2.4504 | |||||

| CSX / CSX Corporation | 1.75 | 0.00 | 57.20 | 10.87 | 2.4216 | 0.4691 | |||

| HSII / Heidrick & Struggles International, Inc. | 1.00 | 0.00 | 45.87 | 6.84 | 1.9419 | 0.3171 | |||

| GOOGL / Alphabet Inc. | 0.23 | -64.91 | 39.78 | -60.01 | 1.6839 | -2.0804 | |||

| AQN / Algonquin Power & Utilities Corp. | 6.18 | 8.80 | 35.43 | 21.28 | 1.5000 | 0.3944 | |||

| FTRE / Fortrea Holdings Inc. | 4.51 | 0.75 | 22.27 | -34.08 | 0.9428 | -0.3357 | |||

| IAS / Integral Ad Science Holding Corp. | 2.62 | 0.00 | 21.76 | 3.10 | 0.9210 | 0.1224 | |||

| ORCL / Oracle Corporation | 0.10 | 21.75 | 0.9209 | 0.9209 | |||||

| LNG / Cheniere Energy, Inc. | 0.06 | -58.79 | 14.09 | -56.63 | 0.5965 | -0.6330 | |||

| LLYVK / Liberty Live Group | 0.03 | 94.21 | 2.62 | 131.31 | 0.1111 | 0.0681 | |||

| NVDA / NVIDIA Corporation | 0.02 | 0.00 | 2.57 | 45.77 | 0.1087 | 0.0420 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 1.77 | 28.05 | 0.0750 | 0.0226 | |||

| AMBP / Ardagh Metal Packaging S.A. | 0.40 | 0.00 | 1.71 | 41.78 | 0.0723 | 0.0267 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.01 | -33.33 | 1.08 | -27.94 | 0.0457 | -0.0109 | |||

| TSLA / Tesla, Inc. | 0.00 | 0.00 | 0.91 | 22.63 | 0.0383 | 0.0104 | |||

| LAB / Standard BioTools Inc. | 0.04 | 0.00 | 0.05 | 12.77 | 0.0023 | 0.0004 | |||

| FLYX.WS / flyExclusive, Inc. - Equity Warrant | 0.20 | 0.00 | 0.02 | 0.00 | 0.0009 | 0.0001 | |||

| IBIT / iShares Bitcoin Trust ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KOF / Coca-Cola FEMSA, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UGI / UGI Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IWM / iShares Trust - iShares Russell 2000 ETF | Call | 0.00 | -100.00 | 0.00 | -100.00 | -1.8874 | |||

| PLTR / Palantir Technologies Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 |