Basic Stats

| Insider Profile | CHUBB CORP |

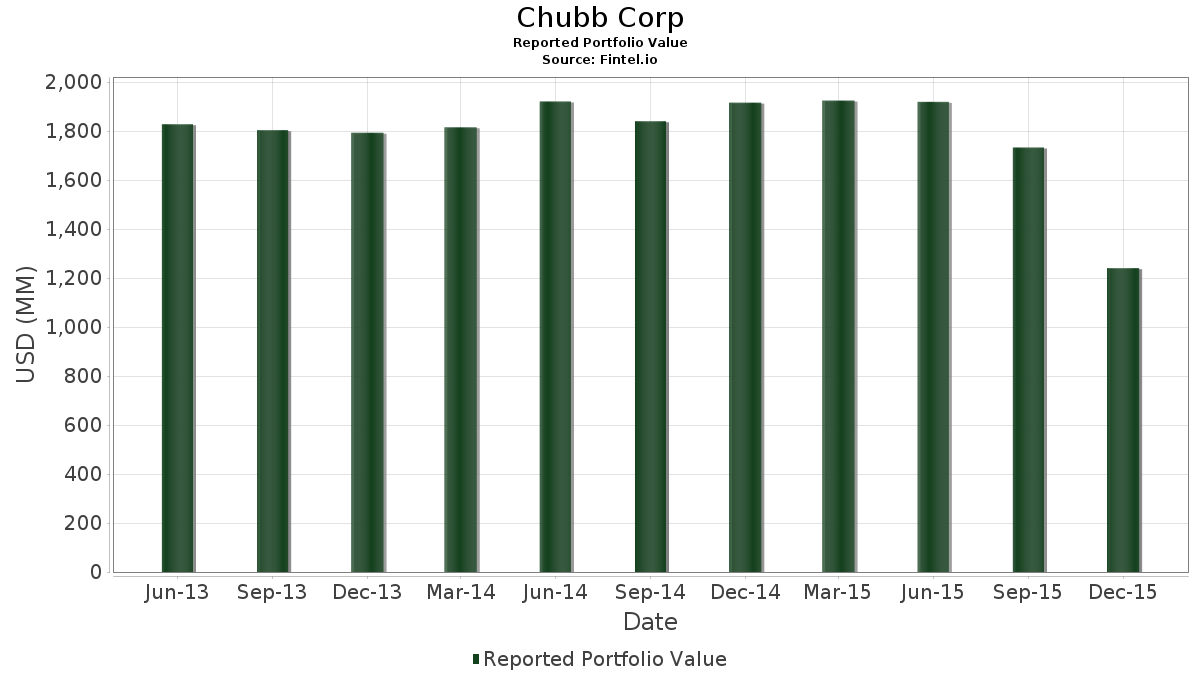

| Portfolio Value | $ 1,240,612,000 |

| Current Positions | 71 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Chubb Corp has disclosed 71 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,240,612,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Chubb Corp’s top holdings are Tyson Foods, Inc. (US:TSN) , Delta Air Lines, Inc. (US:DAL) , The Kroger Co. (US:KR) , Microsoft Corporation (US:MSFT) , and Newell Brands Inc. (US:NWL) . Chubb Corp’s new positions include Community Health Systems, Inc. (US:CYH) , DHI Group, Inc. (US:DHX) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.80 | 42.66 | 3.4389 | 1.4497 | |

| 0.60 | 33.29 | 2.6832 | 1.1511 | |

| 0.35 | 26.92 | 2.1701 | 0.8183 | |

| 0.37 | 26.32 | 2.1217 | 0.8095 | |

| 1.50 | 27.66 | 2.2295 | 0.8094 | |

| 0.03 | 22.83 | 1.8401 | 0.7842 | |

| 0.03 | 23.34 | 1.8813 | 0.7764 | |

| 0.92 | 29.61 | 2.3871 | 0.7246 | |

| 1.20 | 27.95 | 2.2528 | 0.7040 | |

| 0.80 | 40.55 | 3.2686 | 0.6799 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.6215 | ||

| 0.00 | 0.00 | -1.4458 | ||

| 0.00 | 0.00 | -1.4362 | ||

| 0.00 | 0.00 | -1.4062 | ||

| 0.00 | 0.00 | -1.3781 | ||

| 0.00 | 0.00 | -1.2799 | ||

| 0.00 | 0.00 | -1.2091 | ||

| 0.00 | 0.00 | -1.1724 | ||

| 0.00 | 0.00 | -1.1580 | ||

| 0.00 | 0.00 | -1.1298 |

13F and Fund Filings

This form was filed on 2016-02-11 for the reporting period 2015-12-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TSN / Tyson Foods, Inc. | 0.80 | 0.00 | 42.66 | 23.74 | 3.4389 | 1.4497 | |||

| DAL / Delta Air Lines, Inc. | 0.80 | -20.00 | 40.55 | -9.63 | 3.2686 | 0.6799 | |||

| KR / The Kroger Co. | 0.90 | -25.00 | 37.65 | -13.02 | 3.0346 | 0.5373 | |||

| MSFT / Microsoft Corporation | 0.60 | 0.00 | 33.29 | 25.35 | 2.6832 | 1.1511 | |||

| NWL / Newell Brands Inc. | 0.70 | -22.22 | 30.86 | -13.66 | 2.4872 | 0.4252 | |||

| PFE / Pfizer Inc. | 0.92 | 0.00 | 29.61 | 2.77 | 2.3871 | 0.7246 | |||

| JBL / Jabil Inc. | 1.20 | 0.00 | 27.95 | 4.11 | 2.2528 | 0.7040 | |||

| BSX / Boston Scientific Corporation | 1.50 | 0.00 | 27.66 | 12.37 | 2.2295 | 0.8094 | |||

| MDT / Medtronic plc | 0.35 | 0.00 | 26.92 | 14.91 | 2.1701 | 0.8183 | |||

| DGX / Quest Diagnostics Incorporated | 0.37 | 0.00 | 26.32 | 15.73 | 2.1217 | 0.8095 | |||

| CMCSA / Comcast Corporation | 0.45 | 0.00 | 25.39 | -0.79 | 2.0468 | 0.5701 | |||

| LPNT / LifePoint Health, Inc. | 0.34 | -9.93 | 25.04 | -6.75 | 2.0186 | 0.4691 | |||

| BK / The Bank of New York Mellon Corporation | 0.60 | 0.00 | 24.73 | 5.29 | 1.9935 | 0.6383 | |||

| STJ / St. Jude Medical, Inc. | 0.40 | 0.00 | 24.71 | -2.09 | 1.9916 | 0.5356 | |||

| CCEP / Coca-Cola Europacific Partners PLC | 0.50 | 0.00 | 24.62 | 1.84 | 1.9845 | 0.5897 | |||

| MRK / Merck & Co., Inc. | 0.46 | 0.00 | 24.35 | 6.94 | 1.9627 | 0.6491 | |||

| JPM / JPMorgan Chase & Co. | 0.36 | 0.00 | 23.77 | 8.30 | 1.9161 | 0.6497 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.70 | 0.00 | 23.77 | 6.70 | 1.9157 | 0.6306 | |||

| UNH / UnitedHealth Group Incorporated | 0.20 | -42.86 | 23.53 | -42.05 | 1.8965 | -0.4461 | |||

| GOOGL / Alphabet Inc. | 0.03 | 0.00 | 23.34 | 21.87 | 1.8813 | 0.7764 | |||

| AAL / American Airlines Group Inc. | 0.55 | 0.00 | 23.29 | 9.06 | 1.8775 | 0.6454 | |||

| DOX / Amdocs Limited | 0.43 | 0.00 | 23.20 | -4.06 | 1.8704 | 0.4750 | |||

| GOOG / Alphabet Inc. | 0.03 | 0.00 | 22.83 | 24.74 | 1.8401 | 0.7842 | |||

| MDLZ / Mondelez International, Inc. | 0.51 | 0.00 | 22.68 | 7.10 | 1.8284 | 0.6064 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.55 | 0.00 | 22.19 | 4.94 | 1.7888 | 0.5687 | |||

| FLEX / Flex Ltd. | 1.98 | 0.00 | 22.14 | 6.36 | 1.7846 | 0.5836 | |||

| BAC / Bank of America Corporation | 1.30 | 0.00 | 21.88 | 8.02 | 1.7636 | 0.5950 | |||

| SANM / Sanmina Corporation | 1.06 | 0.00 | 21.87 | -3.70 | 1.7627 | 0.4526 | |||

| STT / State Street Corporation | 0.33 | 0.00 | 21.57 | -1.26 | 1.7384 | 0.4782 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.40 | 0.00 | 21.49 | -2.93 | 1.7324 | 0.4550 | |||

| AAPL / Apple Inc. | 0.20 | -28.57 | 21.05 | -31.84 | 1.6969 | -0.0849 | |||

| C / Citigroup Inc. | 0.40 | 0.00 | 20.70 | 4.31 | 1.6685 | 0.5236 | |||

| 024237020 / Dean Foods Co | 1.18 | 0.00 | 20.17 | 3.81 | 1.6256 | 0.5048 | |||

| CYH / Community Health Systems, Inc. | 0.74 | 19.60 | 1.5799 | -0.2431 | |||||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.45 | 0.00 | 19.19 | -10.16 | 1.5470 | 0.3145 | |||

| CSCO / Cisco Systems, Inc. | 0.70 | 0.00 | 19.01 | 3.45 | 1.5322 | 0.4721 | |||

| AVY / Avery Dennison Corporation | 0.30 | -40.00 | 18.80 | -33.54 | 1.5152 | -0.1167 | |||

| CLS / Celestica Inc. | 1.70 | 0.00 | 18.75 | -14.43 | 1.5114 | 0.2472 | |||

| AEO / American Eagle Outfitters, Inc. | 1.20 | 0.00 | 18.60 | -0.83 | 1.4993 | 0.4171 | |||

| WU / The Western Union Company | 1.00 | 0.00 | 17.91 | -2.45 | 1.4436 | 0.3844 | |||

| ODP / The ODP Corporation | 3.00 | 0.00 | 16.92 | -12.15 | 1.3638 | 0.2527 | |||

| ADM / Archer-Daniels-Midland Company | 0.45 | 0.00 | 16.51 | -11.51 | 1.3305 | 0.2543 | |||

| MS / Morgan Stanley | 0.49 | 0.00 | 15.60 | 0.98 | 1.2576 | 0.3662 | |||

| OI / O-I Glass, Inc. | 0.89 | 0.00 | 15.50 | -15.93 | 1.2497 | 0.1858 | |||

| NLOK / NortonLifeLock Inc | 0.70 | 0.00 | 14.70 | 7.86 | 1.1849 | 0.3986 | |||

| ERIC / Telefonaktiebolaget LM Ericsson (publ) - Depositary Receipt (Common Stock) | 1.50 | 0.00 | 14.41 | -1.74 | 1.1619 | 0.3156 | |||

| / Total S.A. | 0.30 | 0.00 | 13.48 | 0.54 | 1.0870 | 0.3131 | |||

| ARNC / Arconic Corporation | 1.30 | 0.00 | 12.83 | 2.18 | 1.0343 | 0.3098 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.40 | 0.00 | 12.50 | 2.29 | 1.0079 | 0.3026 | |||

| VIAB / Viacom, Inc. | 0.30 | 0.00 | 12.35 | -4.61 | 0.9953 | 0.2485 | |||

| KHC / The Kraft Heinz Company | 0.17 | 0.00 | 12.27 | 3.09 | 0.9889 | 0.3023 | |||

| US0325111070 / Anadarko Petroleum Corp. | 0.25 | 0.00 | 12.14 | -19.56 | 0.9790 | 0.1079 | |||

| SPLS / Staples, Inc. | 1.20 | 0.00 | 11.36 | -19.27 | 0.9160 | 0.1039 | |||

| EXC / Exelon Corporation | 0.39 | 0.00 | 10.92 | -6.50 | 0.8801 | 0.2064 | |||

| WFT / Weatherford International plc | 1.20 | 0.00 | 10.07 | -1.06 | 0.8115 | 0.2244 | |||

| HES / Hess Corporation | 0.20 | 0.00 | 9.70 | -3.16 | 0.7815 | 0.2039 | |||

| RDS.A / Shell Plc - ADR (Representing Ordinary Shares - Class A) | 0.20 | 0.00 | 9.16 | -3.38 | 0.7382 | 0.1914 | |||

| WMB / The Williams Companies, Inc. | 0.35 | 0.00 | 8.99 | -30.26 | 0.7250 | -0.0191 | |||

| RDC / Rowan Companies plc | 0.50 | 0.00 | 8.47 | 4.95 | 0.6831 | 0.2172 | |||

| MRO / Marathon Oil Corporation | 0.45 | 0.00 | 5.67 | -18.24 | 0.4567 | 0.0569 | |||

| US98212B1035 / WPX Energy, Inc. | 0.80 | 0.00 | 4.59 | -13.29 | 0.3701 | 0.0646 | |||

| AVP / Avon Products, Inc. | 1.13 | 0.00 | 4.56 | 24.59 | 0.3676 | 0.1564 | |||

| BAC.PRL / Bank of America Corporation - Preferred Stock | 0.00 | 0.00 | 2.19 | 1.53 | 0.1763 | 0.0520 | |||

| ATEC / Alphatec Holdings, Inc. | 2.30 | 0.00 | 0.69 | -9.08 | 0.0557 | 0.0119 | |||

| DHX / DHI Group, Inc. | 0.04 | 0.34 | 0.0275 | 0.0275 | |||||

| LMOS / Lumos Networks Corp. | 0.03 | 0.00 | 0.31 | -7.94 | 0.0252 | 0.0056 | |||

| / XL Group Ltd. | 0.09 | 0.00 | 0.25 | -18.63 | 0.0201 | 0.0024 | |||

| NEWT / NewtekOne, Inc. | 0.01 | 4.74 | 0.20 | -9.13 | 0.0160 | 0.0034 | |||

| / XL Group Ltd. | 0.02 | 0.00 | 0.15 | -7.41 | 0.0121 | 0.0027 | |||

| EGAN / eGain Corporation | 0.02 | 0.00 | 0.09 | 7.06 | 0.0073 | 0.0024 | |||

| CYH / Community Health Systems, Inc. | 2.00 | 0.00 | 0.02 | 0.00 | 0.0014 | 0.0004 | |||

| / XL Group Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3771 | ||||

| US85207U1051 / Sprint Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0365 | ||||

| WMT / Walmart Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7482 | ||||

| ED / Consolidated Edison, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.2091 | ||||

| WFC / Wells Fargo & Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.1180 | ||||

| T / AT&T Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2631 | ||||

| NVDA / NVIDIA Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.2799 | ||||

| BAX / Baxter International Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5117 | ||||

| ORCL / Oracle Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.6043 | ||||

| ATO / Atmos Energy Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.1580 | ||||

| PNW / Pinnacle West Capital Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.4062 | ||||

| EVER / EverQuote, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0998 | ||||

| SYA / Symetra Financial Corporation | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| KRFT / | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| 887228104 / Time Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| VZ / Verizon Communications Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1724 | ||||

| MNKKQ / Mallinckrodt Plc | 0.00 | -100.00 | 0.00 | -100.00 | -0.1821 | ||||

| GIS / General Mills, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1010 | ||||

| NI / NiSource Inc. | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| OCR / | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| COP / ConocoPhillips | 0.00 | -100.00 | 0.00 | -100.00 | -0.5257 | ||||

| NOC / Northrop Grumman Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.4362 | ||||

| DTE / DTE Energy Company | 0.00 | -100.00 | 0.00 | -100.00 | -1.6215 | ||||

| ALB / Albemarle Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1028 | ||||

| GE / General Electric Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.6257 | ||||

| DUK / Duke Energy Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.1298 | ||||

| / Weight Watchers International, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2577 | ||||

| DOW / Dow Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| FTR / Frontier Communications Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0308 | ||||

| WBA / Walgreens Boots Alliance, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9589 | ||||

| HII / Huntington Ingalls Industries, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1546 | ||||

| HIG / The Hartford Insurance Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2641 | ||||

| POM / PEPCO Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0035 | ||||

| BXLT / Baxalta Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.4909 | ||||

| GXP / Great Plains Energy, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6346 | ||||

| HUM / Humana Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.4458 | ||||

| GNW / Genworth Financial, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0747 | ||||

| 19041P105 / CBS Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8748 | ||||

| MPC / Marathon Petroleum Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.8019 | ||||

| AEE / Ameren Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.6829 | ||||

| CPGX / Columbia Pipeline Group Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4221 | ||||

| TRV / The Travelers Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.3781 |