Basic Stats

| Portfolio Value | $ 4,656,015,519 |

| Current Positions | 166 |

Latest Holdings, Performance, AUM (from 13F, 13D)

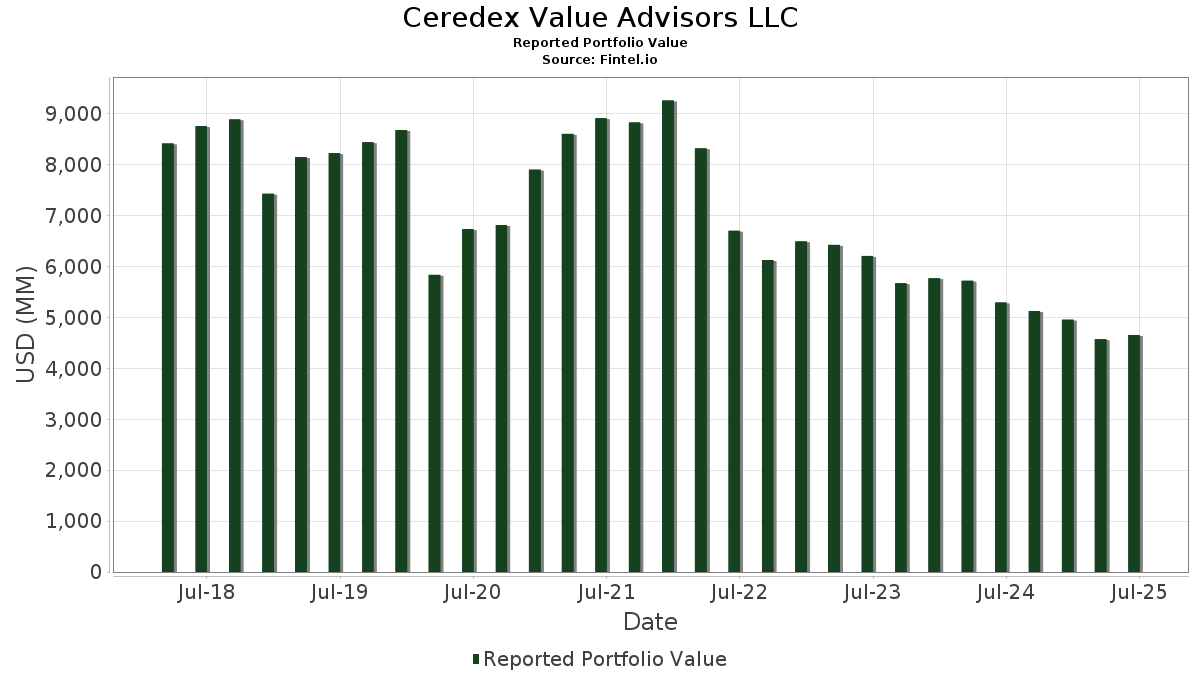

Ceredex Value Advisors LLC has disclosed 166 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 4,656,015,519 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Ceredex Value Advisors LLC’s top holdings are KeyCorp (US:KEY) , PPL Corporation (US:PPL) , Ameren Corporation (US:AEE) , Dell Technologies Inc. (US:DELL) , and International Paper Company (US:IP) . Ceredex Value Advisors LLC’s new positions include Meta Platforms, Inc. (US:META) , Primo Brands Corporation (US:PRMB) , Corning Incorporated (US:GLW) , Alcon Inc. (MX:ALC N) , and Ventas, Inc. (US:VTR) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.06 | 44.14 | 0.9480 | 0.9480 | |

| 1.39 | 41.15 | 0.8839 | 0.8839 | |

| 0.31 | 40.48 | 0.8695 | 0.8695 | |

| 0.59 | 31.24 | 0.6710 | 0.6710 | |

| 0.35 | 31.11 | 0.6682 | 0.6682 | |

| 0.46 | 28.86 | 0.6198 | 0.6198 | |

| 0.73 | 60.78 | 0.6052 | 0.6052 | |

| 0.06 | 28.17 | 0.6050 | 0.6050 | |

| 0.03 | 26.27 | 0.5642 | 0.5642 | |

| 0.48 | 25.09 | 0.5389 | 0.5389 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.35 | 45.71 | 0.4552 | -1.5714 | |

| 0.11 | 28.75 | 0.2863 | -1.5644 | |

| 0.04 | 21.89 | 0.2180 | -1.3575 | |

| 0.37 | 36.13 | 0.3597 | -1.0930 | |

| 0.26 | 30.05 | 0.2992 | -1.0911 | |

| 0.22 | 25.73 | 0.2562 | -1.0833 | |

| 0.22 | 47.37 | 0.4716 | -1.0610 | |

| 0.29 | 35.58 | 0.3543 | -1.0280 | |

| 4.83 | 84.09 | 0.8374 | -0.9909 | |

| 1.61 | 75.62 | 0.7530 | -0.9811 |

13F and Fund Filings

This form was filed on 2025-08-13 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| KEY / KeyCorp | 4.83 | -7.66 | 84.09 | 0.60 | 0.8374 | -0.9909 | |||

| PPL / PPL Corporation | 2.34 | 185.72 | 79.42 | 168.16 | 0.7908 | 0.1431 | |||

| AEE / Ameren Corporation | 0.82 | 62.77 | 78.93 | 55.70 | 0.7859 | -0.3228 | |||

| DELL / Dell Technologies Inc. | 0.62 | 48.63 | 75.64 | 99.91 | 0.7532 | -0.0744 | |||

| IP / International Paper Company | 1.61 | 8.65 | 75.62 | -4.63 | 0.7530 | -0.9811 | |||

| ROK / Rockwell Automation, Inc. | 0.23 | -13.00 | 75.47 | 11.85 | 0.7514 | -0.7242 | |||

| URI / United Rentals, Inc. | 0.10 | -5.86 | 74.26 | 13.18 | 0.7394 | -0.6956 | |||

| FCX / Freeport-McMoRan Inc. | 1.64 | 137.33 | 71.27 | 171.76 | 0.7097 | 0.1361 | |||

| NXPI / NXP Semiconductors N.V. | 0.30 | -22.80 | 66.37 | -11.25 | 0.6609 | -0.9748 | |||

| JPM / JPMorgan Chase & Co. | 0.23 | -5.57 | 66.25 | 11.61 | 0.6596 | -0.6386 | |||

| OWL / Blue Owl Capital Inc. | 3.30 | 1.33 | 63.45 | -2.87 | 0.6318 | -0.7969 | |||

| IR / Ingersoll Rand Inc. | 0.73 | 60.78 | 0.6052 | 0.6052 | |||||

| FANG / Diamondback Energy, Inc. | 0.43 | 95.97 | 59.68 | 68.42 | 0.5942 | -0.1808 | |||

| RVTY / Revvity, Inc. | 0.59 | 51.71 | 56.75 | 38.69 | 0.5651 | -0.3299 | |||

| BAC / Bank of America Corporation | 1.19 | -15.23 | 56.09 | -3.87 | 0.5585 | -0.7177 | |||

| SBUX / Starbucks Corporation | 0.55 | 28.47 | 50.70 | 20.01 | 0.5049 | -0.4191 | |||

| DHR / Danaher Corporation | 0.25 | 1.57 | 49.26 | -2.12 | 0.4905 | -0.6103 | |||

| ELS / Equity LifeStyle Properties, Inc. | 0.79 | 1.36 | 49.02 | -6.29 | 0.4881 | -0.6560 | |||

| AON / Aon plc | 0.14 | 8.75 | 48.56 | -2.78 | 0.4835 | -0.6089 | |||

| XOM / Exxon Mobil Corporation | 0.44 | 47.86 | 0.4766 | 0.4766 | |||||

| HD / The Home Depot, Inc. | 0.13 | -12.06 | 47.70 | -12.03 | 0.4750 | -0.7109 | |||

| COF / Capital One Financial Corporation | 0.22 | -43.04 | 47.37 | -32.40 | 0.4716 | -1.0610 | |||

| MSFT / Microsoft Corporation | 0.10 | -15.90 | 47.32 | 11.44 | 0.4711 | -0.4575 | |||

| JNJ / Johnson & Johnson | 0.31 | 47.11 | 0.4691 | 0.4691 | |||||

| SLB / Schlumberger Limited | 1.35 | -38.99 | 45.71 | -50.67 | 0.4552 | -1.5714 | |||

| SNX / TD SYNNEX Corporation | 0.33 | 257.29 | 45.24 | 366.39 | 0.4504 | 0.2383 | |||

| CHD / Church & Dwight Co., Inc. | 0.47 | 0.33 | 44.85 | -12.41 | 0.4466 | -0.6733 | |||

| MMM / 3M Company | 0.29 | -15.77 | 44.65 | -12.69 | 0.4446 | -0.6738 | |||

| EGP / EastGroup Properties, Inc. | 0.27 | 65.72 | 44.55 | 57.23 | 0.4436 | -0.1761 | |||

| META / Meta Platforms, Inc. | 0.06 | 44.14 | 0.9480 | 0.9480 | |||||

| RRX / Regal Rexnord Corporation | 0.30 | -21.81 | 43.77 | -0.45 | 0.4359 | -0.5258 | |||

| RJF / Raymond James Financial, Inc. | 0.28 | -6.32 | 43.69 | 3.44 | 0.4351 | -0.4888 | |||

| DIS / The Walt Disney Company | 0.35 | 44.63 | 43.53 | 81.71 | 0.4334 | -0.0905 | |||

| HXL / Hexcel Corporation | 0.77 | 8.22 | 43.49 | 11.64 | 0.4330 | -0.4189 | |||

| PRMB / Primo Brands Corporation | 1.39 | 41.15 | 0.8839 | 0.8839 | |||||

| MDLZ / Mondelez International, Inc. | 0.61 | -18.36 | 40.95 | -18.86 | 0.4077 | -0.6959 | |||

| JCI / Johnson Controls International plc | 0.39 | -18.53 | 40.88 | 7.41 | 0.4070 | -0.4253 | |||

| J / Jacobs Solutions Inc. | 0.31 | 40.48 | 0.8695 | 0.8695 | |||||

| AMT / American Tower Corporation | 0.18 | -21.70 | 39.91 | -20.47 | 0.3974 | -0.7002 | |||

| NKE / NIKE, Inc. | 0.56 | 23.01 | 39.60 | 37.66 | 0.3943 | -0.2348 | |||

| FDX / FedEx Corporation | 0.17 | -5.59 | 39.37 | -11.96 | 0.3920 | -0.5860 | |||

| VNT / Vontier Corporation | 1.02 | 195.24 | 37.78 | 231.66 | 0.3762 | 0.1270 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.02 | 0.06 | 36.55 | 5.59 | 0.3639 | -0.3931 | |||

| LRCX / Lam Research Corporation | 0.37 | -59.38 | 36.13 | -45.61 | 0.3597 | -1.0930 | |||

| MU / Micron Technology, Inc. | 0.29 | -60.31 | 35.58 | -43.71 | 0.3543 | -1.0280 | |||

| EVR / Evercore Inc. | 0.13 | 215.38 | 35.17 | 326.41 | 0.3502 | 0.1698 | |||

| BDX / Becton, Dickinson and Company | 0.20 | -5.32 | 34.33 | -28.80 | 0.3419 | -0.7128 | |||

| LEN / Lennar Corporation | 0.31 | -7.55 | 33.96 | -10.91 | 0.3382 | -0.4956 | |||

| OC / Owens Corning | 0.24 | 1.99 | 33.45 | -1.79 | 0.3331 | -0.4119 | |||

| SO / The Southern Company | 0.36 | -31.17 | 32.98 | -31.26 | 0.3284 | -0.7209 | |||

| DOW / Dow Inc. | 1.24 | 17.39 | 32.77 | -10.98 | 0.3263 | -0.4788 | |||

| VRT / Vertiv Holdings Co | 0.25 | -46.69 | 32.58 | -5.18 | 0.3245 | -0.4271 | |||

| MSI / Motorola Solutions, Inc. | 0.08 | 32.40 | 38,931.33 | 0.3226 | 0.3212 | ||||

| CNP / CenterPoint Energy, Inc. | 0.87 | 32.11 | 0.3198 | 0.3198 | |||||

| KNSL / Kinsale Capital Group, Inc. | 0.07 | 32.03 | 0.3190 | 0.3190 | |||||

| ETR / Entergy Corporation | 0.38 | 17.88 | 31.99 | 14.62 | 0.3185 | -0.2919 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.10 | 0.93 | 31.50 | 53.83 | 0.3137 | -0.1342 | |||

| DOV / Dover Corporation | 0.17 | 15.63 | 31.29 | 20.60 | 0.3115 | -0.2559 | |||

| GLW / Corning Incorporated | 0.59 | 31.24 | 0.6710 | 0.6710 | |||||

| ALC N / Alcon Inc. | 0.35 | 31.11 | 0.6682 | 0.6682 | |||||

| MCHP / Microchip Technology Incorporated | 0.44 | 30.97 | 0.3084 | 0.3084 | |||||

| BAH / Booz Allen Hamilton Holding Corporation | 0.30 | 30.84 | 0.3071 | 0.3071 | |||||

| MAA / Mid-America Apartment Communities, Inc. | 0.20 | 9.45 | 30.19 | -3.33 | 0.3006 | -0.3825 | |||

| PPG / PPG Industries, Inc. | 0.26 | -54.55 | 30.05 | -52.73 | 0.2992 | -1.0911 | |||

| WDC / Western Digital Corporation | 0.47 | 29.95 | 0.2983 | 0.2983 | |||||

| CCI / Crown Castle Inc. | 0.29 | 29.94 | 0.2981 | 0.2981 | |||||

| TEL / TE Connectivity plc | 0.18 | -22.35 | 29.71 | -7.32 | 0.2958 | -0.4053 | |||

| HUBB / Hubbell Incorporated | 0.07 | -28.46 | 29.21 | -11.70 | 0.2909 | -0.4327 | |||

| VTR / Ventas, Inc. | 0.46 | 28.86 | 0.6198 | 0.6198 | |||||

| VMC / Vulcan Materials Company | 0.11 | -69.61 | 28.75 | -66.03 | 0.2863 | -1.5644 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.14 | 28.41 | 0.2829 | 0.2829 | |||||

| MCO / Moody's Corporation | 0.06 | 28.17 | 0.6050 | 0.6050 | |||||

| ROP / Roper Technologies, Inc. | 0.05 | 12.07 | 28.10 | 7.75 | 0.2798 | -0.2906 | |||

| WMT / Walmart Inc. | 0.29 | 12.25 | 27.96 | 25.03 | 0.2784 | -0.2107 | |||

| ALL / The Allstate Corporation | 0.14 | 0.58 | 27.68 | -2.22 | 0.2756 | -0.3435 | |||

| WMB / The Williams Companies, Inc. | 0.44 | 27.62 | 0.2751 | 0.2751 | |||||

| DAL / Delta Air Lines, Inc. | 0.55 | -14.31 | 26.99 | -3.34 | 0.2688 | -0.3419 | |||

| LPLA / LPL Financial Holdings Inc. | 0.07 | -23.78 | 26.83 | -12.64 | 0.2672 | -0.4045 | |||

| EME / EMCOR Group, Inc. | 0.05 | 26.54 | 0.2643 | 0.2643 | |||||

| LVS / Las Vegas Sands Corp. | 0.61 | -4.20 | 26.34 | 7.90 | 0.2623 | -0.2716 | |||

| AMH / American Homes 4 Rent | 0.73 | -25.57 | 26.31 | -28.99 | 0.2619 | -0.5483 | |||

| EQIX / Equinix, Inc. | 0.03 | 26.27 | 0.5642 | 0.5642 | |||||

| SGI / Somnigroup International Inc. | 0.38 | 23.90 | 26.19 | 40.81 | 0.2608 | -0.1460 | |||

| EXE / Expand Energy Corporation | 0.22 | -60.01 | 25.73 | -57.99 | 0.2562 | -1.0833 | |||

| GD / General Dynamics Corporation | 0.09 | -20.30 | 25.70 | -14.72 | 0.2559 | -0.4033 | |||

| ROST / Ross Stores, Inc. | 0.20 | 15.46 | 25.29 | 15.27 | 0.2519 | -0.2280 | |||

| JBL / Jabil Inc. | 0.12 | 25.25 | 0.2514 | 0.2514 | |||||

| VLO / Valero Energy Corporation | 0.19 | -25.02 | 25.14 | -23.69 | 0.2503 | -0.4701 | |||

| FLS / Flowserve Corporation | 0.48 | 25.09 | 0.5389 | 0.5389 | |||||

| PWR / Quanta Services, Inc. | 0.07 | -48.07 | 24.98 | -22.76 | 0.2488 | -0.4587 | |||

| TOL / Toll Brothers, Inc. | 0.19 | -29.09 | 22.01 | -23.36 | 0.2192 | -0.4090 | |||

| GEV / GE Vernova Inc. | 0.04 | -82.47 | 21.89 | -69.61 | 0.2180 | -1.3575 | |||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.49 | 21.49 | 0.2140 | 0.2140 | |||||

| HIG / The Hartford Insurance Group, Inc. | 0.17 | -29.81 | 20.95 | -28.03 | 0.2086 | -0.4281 | |||

| STZ / Constellation Brands, Inc. | 0.13 | 20.61 | 0.2052 | 0.2052 | |||||

| IDA / IDACORP, Inc. | 0.17 | -3.57 | 19.61 | -4.21 | 0.1953 | -0.2525 | |||

| OGE / OGE Energy Corp. | 0.41 | -8.42 | 18.08 | -11.56 | 0.1800 | -0.2671 | |||

| EXR / Extra Space Storage Inc. | 0.12 | -27.16 | 17.83 | -27.68 | 0.1776 | -0.3617 | |||

| HUM / Humana Inc. | 0.07 | 17.52 | 0.1744 | 0.1744 | |||||

| MTDR / Matador Resources Company | 0.35 | 19.30 | 16.68 | 11.43 | 0.1661 | -0.1613 | |||

| ALLY / Ally Financial Inc. | 0.42 | 20.51 | 16.36 | 28.71 | 0.1629 | -0.1151 | |||

| WTFC / Wintrust Financial Corporation | 0.13 | 13.37 | 16.28 | 24.98 | 0.1621 | -0.1228 | |||

| UMBF / UMB Financial Corporation | 0.15 | 16.52 | 15.98 | 21.20 | 0.1592 | -0.1293 | |||

| RRC / Range Resources Corporation | 0.39 | 18.17 | 15.92 | 20.37 | 0.1585 | -0.1308 | |||

| SBCF / Seacoast Banking Corporation of Florida | 0.57 | 12.05 | 15.78 | 20.27 | 0.1571 | -0.1298 | |||

| PNFP / Pinnacle Financial Partners, Inc. | 0.14 | 18.29 | 15.58 | 23.17 | 0.1551 | -0.1215 | |||

| NVT / nVent Electric plc | 0.21 | -24.21 | 15.36 | 5.90 | 0.1530 | -0.1643 | |||

| CFR / Cullen/Frost Bankers, Inc. | 0.12 | 0.17 | 15.33 | 2.85 | 0.1526 | -0.1733 | |||

| SSB / SouthState Corporation | 0.16 | 11.59 | 15.11 | 10.64 | 0.1505 | -0.1483 | |||

| WCC / WESCO International, Inc. | 0.08 | -5.75 | 15.11 | 12.39 | 0.1504 | -0.1435 | |||

| GBCI / Glacier Bancorp, Inc. | 0.35 | 21.80 | 15.01 | 18.66 | 0.1495 | -0.1272 | |||

| ESI / Element Solutions Inc | 0.66 | 2.34 | 14.84 | 2.52 | 0.1478 | -0.1688 | |||

| HRI / Herc Holdings Inc. | 0.11 | 42.49 | 14.61 | 39.75 | 0.1455 | -0.0832 | |||

| CPT / Camden Property Trust | 0.13 | 7.21 | 14.57 | -1.21 | 0.1451 | -0.1775 | |||

| FNB / F.N.B. Corporation | 1.00 | 10.85 | 14.55 | 20.16 | 0.1449 | -0.1200 | |||

| TKR / The Timken Company | 0.20 | 9.88 | 14.47 | 10.92 | 0.1441 | -0.1412 | |||

| SFBS / ServisFirst Bancshares, Inc. | 0.19 | 9.29 | 14.36 | 2.56 | 0.1430 | -0.1633 | |||

| MSM / MSC Industrial Direct Co., Inc. | 0.17 | 1.35 | 14.36 | 10.94 | 0.1430 | -0.1401 | |||

| ESE / ESCO Technologies Inc. | 0.07 | -4.11 | 14.33 | 15.63 | 0.1427 | -0.1284 | |||

| BDC / Belden Inc. | 0.12 | -5.84 | 14.32 | 8.77 | 0.1426 | -0.1454 | |||

| COLB / Columbia Banking System, Inc. | 0.60 | 25.47 | 14.13 | 17.62 | 0.1407 | -0.1220 | |||

| ADC / Agree Realty Corporation | 0.19 | 15.82 | 13.99 | 9.63 | 0.1394 | -0.1399 | |||

| HLIO / Helios Technologies, Inc. | 0.42 | 19.24 | 13.95 | 24.00 | 0.1389 | -0.1071 | |||

| NBTB / NBT Bancorp Inc. | 0.33 | 2.39 | 13.89 | -0.83 | 0.1383 | -0.1680 | |||

| NNN / NNN REIT, Inc. | 0.32 | -1.20 | 13.86 | 0.03 | 0.1380 | -0.1650 | |||

| PB / Prosperity Bancshares, Inc. | 0.19 | 1.83 | 13.47 | 0.22 | 0.1341 | -0.1599 | |||

| FRME / First Merchants Corporation | 0.35 | 1.41 | 13.24 | -3.95 | 0.1318 | -0.1696 | |||

| SNDR / Schneider National, Inc. | 0.54 | 25.86 | 12.92 | 33.02 | 0.1287 | -0.0838 | |||

| FBIN / Fortune Brands Innovations, Inc. | 0.25 | 7.43 | 12.87 | -9.15 | 0.1282 | -0.1817 | |||

| KWR / Quaker Chemical Corporation | 0.11 | 10.71 | 12.67 | 0.25 | 0.1262 | -0.1503 | |||

| SSD / Simpson Manufacturing Co., Inc. | 0.08 | 22.09 | 12.64 | 20.72 | 0.1258 | -0.1031 | |||

| LFUS / Littelfuse, Inc. | 0.05 | -24.05 | 11.80 | -12.47 | 0.1175 | -0.1773 | |||

| PCH / PotlatchDeltic Corporation | 0.31 | 26.77 | 11.75 | 7.81 | 0.1170 | -0.1214 | |||

| BRX / Brixmor Property Group Inc. | 0.45 | -25.33 | 11.61 | -26.76 | 0.1156 | -0.2312 | |||

| DTM / DT Midstream, Inc. | 0.10 | 11.54 | 0.2479 | 0.2479 | |||||

| VOYA / Voya Financial, Inc. | 0.16 | 33.58 | 11.47 | 39.97 | 0.1142 | -0.0650 | |||

| KLIC / Kulicke and Soffa Industries, Inc. | 0.33 | -14.69 | 11.46 | -10.51 | 0.1142 | -0.1660 | |||

| AEIS / Advanced Energy Industries, Inc. | 0.09 | 11.34 | 0.2435 | 0.2435 | |||||

| POWI / Power Integrations, Inc. | 0.20 | -26.42 | 11.15 | -18.55 | 0.1110 | -0.1883 | |||

| TNC / Tennant Company | 0.14 | 14.97 | 11.07 | 11.71 | 0.1102 | -0.1065 | |||

| SIGI / Selective Insurance Group, Inc. | 0.13 | 10.64 | 11.06 | 4.74 | 0.1101 | -0.1208 | |||

| VMI / Valmont Industries, Inc. | 0.03 | 15.75 | 11.04 | 32.48 | 0.1099 | -0.0723 | |||

| CIGI / Colliers International Group Inc. | 0.08 | 2.88 | 10.97 | 10.72 | 0.1092 | -0.1075 | |||

| LPX / Louisiana-Pacific Corporation | 0.12 | 57.24 | 10.67 | 47.00 | 0.1063 | -0.0525 | |||

| MUSA / Murphy USA Inc. | 0.03 | 10.59 | 0.2274 | 0.2274 | |||||

| KMPR / Kemper Corporation | 0.16 | 3.02 | 10.56 | -0.54 | 0.1051 | -0.1270 | |||

| FAF / First American Financial Corporation | 0.17 | -20.40 | 10.37 | -25.54 | 0.1033 | -0.2014 | |||

| NOV / NOV Inc. | 0.82 | 17.81 | 10.20 | -3.78 | 0.1016 | -0.1303 | |||

| ALV / Autoliv, Inc. | 0.09 | -32.21 | 10.17 | -14.24 | 0.1012 | -0.1580 | |||

| AXS / AXIS Capital Holdings Limited | 0.10 | -22.43 | 10.12 | -19.66 | 0.1007 | -0.1747 | |||

| MTH / Meritage Homes Corporation | 0.15 | 9.99 | 0.2145 | 0.2145 | |||||

| CCOI / Cogent Communications Holdings, Inc. | 0.21 | 44.56 | 9.97 | 13.67 | 0.0993 | -0.0925 | |||

| AVNT / Avient Corporation | 0.30 | -9.60 | 9.75 | -21.40 | 0.0971 | -0.1742 | |||

| REYN / Reynolds Consumer Products Inc. | 0.43 | -21.27 | 9.21 | -29.32 | 0.0917 | -0.1932 | |||

| BRKR / Bruker Corporation | 0.21 | -23.29 | 8.83 | -24.28 | 0.0879 | -0.1671 | |||

| CUBE / CubeSmart | 0.20 | 8.41 | 0.0838 | 0.0838 | |||||

| PWP / Perella Weinberg Partners | 0.43 | 22.69 | 8.32 | 29.51 | 0.0829 | -0.0577 | |||

| BBWI / Bath & Body Works, Inc. | 0.28 | 8.29 | 0.0825 | 0.0825 | |||||

| CON / Concentra Group Holdings Parent, Inc. | 0.39 | 13.72 | 8.06 | 7.79 | 0.0803 | -0.0833 | |||

| LEVI / Levi Strauss & Co. | 0.42 | -11.52 | 7.71 | 4.92 | 0.0768 | -0.0840 | |||

| BWXT / BWX Technologies, Inc. | 0.05 | -46.53 | 7.49 | -21.91 | 0.0746 | -0.1352 | |||

| TXNM / TXNM Energy, Inc. | 0.13 | 7.43 | 0.1595 | 0.1595 | |||||

| ZGN / Ermenegildo Zegna N.V. | 0.87 | -9.20 | 7.40 | 4.92 | 0.0737 | -0.0806 | |||

| MTRN / Materion Corporation | 0.09 | -42.55 | 7.33 | -44.13 | 0.0730 | -0.2139 | |||

| WLY / John Wiley & Sons, Inc. | 0.15 | -18.63 | 6.88 | -18.51 | 0.0685 | -0.1162 | |||

| MTN / Vail Resorts, Inc. | 0.04 | -6.54 | 6.55 | -8.22 | 0.0652 | -0.0909 | |||

| RWT / Redwood Trust, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NUE / Nucor Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CVX / Chevron Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EFX / Equifax Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CDW / CDW Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PCG / PG&E Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PH / Parker-Hannifin Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MDT / Medtronic plc | 0.00 | -100.00 | 0.00 | -100.00 | -0.9249 | ||||

| AJG / Arthur J. Gallagher & Co. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ASH / Ashland Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HII / Huntington Ingalls Industries, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FLO / Flowers Foods, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CHRD / Chord Energy Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WHD / Cactus, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PRG / PROG Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RHI / Robert Half Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| OXM / Oxford Industries, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AME / AMETEK, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PLD / Prologis, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ACN / Accenture plc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PTEN / Patterson-UTI Energy, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MRVL / Marvell Technology, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AEP / American Electric Power Company, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MCK / McKesson Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| STAG / STAG Industrial, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WD / Walker & Dunlop, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BBY / Best Buy Co., Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MSCI / MSCI Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |