Basic Stats

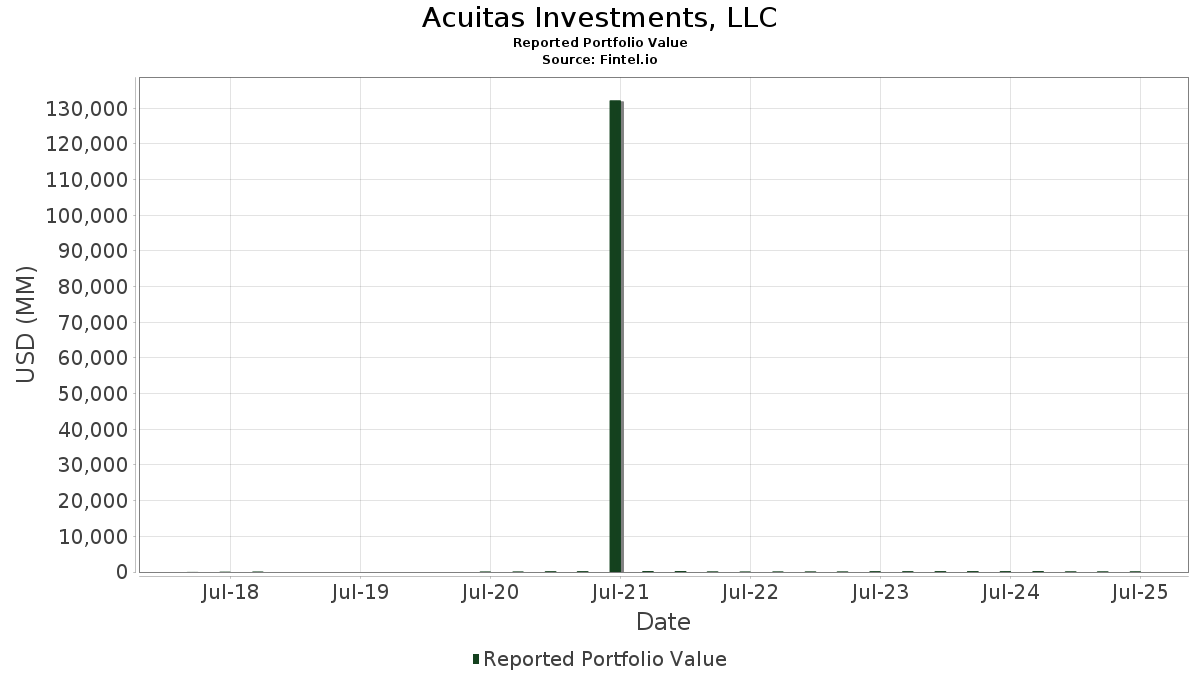

| Portfolio Value | $ 125,667,698 |

| Current Positions | 53 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Acuitas Investments, LLC has disclosed 53 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 125,667,698 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Acuitas Investments, LLC’s top holdings are Solaris Energy Infrastructure, Inc. (US:SEI) , Oportun Financial Corporation (US:OPRT) , Natural Gas Services Group, Inc. (US:NGS) , Great Lakes Dredge & Dock Corporation (US:GLDD) , and HomeStreet, Inc. (US:HMST) . Acuitas Investments, LLC’s new positions include OR Royalties Inc. (US:OR) , Vishay Precision Group, Inc. (US:VPG) , PubMatic, Inc. (US:PUBM) , A-Mark Precious Metals, Inc. (US:AMRK) , and Ituran Location and Control Ltd. (US:ITRN) . Acuitas Investments, LLC’s top industries are "Holding And Other Investment Offices" (sic 67) , "Rubber And Miscellaneous Plastics Products" (sic 30) , and "Miscellaneous Retail " (sic 59) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 2.69 | 2.1367 | 2.1367 | |

| 0.51 | 4.61 | 3.6674 | 1.7007 | |

| 0.36 | 4.78 | 3.8016 | 1.6283 | |

| 0.07 | 2.01 | 1.5955 | 1.5955 | |

| 0.15 | 1.82 | 1.4501 | 1.4501 | |

| 0.40 | 1.44 | 1.1466 | 1.1466 | |

| 0.06 | 1.40 | 1.1125 | 1.1125 | |

| 0.19 | 5.35 | 4.2551 | 1.0791 | |

| 0.42 | 5.16 | 4.1054 | 0.9684 | |

| 0.74 | 5.31 | 4.2244 | 0.8830 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.27 | 1.55 | 1.2329 | -1.3847 | |

| 0.19 | 2.90 | 2.3039 | -1.3732 | |

| 0.11 | 1.92 | 1.5272 | -1.2367 | |

| 0.42 | 3.40 | 2.7030 | -1.1195 | |

| 0.13 | 2.90 | 2.3060 | -0.9816 | |

| 0.42 | 2.60 | 2.0657 | -0.8796 | |

| 0.02 | 2.26 | 1.7999 | -0.6645 | |

| 1.43 | 1.95 | 1.5546 | -0.6112 | |

| 0.11 | 2.82 | 2.2473 | -0.5185 | |

| 0.15 | 1.77 | 1.4083 | -0.3836 |

13D/G Filings

This is a list of 13D and 13G filings made in the last year (if any). Click the link icon to see the full transaction history. Green rows indicate new positions. Red rows indicate closed positions.

| File Date | Form | Security | Prev Shares |

Current Shares |

ΔShares % | % Ownership |

% ΔOwnership | |

|---|---|---|---|---|---|---|---|---|

| 2025-05-02 | RRGB / Red Robin Gourmet Burgers, Inc. | 845,156 | 877,606 | 3.84 | 5.02 | 3.29 | ||

| 2025-05-02 | OESX / Orion Energy Systems, Inc. | 1,715,349 | 1,017,701 | -40.67 | 3.09 | -40.69 | ||

| 2024-11-07 | HURC / Hurco Companies, Inc. | 326,607 | 423,287 | 29.60 | 6.11 | 20.99 | ||

| 2024-11-07 | INFU / InfuSystem Holdings, Inc. | 1,225,151 | 1,029,014 | -16.01 | 4.83 | -16.72 |

13F and Fund Filings

This form was filed on 2025-07-31 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SEI / Solaris Energy Infrastructure, Inc. | 0.19 | 10.33 | 5.35 | 43.47 | 4.2551 | 1.0791 | |||

| OPRT / Oportun Financial Corporation | 0.74 | 3.79 | 5.31 | 35.34 | 4.2244 | 0.8830 | |||

| NGS / Natural Gas Services Group, Inc. | 0.20 | 0.00 | 5.17 | 17.49 | 4.1118 | 0.3645 | |||

| GLDD / Great Lakes Dredge & Dock Corporation | 0.42 | 0.00 | 5.16 | 40.11 | 4.1054 | 0.9684 | |||

| HMST / HomeStreet, Inc. | 0.38 | 0.00 | 5.01 | 11.34 | 3.9865 | 0.1527 | |||

| METC / Ramaco Resources, Inc. | 0.36 | 17.30 | 4.78 | 87.33 | 3.8016 | 1.6283 | |||

| ORN / Orion Group Holdings, Inc. | 0.51 | 15.12 | 4.61 | 99.65 | 3.6674 | 1.7007 | |||

| AOSL / Alpha and Omega Semiconductor Limited | 0.17 | 18.75 | 4.46 | 22.59 | 3.5492 | 0.4490 | |||

| ANGO / AngioDynamics, Inc. | 0.44 | 0.00 | 4.39 | 5.64 | 3.4909 | -0.0470 | |||

| ARHS / Arhaus, Inc. | 0.48 | 0.00 | 4.19 | -0.33 | 3.3369 | -0.2481 | |||

| FTK / Flotek Industries, Inc. | 0.26 | -18.82 | 3.86 | 43.86 | 3.0695 | 0.7849 | |||

| TGB / Taseko Mines Limited | 1.18 | 0.00 | 3.72 | 40.62 | 2.9589 | 0.7061 | |||

| MG / Mistras Group, Inc. | 0.42 | 0.00 | 3.40 | -24.30 | 2.7030 | -1.1195 | |||

| RRGB / Red Robin Gourmet Burgers, Inc. | 0.56 | 0.00 | 3.24 | 62.67 | 2.5802 | 0.8817 | |||

| RDCM / RADCOM Ltd. | 0.22 | -3.34 | 2.93 | 14.93 | 2.3281 | 0.1591 | |||

| PGNY / Progyny, Inc. | 0.13 | -23.74 | 2.90 | -24.91 | 2.3060 | -0.9816 | |||

| INVX / Innovex International, Inc. | 0.19 | -22.87 | 2.90 | -32.91 | 2.3039 | -1.3732 | |||

| HCKT / The Hackett Group, Inc. | 0.11 | 0.00 | 2.82 | -13.00 | 2.2473 | -0.5185 | |||

| INBK / First Internet Bancorp | 0.10 | 0.00 | 2.82 | 0.43 | 2.2440 | -0.1478 | |||

| OR / OR Royalties Inc. | 0.10 | 2.69 | 2.1367 | 2.1367 | |||||

| SBH / Sally Beauty Holdings, Inc. | 0.29 | 0.00 | 2.65 | 2.55 | 2.1117 | -0.0930 | |||

| HZO / MarineMax, Inc. | 0.11 | 25.63 | 2.65 | 46.92 | 2.1062 | 0.5712 | |||

| HLX / Helix Energy Solutions Group, Inc. | 0.42 | 0.00 | 2.60 | -24.93 | 2.0657 | -0.8796 | |||

| UROY / Uranium Royalty Corp. | 1.01 | 0.00 | 2.53 | 42.09 | 2.0152 | 0.4963 | |||

| YTRA / Yatra Online, Inc. | 2.42 | 0.00 | 2.36 | 25.11 | 1.8757 | 0.2700 | |||

| URG / Ur-Energy Inc. | 2.24 | 9.94 | 2.35 | 71.33 | 1.8695 | 0.7007 | |||

| LGND / Ligand Pharmaceuticals Incorporated | 0.02 | -27.68 | 2.26 | -21.82 | 1.7999 | -0.6645 | |||

| VPG / Vishay Precision Group, Inc. | 0.07 | 2.01 | 1.5955 | 1.5955 | |||||

| CRAI / CRA International, Inc. | 0.01 | 0.00 | 1.99 | 8.23 | 1.5805 | 0.0163 | |||

| ARAY / Accuray Incorporated | 1.43 | 0.41 | 1.95 | -23.17 | 1.5546 | -0.6112 | |||

| TRC / Tejon Ranch Co. | 0.11 | -44.71 | 1.92 | -40.84 | 1.5272 | -1.2367 | |||

| PUBM / PubMatic, Inc. | 0.15 | 1.82 | 1.4501 | 1.4501 | |||||

| SILC / Silicom Ltd. | 0.11 | -0.42 | 1.78 | 4.91 | 1.4129 | -0.0288 | |||

| RNGR / Ranger Energy Services, Inc. | 0.15 | 0.00 | 1.77 | -15.88 | 1.4083 | -0.3836 | |||

| CTLP / Cantaloupe, Inc. | 0.16 | 0.00 | 1.75 | 39.68 | 1.3900 | 0.3243 | |||

| TLS / Telos Corporation | 0.52 | 14.33 | 1.65 | 52.26 | 1.3153 | 0.3905 | |||

| EQX / Equinox Gold Corp. | 0.27 | -39.66 | 1.55 | -49.58 | 1.2329 | -1.3847 | |||

| METCB / Ramaco Resources, Inc. | 0.18 | 20.39 | 1.48 | 38.59 | 1.1746 | 0.2666 | |||

| KRMD / KORU Medical Systems, Inc. | 0.40 | 1.44 | 1.1466 | 1.1466 | |||||

| AMRK / A-Mark Precious Metals, Inc. | 0.06 | 1.40 | 1.1125 | 1.1125 | |||||

| AIP / Arteris, Inc. | 0.09 | 0.86 | 0.6825 | 0.6825 | |||||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | 0.80 | 0.6353 | 0.6353 | |||||

| TTGT / TechTarget, Inc. | 0.10 | 68.52 | 0.78 | -11.50 | 0.6183 | -0.1304 | |||

| AVNW / Aviat Networks, Inc. | 0.03 | 0.00 | 0.76 | 25.37 | 0.6062 | 0.0889 | |||

| VTMX / Corporación Inmobiliaria Vesta, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 0.75 | 20.16 | 0.5928 | 0.0642 | |||

| ITRN / Ituran Location and Control Ltd. | 0.01 | 0.58 | 0.4623 | 0.4623 | |||||

| ALLT / Allot Ltd. | 0.07 | 0.56 | 0.4443 | 0.4443 | |||||

| VLRS / Controladora Vuela Compañía de Aviación, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.08 | 0.00 | 0.38 | -8.94 | 0.3001 | -0.0530 | |||

| HBIO / Harvard Bioscience, Inc. | 0.49 | 0.00 | 0.22 | -21.66 | 0.1734 | -0.0634 | |||

| YEXT / Yext, Inc. | 0.02 | 0.17 | 0.1346 | 0.1346 | |||||

| MCHX / Marchex, Inc. | 0.06 | 0.14 | 0.1123 | 0.1123 | |||||

| EWZ / iShares, Inc. - iShares MSCI Brazil ETF | 0.00 | 0.09 | 0.0689 | 0.0689 | |||||

| SBSW / Sibanye Stillwater Limited - Depositary Receipt (Common Stock) | 0.00 | 0.02 | 0.0172 | 0.0172 | |||||

| CTKB / Cytek Biosciences, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ERO / Ero Copper Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KRNT / Kornit Digital Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AXTA / Axalta Coating Systems Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XOMA / XOMA Royalty Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| THRY / Thryv Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BTG / B2Gold Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SEE / Sealed Air Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LW / Lamb Weston Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| OR / OR Royalties Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ODD / Oddity Tech Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FORR / Forrester Research, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TRUE / TrueCar, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KSPI / Joint Stock Company Kaspi.kz - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DNN / Denison Mines Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CCJ / Cameco Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CAPR / Capricor Therapeutics, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1741 | ||||

| VIK / Viking Holdings Ltd | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| APLD / Applied Digital Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| OESX / Orion Energy Systems, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CLS / Celestica Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GFL / GFL Environmental Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FTI / TechnipFMC plc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TAP / Molson Coors Beverage Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BWA / BorgWarner Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MGTX / MeiraGTx Holdings plc | 0.00 | -100.00 | 0.00 | 0.0000 |