Basic Stats

| Portfolio Value | $ 449,709,000 |

| Current Positions | 22 |

Latest Holdings, Performance, AUM (from 13F, 13D)

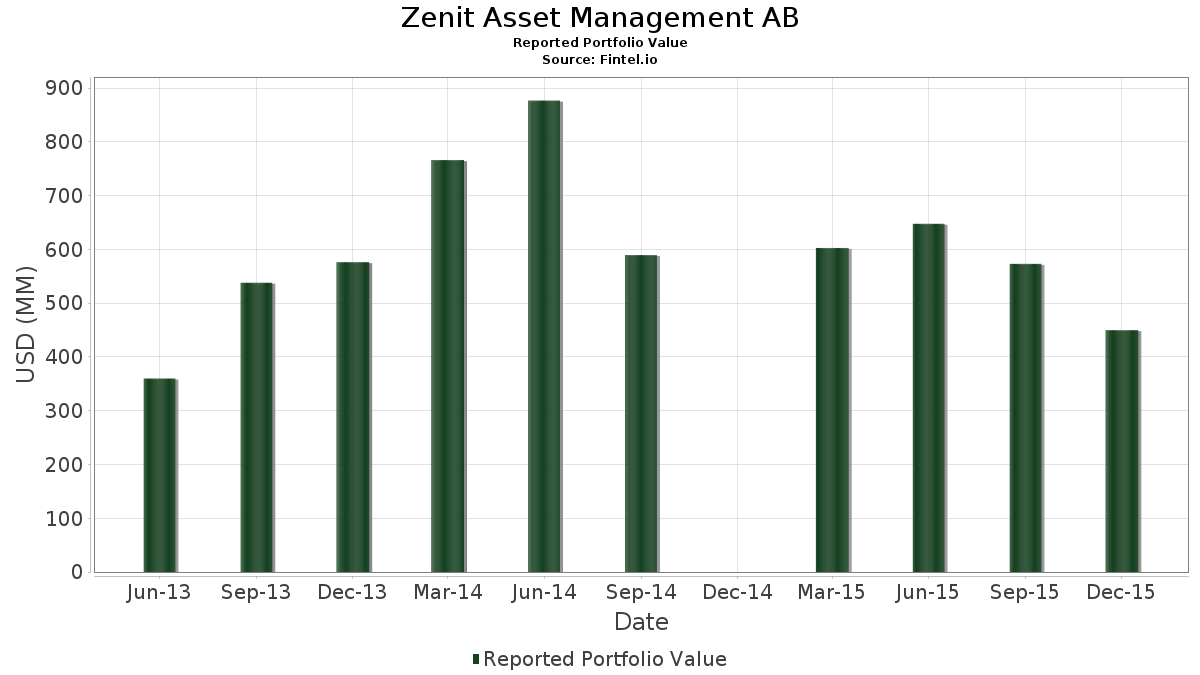

Zenit Asset Management AB has disclosed 22 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 449,709,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Zenit Asset Management AB’s top holdings are Altaba Inc (US:AABA) , Navient Corporation (US:NAVI) , Alibaba Group Holding Limited - Depositary Receipt (Common Stock) (US:BABA) , The Walt Disney Company (US:DIS) , and Zynga Inc - Class A (US:ZNGA) . Zenit Asset Management AB’s new positions include Synchrony Financial (US:SYF) , Hewlett Packard Enterprise Company (US:HPE) , Summit Materials, Inc. (US:SUM) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.31 | 33.24 | 7.3919 | 7.3919 | |

| 3.41 | 114.03 | 25.3571 | 3.1088 | |

| 0.45 | 13.63 | 3.0302 | 3.0302 | |

| 4.00 | 45.35 | 10.0847 | 2.9647 | |

| 0.85 | 12.93 | 2.8752 | 2.8752 | |

| 0.23 | 10.20 | 2.2686 | 2.2686 | |

| 0.39 | 23.37 | 5.1974 | 1.9397 | |

| 9.00 | 24.12 | 5.3635 | 1.7827 | |

| 0.30 | 6.11 | 1.3580 | 1.3580 | |

| 0.16 | 4.44 | 0.9864 | 0.9864 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -3.8782 | ||

| 0.00 | 0.00 | -3.6016 | ||

| 0.00 | 0.00 | -2.8397 | ||

| 0.02 | 15.28 | 3.3966 | -2.5995 | |

| 0.00 | 0.00 | -2.0947 | ||

| 0.00 | 0.00 | -1.8197 | ||

| 0.00 | 0.00 | -1.7888 | ||

| 0.50 | 40.63 | 9.0358 | -1.3558 | |

| 0.05 | 5.72 | 1.2713 | -1.2712 | |

| 0.66 | 13.40 | 2.9795 | -1.1662 |

13F and Fund Filings

This form was filed on 2016-02-16 for the reporting period 2015-12-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AABA / Altaba Inc | 3.41 | -22.81 | 114.03 | -10.56 | 25.3571 | 3.1088 | |||

| NAVI / Navient Corporation | 4.00 | 12.97 | 45.35 | 11.15 | 10.0847 | 2.9647 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.50 | -50.00 | 40.63 | -31.76 | 9.0358 | -1.3558 | |||

| DIS / The Walt Disney Company | 0.31 | 94.77 | 33.24 | 80.50 | 7.3919 | 7.3919 | |||

| ZNGA / Zynga Inc - Class A | 9.00 | 0.00 | 24.12 | 17.54 | 5.3635 | 1.7827 | |||

| WDC / Western Digital Corporation | 0.39 | 65.19 | 23.37 | 25.20 | 5.1974 | 1.9397 | |||

| SC / Santander Consumer USA Holdings Inc | 1.46 | -13.42 | 23.17 | -32.18 | 5.1527 | -0.8094 | |||

| DFS / Discover Financial Services | 0.32 | -34.10 | 17.55 | -31.31 | 3.9019 | -0.5558 | |||

| GOOG / Alphabet Inc. | 0.02 | -64.79 | 15.28 | -55.55 | 3.3966 | -2.5995 | |||

| BAC / Bank of America Corporation | 0.86 | -39.36 | 14.55 | -33.51 | 3.2365 | -0.5837 | |||

| SYF / Synchrony Financial | 0.45 | 13.63 | 3.0302 | 3.0302 | |||||

| FITB / Fifth Third Bancorp | 0.66 | -47.11 | 13.40 | -43.60 | 2.9795 | -1.1662 | |||

| HPE / Hewlett Packard Enterprise Company | 0.85 | 12.93 | 2.8752 | 2.8752 | |||||

| LPG / Dorian LPG Ltd. | 0.95 | -17.08 | 11.13 | -5.31 | 2.4758 | 0.4240 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.23 | 0.00 | 10.20 | 2.2686 | 2.2686 | ||||

| CFG / Citizens Financial Group, Inc. | 0.29 | 0.63 | 7.53 | 11.94 | 1.6735 | 0.5003 | |||

| SUM / Summit Materials, Inc. | 0.30 | 6.11 | 1.3580 | 1.3580 | |||||

| MELI / MercadoLibre, Inc. | 0.05 | -69.14 | 5.72 | -60.76 | 1.2713 | -1.2712 | |||

| US456837AE31 / ING Groep N.V. 6% Perpetual Bond | 5.00 | 0.00 | 5.02 | 3.19 | 1.1161 | 0.2673 | |||

| MTG / MGIC Investment Corporation | 0.54 | -54.68 | 4.72 | -57.33 | 1.0505 | -0.8816 | |||

| EBAY / eBay Inc. | 0.16 | 4.44 | 0.9864 | 0.9864 | |||||

| 23335SAB2 / DHT Holdings, Inc. Bond | 3.00 | 3.58 | 0.7970 | 0.7970 | |||||

| BKNG / Booking Holdings Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.5336 | ||||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| SBLK / Star Bulk Carriers Corp. | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| AAPL / Apple Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.0947 | ||||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| KANG / iKang Healthcare Group, Inc. | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| C / Citigroup Inc. | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| STLD / Steel Dynamics, Inc. | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| HOLI / Hollysys Automation Technologies Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1142 | ||||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| SFL / SFL Corporation Ltd. | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| MBLY / Mobileye Global Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.8397 | ||||

| SPY / SPDR S&P 500 ETF | 0.00 | -100.00 | 0.00 | -100.00 | -1.8197 | ||||

| HD / The Home Depot, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.7888 | ||||

| KING / King Digital Entertainment plc | 0.00 | -100.00 | 0.00 | -100.00 | -3.8782 | ||||

| EWZ / iShares, Inc. - iShares MSCI Brazil ETF | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| SNI / Scripps Networks Interactive, Inc. | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| CMCSA / Comcast Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.9238 | ||||

| T / AT&T Inc. | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| X / United States Steel Corporation | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| HPQ / HP Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.6016 | ||||

| SNDK / Sandisk Corporation | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| NETI / Eneti Inc. | 0.00 | 0.00 | 0.0000 | 0.0000 |