Basic Stats

| Portfolio Value | $ 331,291,813 |

| Current Positions | 141 |

Latest Holdings, Performance, AUM (from 13F, 13D)

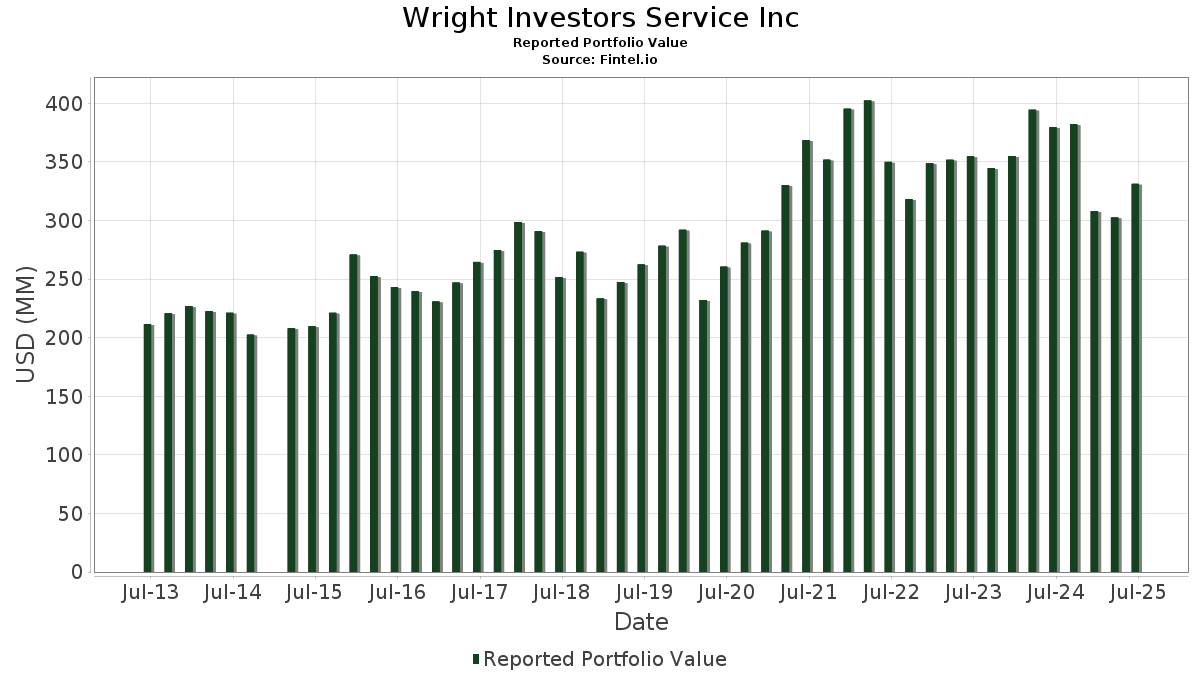

Wright Investors Service Inc has disclosed 141 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 331,291,813 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Wright Investors Service Inc’s top holdings are Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Meta Platforms, Inc. (US:META) , Apple Inc. (US:AAPL) , and Amazon.com, Inc. (US:AMZN) . Wright Investors Service Inc’s new positions include BJ's Wholesale Club Holdings, Inc. (US:BJ) , Palantir Technologies Inc. (US:PLTR) , MasTec, Inc. (US:MTZ) , Aptiv PLC (US:APTV) , and Maplebear Inc. (US:CART) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 19.70 | 5.9467 | 0.9030 | |

| 0.04 | 7.28 | 2.1979 | 0.6606 | |

| 0.01 | 1.83 | 0.5528 | 0.5528 | |

| 0.12 | 3.56 | 1.0732 | 0.5525 | |

| 0.03 | 3.18 | 0.7206 | 0.4612 | |

| 0.00 | 1.65 | 0.3740 | 0.3740 | |

| 0.02 | 1.62 | 0.3674 | 0.3674 | |

| 0.00 | 1.40 | 0.3176 | 0.3176 | |

| 0.01 | 0.83 | 0.2517 | 0.2517 | |

| 0.01 | 0.82 | 0.2481 | 0.2481 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 3.67 | 0.8325 | -1.8204 | |

| 0.07 | 13.50 | 4.0756 | -1.2957 | |

| 0.02 | 3.65 | 0.8282 | -1.2782 | |

| 0.00 | 1.17 | 0.3532 | -0.9588 | |

| 0.02 | 6.71 | 1.5234 | -0.8819 | |

| 0.09 | 4.16 | 0.9435 | -0.8591 | |

| 0.03 | 9.04 | 2.0522 | -0.8244 | |

| 0.01 | 4.92 | 1.1172 | -0.6622 | |

| 0.09 | 6.70 | 1.5204 | -0.6126 | |

| 0.05 | 5.65 | 1.2817 | -0.5948 |

13F and Fund Filings

This form was filed on 2025-07-11 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.04 | -2.56 | 19.70 | 29.11 | 5.9467 | 0.9030 | |||

| NVDA / NVIDIA Corporation | 0.11 | 3.05 | 17.76 | 50.24 | 4.0297 | 0.1223 | |||

| META / Meta Platforms, Inc. | 0.02 | -3.39 | 14.69 | 23.72 | 3.3328 | -0.5914 | |||

| AAPL / Apple Inc. | 0.07 | -10.04 | 13.50 | -16.91 | 4.0756 | -1.2957 | |||

| AMZN / Amazon.com, Inc. | 0.06 | -2.72 | 12.17 | 12.18 | 3.6736 | 0.0874 | |||

| AVGO / Broadcom Inc. | 0.04 | -3.45 | 11.02 | 58.95 | 2.5008 | 0.2091 | |||

| PGR / The Progressive Corporation | 0.03 | 10.21 | 9.04 | 3.92 | 2.0522 | -0.8244 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | 0.17 | 8.33 | 18.39 | 1.8907 | -0.4357 | |||

| GOOGL / Alphabet Inc. | 0.04 | 37.38 | 7.28 | 56.58 | 2.1979 | 0.6606 | |||

| AXP / American Express Company | 0.02 | -0.86 | 7.21 | 17.55 | 2.1776 | 0.1488 | |||

| V / Visa Inc. | 0.02 | -8.93 | 6.71 | -7.74 | 1.5234 | -0.8819 | |||

| KO / The Coca-Cola Company | 0.09 | 5.11 | 6.70 | 3.84 | 1.5204 | -0.6126 | |||

| GILD / Gilead Sciences, Inc. | 0.05 | 0.56 | 5.65 | -0.51 | 1.2817 | -0.5948 | |||

| CAT / Caterpillar Inc. | 0.01 | -12.76 | 5.43 | 2.69 | 1.2320 | -0.5157 | |||

| XOM / Exxon Mobil Corporation | 0.05 | 7.70 | 5.28 | -2.37 | 1.1984 | -0.5898 | |||

| HD / The Home Depot, Inc. | 0.01 | -8.58 | 4.92 | -8.55 | 1.1172 | -0.6622 | |||

| BAC / Bank of America Corporation | 0.10 | 0.17 | 4.59 | 13.60 | 1.0408 | -0.2939 | |||

| NRG / NRG Energy, Inc. | 0.03 | -14.20 | 4.45 | 44.33 | 1.0108 | -0.0093 | |||

| TSLA / Tesla, Inc. | 0.01 | 8.51 | 4.39 | 33.04 | 1.3248 | 0.2341 | |||

| CI / The Cigna Group | 0.01 | 19.04 | 4.22 | 19.61 | 0.9578 | -0.2087 | |||

| BMY / Bristol-Myers Squibb Company | 0.09 | 0.46 | 4.16 | -23.77 | 0.9435 | -0.8591 | |||

| NFLX / Netflix, Inc. | 0.00 | -3.99 | 4.16 | 37.90 | 0.9429 | -0.0533 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 50.55 | 3.97 | -10.33 | 0.9005 | -0.5623 | |||

| ORCL / Oracle Corporation | 0.02 | -42.79 | 3.78 | -10.54 | 0.8572 | -0.5386 | |||

| CMCSA / Comcast Corporation | 0.10 | 12.37 | 3.69 | 8.69 | 1.1137 | -0.0085 | |||

| ABBV / AbbVie Inc. | 0.02 | -48.40 | 3.67 | -54.29 | 0.8325 | -1.8204 | |||

| GOOG / Alphabet Inc. | 0.02 | -49.56 | 3.65 | -42.73 | 0.8282 | -1.2782 | |||

| T / AT&T Inc. | 0.12 | 120.55 | 3.56 | 125.71 | 1.0732 | 0.5525 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 0.49 | 3.35 | 30.21 | 0.7600 | -0.0904 | |||

| HWM / Howmet Aerospace Inc. | 0.02 | -1.99 | 3.31 | 40.60 | 0.7522 | -0.0270 | |||

| AMAT / Applied Materials, Inc. | 0.02 | -32.59 | 3.23 | -14.97 | 0.7324 | -0.5221 | |||

| CSCO / Cisco Systems, Inc. | 0.05 | 0.45 | 3.20 | 12.95 | 0.7266 | -0.2106 | |||

| ANET / Arista Networks Inc | 0.03 | 206.54 | 3.18 | 304.97 | 0.7206 | 0.4612 | |||

| COST / Costco Wholesale Corporation | 0.00 | 33.80 | 3.13 | 40.10 | 0.7096 | -0.0285 | |||

| NEE / NextEra Energy, Inc. | 0.04 | 8.84 | 2.77 | 6.58 | 0.6290 | -0.2307 | |||

| SYF / Synchrony Financial | 0.04 | 8.09 | 2.74 | 36.32 | 0.6209 | -0.0428 | |||

| IBM / International Business Machines Corporation | 0.01 | 1.67 | 2.67 | 20.53 | 0.6061 | -0.1264 | |||

| CB / Chubb Limited | 0.01 | 0.28 | 2.46 | -3.79 | 0.7429 | -0.1027 | |||

| VICI / VICI Properties Inc. | 0.07 | 0.44 | 2.43 | 0.41 | 0.5512 | -0.2487 | |||

| WFC / Wells Fargo & Company | 0.03 | 41.30 | 2.21 | 57.73 | 0.5004 | 0.0382 | |||

| TJX / The TJX Companies, Inc. | 0.02 | -1.94 | 2.06 | -0.58 | 0.6228 | -0.0632 | |||

| BLK / BlackRock, Inc. | 0.00 | 1.35 | 2.04 | 12.33 | 0.4633 | -0.1374 | |||

| LLY / Eli Lilly and Company | 0.00 | -4.03 | 2.01 | -9.39 | 0.6059 | -0.1266 | |||

| OHI / Omega Healthcare Investors, Inc. | 0.05 | 53.85 | 1.90 | 48.05 | 0.5741 | 0.1495 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.03 | 105.33 | 1.88 | 88.40 | 0.4277 | 0.0971 | |||

| BA / The Boeing Company | 0.01 | 1.83 | 0.5528 | 0.5528 | |||||

| AMGN / Amgen Inc. | 0.01 | -1.98 | 1.80 | -12.16 | 0.4083 | -0.2687 | |||

| PHM / PulteGroup, Inc. | 0.02 | -0.21 | 1.80 | 2.34 | 0.5421 | -0.0378 | |||

| ADBE / Adobe Inc. | 0.00 | -2.49 | 1.79 | -1.65 | 0.4061 | -0.1953 | |||

| CBRE / CBRE Group, Inc. | 0.01 | -0.17 | 1.79 | 6.95 | 0.4052 | -0.1467 | |||

| KR / The Kroger Co. | 0.02 | 0.47 | 1.78 | 6.51 | 0.4046 | -0.1490 | |||

| EBAY / eBay Inc. | 0.02 | 0.14 | 1.76 | 10.09 | 0.3986 | -0.1288 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 14.22 | 1.72 | 4.19 | 0.3897 | -0.1552 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | 1.65 | 0.3740 | 0.3740 | |||||

| PM / Philip Morris International Inc. | 0.01 | 3.09 | 1.64 | 18.25 | 0.3720 | -0.0861 | |||

| SCHW / The Charles Schwab Corporation | 0.02 | 1.62 | 0.3674 | 0.3674 | |||||

| C / Citigroup Inc. | 0.02 | -19.72 | 1.57 | -3.74 | 0.3567 | -0.1831 | |||

| UBER / Uber Technologies, Inc. | 0.02 | 38.55 | 1.53 | 77.34 | 0.3483 | 0.0623 | |||

| JBL / Jabil Inc. | 0.01 | 126.43 | 1.50 | 263.29 | 0.3413 | 0.2043 | |||

| RTX / RTX Corporation | 0.01 | 0.47 | 1.46 | 10.69 | 0.3315 | -0.1045 | |||

| DAL / Delta Air Lines, Inc. | 0.03 | -35.46 | 1.40 | -27.18 | 0.3186 | -0.3189 | |||

| ACN / Accenture plc | 0.00 | 1.40 | 0.3176 | 0.3176 | |||||

| UGI / UGI Corporation | 0.04 | -2.29 | 1.32 | 7.61 | 0.2985 | -0.1056 | |||

| HHH / Howard Hughes Holdings Inc. | 0.02 | 0.48 | 1.28 | -8.42 | 0.2914 | -0.1722 | |||

| ZM / Zoom Communications Inc. | 0.02 | 0.48 | 1.23 | 6.21 | 0.2795 | -0.1038 | |||

| EOG / EOG Resources, Inc. | 0.01 | 15.82 | 1.22 | 8.05 | 0.2772 | -0.0966 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | -45.09 | 1.22 | -43.07 | 0.3672 | -0.3391 | |||

| CL / Colgate-Palmolive Company | 0.01 | -40.86 | 1.20 | -42.66 | 0.3621 | -0.3291 | |||

| AMP / Ameriprise Financial, Inc. | 0.00 | -26.94 | 1.18 | -19.49 | 0.2673 | -0.2161 | |||

| AMT / American Tower Corporation | 0.01 | -4.14 | 1.18 | -2.65 | 0.2669 | -0.1324 | |||

| CRM / Salesforce, Inc. | 0.00 | -70.99 | 1.17 | -70.52 | 0.3532 | -0.9588 | |||

| NOW / ServiceNow, Inc. | 0.00 | -3.95 | 1.15 | 24.08 | 0.2608 | -0.0455 | |||

| MRK / Merck & Co., Inc. | 0.01 | 43.97 | 1.13 | 27.06 | 0.3402 | 0.0468 | |||

| APP / AppLovin Corporation | 0.00 | -4.11 | 1.12 | 26.76 | 0.2538 | -0.0380 | |||

| USFD / US Foods Holding Corp. | 0.01 | -1.85 | 1.10 | 15.51 | 0.2501 | -0.0654 | |||

| CVX / Chevron Corporation | 0.01 | 1.57 | 1.04 | -13.05 | 0.2359 | -0.1593 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.47 | 1.02 | 74.14 | 0.3071 | 0.1140 | |||

| FCX / Freeport-McMoRan Inc. | 0.02 | 56.47 | 1.01 | 79.22 | 0.3047 | 0.1185 | |||

| CHTR / Charter Communications, Inc. | 0.00 | 86.52 | 0.98 | 107.16 | 0.2234 | 0.0661 | |||

| EXPE / Expedia Group, Inc. | 0.01 | -4.01 | 0.97 | -3.67 | 0.2207 | -0.1131 | |||

| ABT / Abbott Laboratories | 0.01 | 0.47 | 0.96 | 2.99 | 0.2190 | -0.0907 | |||

| MGM / MGM Resorts International | 0.03 | 0.48 | 0.92 | 16.58 | 0.2090 | -0.0521 | |||

| VZ / Verizon Communications Inc. | 0.02 | 1.16 | 0.92 | -3.57 | 0.2087 | -0.1063 | |||

| HON / Honeywell International Inc. | 0.00 | -0.15 | 0.92 | 9.82 | 0.2081 | -0.0680 | |||

| ACGL / Arch Capital Group Ltd. | 0.01 | 0.47 | 0.90 | -4.95 | 0.2049 | -0.1089 | |||

| VRT / Vertiv Holdings Co | 0.01 | -4.01 | 0.90 | 70.86 | 0.2710 | 0.0972 | |||

| COP / ConocoPhillips | 0.01 | -0.28 | 0.85 | -14.73 | 0.2569 | -0.0733 | |||

| MET / MetLife, Inc. | 0.01 | -36.77 | 0.85 | -36.67 | 0.1925 | -0.2503 | |||

| DIS / The Walt Disney Company | 0.01 | -21.61 | 0.84 | -1.42 | 0.2524 | -0.0282 | |||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.01 | 0.83 | 0.2517 | 0.2517 | |||||

| PLTR / Palantir Technologies Inc. | 0.01 | 0.82 | 0.2481 | 0.2481 | |||||

| PYPL / PayPal Holdings, Inc. | 0.01 | 0.47 | 0.80 | 14.57 | 0.1820 | -0.0497 | |||

| UPS / United Parcel Service, Inc. | 0.01 | 1.34 | 0.79 | -7.03 | 0.1801 | -0.1020 | |||

| ADT / ADT Inc. | 0.09 | 25.76 | 0.76 | 31.02 | 0.1716 | -0.0194 | |||

| CACI / CACI International Inc | 0.00 | 0.74 | 0.1670 | 0.1670 | |||||

| MTZ / MasTec, Inc. | 0.00 | 0.71 | 0.2152 | 0.2152 | |||||

| STLD / Steel Dynamics, Inc. | 0.01 | -0.09 | 0.69 | 2.22 | 0.1571 | -0.0667 | |||

| NXPI / NXP Semiconductors N.V. | 0.00 | 0.85 | 0.67 | 15.89 | 0.1524 | -0.0391 | |||

| TKO / TKO Group Holdings, Inc. | 0.00 | -49.52 | 0.66 | -39.96 | 0.1488 | -0.2118 | |||

| MCHP / Microchip Technology Incorporated | 0.01 | 0.46 | 0.61 | 46.30 | 0.1392 | 0.0003 | |||

| PFE / Pfizer Inc. | 0.02 | 0.49 | 0.59 | -3.89 | 0.1346 | -0.0694 | |||

| VLO / Valero Energy Corporation | 0.00 | 1.15 | 0.59 | 2.96 | 0.1345 | -0.0558 | |||

| HST / Host Hotels & Resorts, Inc. | 0.04 | 0.48 | 0.58 | 8.60 | 0.1319 | -0.0450 | |||

| FOXA / Fox Corporation | 0.01 | 0.50 | 0.57 | -0.53 | 0.1707 | -0.0172 | |||

| CRH / CRH plc | 0.01 | -43.57 | 0.56 | -41.13 | 0.1281 | -0.1888 | |||

| EME / EMCOR Group, Inc. | 0.00 | 1.06 | 0.56 | 46.46 | 0.1267 | 0.0005 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | 2.96 | 0.56 | 9.20 | 0.1267 | -0.0423 | |||

| APTV / Aptiv PLC | 0.01 | 0.55 | 0.1653 | 0.1653 | |||||

| OXY / Occidental Petroleum Corporation | 0.01 | 0.48 | 0.55 | -14.53 | 0.1242 | -0.0874 | |||

| GEN / Gen Digital Inc. | 0.02 | 0.48 | 0.54 | 11.39 | 0.1221 | -0.0377 | |||

| MS / Morgan Stanley | 0.00 | 4.27 | 0.54 | 25.82 | 0.1218 | -0.0191 | |||

| CSX / CSX Corporation | 0.02 | 0.37 | 0.53 | 11.30 | 0.1208 | -0.0373 | |||

| HPE / Hewlett Packard Enterprise Company | 0.03 | 0.47 | 0.53 | 33.00 | 0.1200 | -0.0113 | |||

| OKE / ONEOK, Inc. | 0.01 | 2.88 | 0.52 | -15.40 | 0.1186 | -0.0855 | |||

| CNC / Centene Corporation | 0.01 | 0.47 | 0.52 | -10.21 | 0.1178 | -0.0732 | |||

| BEN / Franklin Resources, Inc. | 0.02 | 3.48 | 0.50 | 28.21 | 0.1135 | -0.0154 | |||

| FTNT / Fortinet, Inc. | 0.00 | 0.49 | 0.1120 | 0.1120 | |||||

| TMUS / T-Mobile US, Inc. | 0.00 | 0.49 | 0.49 | -10.28 | 0.1112 | -0.0692 | |||

| CART / Maplebear Inc. | 0.01 | 0.49 | 0.1466 | 0.1466 | |||||

| SLGN / Silgan Holdings Inc. | 0.01 | -4.10 | 0.48 | 1.69 | 0.1090 | -0.0472 | |||

| DUK / Duke Energy Corporation | 0.00 | 3.10 | 0.47 | -0.21 | 0.1070 | -0.0493 | |||

| TFC / Truist Financial Corporation | 0.01 | 3.40 | 0.47 | 8.03 | 0.1070 | -0.0373 | |||

| EMR / Emerson Electric Co. | 0.00 | -50.41 | 0.47 | -39.74 | 0.1069 | -0.1513 | |||

| CHRW / C.H. Robinson Worldwide, Inc. | 0.00 | 0.47 | 0.1410 | 0.1410 | |||||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.02 | 2.67 | 0.47 | -8.97 | 0.1410 | -0.0288 | |||

| G / Genpact Limited | 0.01 | 0.46 | 0.1380 | 0.1380 | |||||

| TD / The Toronto-Dominion Bank | 0.01 | 3.06 | 0.43 | 26.33 | 0.0971 | -0.0149 | |||

| CAG / Conagra Brands, Inc. | 0.02 | 0.42 | 0.1266 | 0.1266 | |||||

| ETN / Eaton Corporation plc | 0.00 | -4.00 | 0.39 | 25.96 | 0.0894 | -0.0139 | |||

| BKR / Baker Hughes Company | 0.01 | 0.48 | 0.38 | -12.41 | 0.0866 | -0.0573 | |||

| VST / Vistra Corp. | 0.00 | 0.36 | 0.0815 | 0.0815 | |||||

| BLDR / Builders FirstSource, Inc. | 0.00 | -54.38 | 0.35 | -57.39 | 0.0793 | -0.1917 | |||

| COKE / Coca-Cola Consolidated, Inc. | 0.00 | 812.57 | 0.35 | -24.51 | 0.0791 | -0.0735 | |||

| IP / International Paper Company | 0.01 | 2.86 | 0.34 | -9.63 | 0.0768 | -0.0471 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 2.53 | 0.30 | 6.38 | 0.0682 | -0.0253 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | 2.13 | 0.29 | -7.35 | 0.0876 | -0.0160 | |||

| TNL / Travel + Leisure Co. | 0.00 | -8.43 | 0.25 | 2.02 | 0.0576 | -0.0246 | |||

| USB / U.S. Bancorp | 0.01 | 3.24 | 0.25 | 10.53 | 0.0573 | -0.0181 | |||

| PAYX / Paychex, Inc. | 0.00 | 2.40 | 0.24 | -3.60 | 0.0548 | -0.0279 | |||

| TGT / Target Corporation | 0.00 | 3.93 | 0.22 | -1.75 | 0.0509 | -0.0246 | |||

| DLR / Digital Realty Trust, Inc. | 0.00 | -66.92 | 0.21 | -59.77 | 0.0486 | -0.1273 | |||

| LKQ / LKQ Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PPC / Pilgrim's Pride Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SLB / Schlumberger Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WMS / Advanced Drainage Systems, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| FDX / FedEx Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AMD / Advanced Micro Devices, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| COR / Cencora, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XPRO / Expro Group Holdings N.V. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SGI / Somnigroup International Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PH / Parker-Hannifin Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HLN / Haleon plc - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AMH / American Homes 4 Rent | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LEN / Lennar Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |