Basic Stats

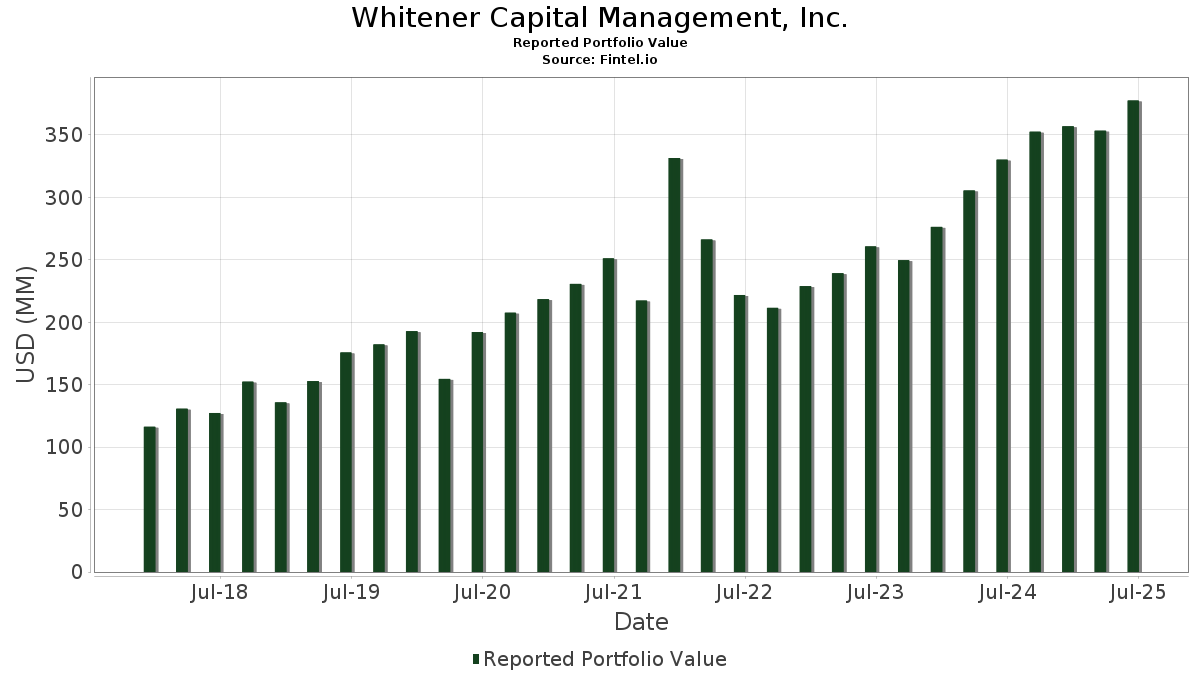

| Portfolio Value | $ 377,548,894 |

| Current Positions | 155 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Whitener Capital Management, Inc. has disclosed 155 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 377,548,894 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Whitener Capital Management, Inc.’s top holdings are JPMorgan Chase & Co. (US:JPM) , Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , and Walmart Inc. (US:WMT) . Whitener Capital Management, Inc.’s new positions include Barrick Mining Corporation (US:B) , General Electric Company (US:GE) , iShares, Inc. - iShares MSCI Global Gold Miners ETF (US:RING) , Marvell Technology, Inc. (US:MRVL) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.12 | 19.38 | 5.1336 | 1.3497 | |

| 0.04 | 20.51 | 5.4325 | 0.9547 | |

| 0.08 | 22.71 | 6.0152 | 0.4971 | |

| 0.07 | 1.43 | 0.3798 | 0.3798 | |

| 0.01 | 8.62 | 2.2821 | 0.3577 | |

| 0.08 | 17.04 | 4.5139 | 0.2818 | |

| 0.01 | 3.73 | 0.9867 | 0.2183 | |

| 0.01 | 4.95 | 1.3105 | 0.2170 | |

| 0.10 | 16.77 | 4.4426 | 0.2043 | |

| 0.19 | 18.54 | 4.9105 | 0.1365 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 20.91 | 5.5382 | -1.0654 | |

| 0.05 | 6.02 | 1.5938 | -0.3800 | |

| 0.04 | 7.22 | 1.9111 | -0.3642 | |

| 0.03 | 8.96 | 2.3744 | -0.3105 | |

| 0.01 | 5.73 | 1.5177 | -0.2583 | |

| 0.02 | 3.32 | 0.8786 | -0.2117 | |

| 0.04 | 5.70 | 1.5095 | -0.1894 | |

| 0.03 | 11.57 | 3.0633 | -0.1843 | |

| 0.01 | 1.62 | 0.4288 | -0.1736 | |

| 0.04 | 3.13 | 0.8300 | -0.1594 |

13F and Fund Filings

This form was filed on 2025-07-14 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JPM / JPMorgan Chase & Co. | 0.08 | -1.46 | 22.71 | 16.46 | 6.0152 | 0.4971 | |||

| AAPL / Apple Inc. | 0.10 | -3.00 | 20.91 | -10.40 | 5.5382 | -1.0654 | |||

| MSFT / Microsoft Corporation | 0.04 | -2.17 | 20.51 | 29.61 | 5.4325 | 0.9547 | |||

| NVDA / NVIDIA Corporation | 0.12 | -0.57 | 19.38 | 44.95 | 5.1336 | 1.3497 | |||

| WMT / Walmart Inc. | 0.19 | -1.34 | 18.54 | 9.89 | 4.9105 | 0.1365 | |||

| AMZN / Amazon.com, Inc. | 0.08 | -1.18 | 17.04 | 13.95 | 4.5139 | 0.2818 | |||

| GOOGL / Alphabet Inc. | 0.10 | -1.73 | 16.77 | 11.99 | 4.4426 | 0.2043 | |||

| V / Visa Inc. | 0.03 | -0.53 | 11.57 | 0.78 | 3.0633 | -0.1843 | |||

| HON / Honeywell International Inc. | 0.04 | -1.28 | 10.10 | 8.57 | 2.6745 | 0.0427 | |||

| MCD / McDonald's Corporation | 0.03 | 1.01 | 8.96 | -5.52 | 2.3744 | -0.3105 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | -2.21 | 8.62 | 26.71 | 2.2821 | 0.3577 | |||

| ABBV / AbbVie Inc. | 0.04 | 1.29 | 7.22 | -10.26 | 1.9111 | -0.3642 | |||

| PEP / PepsiCo, Inc. | 0.05 | -2.04 | 6.02 | -13.73 | 1.5938 | -0.3800 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | 0.09 | 5.73 | -8.70 | 1.5177 | -0.2583 | |||

| PG / The Procter & Gamble Company | 0.04 | 1.54 | 5.70 | -5.08 | 1.5095 | -0.1894 | |||

| DUK / Duke Energy Corporation | 0.05 | 2.70 | 5.55 | -0.64 | 1.4694 | -0.1106 | |||

| TFC / Truist Financial Corporation | 0.12 | 0.19 | 5.20 | 4.65 | 1.3770 | -0.0285 | |||

| ROK / Rockwell Automation, Inc. | 0.01 | -0.40 | 4.95 | 28.03 | 1.3105 | 0.2170 | |||

| XOM / Exxon Mobil Corporation | 0.04 | 6.75 | 4.82 | -3.25 | 1.2771 | -0.1330 | |||

| SCHB / Schwab Strategic Trust - Schwab U.S. Broad Market ETF | 0.20 | -5.16 | 4.75 | 4.97 | 1.2580 | -0.0223 | |||

| HD / The Home Depot, Inc. | 0.01 | 3.58 | 4.38 | 3.70 | 1.1593 | -0.0350 | |||

| CAT / Caterpillar Inc. | 0.01 | 1.41 | 4.37 | 19.36 | 1.1578 | 0.1215 | |||

| LOW / Lowe's Companies, Inc. | 0.02 | 12.82 | 3.93 | 7.32 | 1.0410 | 0.0047 | |||

| META / Meta Platforms, Inc. | 0.01 | 7.13 | 3.73 | 37.20 | 0.9867 | 0.2183 | |||

| DE / Deere & Company | 0.01 | -0.26 | 3.69 | 8.08 | 0.9782 | 0.0111 | |||

| ABT / Abbott Laboratories | 0.03 | 3.81 | 3.51 | 6.43 | 0.9301 | -0.0034 | |||

| JNJ / Johnson & Johnson | 0.02 | 5.47 | 3.41 | -2.88 | 0.9024 | -0.0901 | |||

| ISRG / Intuitive Surgical, Inc. | 0.01 | 0.64 | 3.32 | 10.43 | 0.8806 | 0.0286 | |||

| CVX / Chevron Corporation | 0.02 | 0.58 | 3.32 | -13.91 | 0.8786 | -0.2117 | |||

| MRK / Merck & Co., Inc. | 0.04 | 1.63 | 3.13 | -10.38 | 0.8300 | -0.1594 | |||

| COST / Costco Wholesale Corporation | 0.00 | -0.33 | 3.00 | 4.31 | 0.7945 | -0.0191 | |||

| EMR / Emerson Electric Co. | 0.02 | -0.38 | 2.93 | 21.16 | 0.7751 | 0.0915 | |||

| RY / Royal Bank of Canada | 0.02 | -3.61 | 2.87 | 12.49 | 0.7614 | 0.0383 | |||

| MMM / 3M Company | 0.02 | -0.25 | 2.58 | 3.37 | 0.6826 | -0.0227 | |||

| RTX / RTX Corporation | 0.02 | 0.56 | 2.57 | 10.82 | 0.6812 | 0.0247 | |||

| FNDX / Schwab Strategic Trust - Schwab Fundamental U.S. Large Company ETF | 0.10 | 1.62 | 2.50 | 5.62 | 0.6626 | -0.0076 | |||

| KO / The Coca-Cola Company | 0.04 | 0.87 | 2.49 | -0.32 | 0.6582 | -0.0475 | |||

| SPGI / S&P Global Inc. | 0.00 | 1.17 | 2.37 | 4.95 | 0.6288 | -0.0111 | |||

| PANW / Palo Alto Networks, Inc. | 0.01 | -1.10 | 2.37 | 18.61 | 0.6265 | 0.0622 | |||

| IAU / iShares Gold Trust | 0.04 | -4.33 | 2.35 | 1.21 | 0.6212 | -0.0347 | |||

| MO / Altria Group, Inc. | 0.04 | 1.24 | 2.11 | -1.08 | 0.5582 | -0.0448 | |||

| NFLX / Netflix, Inc. | 0.00 | -1.60 | 1.98 | 41.34 | 0.5235 | 0.1277 | |||

| IBM / International Business Machines Corporation | 0.01 | -6.43 | 1.97 | 10.93 | 0.5216 | 0.0192 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.00 | -1.85 | 1.95 | 41.75 | 0.5164 | 0.1273 | |||

| LIN / Linde plc | 0.00 | 1.97 | 1.92 | 2.79 | 0.5080 | -0.0202 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.07 | -3.25 | 1.85 | -8.31 | 0.4910 | -0.0811 | |||

| PFE / Pfizer Inc. | 0.08 | 3.41 | 1.82 | -1.09 | 0.4821 | -0.0386 | |||

| XLB / The Select Sector SPDR Trust - The Materials Select Sector SPDR Fund | 0.02 | 3.07 | 1.75 | 5.24 | 0.4632 | -0.0069 | |||

| NKE / NIKE, Inc. | 0.02 | -26.55 | 1.71 | -17.79 | 0.4517 | -0.1354 | |||

| NSC / Norfolk Southern Corporation | 0.01 | -0.46 | 1.67 | 7.58 | 0.4435 | 0.0031 | |||

| SCHW / The Charles Schwab Corporation | 0.02 | 1.89 | 1.66 | 18.72 | 0.4385 | 0.0440 | |||

| PM / Philip Morris International Inc. | 0.01 | -1.86 | 1.65 | 12.59 | 0.4382 | 0.0225 | |||

| CMI / Cummins Inc. | 0.01 | 5.00 | 1.64 | 9.75 | 0.4352 | 0.0114 | |||

| PEO / Adams Natural Resources Fund, Inc. | 0.08 | -0.28 | 1.63 | -6.58 | 0.4330 | -0.0621 | |||

| MLM / Martin Marietta Materials, Inc. | 0.00 | 2.97 | 1.62 | 18.26 | 0.4289 | 0.0413 | |||

| AMGN / Amgen Inc. | 0.01 | -15.15 | 1.62 | -23.97 | 0.4288 | -0.1736 | |||

| VZ / Verizon Communications Inc. | 0.04 | 5.52 | 1.52 | 0.66 | 0.4015 | -0.0246 | |||

| B / Barrick Mining Corporation | 0.07 | 1.43 | 0.3798 | 0.3798 | |||||

| SCHG / Schwab Strategic Trust - Schwab U.S. Large-Cap Growth ETF | 0.05 | 16.44 | 1.41 | 35.83 | 0.3747 | 0.0800 | |||

| MA / Mastercard Incorporated | 0.00 | 0.29 | 1.34 | 2.84 | 0.3553 | -0.0139 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | -3.97 | 1.33 | -12.94 | 0.3530 | -0.0802 | |||

| SCHV / Schwab Strategic Trust - Schwab U.S. Large-Cap Value ETF | 0.05 | 6.22 | 1.30 | 10.62 | 0.3449 | 0.0117 | |||

| COF / Capital One Financial Corporation | 0.01 | -0.07 | 1.29 | 18.55 | 0.3421 | 0.0339 | |||

| KR / The Kroger Co. | 0.02 | 6.49 | 1.28 | 12.83 | 0.3378 | 0.0180 | |||

| BSCS / Invesco Exchange-Traded Self-Indexed Fund Trust - Invesco BulletShares 2028 Corporate Bond ETF | 0.06 | 45.11 | 1.25 | 46.14 | 0.3308 | 0.0889 | |||

| PFF / iShares Trust - iShares Preferred and Income Securities ETF | 0.04 | 25.74 | 1.18 | 25.51 | 0.3116 | 0.0464 | |||

| LLY / Eli Lilly and Company | 0.00 | -0.47 | 1.15 | -6.13 | 0.3043 | -0.0418 | |||

| IYC / iShares Trust - iShares U.S. Consumer Discretionary ETF | 0.01 | -3.74 | 1.15 | 8.63 | 0.3037 | 0.0049 | |||

| MDT / Medtronic plc | 0.01 | -2.56 | 1.13 | -5.46 | 0.2984 | -0.0389 | |||

| NDAQ / Nasdaq, Inc. | 0.01 | 1.85 | 1.11 | 20.09 | 0.2945 | 0.0324 | |||

| BK / The Bank of New York Mellon Corporation | 0.01 | -4.50 | 1.08 | 3.74 | 0.2867 | -0.0085 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.00 | 4.11 | 1.07 | 27.68 | 0.2835 | 0.0463 | |||

| TY / Tri-Continental Corporation | 0.03 | -7.70 | 1.07 | -4.73 | 0.2829 | -0.0343 | |||

| ORCL / Oracle Corporation | 0.00 | 0.12 | 1.07 | 56.62 | 0.2822 | 0.0897 | |||

| GD / General Dynamics Corporation | 0.00 | 2.47 | 1.06 | 9.70 | 0.2818 | 0.0074 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.03 | -3.35 | 1.04 | -12.27 | 0.2767 | -0.0600 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.00 | 2.02 | 0.99 | 7.74 | 0.2617 | 0.0020 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | -0.63 | 0.94 | -1.68 | 0.2485 | -0.0215 | |||

| AMAT / Applied Materials, Inc. | 0.01 | 0.67 | 0.94 | 27.04 | 0.2477 | 0.0393 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | -1.14 | 0.91 | 11.18 | 0.2399 | 0.0093 | |||

| BAC / Bank of America Corporation | 0.02 | 0.00 | 0.86 | 13.49 | 0.2273 | 0.0131 | |||

| D / Dominion Energy, Inc. | 0.01 | -0.44 | 0.84 | 0.36 | 0.2216 | -0.0143 | |||

| AVGO / Broadcom Inc. | 0.00 | 25.07 | 0.76 | 105.93 | 0.2026 | 0.0975 | |||

| EW / Edwards Lifesciences Corporation | 0.01 | -1.32 | 0.73 | 6.56 | 0.1936 | -0.0006 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.89 | 0.73 | -1.75 | 0.1932 | -0.0169 | |||

| RVT / Royce Small-Cap Trust, Inc. | 0.05 | 3.43 | 0.72 | 9.28 | 0.1904 | 0.0043 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | -1.61 | 0.70 | -2.23 | 0.1862 | -0.0172 | |||

| FNDF / Schwab Strategic Trust - Schwab Fundamental International Equity ETF | 0.02 | 9.70 | 0.69 | 21.44 | 0.1831 | 0.0221 | |||

| TXN / Texas Instruments Incorporated | 0.00 | -18.06 | 0.69 | -5.35 | 0.1829 | -0.0235 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.04 | 6.56 | 0.68 | 3.99 | 0.1797 | -0.0050 | |||

| IYF / iShares Trust - iShares U.S. Financials ETF | 0.01 | 11.49 | 0.67 | 19.53 | 0.1767 | 0.0188 | |||

| PSX / Phillips 66 | 0.01 | 3.48 | 0.66 | 0.00 | 0.1749 | -0.0120 | |||

| LHX / L3Harris Technologies, Inc. | 0.00 | 9.46 | 0.64 | 31.28 | 0.1691 | 0.0314 | |||

| BDX / Becton, Dickinson and Company | 0.00 | -0.69 | 0.62 | -25.36 | 0.1631 | -0.0702 | |||

| ACN / Accenture plc | 0.00 | 23.57 | 0.61 | 18.36 | 0.1606 | 0.0156 | |||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 0.00 | 7.86 | 0.59 | 18.71 | 0.1565 | 0.0157 | |||

| BSCR / Invesco Exchange-Traded Self-Indexed Fund Trust - Invesco BulletShares 2027 Corporate Bond ETF | 0.03 | 7.89 | 0.59 | 8.26 | 0.1564 | 0.0020 | |||

| AXP / American Express Company | 0.00 | 0.00 | 0.59 | 18.55 | 0.1559 | 0.0154 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 48.32 | 0.59 | 74.63 | 0.1552 | 0.0602 | |||

| GOOG / Alphabet Inc. | 0.00 | 0.87 | 0.55 | 14.46 | 0.1469 | 0.0099 | |||

| ARCC / Ares Capital Corporation | 0.03 | -10.84 | 0.55 | -11.58 | 0.1457 | -0.0305 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -0.46 | 0.53 | 10.10 | 0.1416 | 0.0041 | |||

| FCX / Freeport-McMoRan Inc. | 0.01 | 6.76 | 0.52 | 22.25 | 0.1385 | 0.0175 | |||

| DIS / The Walt Disney Company | 0.00 | -2.26 | 0.52 | 22.88 | 0.1380 | 0.0180 | |||

| NOC / Northrop Grumman Corporation | 0.00 | -7.77 | 0.52 | -9.97 | 0.1367 | -0.0255 | |||

| FRA / BlackRock Floating Rate Income Strategies Fund, Inc. | 0.04 | 2.71 | 0.50 | 4.40 | 0.1321 | -0.0030 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | -6.57 | 0.49 | -3.14 | 0.1309 | -0.0135 | |||

| ETR / Entergy Corporation | 0.01 | 0.22 | 0.49 | -2.60 | 0.1291 | -0.0124 | |||

| BSCQ / Invesco Exchange-Traded Self-Indexed Fund Trust - Invesco BulletShares 2026 Corporate Bond ETF | 0.02 | 7.36 | 0.48 | 7.61 | 0.1275 | 0.0009 | |||

| NOBL / ProShares Trust - ProShares S&P 500 Dividend Aristocrats ETF | 0.00 | 9.98 | 0.48 | 8.41 | 0.1264 | 0.0018 | |||

| PSA / Public Storage | 0.00 | 2.29 | 0.47 | 0.21 | 0.1251 | -0.0082 | |||

| TGT / Target Corporation | 0.00 | -5.57 | 0.46 | -10.79 | 0.1228 | -0.0242 | |||

| DGRO / iShares Trust - iShares Core Dividend Growth ETF | 0.01 | 0.00 | 0.46 | 3.58 | 0.1228 | -0.0040 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -7.63 | 0.46 | -4.37 | 0.1218 | -0.0141 | |||

| STXG / EA Series Trust - Strive 1000 Growth ETF | 0.01 | 5.00 | 0.46 | 20.69 | 0.1206 | 0.0138 | |||

| SF / Stifel Financial Corp. | 0.00 | -6.05 | 0.45 | 3.44 | 0.1196 | -0.0039 | |||

| KLAC / KLA Corporation | 0.00 | -9.09 | 0.45 | 19.84 | 0.1186 | 0.0128 | |||

| BEN / Franklin Resources, Inc. | 0.02 | -13.53 | 0.44 | 7.35 | 0.1160 | 0.0003 | |||

| XLP / The Select Sector SPDR Trust - The Consumer Staples Select Sector SPDR Fund | 0.01 | -2.15 | 0.42 | -3.00 | 0.1113 | -0.0113 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.00 | 7.64 | 0.42 | -0.71 | 0.1111 | -0.0083 | |||

| MU / Micron Technology, Inc. | 0.00 | 1.21 | 0.41 | 43.55 | 0.1092 | 0.0279 | |||

| T / AT&T Inc. | 0.01 | -0.11 | 0.40 | 2.30 | 0.1062 | -0.0048 | |||

| FFC / Flaherty & Crumrine Preferred Securities Income Fund Inc. | 0.02 | 8.91 | 0.39 | 11.53 | 0.1026 | 0.0042 | |||

| BSCT / Invesco Exchange-Traded Self-Indexed Fund Trust - Invesco BulletShares 2029 Corporate Bond ETF | 0.02 | 4.77 | 0.37 | 5.97 | 0.0989 | -0.0010 | |||

| HWM / Howmet Aerospace Inc. | 0.00 | 0.00 | 0.36 | 43.60 | 0.0953 | 0.0243 | |||

| CMCSA / Comcast Corporation | 0.01 | 0.00 | 0.35 | -3.28 | 0.0938 | -0.0098 | |||

| CSX / CSX Corporation | 0.01 | -48.48 | 0.35 | -42.88 | 0.0936 | -0.0815 | |||

| EIPI / First Trust Exchange-Traded Fund VIII - FT Energy Income Partners Enhanced Income ETF | 0.02 | -7.52 | 0.34 | -10.03 | 0.0904 | -0.0171 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.00 | 7.82 | 0.34 | 13.80 | 0.0897 | 0.0054 | |||

| C / Citigroup Inc. | 0.00 | 2.17 | 0.33 | 22.39 | 0.0870 | 0.0111 | |||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 0.00 | -2.80 | 0.33 | 9.36 | 0.0867 | 0.0020 | |||

| MAIN / Main Street Capital Corporation | 0.01 | 0.59 | 0.32 | 5.21 | 0.0856 | -0.0014 | |||

| TROW / T. Rowe Price Group, Inc. | 0.00 | 38.34 | 0.32 | 45.05 | 0.0855 | 0.0226 | |||

| PRU / Prudential Financial, Inc. | 0.00 | 25.97 | 0.32 | 21.15 | 0.0835 | 0.0099 | |||

| GLD / SPDR Gold Trust | 0.00 | 0.00 | 0.30 | 5.56 | 0.0807 | -0.0008 | |||

| JEF / Jefferies Financial Group Inc. | 0.01 | 0.91 | 0.30 | 3.06 | 0.0803 | -0.0030 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 15.38 | 0.28 | 16.39 | 0.0754 | 0.0062 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.00 | 14.39 | 0.27 | 3.45 | 0.0718 | -0.0021 | |||

| ICE / Intercontinental Exchange, Inc. | 0.00 | 0.48 | 0.27 | 6.80 | 0.0708 | 0.0000 | |||

| ENB / Enbridge Inc. | 0.01 | -1.34 | 0.26 | 0.77 | 0.0698 | -0.0041 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.26 | 23.44 | 0.0684 | 0.0090 | |||

| DRLL / EA Series Trust - Strive U.S. Energy ETF | 0.01 | 10.17 | 0.25 | 0.40 | 0.0670 | -0.0041 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 0.25 | 10.13 | 0.0664 | 0.0022 | |||

| BSCP / Invesco Exchange-Traded Self-Indexed Fund Trust - Invesco BulletShares 2025 Corporate Bond ETF | 0.01 | 3.52 | 0.25 | 3.73 | 0.0663 | -0.0021 | |||

| CME / CME Group Inc. | 0.00 | 0.00 | 0.24 | 3.86 | 0.0642 | -0.0018 | |||

| SUN / Sunoco LP - Limited Partnership | 0.00 | 0.22 | 0.24 | -7.66 | 0.0640 | -0.0099 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 3.27 | 0.23 | -15.75 | 0.0610 | -0.0164 | |||

| GE / General Electric Company | 0.00 | 0.22 | 0.0584 | 0.0584 | |||||

| SNOW / Snowflake Inc. | 0.00 | 0.22 | 0.0581 | 0.0581 | |||||

| RING / iShares, Inc. - iShares MSCI Global Gold Miners ETF | 0.01 | 0.22 | 0.0580 | 0.0580 | |||||

| MRVL / Marvell Technology, Inc. | 0.00 | 0.22 | 0.0574 | 0.0574 | |||||

| PAI / Western Asset Investment Grade Income Fund Inc. | 0.02 | -0.11 | 0.21 | 0.94 | 0.0568 | -0.0033 | |||

| VNO / Vornado Realty Trust | 0.01 | -1.33 | 0.21 | 1.92 | 0.0564 | -0.0027 | |||

| MSTR / Strategy Inc | 0.00 | -50.00 | 0.20 | -29.86 | 0.0535 | -0.0280 | |||

| TSI / TCW Strategic Income Fund, Inc. | 0.04 | -3.91 | 0.18 | -3.21 | 0.0480 | -0.0051 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AKAM / Akamai Technologies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GOLD / Barrick Mining Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |