Basic Stats

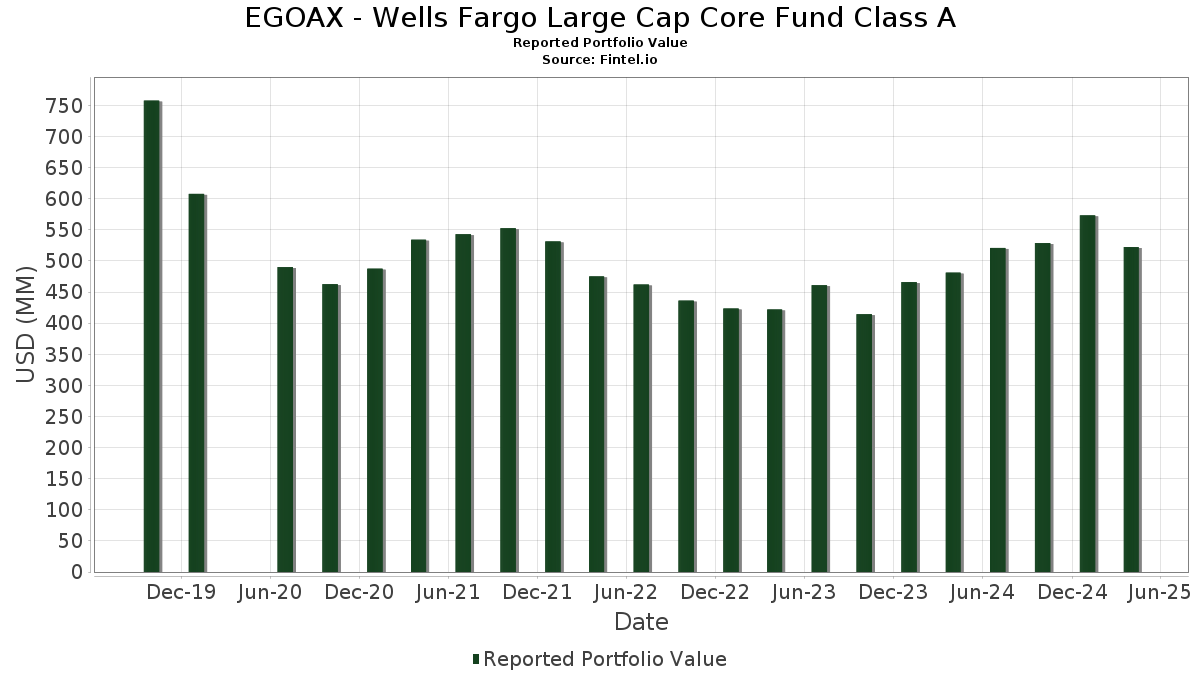

| Portfolio Value | $ 522,285,385 |

| Current Positions | 54 |

Latest Holdings, Performance, AUM (from 13F, 13D)

EGOAX - Wells Fargo Large Cap Core Fund Class A has disclosed 54 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 522,285,385 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). EGOAX - Wells Fargo Large Cap Core Fund Class A’s top holdings are Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Alphabet Inc. (US:GOOG) , Netflix, Inc. (US:NFLX) , and Broadcom Inc. (US:AVGO) . EGOAX - Wells Fargo Large Cap Core Fund Class A’s new positions include Tenet Healthcare Corporation (IT:1THC) , Uber Technologies, Inc. (US:UBER) , Omega Healthcare Investors, Inc. (US:OHI) , Cheniere Energy, Inc. (US:LNG) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 11.86 | 2.3056 | 2.3056 | |

| 0.13 | 10.92 | 2.1225 | 2.1225 | |

| 0.27 | 10.68 | 2.0764 | 2.0764 | |

| 0.05 | 10.41 | 2.0245 | 2.0245 | |

| 8.90 | 8.90 | 1.7299 | 1.7299 | |

| 8.90 | 8.90 | 1.7299 | 1.7299 | |

| 0.02 | 17.00 | 3.3055 | 0.7676 | |

| 0.40 | 15.58 | 3.0284 | 0.7472 | |

| 0.03 | 11.54 | 2.2425 | 0.6261 | |

| 0.04 | 11.15 | 2.1668 | 0.4925 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 9.58 | 1.8621 | -1.8258 | |

| 0.11 | 7.87 | 1.5306 | -0.5635 | |

| 0.12 | 18.74 | 3.6421 | -0.4983 | |

| 0.10 | 8.44 | 1.6410 | -0.4037 | |

| 0.07 | 12.69 | 2.4669 | -0.3614 | |

| 0.07 | 12.05 | 2.3428 | -0.2943 | |

| 0.09 | 9.66 | 1.8774 | -0.2707 | |

| 0.07 | 8.02 | 1.5582 | -0.2515 | |

| 0.31 | 7.73 | 1.5026 | -0.2374 | |

| 0.09 | 10.08 | 1.9597 | -0.2223 |

13F and Fund Filings

This form was filed on 2025-06-25 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.07 | 0.82 | 26.39 | -3.99 | 5.1292 | 0.3377 | |||

| AAPL / Apple Inc. | 0.11 | 0.82 | 23.38 | -9.21 | 4.5455 | 0.0547 | |||

| GOOG / Alphabet Inc. | 0.12 | 0.82 | 18.74 | -21.10 | 3.6421 | -0.4983 | |||

| NFLX / Netflix, Inc. | 0.02 | 0.83 | 17.00 | 16.83 | 3.3055 | 0.7676 | |||

| AVGO / Broadcom Inc. | 0.09 | 0.82 | 16.41 | -12.30 | 3.1909 | -0.0725 | |||

| EXEL / Exelixis, Inc. | 0.40 | 0.82 | 15.58 | 19.07 | 3.0284 | 0.7472 | |||

| JPM / JPMorgan Chase & Co. | 0.05 | 14.50 | 12.99 | 4.78 | 2.5259 | 0.3638 | |||

| AMZN / Amazon.com, Inc. | 0.07 | 0.82 | 12.69 | -21.77 | 2.4669 | -0.3614 | |||

| IBKR / Interactive Brokers Group, Inc. | 0.07 | 0.82 | 12.05 | -20.31 | 2.3428 | -0.2943 | |||

| 1THC / Tenet Healthcare Corporation | 0.08 | 11.86 | 2.3056 | 2.3056 | |||||

| ULTA / Ulta Beauty, Inc. | 0.03 | 94.12 | 11.54 | 52.98 | 2.2425 | 0.6261 | |||

| FOXA / Fox Corporation | 0.23 | 0.82 | 11.42 | -1.92 | 2.2192 | 0.1899 | |||

| VIRT / Virtu Financial, Inc. | 0.29 | 0.82 | 11.35 | -1.47 | 2.2073 | 0.1980 | |||

| COST / Costco Wholesale Corporation | 0.01 | -13.08 | 11.18 | -11.78 | 2.1739 | -0.0363 | |||

| COR / Cencora, Inc. | 0.04 | 0.82 | 11.15 | 16.08 | 2.1668 | 0.4925 | |||

| UBER / Uber Technologies, Inc. | 0.13 | 10.92 | 2.1225 | 2.1225 | |||||

| ABBV / AbbVie Inc. | 0.06 | 0.82 | 10.82 | 6.96 | 2.1029 | 0.3396 | |||

| OHI / Omega Healthcare Investors, Inc. | 0.27 | 10.68 | 2.0764 | 2.0764 | |||||

| GS / The Goldman Sachs Group, Inc. | 0.02 | 0.82 | 10.65 | -13.79 | 2.0697 | -0.0837 | |||

| LNG / Cheniere Energy, Inc. | 0.05 | 10.41 | 2.0245 | 2.0245 | |||||

| SPG / Simon Property Group, Inc. | 0.07 | 0.82 | 10.35 | -8.73 | 2.0116 | 0.0347 | |||

| OKTA / Okta, Inc. | 0.09 | -32.33 | 10.08 | -19.45 | 1.9597 | -0.2223 | |||

| LDOS / Leidos Holdings, Inc. | 0.07 | 0.82 | 9.69 | 4.48 | 1.8830 | 0.2665 | |||

| SNX / TD SYNNEX Corporation | 0.09 | 0.82 | 9.66 | -21.62 | 1.8774 | -0.2707 | |||

| TWLO / Twilio Inc. | 0.10 | -31.36 | 9.58 | -54.71 | 1.8621 | -1.8258 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.04 | 0.82 | 9.57 | -18.73 | 1.8604 | -0.1927 | |||

| CL / Colgate-Palmolive Company | 0.10 | 0.82 | 9.44 | 7.21 | 1.8360 | 0.3000 | |||

| EME / EMCOR Group, Inc. | 0.02 | 0.82 | 9.34 | -9.83 | 1.8147 | 0.0095 | |||

| ALLSPRING GOVERNMENT MONEY MAR / STIV (000000000) | 8.90 | 8.90 | 1.7299 | 1.7299 | |||||

| ALLSPRING GOVERNMENT MONEY MAR / STIV (000000000) | 8.90 | 8.90 | 1.7299 | 1.7299 | |||||

| KLAC / KLA Corporation | 0.01 | 0.82 | 8.68 | -4.03 | 1.6877 | 0.1104 | |||

| ANET / Arista Networks Inc | 0.10 | 0.82 | 8.44 | -28.01 | 1.6410 | -0.4037 | |||

| DELL / Dell Technologies Inc. | 0.09 | 0.82 | 8.16 | -10.70 | 1.5854 | -0.0070 | |||

| OC / Owens Corning | 0.06 | 0.82 | 8.10 | -20.56 | 1.5743 | -0.2032 | |||

| GNRC / Generac Holdings Inc. | 0.07 | 0.82 | 8.02 | -22.78 | 1.5582 | -0.2515 | |||

| UAL / United Airlines Holdings, Inc. | 0.11 | 0.82 | 7.87 | -34.44 | 1.5306 | -0.5635 | |||

| QCOM / QUALCOMM Incorporated | 0.05 | 0.82 | 7.83 | -13.44 | 1.5228 | -0.0552 | |||

| UTHR / United Therapeutics Corporation | 0.03 | 0.83 | 7.78 | -12.98 | 1.5120 | -0.0464 | |||

| PINS / Pinterest, Inc. | 0.31 | 0.82 | 7.73 | -22.55 | 1.5026 | -0.2374 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.00 | 0.82 | 7.61 | -18.64 | 1.4799 | -0.1515 | |||

| PHM / PulteGroup, Inc. | 0.07 | 0.82 | 7.18 | -9.10 | 1.3961 | 0.0185 | |||

| EOG / EOG Resources, Inc. | 0.06 | 0.82 | 6.99 | -11.58 | 1.3586 | -0.0194 | |||

| C / Citigroup Inc. | 0.10 | 0.82 | 6.84 | -15.34 | 1.3297 | -0.0790 | |||

| CF / CF Industries Holdings, Inc. | 0.09 | 31.01 | 6.79 | 11.34 | 1.3204 | 0.2568 | |||

| COP / ConocoPhillips | 0.06 | 0.82 | 5.54 | -9.08 | 1.0766 | 0.0145 | |||

| NUE / Nucor Corporation | 0.05 | 0.82 | 5.41 | -6.29 | 1.0513 | 0.0451 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.01 | 0.83 | 5.40 | -10.30 | 1.0500 | 0.0002 | |||

| LEN / Lennar Corporation | 0.05 | 0.82 | 5.29 | -16.56 | 1.0287 | -0.0771 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 0.83 | 5.28 | -23.54 | 1.0262 | -0.1775 | |||

| CFG / Citizens Financial Group, Inc. | 0.14 | 0.82 | 5.21 | -21.81 | 1.0121 | -0.1489 | |||

| WY / Weyerhaeuser Company | 0.20 | 0.82 | 5.18 | -14.68 | 1.0067 | -0.0517 | |||

| ADBE / Adobe Inc. | 0.01 | 0.82 | 4.51 | -13.57 | 0.8768 | -0.0332 | |||

| S+P500 EMINI FUT JUN25 / DE (000000000) | -0.13 | -0.0257 | -0.0257 | ||||||

| S+P500 EMINI FUT JUN25 / DE (000000000) | -0.13 | -0.0257 | -0.0257 |