Basic Stats

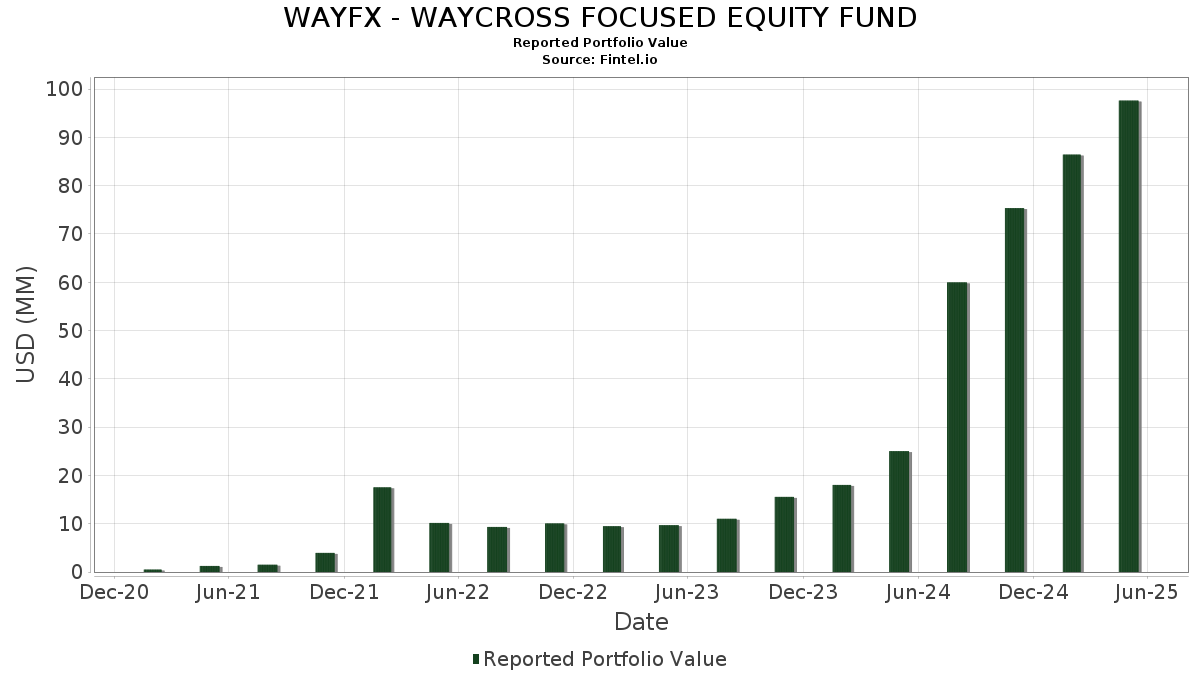

| Portfolio Value | $ 97,619,118 |

| Current Positions | 31 |

Latest Holdings, Performance, AUM (from 13F, 13D)

WAYFX - WAYCROSS FOCUSED EQUITY FUND has disclosed 31 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 97,619,118 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). WAYFX - WAYCROSS FOCUSED EQUITY FUND’s top holdings are NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Meta Platforms, Inc. (US:META) , Apple Inc. (US:AAPL) , and Alphabet Inc. (US:GOOGL) . WAYFX - WAYCROSS FOCUSED EQUITY FUND’s new positions include Salesforce, Inc. (US:CRM) , NXP Semiconductors N.V. (US:NXPI) , The Southern Company (US:SO) , Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I (US:FIGXX) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 2.73 | 2.7926 | 2.7926 | |

| 0.01 | 2.43 | 2.4855 | 2.4855 | |

| 0.02 | 4.07 | 4.1616 | 1.0989 | |

| 0.01 | 1.05 | 1.0778 | 1.0778 | |

| 0.02 | 6.92 | 7.0826 | 1.0238 | |

| 0.01 | 3.35 | 3.4237 | 0.6256 | |

| 0.00 | 1.81 | 1.8482 | 0.6056 | |

| 0.05 | 7.04 | 7.2089 | 0.5984 | |

| 0.00 | 2.53 | 2.5887 | 0.4021 | |

| 0.01 | 2.81 | 2.8791 | 0.2828 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 5.02 | 5.1385 | -0.9986 | |

| 0.04 | 2.13 | 2.1810 | -0.9258 | |

| 0.01 | 2.13 | 2.1828 | -0.6463 | |

| 0.02 | 1.60 | 1.6410 | -0.5103 | |

| 0.02 | 2.92 | 2.9888 | -0.3406 | |

| 0.01 | 1.62 | 1.6599 | -0.2651 | |

| 0.01 | 2.95 | 3.0196 | -0.2008 | |

| 0.04 | 3.33 | 3.4092 | -0.1804 | |

| 0.05 | 3.51 | 3.5958 | -0.1398 | |

| 0.01 | 5.59 | 5.7191 | -0.1367 |

13F and Fund Filings

This form was filed on 2025-07-29 for the reporting period 2025-05-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.05 | 13.88 | 7.04 | 23.19 | 7.2089 | 0.5984 | |||

| MSFT / Microsoft Corporation | 0.02 | 13.87 | 6.92 | 32.06 | 7.0826 | 1.0238 | |||

| META / Meta Platforms, Inc. | 0.01 | 13.85 | 5.59 | 10.33 | 5.7191 | -0.1367 | |||

| AAPL / Apple Inc. | 0.02 | 13.88 | 5.02 | -5.43 | 5.1385 | -0.9986 | |||

| GOOGL / Alphabet Inc. | 0.03 | 13.88 | 4.76 | 14.86 | 4.8668 | 0.0802 | |||

| BA / The Boeing Company | 0.02 | 29.29 | 4.07 | 53.49 | 4.1616 | 1.0989 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 13.89 | 3.97 | 9.97 | 4.0662 | -0.1099 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | 13.90 | 3.93 | 9.88 | 4.0192 | -0.1119 | |||

| MA / Mastercard Incorporated | 0.01 | 13.88 | 3.75 | 15.74 | 3.8394 | 0.0916 | |||

| WFC / Wells Fargo & Company | 0.05 | 13.88 | 3.51 | 8.73 | 3.5958 | -0.1398 | |||

| HON / Honeywell International Inc. | 0.01 | 13.89 | 3.38 | 21.28 | 3.4585 | 0.2367 | |||

| AVGO / Broadcom Inc. | 0.01 | 13.87 | 3.35 | 38.22 | 3.4237 | 0.6256 | |||

| C / Citigroup Inc. | 0.04 | 13.88 | 3.33 | 7.31 | 3.4092 | -0.1804 | |||

| ISRG / Intuitive Surgical, Inc. | 0.01 | 13.88 | 2.96 | 9.74 | 3.0340 | -0.0890 | |||

| ADI / Analog Devices, Inc. | 0.01 | 13.88 | 2.95 | 5.92 | 3.0196 | -0.2008 | |||

| ABBV / AbbVie Inc. | 0.02 | 13.89 | 2.92 | 1.42 | 2.9888 | -0.3406 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 37.98 | 2.81 | 25.30 | 2.8791 | 0.2828 | |||

| CRM / Salesforce, Inc. | 0.01 | 2.73 | 2.7926 | 2.7926 | |||||

| CSX / CSX Corporation | 0.08 | 13.88 | 2.60 | 12.40 | 2.6638 | -0.0136 | |||

| SYY / Sysco Corporation | 0.04 | 13.89 | 2.56 | 10.08 | 2.6154 | -0.0690 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | 13.87 | 2.53 | 33.74 | 2.5887 | 0.4021 | |||

| NXPI / NXP Semiconductors N.V. | 0.01 | 2.43 | 2.4855 | 2.4855 | |||||

| BDX / Becton, Dickinson and Company | 0.01 | 13.89 | 2.13 | -12.87 | 2.1828 | -0.6463 | |||

| DAL / Delta Air Lines, Inc. | 0.04 | 420.24 | 2.13 | 532.05 | 2.1810 | -0.9258 | |||

| ADBE / Adobe Inc. | 0.00 | 13.89 | 2.04 | 7.79 | 2.0830 | -0.0998 | |||

| NOW / ServiceNow, Inc. | 0.00 | 54.50 | 1.81 | 68.06 | 1.8482 | 0.6056 | |||

| EOG / EOG Resources, Inc. | 0.01 | 13.88 | 1.62 | -2.64 | 1.6599 | -0.2651 | |||

| TGT / Target Corporation | 0.02 | 13.87 | 1.60 | -13.82 | 1.6410 | -0.5103 | |||

| PYPL / PayPal Holdings, Inc. | 0.02 | 13.87 | 1.34 | 12.59 | 1.3734 | -0.0040 | |||

| SO / The Southern Company | 0.01 | 1.05 | 1.0778 | 1.0778 | |||||

| FIGXX / Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I | 0.79 | 34.24 | 0.8070 | 0.1279 |