Basic Stats

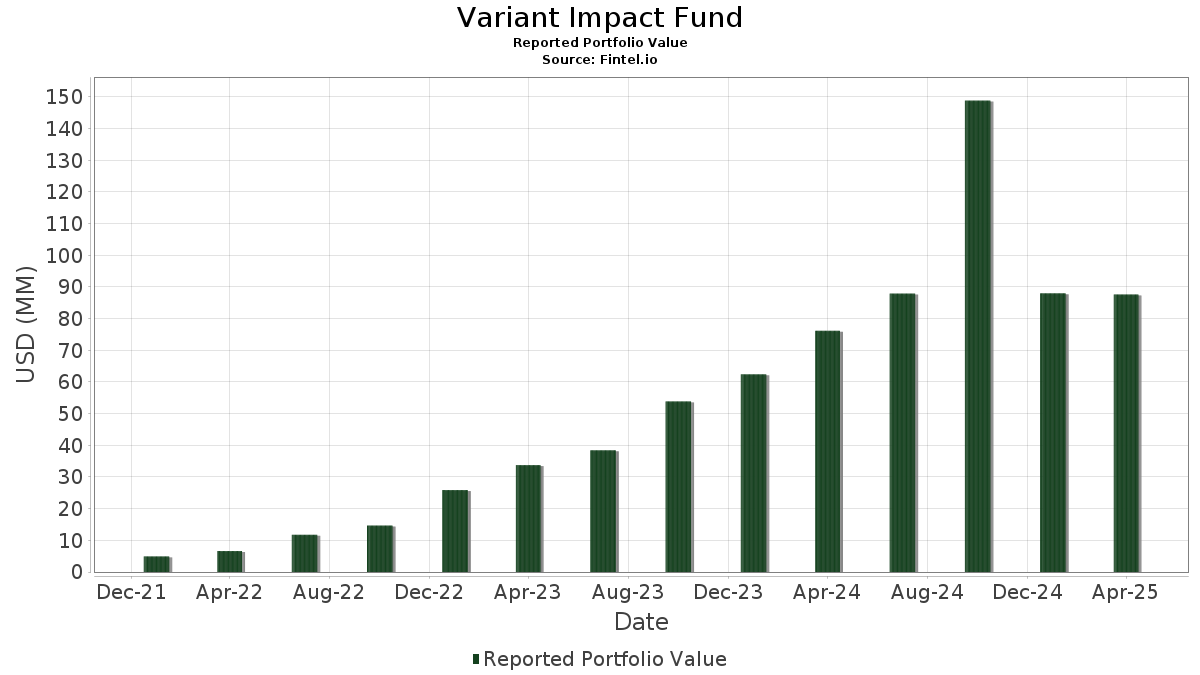

| Portfolio Value | $ 87,624,210 |

| Current Positions | 47 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Variant Impact Fund has disclosed 47 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 87,624,210 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Variant Impact Fund’s top holdings are Goldman Sachs Financial Square Funds - Government Fund (US:US38141W2733) , Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I (US:FIGXX) , and Vanguard Money Market Reserves - Federal Money Market Fund (US:VMFXX) . Variant Impact Fund’s new positions include Goldman Sachs Financial Square Funds - Government Fund (US:US38141W2733) , Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I (US:FIGXX) , and Vanguard Money Market Reserves - Federal Money Market Fund (US:VMFXX) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 25.12 | 27.5763 | 6.8068 | ||

| 5.45 | 5.9829 | 5.9829 | ||

| 5.21 | 5.7208 | 5.7208 | ||

| 0.00 | 4.86 | 5.3348 | 5.3348 | |

| 4.63 | 5.0782 | 5.0782 | ||

| 3.60 | 3.9541 | 3.9541 | ||

| 3.24 | 3.5546 | 3.5546 | ||

| 2.76 | 3.0291 | 3.0291 | ||

| 0.00 | 2.73 | 2.9975 | 2.9975 | |

| 2.56 | 2.8155 | 2.8155 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| -0.30 | -0.3321 | -0.3321 |

13F and Fund Filings

This form was filed on 2025-06-27 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US38141W2733 / Goldman Sachs Financial Square Funds - Government Fund | 25.12 | 29.93 | 27.5763 | 6.8068 | |||||

| Castellan Affordable Housing Fund LLC / / DBT (999999999) | 5.45 | 5.9829 | 5.9829 | ||||||

| Drapo Contractor Sub Subsidiary Finance / / DBT (999999999) | 5.21 | 5.7208 | 5.7208 | ||||||

| North Sky Clean Growth Fund VI, LP / / EC (999999999) | 0.00 | 4.86 | 5.3348 | 5.3348 | |||||

| APP ACADEMY IMPACT CREDIT FACILITY / / DBT (999999999) | 4.63 | 5.0782 | 5.0782 | ||||||

| Almavest Impact Debt Facility / / DBT (999999999) | 3.60 | 3.9541 | 3.9541 | ||||||

| ZANIFU CREDIT FACILITY / / DBT (999999999) | 3.24 | 3.5546 | 3.5546 | ||||||

| JALI TRANSPORT FACILITY / / DBT (999999999) | 2.76 | 3.0291 | 3.0291 | ||||||

| SGF II / / EC (999999999) | 0.00 | 2.73 | 2.9975 | 2.9975 | |||||

| LIBREMAX (PREF) (BRICK BY BRICK) / / DBT (999999999) | 2.56 | 2.8155 | 2.8155 | ||||||

| CIM EM Credit Fund / / EC (999999999) | 0.00 | 2.40 | 2.6312 | 2.6312 | |||||

| JGB (Woodland Hills) FACILITY / / DBT (999999999) | 1.97 | 2.1651 | 2.1651 | ||||||

| RKB ENERGY REBATES CREDIT FACILITY II / / DBT (999999999) | 1.93 | 2.1145 | 2.1145 | ||||||

| CVI CLEAN ENERGY FUND II / / EC (999999999) | 0.00 | 1.89 | 2.0743 | 2.0743 | |||||

| SUNNOVA MEZZANINE PA / / DBT (999999999) | 1.86 | 2.0424 | 2.0424 | ||||||

| Almavest Impact Debt 90 Day Facility / / DBT (999999999) | 1.66 | 1.8196 | 1.8196 | ||||||

| Hawks Point Envest Renewable Energy TL / / DBT (999999999) | 1.18 | 1.2917 | 1.2917 | ||||||

| Power-Earned Wage Ac Credit Facility / / DBT (999999999) | 1.12 | 1.2303 | 1.2303 | ||||||

| Upper90 Crusoe Loan LOAN II / / EC (999999999) | 0.00 | 1.07 | 1.1759 | 1.1759 | |||||

| Drip Trade Finance Series-AW / / DBT (999999999) | 1.00 | 1.0978 | 1.0978 | ||||||

| DRIP TRADE FINANCE SERIES - 2024-J / / DBT (999999999) | 1.00 | 1.0978 | 1.0978 | ||||||

| Outcome Shared Income Facility / / DBT (999999999) | 0.95 | 1.0464 | 1.0464 | ||||||

| SIXPOINT CAP CREDIT / / DBT (999999999) | 0.95 | 1.0423 | 1.0423 | ||||||

| Conservation Farming / / EC (999999999) | 0.00 | 0.92 | 1.0141 | 1.0141 | |||||

| STAR STRONG - CHASM / / DBT (999999999) | 0.79 | 0.8618 | 0.8618 | ||||||

| CREDIX EMERGING MARKETS FACILITY / / DBT (999999999) | 0.78 | 0.8508 | 0.8508 | ||||||

| Cauris Facility / / DBT (999999999) | 0.70 | 0.7684 | 0.7684 | ||||||

| RIVONIA - PLANET42 CREDIT FACILITY / / DBT (999999999) | 0.66 | 0.7261 | 0.7261 | ||||||

| ALMOND - KITISURU 2 BLOCK B / / DBT (999999999) | 0.61 | 0.6653 | 0.6653 | ||||||

| Fundamental Partners IV / / EC (999999999) | 0.00 | 0.58 | 0.6376 | 0.6376 | |||||

| ALMOND AFRICAN AFFORABLE HOUSING / / DBT (999999999) | 0.48 | 0.5302 | 0.5302 | ||||||

| ALMOND AFRICAN AFFORABLE HOUSING / / DBT (999999999) | 0.48 | 0.5302 | 0.5302 | ||||||

| FINANCIAL GYM LOAN / / DBT (999999999) | 0.47 | 0.5121 | 0.5121 | ||||||

| STAR STRONG - BLACE / / DBT (999999999) | 0.40 | 0.4401 | 0.4401 | ||||||

| CIRCULARIS CLIMATE CONT VEHICLE / / EC (999999999) | 0.00 | 0.40 | 0.4382 | 0.4382 | |||||

| BARTLESVILLE OK REAL ESTATE / / DBT (999999999) | 0.25 | 0.2744 | 0.2744 | ||||||

| WINDSAIL CREDIT QP FUND LP / / EC (999999999) | 0.00 | 0.21 | 0.2331 | 0.2331 | |||||

| Prepped INC LOAN / / DBT (999999999) | 0.16 | 0.1805 | 0.1805 | ||||||

| FIGXX / Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I | 0.16 | 1.27 | 0.1747 | 0.0055 | |||||

| STRIDE ISA MEZZANINE DEBT / / DBT (999999999) | 0.16 | 0.1731 | 0.1731 | ||||||

| TRG Credito Facil Credit Facility / / DBT (999999999) | 0.14 | 0.1553 | 0.1553 | ||||||

| Skydan Debt Facility / / DBT (999999999) | 0.11 | 0.1158 | 0.1158 | ||||||

| ANIMAL REPAIR SHOP LOAN / / DBT (999999999) | 0.10 | 0.1133 | 0.1133 | ||||||

| North Sky Clean Growth Fund III / / EC (999999999) | 0.00 | 0.10 | 0.1078 | 0.1078 | |||||

| Star Strong Impact Facility / / DBT (999999999) | 0.09 | 0.0944 | 0.0944 | ||||||

| Henry Facility / / DBT (999999999) | 0.05 | 0.0535 | 0.0535 | ||||||

| VMFXX / Vanguard Money Market Reserves - Federal Money Market Fund | 0.00 | 0.0000 | 0.0000 | ||||||

| EUR/USD FUTURE JUN 2025 / / DFE (999999999) | -0.30 | -0.3321 | -0.3321 |