Basic Stats

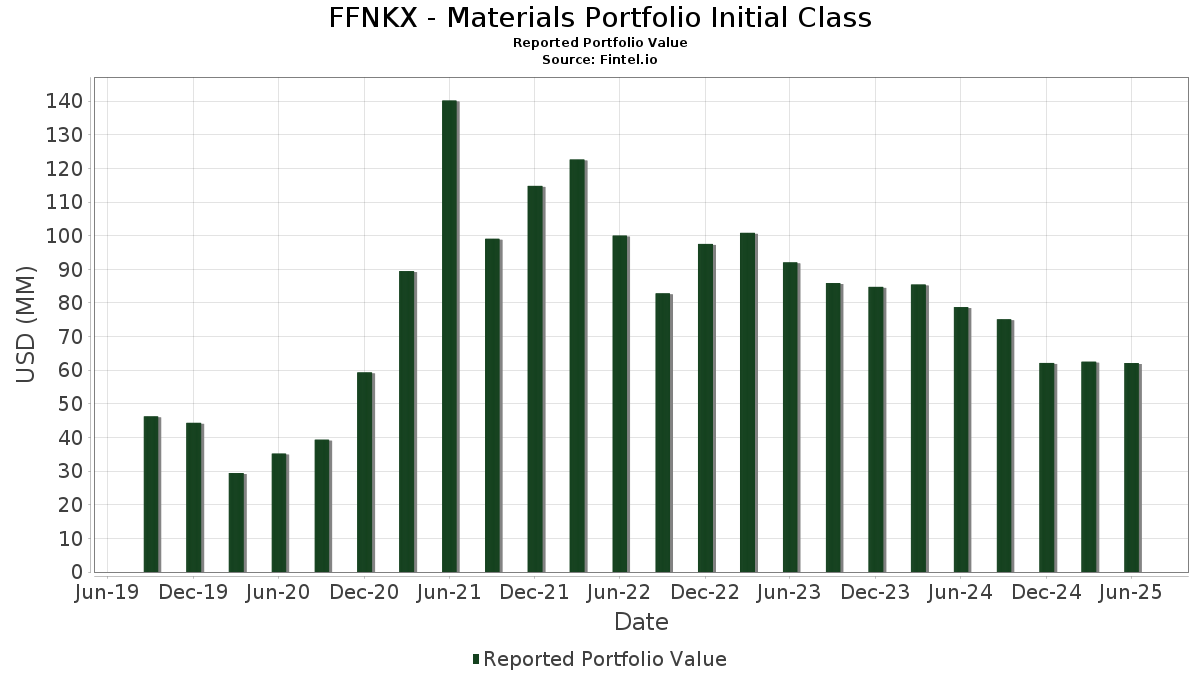

| Portfolio Value | $ 62,129,148 |

| Current Positions | 44 |

Latest Holdings, Performance, AUM (from 13F, 13D)

FFNKX - Materials Portfolio Initial Class has disclosed 44 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 62,129,148 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). FFNKX - Materials Portfolio Initial Class’s top holdings are Linde plc (US:LIN) , Ecolab Inc. (US:ECL) , Air Products and Chemicals, Inc. (US:APD) , Corteva, Inc. (US:CTVA) , and The Mosaic Company (US:MOS) . FFNKX - Materials Portfolio Initial Class’s new positions include MP Materials Corp. (US:MP) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 3.05 | 4.9377 | 2.8814 | |

| 0.04 | 1.82 | 2.9506 | 2.5947 | |

| 0.12 | 2.13 | 3.4432 | 0.7959 | |

| 0.04 | 3.15 | 5.1042 | 0.7286 | |

| 0.01 | 0.47 | 0.7597 | 0.5207 | |

| 0.01 | 0.27 | 0.4363 | 0.4363 | |

| 0.00 | 1.48 | 2.3904 | 0.3671 | |

| 0.02 | 0.98 | 1.5841 | 0.3370 | |

| 0.01 | 0.39 | 0.6301 | 0.2865 | |

| 0.02 | 1.86 | 3.0139 | 0.2661 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 0.34 | 0.5531 | -2.3278 | |

| 0.39 | 0.39 | 0.6236 | -0.8741 | |

| 0.01 | 0.38 | 0.6071 | -0.8381 | |

| 0.01 | 3.18 | 5.1549 | -0.7730 | |

| 0.05 | 2.16 | 3.4953 | -0.7724 | |

| 0.02 | 10.79 | 17.4714 | -0.6657 | |

| 0.01 | 1.92 | 3.1152 | -0.6343 | |

| 0.05 | 1.23 | 1.9839 | -0.6108 | |

| 0.05 | 0.61 | 0.9825 | -0.5963 | |

| 0.06 | 1.65 | 2.6775 | -0.5258 |

13F and Fund Filings

This form was filed on 2025-08-22 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| LIN / Linde plc | 0.02 | -4.96 | 10.79 | -4.23 | 17.4714 | -0.6657 | |||

| ECL / Ecolab Inc. | 0.02 | -5.58 | 5.47 | 0.35 | 8.8556 | 0.0825 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | -9.61 | 3.18 | -13.55 | 5.1549 | -0.7730 | |||

| CTVA / Corteva, Inc. | 0.04 | -2.08 | 3.15 | 15.97 | 5.1042 | 0.7286 | |||

| MOS / The Mosaic Company | 0.08 | 76.74 | 3.05 | 138.76 | 4.9377 | 2.8814 | |||

| IP / International Paper Company | 0.05 | -7.24 | 2.16 | -18.60 | 3.4953 | -0.7724 | |||

| FQVLF / First Quantum Minerals Ltd. | 0.12 | -2.13 | 2.13 | 29.32 | 3.4432 | 0.7959 | |||

| ATR / AptarGroup, Inc. | 0.01 | -21.66 | 1.92 | -17.39 | 3.1152 | -0.6343 | |||

| CRH / CRH plc | 0.02 | -9.13 | 1.92 | -5.19 | 3.1063 | -0.1503 | |||

| WPM / Wheaton Precious Metals Corp. | 0.02 | -5.91 | 1.86 | 9.02 | 3.0139 | 0.2661 | |||

| MLM / Martin Marietta Materials, Inc. | 0.00 | -5.67 | 1.83 | 8.31 | 2.9561 | 0.2426 | |||

| FCX / Freeport-McMoRan Inc. | 0.04 | 619.86 | 1.82 | 724.43 | 2.9506 | 2.5947 | |||

| NUE / Nucor Corporation | 0.01 | -6.21 | 1.76 | 0.97 | 2.8523 | 0.0438 | |||

| BCPC / Balchem Corporation | 0.01 | -6.14 | 1.70 | -9.99 | 2.7579 | -0.2879 | |||

| VMC / Vulcan Materials Company | 0.01 | -7.14 | 1.70 | 3.80 | 2.7448 | 0.1163 | |||

| AXTA / Axalta Coating Systems Ltd. | 0.06 | -7.17 | 1.65 | -16.93 | 2.6775 | -0.5258 | |||

| SHW / The Sherwin-Williams Company | 0.00 | 19.44 | 1.48 | 17.42 | 2.3904 | 0.3671 | |||

| ESI / Element Solutions Inc | 0.05 | -24.12 | 1.23 | -24.01 | 1.9839 | -0.6108 | |||

| STLD / Steel Dynamics, Inc. | 0.01 | 2.20 | 1.19 | 4.57 | 1.9275 | 0.0954 | |||

| AEM / Agnico Eagle Mines Limited | 0.01 | -10.91 | 1.17 | -2.02 | 1.8904 | -0.0278 | |||

| NTR / Nutrien Ltd. | 0.02 | 7.69 | 0.98 | 26.36 | 1.5841 | 0.3370 | |||

| TECK / Teck Resources Limited | 0.02 | -6.77 | 0.94 | 3.28 | 1.5298 | 0.0581 | |||

| AVY / Avery Dennison Corporation | 0.00 | -7.55 | 0.86 | -8.91 | 1.3921 | -0.1261 | |||

| CCK / Crown Holdings, Inc. | 0.01 | -9.20 | 0.81 | 4.77 | 1.3172 | 0.0673 | |||

| CC / The Chemours Company | 0.05 | -26.90 | 0.61 | -38.16 | 0.9825 | -0.5963 | |||

| SMURFIT WESTROCK PLC / EC (IE00028FXN24) | 0.01 | -9.15 | 0.60 | -13.06 | 0.9711 | -0.1386 | |||

| AGI / Alamos Gold Inc. | 0.02 | -30.68 | 0.49 | -31.06 | 0.7881 | -0.3473 | |||

| CF / CF Industries Holdings, Inc. | 0.01 | 168.42 | 0.47 | 216.89 | 0.7597 | 0.5207 | |||

| CMC / Commercial Metals Company | 0.01 | -7.84 | 0.46 | -2.13 | 0.7444 | -0.0110 | |||

| ATUSF / Altius Minerals Corporation | 0.02 | 5.69 | 0.45 | 23.42 | 0.7259 | 0.1416 | |||

| NEM / Newmont Corporation | 0.01 | -21.35 | 0.41 | -5.13 | 0.6603 | -0.0313 | |||

| DD / DuPont de Nemours, Inc. | 0.01 | 0.00 | 0.40 | -8.31 | 0.6441 | -0.0531 | |||

| SMG / The Scotts Miracle-Gro Company | 0.01 | 37.21 | 0.39 | 14.75 | 0.6301 | 0.2865 | |||

| US31635A1051 / Fidelity Cash Central Fund | 0.39 | -58.61 | 0.39 | -58.60 | 0.6236 | -0.8741 | |||

| CBT / Cabot Corporation | 0.01 | -53.70 | 0.38 | -58.19 | 0.6071 | -0.8381 | |||

| US31635A3032 / Fidelity Securities Lending Cash Central Fund | 0.37 | -13.32 | 0.37 | -13.30 | 0.5911 | -0.0868 | |||

| DOW / Dow Inc. | 0.01 | -71.08 | 0.34 | -80.94 | 0.5531 | -2.3278 | |||

| HL / Hecla Mining Company | 0.05 | -28.53 | 0.32 | -22.98 | 0.5101 | -0.1485 | |||

| ORLA / Orla Mining Ltd. | 0.03 | -14.06 | 0.27 | -7.53 | 0.4375 | -0.0330 | |||

| MP / MP Materials Corp. | 0.01 | 0.27 | 0.4363 | 0.4363 | |||||

| AA / Alcoa Corporation | 0.01 | 0.00 | 0.22 | -3.07 | 0.3583 | -0.0098 | |||

| GEF / Greif, Inc. | 0.00 | 0.00 | 0.21 | 18.23 | 0.3472 | 0.0552 | |||

| MTA / Metalla Royalty & Streaming Ltd. | 0.06 | 11.11 | 0.21 | 46.85 | 0.3413 | 0.1110 | |||

| OEC / Orion S.A. | 0.01 | 8.13 | 0.14 | -12.58 | 0.2259 | -0.0301 |