Basic Stats

| Portfolio Value | $ 230,481,326 |

| Current Positions | 57 |

Latest Holdings, Performance, AUM (from 13F, 13D)

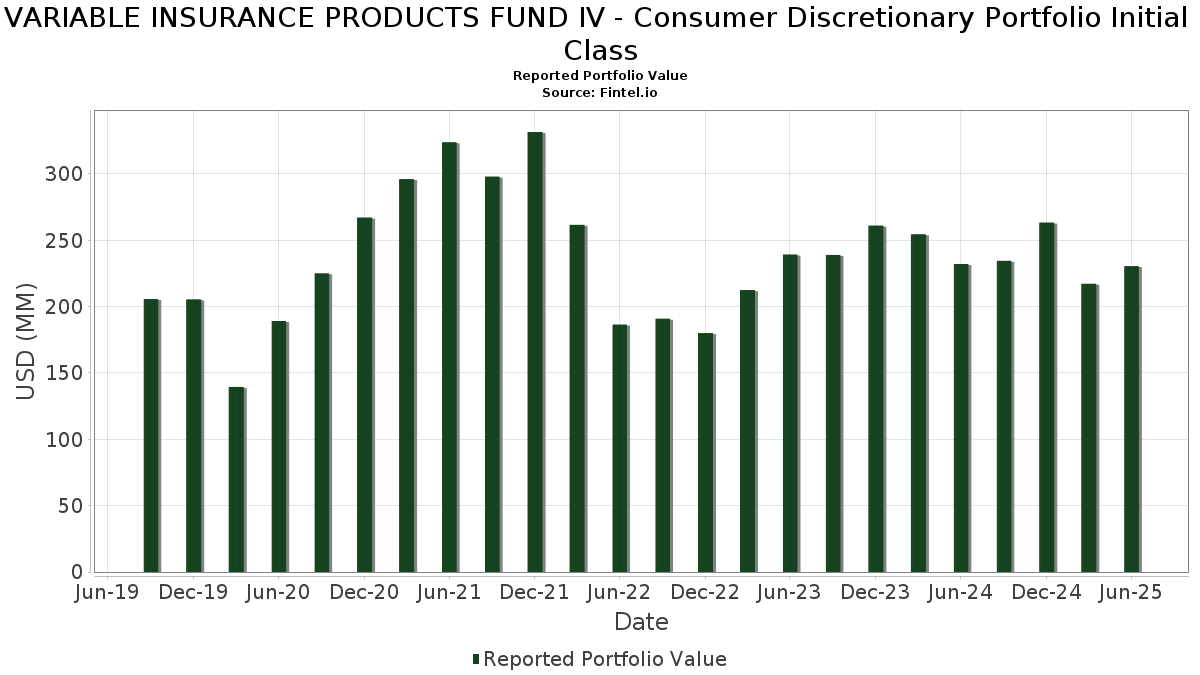

VARIABLE INSURANCE PRODUCTS FUND IV - Consumer Discretionary Portfolio Initial Class has disclosed 57 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 230,481,326 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). VARIABLE INSURANCE PRODUCTS FUND IV - Consumer Discretionary Portfolio Initial Class’s top holdings are Amazon.com, Inc. (US:AMZN) , Tesla, Inc. (US:TSLA) , The Home Depot, Inc. (US:HD) , Lowe's Companies, Inc. (US:LOW) , and The TJX Companies, Inc. (US:TJX) . VARIABLE INSURANCE PRODUCTS FUND IV - Consumer Discretionary Portfolio Initial Class’s new positions include Cavco Industries, Inc. (US:CVCO) , RH (US:RH) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.26 | 57.85 | 25.3874 | 1.2120 | |

| 0.10 | 30.22 | 13.2629 | 1.1792 | |

| 0.08 | 2.06 | 0.9030 | 0.8269 | |

| 0.00 | 1.27 | 0.5586 | 0.5586 | |

| 0.06 | 4.01 | 1.7594 | 0.5453 | |

| 1.28 | 1.28 | 0.5599 | 0.4970 | |

| 0.00 | 0.89 | 0.3898 | 0.3898 | |

| 0.02 | 1.58 | 0.6919 | 0.2952 | |

| 0.04 | 2.20 | 0.9662 | 0.2670 | |

| 0.08 | 5.67 | 2.4866 | 0.2118 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 8.95 | 3.9265 | -0.7418 | |

| 0.01 | 0.41 | 0.1786 | -0.6425 | |

| 0.03 | 9.25 | 4.0595 | -0.5797 | |

| 0.02 | 6.07 | 2.6653 | -0.5616 | |

| 2.52 | 2.52 | 1.1079 | -0.5440 | |

| 0.02 | 1.59 | 0.6976 | -0.3938 | |

| 0.00 | 0.40 | 0.1753 | -0.2966 | |

| 0.01 | 4.23 | 1.8579 | -0.2726 | |

| 0.01 | 1.21 | 0.5296 | -0.2310 | |

| 0.03 | 3.70 | 1.6247 | -0.2238 |

13F and Fund Filings

This form was filed on 2025-08-22 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AMZN / Amazon.com, Inc. | 0.26 | -2.85 | 57.85 | 12.02 | 25.3874 | 1.2120 | |||

| TSLA / Tesla, Inc. | 0.10 | -4.48 | 30.22 | 17.08 | 13.2629 | 1.1792 | |||

| HD / The Home Depot, Inc. | 0.03 | -6.69 | 9.25 | -6.66 | 4.0595 | -0.5797 | |||

| LOW / Lowe's Companies, Inc. | 0.04 | -5.68 | 8.95 | -10.28 | 3.9265 | -0.7418 | |||

| TJX / The TJX Companies, Inc. | 0.05 | 0.71 | 6.45 | 2.11 | 2.8303 | -0.1265 | |||

| MCD / McDonald's Corporation | 0.02 | -5.80 | 6.07 | -11.90 | 2.6653 | -0.5616 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -7.91 | 5.73 | 15.73 | 2.5151 | 0.1968 | |||

| SGI / Somnigroup International Inc. | 0.08 | 2.61 | 5.67 | 16.61 | 2.4866 | 0.2118 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.02 | -7.78 | 5.59 | 7.94 | 2.4509 | 0.0287 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.03 | 1.81 | 5.02 | -0.08 | 2.2016 | -0.1490 | |||

| APTIV PLC / EC (JE00BTDN8H13) | 0.07 | -9.97 | 4.76 | 3.23 | 2.0881 | -0.0697 | |||

| MAR / Marriott International, Inc. | 0.02 | -9.23 | 4.27 | 4.10 | 1.8738 | -0.0462 | |||

| DPZ / Domino's Pizza, Inc. | 0.01 | -5.15 | 4.23 | -6.99 | 1.8579 | -0.2726 | |||

| NKE / NIKE, Inc. | 0.06 | 38.13 | 4.01 | 54.61 | 1.7594 | 0.5453 | |||

| ROST / Ross Stores, Inc. | 0.03 | -6.08 | 3.70 | -6.23 | 1.6247 | -0.2238 | |||

| FND / Floor & Decor Holdings, Inc. | 0.05 | 16.59 | 3.44 | 10.05 | 1.5084 | 0.0464 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.06 | -6.42 | 3.35 | 4.65 | 1.4715 | -0.0285 | |||

| GM / General Motors Company | 0.07 | -9.44 | 3.26 | -5.23 | 1.4302 | -0.1798 | |||

| WSM / Williams-Sonoma, Inc. | 0.02 | -6.46 | 3.12 | -3.35 | 1.3693 | -0.1420 | |||

| TPR / Tapestry, Inc. | 0.04 | -10.67 | 3.10 | 11.41 | 1.3583 | 0.0577 | |||

| MELI / MercadoLibre, Inc. | 0.00 | -6.61 | 2.95 | 25.13 | 1.2960 | 0.1910 | |||

| PHM / PulteGroup, Inc. | 0.03 | 6.69 | 2.74 | 9.42 | 1.2028 | 0.0305 | |||

| QSR / Restaurant Brands International Inc. | 0.04 | 0.00 | 2.67 | -0.49 | 1.1702 | -0.0843 | |||

| GPI / Group 1 Automotive, Inc. | 0.01 | -8.03 | 2.55 | 5.15 | 1.1192 | -0.0162 | |||

| US31635A3032 / Fidelity Securities Lending Cash Central Fund | 2.52 | -28.46 | 2.52 | -28.46 | 1.1079 | -0.5440 | |||

| BLD / TopBuild Corp. | 0.01 | -0.91 | 2.48 | 5.18 | 1.0882 | -0.0152 | |||

| ASO / Academy Sports and Outdoors, Inc. | 0.05 | 6.92 | 2.42 | 5.03 | 1.0636 | -0.0165 | |||

| ATZ / Aritzia Inc. | 0.04 | 0.00 | 2.20 | 47.42 | 0.9662 | 0.2670 | |||

| DECK / Deckers Outdoor Corporation | 0.02 | 0.00 | 2.06 | -7.84 | 0.9034 | -0.1420 | |||

| JHX / James Hardie Industries plc - Depositary Receipt (Common Stock) | 0.08 | 1,024.30 | 2.06 | 1,169.75 | 0.9030 | 0.8269 | |||

| CCL / Carnival Corporation & plc | 0.07 | -11.05 | 1.91 | 28.06 | 0.8392 | 0.1402 | |||

| OLLI / Ollie's Bargain Outlet Holdings, Inc. | 0.01 | -11.88 | 1.70 | -0.18 | 0.7466 | -0.0514 | |||

| SBUX / Starbucks Corporation | 0.02 | -27.01 | 1.59 | -31.83 | 0.6976 | -0.3938 | |||

| DLTR / Dollar Tree, Inc. | 0.02 | 41.01 | 1.58 | 86.07 | 0.6919 | 0.2952 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.01 | -3.84 | 1.57 | 46.54 | 0.6884 | 0.1874 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | -16.45 | 1.47 | 6.66 | 0.6467 | -0.0002 | |||

| RRR / Red Rock Resorts, Inc. | 0.03 | -25.88 | 1.32 | -11.09 | 0.5774 | -0.1153 | |||

| US31635A1051 / Fidelity Cash Central Fund | 1.28 | 850.38 | 1.28 | 851.49 | 0.5599 | 0.4970 | |||

| CVCO / Cavco Industries, Inc. | 0.00 | 1.27 | 0.5586 | 0.5586 | |||||

| PVH / PVH Corp. | 0.02 | -6.18 | 1.24 | -0.40 | 0.5438 | -0.0388 | |||

| CHDN / Churchill Downs Incorporated | 0.01 | -18.32 | 1.21 | -25.74 | 0.5296 | -0.2310 | |||

| ETSY / Etsy, Inc. | 0.02 | -3.68 | 1.18 | 2.43 | 0.5184 | -0.0216 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.01 | 1,325.82 | 1.17 | -10.28 | 0.5132 | -0.0971 | |||

| ARMK / Aramark | 0.03 | 0.00 | 1.08 | 21.35 | 0.4741 | 0.0571 | |||

| RH / RH | 0.00 | 0.89 | 0.3898 | 0.3898 | |||||

| LCII / LCI Industries | 0.01 | 0.00 | 0.81 | 4.27 | 0.3533 | -0.0080 | |||

| CZR / Caesars Entertainment, Inc. | 0.03 | -5.43 | 0.79 | 7.34 | 0.3471 | 0.0023 | |||

| GAP / The Gap, Inc. | 0.03 | -2.55 | 0.75 | 3.16 | 0.3292 | -0.0113 | |||

| PENN / PENN Entertainment, Inc. | 0.04 | -3.13 | 0.72 | 6.21 | 0.3153 | -0.0016 | |||

| SBH / Sally Beauty Holdings, Inc. | 0.07 | 0.00 | 0.67 | 2.61 | 0.2937 | -0.0118 | |||

| CPRI / Capri Holdings Limited | 0.03 | -11.65 | 0.62 | -20.69 | 0.2708 | -0.0937 | |||

| CH1134540470 / On Holding AG | 0.01 | 0.00 | 0.60 | 18.58 | 0.2634 | 0.0263 | |||

| PFGC / Performance Food Group Company | 0.01 | 13.38 | 0.59 | 26.17 | 0.2603 | 0.0401 | |||

| W / Wayfair Inc. | 0.01 | 0.00 | 0.50 | 59.49 | 0.2214 | 0.0735 | |||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.00 | 0.00 | 0.48 | -15.55 | 0.2099 | -0.0550 | |||

| AZEK / The AZEK Company Inc. | 0.01 | -79.13 | 0.41 | -76.85 | 0.1786 | -0.6425 | |||

| LULU / lululemon athletica inc. | 0.00 | -52.79 | 0.40 | -60.38 | 0.1753 | -0.2966 |