Basic Stats

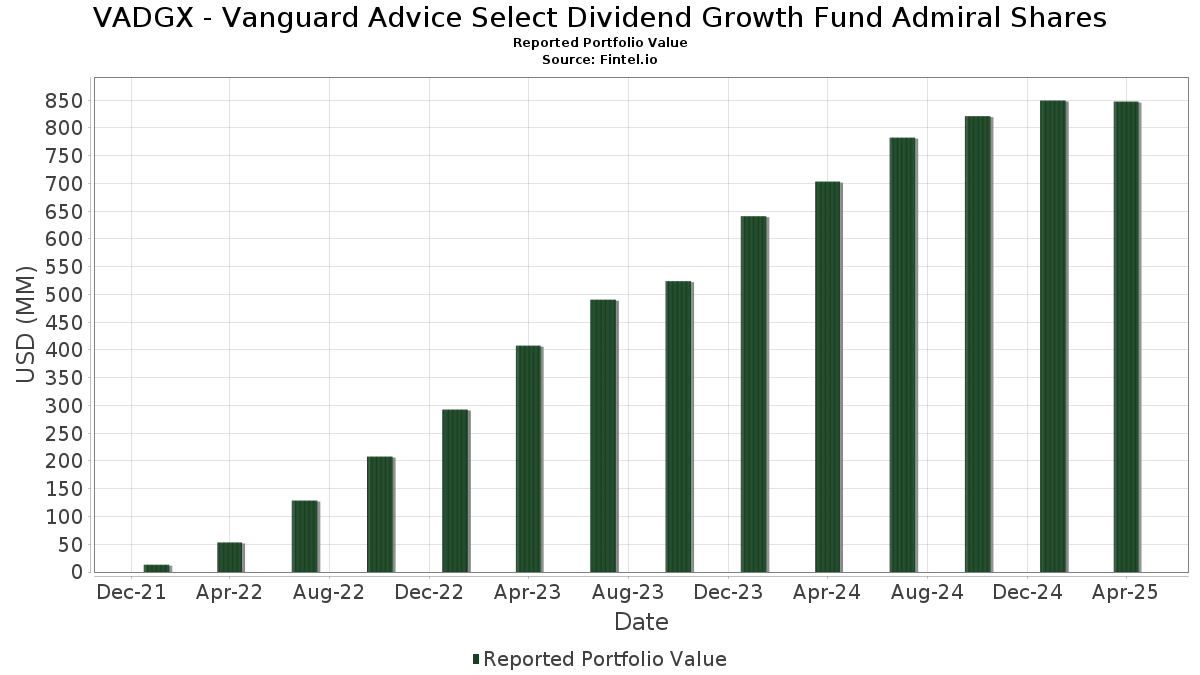

| Portfolio Value | $ 847,533,607 |

| Current Positions | 26 |

Latest Holdings, Performance, AUM (from 13F, 13D)

VADGX - Vanguard Advice Select Dividend Growth Fund Admiral Shares has disclosed 26 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 847,533,607 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). VADGX - Vanguard Advice Select Dividend Growth Fund Admiral Shares’s top holdings are The TJX Companies, Inc. (US:TJX) , Intuit Inc. (US:INTU) , McDonald's Corporation (US:MCD) , Broadcom Inc. (US:AVGO) , and Mastercard Incorporated (US:MA) . VADGX - Vanguard Advice Select Dividend Growth Fund Admiral Shares’s new positions include Broadcom Inc. (US:AVGO) , Eli Lilly and Company (US:LLY) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.21 | 40.01 | 4.7353 | 4.7353 | |

| 0.21 | 21.34 | 2.5259 | 2.5259 | |

| 0.02 | 17.71 | 2.0964 | 2.0964 | |

| 0.52 | 37.61 | 4.4512 | 1.4484 | |

| 0.07 | 44.08 | 5.2164 | 1.4446 | |

| 0.09 | 31.61 | 3.7403 | 0.5269 | |

| 0.24 | 38.80 | 4.5917 | 0.4680 | |

| 0.35 | 45.61 | 5.3977 | 0.3688 | |

| 0.17 | 37.81 | 4.4748 | 0.3396 | |

| 0.07 | 39.72 | 4.7005 | 0.2479 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.14 | 21.61 | 2.5571 | -1.5342 | |

| 0.13 | 37.46 | 4.4336 | -0.6287 | |

| 0.05 | 24.56 | 2.9065 | -0.5513 | |

| 0.05 | 11.54 | 1.3658 | -0.4840 | |

| 0.13 | 40.19 | 4.7564 | -0.3003 | |

| 0.17 | 33.95 | 4.0176 | -0.2987 | |

| 0.05 | 19.73 | 2.3344 | -0.2862 | |

| 0.07 | 34.89 | 4.1292 | -0.2445 | |

| 0.17 | 35.79 | 4.2355 | -0.0892 | |

| 0.09 | 38.84 | 4.5966 | -0.0564 |

13F and Fund Filings

This form was filed on 2025-06-30 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TJX / The TJX Companies, Inc. | 0.35 | 3.38 | 45.61 | 6.61 | 5.3977 | 0.3688 | |||

| INTU / Intuit Inc. | 0.07 | 31.68 | 44.08 | 37.36 | 5.2164 | 1.4446 | |||

| MCD / McDonald's Corporation | 0.13 | -15.62 | 40.19 | -6.58 | 4.7564 | -0.3003 | |||

| AVGO / Broadcom Inc. | 0.21 | 40.01 | 4.7353 | 4.7353 | |||||

| MA / Mastercard Incorporated | 0.07 | 6.26 | 39.72 | 4.85 | 4.7005 | 0.2479 | |||

| LIN / Linde plc | 0.09 | -3.42 | 38.84 | -1.88 | 4.5966 | -0.0564 | |||

| TXN / Texas Instruments Incorporated | 0.24 | 27.57 | 38.80 | 10.60 | 4.5917 | 0.4680 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.17 | 3.38 | 37.81 | 7.48 | 4.4748 | 0.3396 | |||

| MSFT / Microsoft Corporation | 0.10 | 9.09 | 37.80 | 3.88 | 4.4740 | 0.1964 | |||

| KO / The Coca-Cola Company | 0.52 | 28.82 | 37.61 | 47.23 | 4.4512 | 1.4484 | |||

| ACN / Accenture plc | 0.13 | 11.94 | 37.46 | -13.01 | 4.4336 | -0.6287 | |||

| HON / Honeywell International Inc. | 0.17 | 3.38 | 35.79 | -2.73 | 4.2355 | -0.0892 | |||

| SPGI / S&P Global Inc. | 0.07 | -2.23 | 34.89 | -6.23 | 4.1292 | -0.2445 | |||

| DHR / Danaher Corporation | 0.17 | 3.31 | 33.95 | -7.55 | 4.0176 | -0.2987 | |||

| PG / The Procter & Gamble Company | 0.21 | 0.37 | 33.67 | -1.69 | 3.9846 | -0.0412 | |||

| AAPL / Apple Inc. | 0.15 | 10.58 | 32.04 | -0.44 | 3.7912 | 0.0093 | |||

| V / Visa Inc. | 0.09 | 14.37 | 31.61 | 15.61 | 3.7403 | 0.5269 | |||

| SYK / Stryker Corporation | 0.08 | 3.31 | 30.99 | -1.28 | 3.6674 | -0.0224 | |||

| AXP / American Express Company | 0.11 | 22.56 | 30.32 | 2.86 | 3.5880 | 0.1233 | |||

| CB / Chubb Limited | 0.10 | -0.91 | 29.85 | 4.26 | 3.5327 | 0.1674 | |||

| NOC / Northrop Grumman Corporation | 0.05 | -16.38 | 24.56 | -16.51 | 2.9065 | -0.5513 | |||

| GOOGL / Alphabet Inc. | 0.14 | -20.25 | 21.61 | -37.92 | 2.5571 | -1.5342 | |||

| Vanguard Market Liquidity Fund / STIV (N/A) | 0.21 | 21.34 | 2.5259 | 2.5259 | |||||

| UNH / UnitedHealth Group Incorporated | 0.05 | 16.66 | 19.73 | -11.52 | 2.3344 | -0.2862 | |||

| LLY / Eli Lilly and Company | 0.02 | 17.71 | 2.0964 | 2.0964 | |||||

| UNP / Union Pacific Corporation | 0.05 | -15.74 | 11.54 | -26.66 | 1.3658 | -0.4840 |