Basic Stats

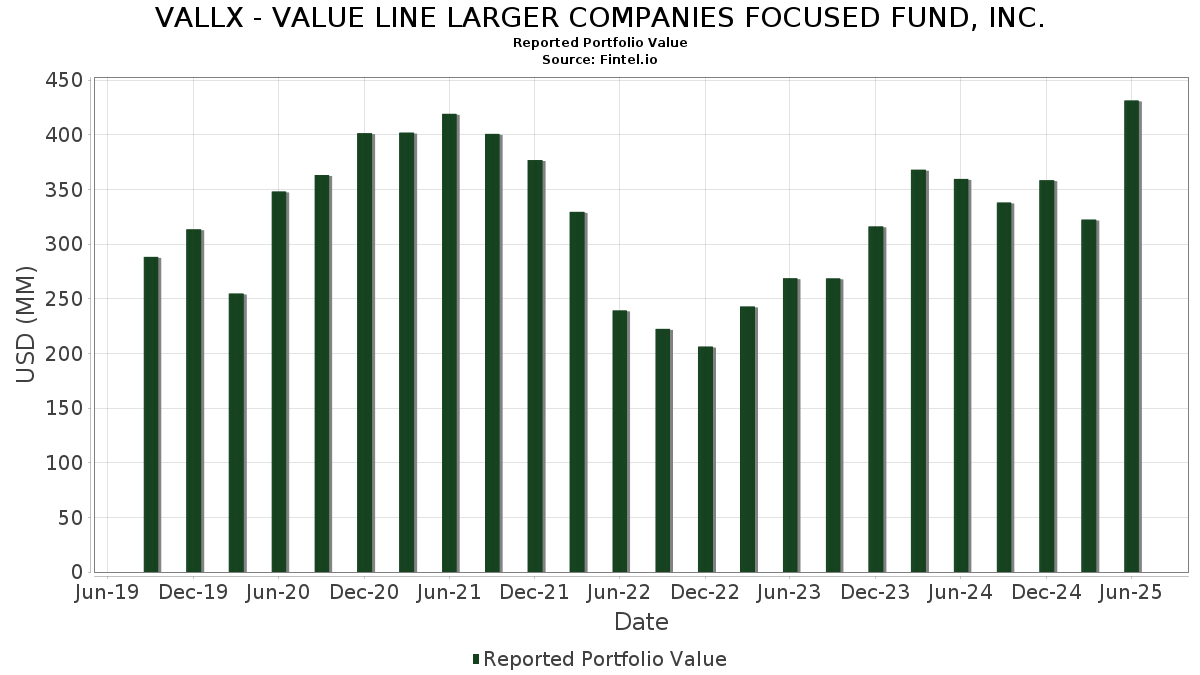

| Portfolio Value | $ 431,306,284 |

| Current Positions | 34 |

Latest Holdings, Performance, AUM (from 13F, 13D)

VALLX - VALUE LINE LARGER COMPANIES FOCUSED FUND, INC. has disclosed 34 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 431,306,284 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). VALLX - VALUE LINE LARGER COMPANIES FOCUSED FUND, INC.’s top holdings are NVIDIA Corporation (US:NVDA) , Meta Platforms, Inc. (US:META) , Netflix, Inc. (US:NFLX) , Robinhood Markets, Inc. (US:HOOD) , and Uber Technologies, Inc. (US:UBER) . VALLX - VALUE LINE LARGER COMPANIES FOCUSED FUND, INC.’s new positions include Arm Holdings plc - Depositary Receipt (Common Stock) (US:ARM) , Madrigal Pharmaceuticals, Inc. (US:MDGL) , Eli Lilly and Company (US:LLY) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.06 | 9.70 | 2.3040 | 2.3040 | |

| 10.33 | 10.33 | 2.4531 | 2.1464 | |

| 0.04 | 13.65 | 3.2415 | 2.0036 | |

| 0.05 | 14.33 | 3.4031 | 1.5258 | |

| 0.21 | 20.13 | 4.7793 | 1.3442 | |

| 0.02 | 5.45 | 1.2933 | 1.2933 | |

| 0.05 | 17.52 | 4.1606 | 1.1567 | |

| 0.26 | 41.08 | 9.7525 | 0.9761 | |

| 0.12 | 17.74 | 4.2112 | 0.8833 | |

| 0.00 | 3.51 | 0.8328 | 0.8328 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.20 | 19.13 | 4.5410 | -2.0399 | |

| 0.01 | 6.54 | 1.5538 | -1.2397 | |

| 0.04 | 12.78 | 3.0346 | -1.1132 | |

| 0.03 | 3.71 | 0.8808 | -1.1111 | |

| 0.00 | 6.37 | 1.5119 | -0.8556 | |

| 0.08 | 17.55 | 4.1670 | -0.6922 | |

| 0.03 | 8.73 | 2.0717 | -0.6865 | |

| 0.18 | 9.46 | 2.2457 | -0.5857 | |

| 0.02 | 5.52 | 1.3105 | -0.5805 | |

| 0.06 | 6.46 | 1.5336 | -0.3974 |

13F and Fund Filings

This form was filed on 2025-08-21 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.26 | 0.00 | 41.08 | 45.78 | 9.7525 | 0.9761 | |||

| META / Meta Platforms, Inc. | 0.05 | 2.13 | 35.43 | 30.79 | 8.4113 | -0.0257 | |||

| NFLX / Netflix, Inc. | 0.02 | 0.00 | 21.43 | 43.61 | 5.0869 | 0.4399 | |||

| HOOD / Robinhood Markets, Inc. | 0.21 | -18.87 | 20.13 | 82.52 | 4.7793 | 1.3442 | |||

| UBER / Uber Technologies, Inc. | 0.20 | -29.31 | 19.13 | -9.48 | 4.5410 | -2.0399 | |||

| AMD / Advanced Micro Devices, Inc. | 0.12 | 20.19 | 17.74 | 66.01 | 4.2112 | 0.8833 | |||

| AMZN / Amazon.com, Inc. | 0.08 | -2.44 | 17.55 | 12.50 | 4.1670 | -0.6922 | |||

| COIN / Coinbase Global, Inc. | 0.05 | -10.71 | 17.52 | 81.71 | 4.1606 | 1.1567 | |||

| MSFT / Microsoft Corporation | 0.03 | 6.67 | 15.92 | 41.35 | 3.7790 | 0.2715 | |||

| EXEL / Exelixis, Inc. | 0.34 | 7.81 | 15.21 | 28.70 | 3.6102 | -0.0695 | |||

| GOOGL / Alphabet Inc. | 0.09 | 21.13 | 15.16 | 38.04 | 3.5983 | 0.1786 | |||

| MSTR / Strategy Inc | 0.04 | -14.29 | 14.55 | 20.19 | 3.4550 | -0.3159 | |||

| AVGO / Broadcom Inc. | 0.05 | 44.44 | 14.33 | 137.81 | 3.4031 | 1.5258 | |||

| APP / AppLovin Corporation | 0.04 | 160.00 | 13.65 | 243.56 | 3.2415 | 2.0036 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.03 | -16.13 | 13.24 | 21.16 | 3.1439 | -0.2603 | |||

| V / Visa Inc. | 0.04 | -5.26 | 12.78 | -4.02 | 3.0346 | -1.1132 | |||

| TSLA / Tesla, Inc. | 0.04 | 0.00 | 12.07 | 22.57 | 2.8659 | -0.2014 | |||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 10.33 | 949.23 | 10.33 | 950.00 | 2.4531 | 2.1464 | |||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | 0.06 | 9.70 | 2.3040 | 2.3040 | |||||

| EXAS / Exact Sciences Corporation | 0.18 | -15.24 | 9.46 | 4.05 | 2.2457 | -0.5857 | |||

| DKNG / DraftKings Inc. | 0.21 | 31.25 | 9.01 | 69.51 | 2.1384 | 0.4834 | |||

| CRM / Salesforce, Inc. | 0.03 | -3.03 | 8.73 | -1.46 | 2.0717 | -0.6865 | |||

| ROKU / Roku, Inc. | 0.10 | 26.67 | 8.35 | 58.04 | 1.9823 | 0.3369 | |||

| NOW / ServiceNow, Inc. | 0.01 | -12.50 | 7.20 | 12.98 | 1.7086 | -0.2751 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | -20.54 | 6.54 | -27.04 | 1.5538 | -1.2397 | |||

| SHOP / Shopify Inc. | 0.06 | -13.85 | 6.46 | 4.18 | 1.5336 | -0.3974 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -33.33 | 6.37 | -16.22 | 1.5119 | -0.8556 | |||

| WDAY / Workday, Inc. | 0.02 | -11.54 | 5.52 | -9.08 | 1.3105 | -0.5805 | |||

| MDGL / Madrigal Pharmaceuticals, Inc. | 0.02 | 5.45 | 1.2933 | 1.2933 | |||||

| RIVN / Rivian Automotive, Inc. | 0.38 | -5.00 | 5.22 | 4.84 | 1.2396 | -0.3114 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 4.84 | 328.89 | 4.84 | 329.08 | 1.1492 | 0.7977 | |||

| SNAP / Snap Inc. | 0.46 | 17.95 | 4.00 | 17.70 | 0.9491 | -0.1089 | |||

| FANG / Diamondback Energy, Inc. | 0.03 | -32.50 | 3.71 | -42.00 | 0.8808 | -1.1111 | |||

| LLY / Eli Lilly and Company | 0.00 | 3.51 | 0.8328 | 0.8328 |