Basic Stats

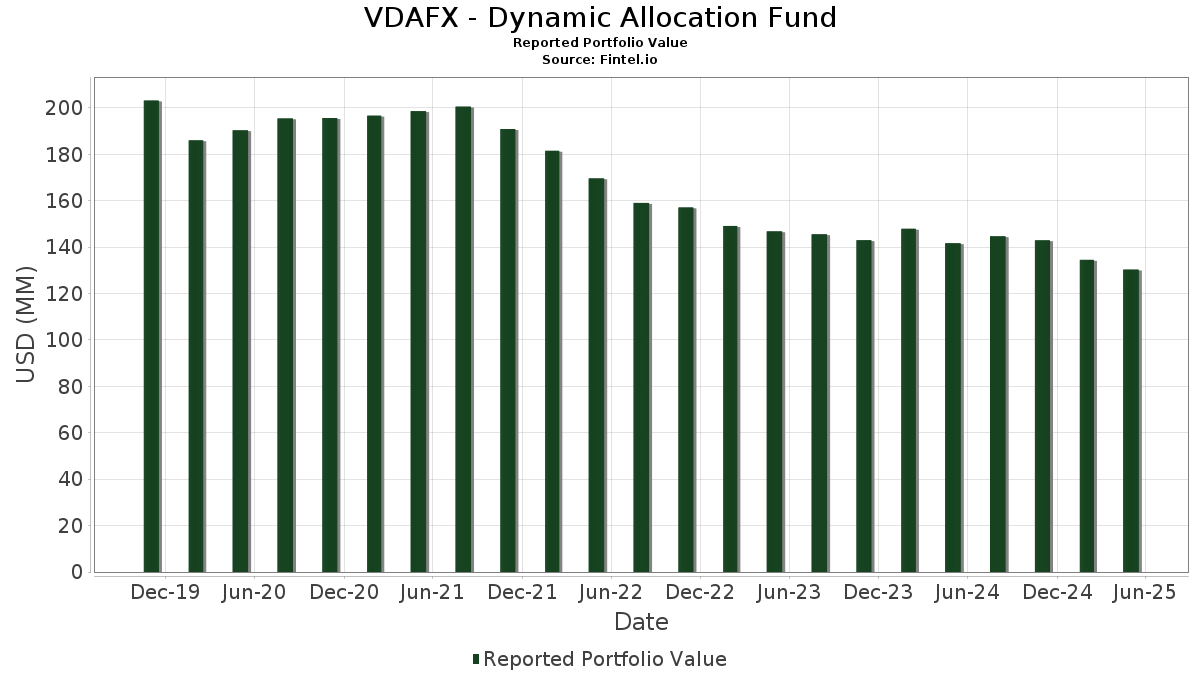

| Portfolio Value | $ 130,313,659 |

| Current Positions | 55 |

Latest Holdings, Performance, AUM (from 13F, 13D)

VDAFX - Dynamic Allocation Fund has disclosed 55 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 130,313,659 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). VDAFX - Dynamic Allocation Fund’s top holdings are VALIC Company I - Core Bond Fund (US:US91915R5413) , VALIC I Stock Index Fund (US:US91915R8482) , VALIC Co. I Systematic Value Fund (US:US91915R6999) , VALIC Co. I Dividend Value Fund (US:US91915R8227) , and VALIC I - Growth & Income Fund (US:US91915R5090) . VDAFX - Dynamic Allocation Fund’s new positions include US TNOTE 3.875% DUE 08/15/2033 (US:US91282CHT18) , US TREASURY NOTE 4.5% 11-15-33 (US:US91282CJJ18) , United States Treasury Note/Bond (US:US91282CHC82) , United States Treasury Note/Bond (US:US91282CFF32) , and United States Treasury Note/Bond (US:US91282CFV81) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.14 | 0.8720 | 0.6194 | ||

| 0.75 | 0.5742 | 0.5742 | ||

| 0.46 | 0.3556 | 0.3556 | ||

| 0.31 | 3.53 | 2.7009 | 0.2731 | |

| 0.25 | 0.1898 | 0.1898 | ||

| 0.26 | 2.32 | 1.7775 | 0.1477 | |

| 0.07 | 1.80 | 1.3760 | 0.1109 | |

| 0.29 | 4.98 | 3.8058 | 0.1043 | |

| 0.17 | 2.32 | 1.7754 | 0.1020 | |

| 0.30 | 5.35 | 4.0952 | 0.0900 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.13 | 0.1018 | -1.2826 | ||

| 4.71 | 4.71 | 3.6008 | -0.3694 | |

| -0.47 | -0.47 | -0.3595 | -0.3595 | |

| -0.42 | -0.42 | -0.3197 | -0.3197 | |

| -0.39 | -0.2990 | -0.2990 | ||

| -0.11 | -0.11 | -0.0841 | -0.0841 | |

| -0.06 | -0.06 | -0.0463 | -0.0463 | |

| 0.27 | 4.47 | 3.4207 | -0.0440 | |

| 0.06 | 0.63 | 0.4799 | -0.0338 | |

| 0.24 | 7.88 | 6.0238 | -0.0324 |

13F and Fund Filings

This form was filed on 2025-07-28 for the reporting period 2025-05-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US91915R5413 / VALIC Company I - Core Bond Fund | 1.71 | 0.93 | 16.55 | -3.27 | 12.6619 | 0.0128 | |||

| US91915R8482 / VALIC I Stock Index Fund | 0.24 | -0.07 | 14.04 | -3.31 | 10.7414 | 0.0074 | |||

| US91915R6999 / VALIC Co. I Systematic Value Fund | 0.57 | 3.35 | 8.38 | -3.02 | 6.4124 | 0.0239 | |||

| US91915R8227 / VALIC Co. I Dividend Value Fund | 0.68 | 3.43 | 8.31 | -2.95 | 6.3571 | 0.0270 | |||

| US91915R5090 / VALIC I - Growth & Income Fund | 0.24 | 1.92 | 7.88 | -3.89 | 6.0238 | -0.0324 | |||

| US91915R5660 / VALIC Company I - Capital Appreciation Fund | 0.29 | -0.85 | 5.97 | -2.75 | 4.5658 | 0.0288 | |||

| US91915R4754 / VALIC Company I - US Socially Responsible Fund | 0.30 | 17.44 | 5.35 | -1.20 | 4.0952 | 0.0900 | |||

| US91915R3012 / Valic Co I-Government Securities Fund | 0.54 | -0.35 | 5.02 | -3.59 | 3.8428 | -0.0087 | |||

| US91915R6163 / Valic I VALIC Growth Fund | 0.29 | 0.53 | 4.98 | -0.66 | 3.8058 | 0.1043 | |||

| US0186167484 / AB Fixed Income Shares, Inc. - Government Money Market Portfolio | 4.71 | -12.36 | 4.71 | -12.36 | 3.6008 | -0.3694 | |||

| US91915R7237 / VALIC I - Large Capital Growth Fund | 0.27 | 23.34 | 4.47 | -4.59 | 3.4207 | -0.0440 | |||

| US91915R7641 / VALIC I - Blue Chip Growth Fund | 0.20 | 6.27 | 3.69 | -1.55 | 2.8220 | 0.0521 | |||

| US91915R6817 / VALIC Co. I International Value Fund | 0.31 | 7.69 | 3.53 | 7.52 | 2.7009 | 0.2731 | |||

| US91282CHT18 / US TNOTE 3.875% DUE 08/15/2033 | 3.14 | -0.70 | 2.4018 | 0.0644 | |||||

| U.S. Treasury Notes / DBT (US91282CJZ59) | 2.60 | -0.95 | 1.9863 | 0.0487 | |||||

| U.S. Treasury Notes / DBT (US91282CKQ32) | 2.58 | -1.11 | 1.9759 | 0.0450 | |||||

| U.S. Treasury Notes / DBT (US91282CLF67) | 2.39 | -1.20 | 1.8269 | 0.0398 | |||||

| US91915R6080 / VALIC I - International Equities Fund | 0.26 | 1.89 | 2.32 | 5.35 | 1.7775 | 0.1477 | |||

| US91915R8144 / VALIC I International Growth Fund | 0.17 | -2.80 | 2.32 | 2.52 | 1.7754 | 0.1020 | |||

| US91282CJJ18 / US TREASURY NOTE 4.5% 11-15-33 | 1.99 | -0.85 | 1.5198 | 0.0383 | |||||

| US91915R8557 / VALIC Co. I International Socially Responsible Fund | 0.07 | 0.76 | 1.80 | 5.14 | 1.3760 | 0.1109 | |||

| US91282CHC82 / United States Treasury Note/Bond | 1.67 | -0.54 | 1.2751 | 0.0363 | |||||

| US91915R7153 / VALIC I - Mid Cap Strategic Growth Fund | 0.08 | -2.60 | 1.66 | -0.42 | 1.2666 | 0.0380 | |||

| US91282CFF32 / United States Treasury Note/Bond | 1.52 | -0.13 | 1.1597 | 0.0373 | |||||

| US91915R7310 / VALIC I - Inflation Protected Fund | 0.17 | -1.60 | 1.44 | -3.75 | 1.1013 | -0.0041 | |||

| US91915R5900 / VALIC I - Global Real Estate Fund | 0.21 | -1.42 | 1.44 | -1.44 | 1.0986 | 0.0218 | |||

| US91915R5173 / VALIC Company I - Mid Cap Value Fund | 0.09 | 7.02 | 1.42 | -5.03 | 1.0828 | -0.0186 | |||

| US91915R8060 / VALIC I - Mid Cap Index Fund | 0.05 | 11.75 | 1.28 | -5.74 | 0.9812 | -0.0242 | |||

| US91282CFV81 / United States Treasury Note/Bond | 1.25 | -0.48 | 0.9533 | 0.0279 | |||||

| U.S. Treasury Notes / DBT (US91282CLW90) | 1.14 | 234.31 | 0.8720 | 0.6194 | |||||

| US91915R5330 / VALIC Company I - High Yield Bond Fund | 0.13 | 3.45 | 0.93 | -2.61 | 0.7141 | 0.0058 | |||

| US91915R4671 / VALIC Company I - Small Cap Growth Fund | 0.06 | -2.67 | 0.91 | -5.22 | 0.6942 | -0.0134 | |||

| US91282CGM73 / United States Treasury Note/Bond | 0.88 | -0.56 | 0.6753 | 0.0195 | |||||

| U.S. Treasury Notes / DBT (US91282CMM00) | 0.75 | 0.5742 | 0.5742 | ||||||

| US91915R6320 / Valic Co I-Small Cap Special Values Fund | 0.06 | 8.02 | 0.63 | -9.78 | 0.4799 | -0.0338 | |||

| US91915R8631 / VALIC I - Small Cap Index Fund | 0.03 | 1.72 | 0.50 | -7.28 | 0.3807 | -0.0157 | |||

| AO89115 ALLIANCE / DE (000000000) | 0.46 | 0.3556 | 0.3556 | ||||||

| US91915R7070 / VALIC I - International Government Bond Fund | 0.04 | -3.63 | 0.41 | -1.46 | 0.3098 | 0.0058 | |||

| US91915R5256 / VALIC Company I - International Opportunities Fund | 0.02 | -0.09 | 0.36 | 8.21 | 0.2729 | 0.0296 | |||

| US91915R6734 / VALIC I - Emerging Economies Fund | 0.05 | 0.64 | 0.30 | 3.07 | 0.2311 | 0.0142 | |||

| AO87023 ALLIANCE / DE (000000000) | 0.25 | 0.1898 | 0.1898 | ||||||

| US91915R4838 / VALIC Company I - Small Cap Value Fund | 0.02 | 5.27 | 0.21 | -9.01 | 0.1628 | -0.0097 | |||

| US91282CEP23 / WI TREASURY N/B REGD 2.87500000 | 0.13 | -92.90 | 0.1018 | -1.2826 | |||||

| AO89353 ALLIANCE / DE (000000000) | 0.05 | 0.0395 | 0.0395 | ||||||

| AO84615 ALLIANCE / DE (000000000) | 0.03 | 0.0251 | 0.0251 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0.03 | 0.0251 | 0.0251 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.02 | 0.0190 | 0.0190 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.02 | 0.0156 | 0.0156 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.02 | 0.0156 | 0.0156 | ||||||

| S+P500 EMINI FUT JUN25 / DE (000000000) | 0.02 | 0.0153 | 0.0153 | ||||||

| SWAP UBS BOC / STIV (000000000) | Short | -0.06 | -0.06 | -0.0463 | -0.0463 | ||||

| SWAP JP MORGAN BOC / STIV (000000000) | Short | -0.11 | -0.11 | -0.0841 | -0.0841 | ||||

| S+P500 EMINI FUT JUN25 / DE (000000000) | -0.39 | -0.2990 | -0.2990 | ||||||

| SWAP GOLDMAN SACHS BOC / STIV (000000000) | Short | -0.42 | -0.42 | -0.3197 | -0.3197 | ||||

| SWAP CITIBANK BOC / STIV (000000000) | Short | -0.47 | -0.47 | -0.3595 | -0.3595 |