Basic Stats

| Portfolio Value | $ 15,207,000 |

| Current Positions | 26 |

Latest Holdings, Performance, AUM (from 13F, 13D)

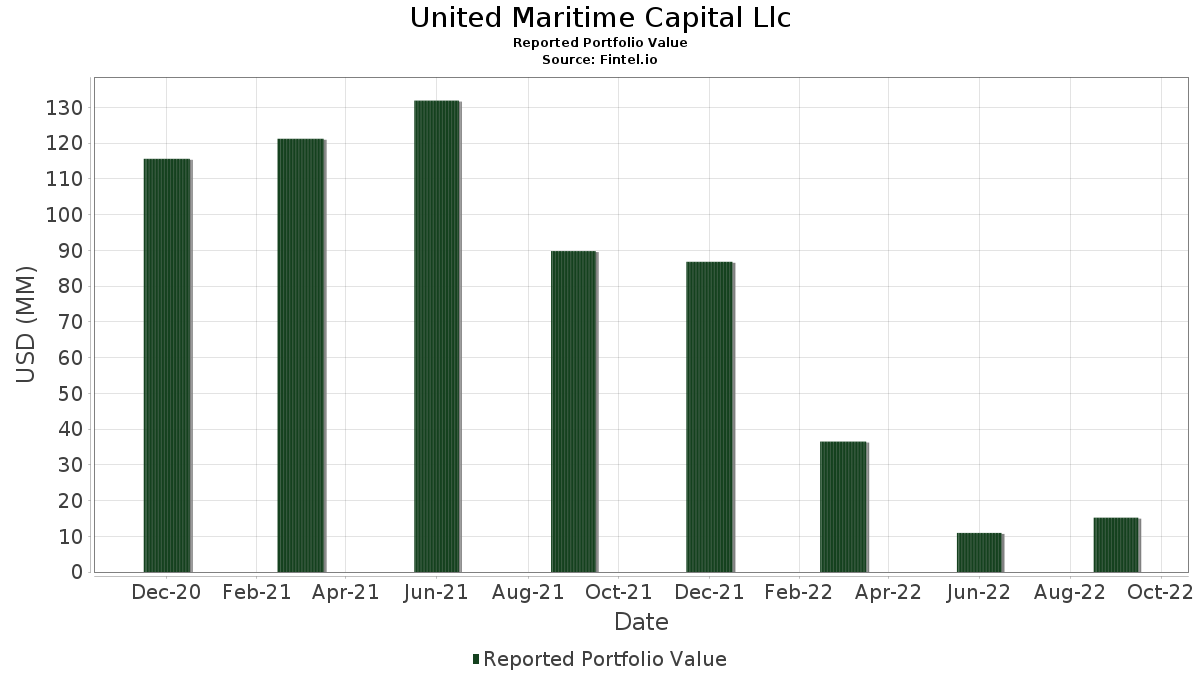

United Maritime Capital Llc has disclosed 26 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 15,207,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). United Maritime Capital Llc’s top holdings are Amazon.com, Inc. (US:AMZN) , MercadoLibre, Inc. (US:MELI) , Apple Inc. (US:AAPL) , SPDR S&P 500 ETF (US:SPY) , and ProShares Trust - ProShares UltraPro QQQ (US:TQQQ) . United Maritime Capital Llc’s new positions include AT&T Inc. (US:T) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 1.46 | 9.6008 | 7.7270 | |

| 0.03 | 0.98 | 6.4181 | 6.4181 | |

| 0.00 | 2.02 | 13.2768 | 4.9038 | |

| 0.03 | 3.81 | 25.0608 | 4.0919 | |

| 0.01 | 0.82 | 5.3988 | 3.0039 | |

| 0.02 | 0.22 | 1.4467 | 1.4467 | |

| 0.02 | 0.17 | 1.1376 | 1.1376 | |

| 0.01 | 0.15 | 1.0061 | 1.0061 | |

| 0.01 | 0.13 | 0.8680 | 0.8680 | |

| 0.01 | 0.08 | 0.4998 | 0.4998 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -6.2980 | ||

| 0.00 | 1.15 | 7.5886 | -6.2048 | |

| 0.00 | 0.00 | -2.5503 | ||

| 0.00 | 0.00 | -2.4040 | ||

| 0.00 | 0.00 | -2.3492 | ||

| 0.01 | 0.34 | 2.2161 | -1.2117 | |

| 0.05 | 1.05 | 6.9179 | -1.1900 | |

| 0.00 | 0.29 | 1.9136 | -1.1760 | |

| 0.00 | 0.00 | -1.1335 | ||

| 0.00 | 0.34 | 2.2687 | -0.9946 |

13F and Fund Filings

This form was filed on 2022-11-10 for the reporting period 2022-09-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.