Basic Stats

| Portfolio Value | $ 835,349,130 |

| Current Positions | 138 |

Latest Holdings, Performance, AUM (from 13F, 13D)

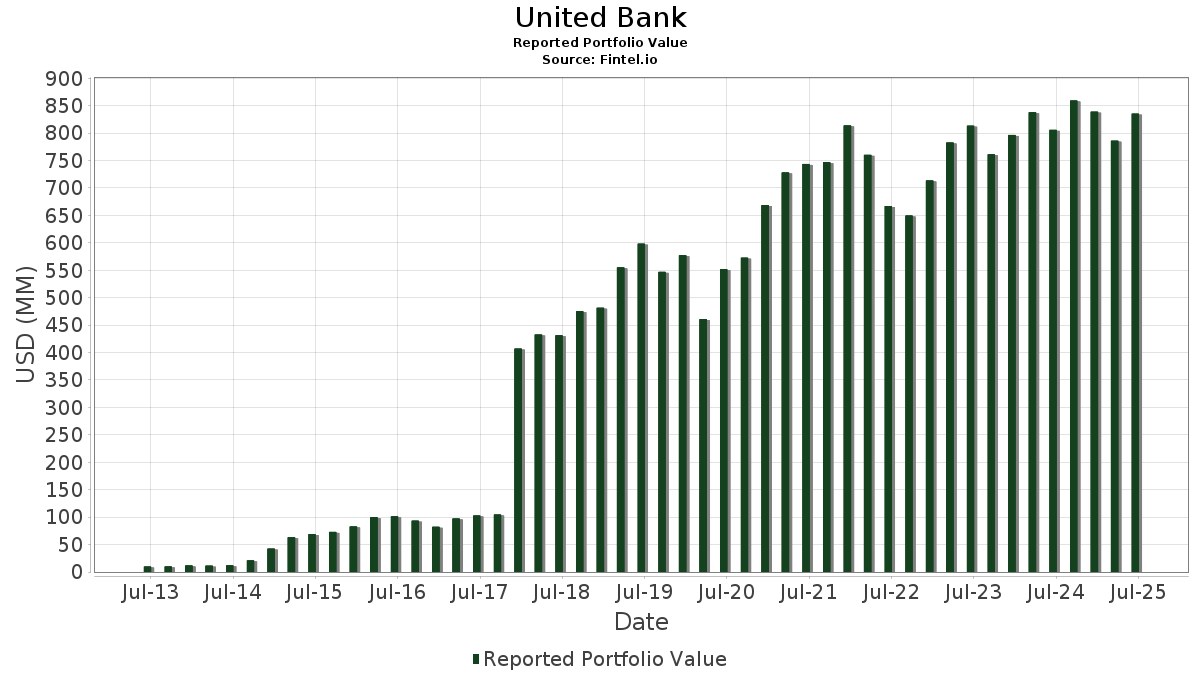

United Bank has disclosed 138 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 835,349,130 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). United Bank’s top holdings are Hubbell Incorporated (US:HUBB) , iShares, Inc. - iShares MSCI Emerging Markets ex China ETF (US:EMXC) , iShares Trust - iShares Core S&P Small-Cap ETF (US:IJR) , Microsoft Corporation (US:MSFT) , and iShares Trust - iShares Core U.S. Aggregate Bond ETF (US:AGG) . United Bank’s new positions include GE Vernova Inc. (US:GEV) , Capital One Financial Corporation (US:COF) , Genelux Corporation (US:GNLX) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.30 | 15.92 | 1.9053 | 0.1082 | |

| 0.01 | 2.55 | 0.3050 | 0.0406 | |

| 0.00 | 0.31 | 0.0375 | 0.0375 | |

| 0.00 | 0.61 | 0.0315 | 0.0315 | |

| 0.00 | 0.22 | 0.0260 | 0.0260 | |

| 0.00 | 0.33 | 0.0169 | 0.0169 | |

| 0.00 | 0.23 | 0.0119 | 0.0119 | |

| 0.00 | 0.22 | 0.0115 | 0.0115 | |

| 0.00 | 0.22 | 0.0113 | 0.0113 | |

| 0.00 | 0.22 | 0.0113 | 0.0113 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.29 | 117.14 | 6.0088 | -6.0658 | |

| 0.40 | 43.51 | 2.2321 | -3.0290 | |

| 0.75 | 47.23 | 2.4225 | -2.8495 | |

| 0.31 | 31.13 | 1.5968 | -2.3411 | |

| 0.08 | 38.70 | 1.9849 | -1.8198 | |

| 0.10 | 28.87 | 1.4809 | -1.6538 | |

| 0.12 | 16.48 | 0.8452 | -1.5366 | |

| 0.05 | 13.77 | 0.7062 | -1.2388 | |

| 0.09 | 14.11 | 0.7239 | -1.2319 | |

| 0.06 | 14.73 | 0.7557 | -1.1997 |

13F and Fund Filings

This form was filed on 2025-07-18 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| HUBB / Hubbell Incorporated | 0.29 | 0.00 | 117.14 | 23.42 | 6.0088 | -6.0658 | |||

| EMXC / iShares, Inc. - iShares MSCI Emerging Markets ex China ETF | 0.75 | -0.57 | 47.23 | 13.96 | 2.4225 | -2.8495 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.40 | 0.68 | 43.51 | 5.22 | 2.2321 | -3.0290 | |||

| MSFT / Microsoft Corporation | 0.08 | -2.35 | 38.70 | 29.39 | 1.9849 | -1.8198 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.31 | 0.28 | 31.13 | 0.57 | 1.5968 | -2.3411 | |||

| JPM / JPMorgan Chase & Co. | 0.10 | -0.86 | 28.87 | 17.17 | 1.4809 | -1.6538 | |||

| AAPL / Apple Inc. | 0.14 | -3.69 | 28.17 | -11.04 | 3.3720 | -0.6562 | |||

| UBSI / United Bankshares, Inc. | 0.71 | 0.18 | 25.97 | 5.27 | 3.1093 | -0.0296 | |||

| IRM / Iron Mountain Incorporated | 0.18 | -3.81 | 18.57 | 14.68 | 0.9524 | -1.1074 | |||

| CSCO / Cisco Systems, Inc. | 0.25 | -1.87 | 17.33 | 10.33 | 0.8889 | -1.1093 | |||

| CVX / Chevron Corporation | 0.12 | 2.82 | 16.48 | -11.99 | 0.8452 | -1.5366 | |||

| GLW / Corning Incorporated | 0.30 | -1.92 | 15.92 | 12.67 | 1.9053 | 0.1082 | |||

| ABT / Abbott Laboratories | 0.12 | -2.41 | 15.65 | 0.06 | 0.8030 | -1.1874 | |||

| WM / Waste Management, Inc. | 0.06 | -3.03 | 14.73 | -4.16 | 0.7557 | -1.1997 | |||

| PG / The Procter & Gamble Company | 0.09 | -1.81 | 14.11 | -8.20 | 0.7239 | -1.2319 | |||

| TXN / Texas Instruments Incorporated | 0.07 | -0.92 | 14.09 | 14.48 | 0.7228 | -0.8432 | |||

| MCD / McDonald's Corporation | 0.05 | -3.73 | 13.77 | -9.95 | 0.7062 | -1.2388 | |||

| DOV / Dover Corporation | 0.07 | -1.64 | 13.57 | 2.59 | 0.6959 | -0.9865 | |||

| GD / General Dynamics Corporation | 0.05 | -1.28 | 13.35 | 5.63 | 0.6848 | -0.9230 | |||

| BLK / BlackRock, Inc. | 0.01 | 0.85 | 13.29 | 11.80 | 0.6817 | -0.8305 | |||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.12 | -0.86 | 12.97 | 17.58 | 0.6652 | -0.7378 | |||

| AMGN / Amgen Inc. | 0.05 | -1.44 | 12.88 | -11.67 | 0.6607 | -1.1944 | |||

| APD / Air Products and Chemicals, Inc. | 0.04 | -0.06 | 12.37 | -4.42 | 0.6345 | -1.0119 | |||

| JNJ / Johnson & Johnson | 0.08 | -1.50 | 12.35 | -9.27 | 0.6334 | -1.0981 | |||

| CMI / Cummins Inc. | 0.04 | 2.47 | 12.12 | 7.07 | 0.6218 | -0.8186 | |||

| EOG / EOG Resources, Inc. | 0.10 | -0.95 | 11.96 | -7.61 | 0.6133 | -1.0332 | |||

| HON / Honeywell International Inc. | 0.05 | 7.46 | 11.73 | 18.18 | 0.6018 | -0.6611 | |||

| CME / CME Group Inc. | 0.04 | 9.76 | 10.28 | 14.03 | 0.5276 | -0.6198 | |||

| AFL / Aflac Incorporated | 0.09 | 7.05 | 9.44 | 1.54 | 0.4841 | -0.6984 | |||

| PEP / PepsiCo, Inc. | 0.07 | 12.38 | 9.39 | -1.03 | 0.4816 | -0.7253 | |||

| HSY / The Hershey Company | 0.06 | 12.41 | 9.37 | 9.07 | 0.4804 | -0.6120 | |||

| LMT / Lockheed Martin Corporation | 0.02 | 9.58 | 9.26 | 13.61 | 0.4752 | -0.5621 | |||

| GILD / Gilead Sciences, Inc. | 0.08 | 9.00 | 9.22 | 7.85 | 0.4731 | -0.6148 | |||

| AWK / American Water Works Company, Inc. | 0.07 | 10.16 | 9.10 | 3.88 | 1.0898 | -0.0251 | |||

| ITW / Illinois Tool Works Inc. | 0.04 | 7.98 | 8.99 | 7.65 | 0.4612 | -0.6013 | |||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0.03 | -2.49 | 8.42 | 5.51 | 0.4321 | -0.5837 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.08 | 0.18 | 7.05 | -1.47 | 0.3615 | -0.5483 | |||

| XOM / Exxon Mobil Corporation | 0.06 | -8.36 | 6.45 | -16.94 | 0.3310 | -0.6573 | |||

| SHV / iShares Trust - iShares Short Treasury Bond ETF | 0.05 | 0.40 | 5.80 | 0.36 | 0.2976 | -0.4378 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.02 | 2.01 | 5.37 | 9.04 | 0.2754 | -0.3511 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | -1.92 | 5.33 | 8.33 | 0.2734 | -0.3526 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.02 | 0.00 | 4.86 | 10.58 | 0.2494 | -0.3100 | |||

| IGSB / iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF | 0.08 | 7.08 | 4.25 | 7.90 | 0.2180 | -0.2831 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.01 | -12.29 | 4.03 | 3.71 | 0.2066 | -0.2876 | |||

| KLAC / KLA Corporation | 0.00 | 0.00 | 3.77 | 31.79 | 0.1933 | -0.1705 | |||

| KO / The Coca-Cola Company | 0.05 | -2.33 | 3.67 | -3.52 | 0.1883 | -0.2957 | |||

| NVDA / NVIDIA Corporation | 0.02 | -1.81 | 3.49 | 43.13 | 0.1790 | -0.1311 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.02 | -10.88 | 2.91 | -8.82 | 0.1491 | -0.2564 | |||

| AMZN / Amazon.com, Inc. | 0.01 | -14.92 | 2.88 | -1.91 | 0.1479 | -0.2260 | |||

| IJK / iShares Trust - iShares S&P Mid-Cap 400 Growth ETF | 0.03 | 0.00 | 2.65 | 9.25 | 0.1358 | -0.1724 | |||

| TSLA / Tesla, Inc. | 0.01 | 0.00 | 2.55 | 22.57 | 0.3050 | 0.0406 | |||

| META / Meta Platforms, Inc. | 0.00 | -26.87 | 1.97 | -6.33 | 0.1010 | -0.1664 | |||

| V / Visa Inc. | 0.01 | -26.38 | 1.90 | -25.42 | 0.2280 | -0.0969 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.02 | 0.00 | 1.82 | 9.43 | 0.0935 | -0.1185 | |||

| BIV / Vanguard Bond Index Funds - Vanguard Intermediate-Term Bond ETF | 0.02 | 0.00 | 1.72 | 1.00 | 0.0883 | -0.1285 | |||

| WMT / Walmart Inc. | 0.02 | 0.00 | 1.60 | 11.44 | 0.0820 | -0.1006 | |||

| MUB / iShares Trust - iShares National Muni Bond ETF | 0.02 | 0.00 | 1.59 | -0.87 | 0.0818 | -0.1229 | |||

| GOOGL / Alphabet Inc. | 0.01 | -37.40 | 1.52 | -28.67 | 0.0781 | -0.1935 | |||

| HD / The Home Depot, Inc. | 0.00 | 2.02 | 1.48 | 2.07 | 0.0758 | -0.1084 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | 0.00 | 1.42 | 17.54 | 0.0729 | -0.0809 | |||

| VXUS / Vanguard STAR Funds - Vanguard Total International Stock ETF | 0.02 | 0.00 | 1.42 | 11.32 | 0.0726 | -0.0893 | |||

| LLY / Eli Lilly and Company | 0.00 | -9.20 | 1.38 | -14.30 | 0.0710 | -0.1345 | |||

| ABBV / AbbVie Inc. | 0.01 | -10.80 | 1.38 | -20.96 | 0.0708 | -0.1514 | |||

| T / AT&T Inc. | 0.04 | -3.81 | 1.30 | -1.59 | 0.0666 | -0.1012 | |||

| AEP / American Electric Power Company, Inc. | 0.01 | -0.62 | 1.29 | -5.64 | 0.0662 | -0.1077 | |||

| VZ / Verizon Communications Inc. | 0.03 | -3.05 | 1.24 | -7.55 | 0.0634 | -0.1067 | |||

| SO / The Southern Company | 0.01 | 0.00 | 1.21 | -0.17 | 0.0619 | -0.0919 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.02 | -16.53 | 1.18 | -11.29 | 0.0605 | -0.1086 | |||

| VBK / Vanguard Index Funds - Vanguard Small-Cap Growth ETF | 0.00 | 0.00 | 1.16 | 10.02 | 0.0597 | -0.0749 | |||

| TFC / Truist Financial Corporation | 0.03 | 0.00 | 1.16 | 4.41 | 0.1390 | -0.0024 | |||

| DUK / Duke Energy Corporation | 0.01 | 0.00 | 1.13 | -3.26 | 0.0578 | -0.0903 | |||

| PFE / Pfizer Inc. | 0.04 | -19.05 | 1.02 | -22.59 | 0.1223 | -0.0456 | |||

| GOOG / Alphabet Inc. | 0.01 | -14.91 | 1.02 | -3.41 | 0.0523 | -0.0820 | |||

| APP / AppLovin Corporation | 0.00 | -14.33 | 0.90 | 13.22 | 0.0462 | -0.0550 | |||

| BSV / Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF | 0.01 | 0.00 | 0.87 | 0.58 | 0.0445 | -0.0653 | |||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.00 | 0.00 | 0.86 | 4.90 | 0.0439 | -0.0599 | |||

| BMY / Bristol-Myers Squibb Company | 0.02 | -5.24 | 0.84 | -28.09 | 0.0430 | -0.1052 | |||

| ORCL / Oracle Corporation | 0.00 | -21.73 | 0.81 | 22.49 | 0.0414 | -0.0424 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.73 | -8.77 | 0.0374 | -0.0642 | |||

| DGX / Quest Diagnostics Incorporated | 0.00 | -32.73 | 0.69 | -28.56 | 0.0356 | -0.0879 | |||

| DE / Deere & Company | 0.00 | -18.47 | 0.67 | -11.68 | 0.0806 | -0.0164 | |||

| RSG / Republic Services, Inc. | 0.00 | -18.21 | 0.67 | -16.67 | 0.0344 | -0.0680 | |||

| MMM / 3M Company | 0.00 | 0.00 | 0.66 | 3.79 | 0.0337 | -0.0469 | |||

| ED / Consolidated Edison, Inc. | 0.01 | 0.00 | 0.65 | -9.26 | 0.0332 | -0.0575 | |||

| MS / Morgan Stanley | 0.00 | 0.00 | 0.63 | 20.57 | 0.0325 | -0.0343 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.00 | 0.63 | 43.61 | 0.0323 | -0.0235 | |||

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.01 | -1.18 | 0.63 | 9.04 | 0.0322 | -0.0410 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.00 | 0.62 | 10.55 | 0.0317 | -0.0395 | |||

| SDY / SPDR Series Trust - SPDR S&P Dividend ETF | 0.00 | 0.61 | 0.0315 | 0.0315 | |||||

| GE / General Electric Company | 0.00 | -1.04 | 0.61 | 27.14 | 0.0313 | -0.0297 | |||

| ALL / The Allstate Corporation | 0.00 | 0.00 | 0.60 | -2.90 | 0.0310 | -0.0481 | |||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | 0.00 | 0.58 | 6.23 | 0.0298 | -0.0398 | |||

| USMV / iShares Trust - iShares MSCI USA Min Vol Factor ETF | 0.01 | 0.00 | 0.56 | 0.36 | 0.0289 | -0.0426 | |||

| GRMN / Garmin Ltd. | 0.00 | 0.00 | 0.52 | -3.87 | 0.0625 | -0.0066 | |||

| CAT / Caterpillar Inc. | 0.00 | -16.12 | 0.52 | -1.33 | 0.0267 | -0.0404 | |||

| NEE / NextEra Energy, Inc. | 0.01 | 0.00 | 0.51 | -2.11 | 0.0263 | -0.0402 | |||

| MO / Altria Group, Inc. | 0.01 | 0.00 | 0.49 | -2.37 | 0.0254 | -0.0390 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -42.71 | 0.49 | -47.81 | 0.0251 | -0.0939 | |||

| YUM / Yum! Brands, Inc. | 0.00 | 0.00 | 0.47 | -5.77 | 0.0243 | -0.0397 | |||

| CMCSA / Comcast Corporation | 0.01 | 0.00 | 0.47 | -3.29 | 0.0241 | -0.0377 | |||

| MA / Mastercard Incorporated | 0.00 | -0.88 | 0.45 | 1.60 | 0.0229 | -0.0329 | |||

| PJT / PJT Partners Inc. | 0.00 | 0.00 | 0.44 | 19.84 | 0.0226 | -0.0243 | |||

| IBIT / iShares Bitcoin Trust ETF | 0.01 | 0.00 | 0.41 | 30.67 | 0.0490 | 0.0092 | |||

| BAC / Bank of America Corporation | 0.01 | -1.13 | 0.38 | 12.13 | 0.0195 | -0.0236 | |||

| PFF / iShares Trust - iShares Preferred and Income Securities ETF | 0.01 | 0.00 | 0.38 | -0.26 | 0.0452 | -0.0029 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -9.72 | 0.38 | 13.60 | 0.0193 | -0.0229 | |||

| D / Dominion Energy, Inc. | 0.01 | -0.69 | 0.38 | 0.00 | 0.0193 | -0.0285 | |||

| LHX / L3Harris Technologies, Inc. | 0.00 | 0.00 | 0.36 | 19.80 | 0.0187 | -0.0200 | |||

| MRK / Merck & Co., Inc. | 0.00 | 0.00 | 0.36 | -11.71 | 0.0186 | -0.0337 | |||

| COST / Costco Wholesale Corporation | 0.00 | -0.84 | 0.35 | 3.85 | 0.0180 | -0.0250 | |||

| VV / Vanguard Index Funds - Vanguard Large-Cap ETF | 0.00 | -47.76 | 0.35 | -42.12 | 0.0179 | -0.0588 | |||

| MU / Micron Technology, Inc. | 0.00 | 0.33 | 0.0169 | 0.0169 | |||||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.00 | 0.00 | 0.33 | 8.33 | 0.0167 | -0.0216 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 109.80 | 0.32 | 25.00 | 0.0165 | -0.0162 | |||

| WFC / Wells Fargo & Company | 0.00 | 0.00 | 0.32 | 11.50 | 0.0164 | -0.0201 | |||

| DVY / iShares Trust - iShares Select Dividend ETF | 0.00 | 0.00 | 0.32 | -1.24 | 0.0163 | -0.0246 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.31 | 0.0375 | 0.0375 | |||||

| TJX / The TJX Companies, Inc. | 0.00 | -1.61 | 0.30 | -0.33 | 0.0155 | -0.0231 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | 0.00 | 0.29 | 19.67 | 0.0150 | -0.0160 | |||

| GIS / General Mills, Inc. | 0.01 | 0.00 | 0.28 | -13.41 | 0.0146 | -0.0272 | |||

| XYL / Xylem Inc. | 0.00 | 0.00 | 0.28 | 8.40 | 0.0341 | 0.0006 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | -52.55 | 0.28 | -52.15 | 0.0143 | -0.0597 | |||

| ZTS / Zoetis Inc. | 0.00 | 0.00 | 0.25 | -5.32 | 0.0128 | -0.0207 | |||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.00 | 0.00 | 0.24 | -1.23 | 0.0124 | -0.0187 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 0.23 | 0.0119 | 0.0119 | |||||

| LOW / Lowe's Companies, Inc. | 0.00 | -77.79 | 0.23 | -78.87 | 0.0117 | -0.1256 | |||

| CTVA / Corteva, Inc. | 0.00 | 0.22 | 0.0115 | 0.0115 | |||||

| IWB / iShares Trust - iShares Russell 1000 ETF | 0.00 | 0.22 | 0.0113 | 0.0113 | |||||

| FWONK / Formula One Group | 0.00 | 0.22 | 0.0113 | 0.0113 | |||||

| CL / Colgate-Palmolive Company | 0.00 | 0.00 | 0.22 | -2.68 | 0.0112 | -0.0174 | |||

| COF / Capital One Financial Corporation | 0.00 | 0.22 | 0.0260 | 0.0260 | |||||

| INTU / Intuit Inc. | 0.00 | 0.22 | 0.0110 | 0.0110 | |||||

| CINF / Cincinnati Financial Corporation | 0.00 | 0.00 | 0.21 | 0.48 | 0.0107 | -0.0156 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.21 | 0.0107 | 0.0107 | |||||

| TRVI / Trevi Therapeutics, Inc. | 0.03 | 0.00 | 0.17 | -13.27 | 0.0088 | -0.0162 | |||

| ATYR / aTyr Pharma, Inc. | 0.02 | 21.69 | 0.09 | 107.32 | 0.0102 | 0.0049 | |||

| CRDF / Cardiff Oncology, Inc. | 0.02 | -2.18 | 0.07 | -1.41 | 0.0036 | -0.0055 | |||

| GNLX / Genelux Corporation | 0.01 | 0.03 | 0.0041 | 0.0041 | |||||

| AVGO / Broadcom Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| UPS / United Parcel Service, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RTX / RTX Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NSC / Norfolk Southern Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TGT / Target Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VOR / Vor Biopharma Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| USB / U.S. Bancorp | 0.00 | -100.00 | 0.00 | 0.0000 |