Basic Stats

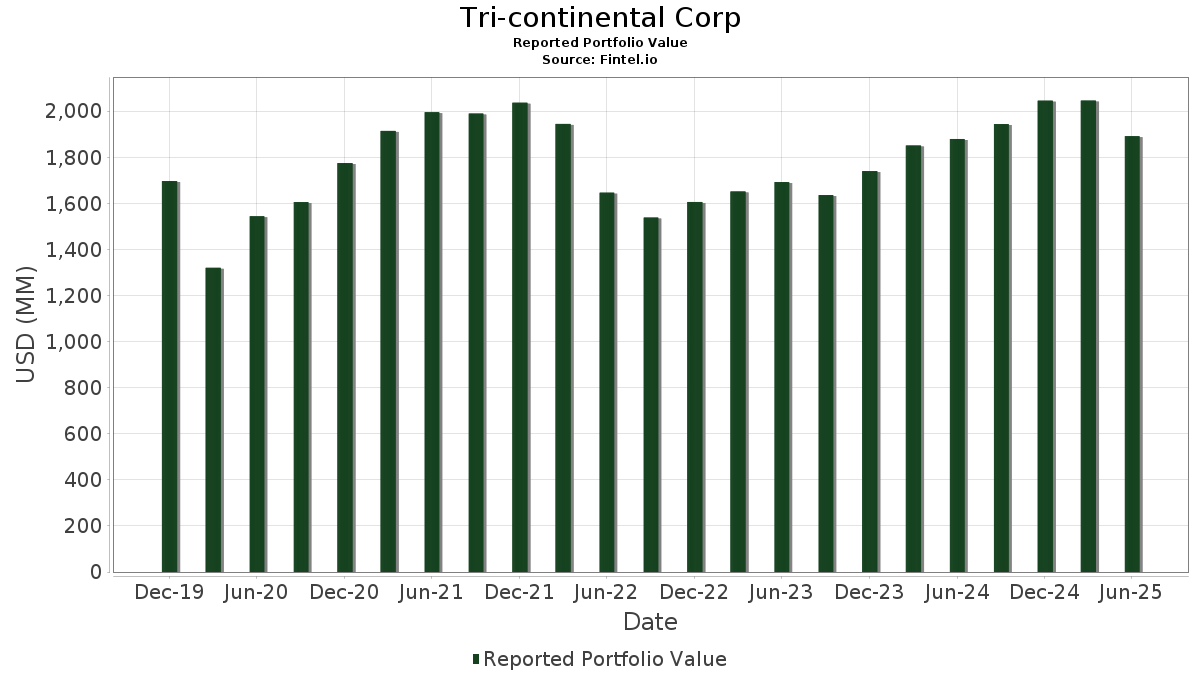

| Portfolio Value | $ 1,891,801,640 |

| Current Positions | 247 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Tri-continental Corp has disclosed 247 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,891,801,640 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Tri-continental Corp’s top holdings are NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Alphabet Inc. (US:GOOGL) , and Meta Platforms, Inc. (US:META) . Tri-continental Corp’s new positions include Hilcorp Energy I LP (US:US431318AY04) , Fertitta Entertainment LLC / Fertitta Entertainment Finance Co Inc (US:US31556TAC36) , Lions Gate Capital Holdings LLC (US:US53627NAE13) , FIRSTENERGY CORP 3.4% 03/01/2050 (US:US337932AM94) , and Clear Channel Outdoor Holdings Inc (US:US18453HAC07) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.53 | 82.98 | 4.4514 | 1.2322 | |

| 0.15 | 15.96 | 0.8564 | 0.8564 | |

| 0.13 | 62.52 | 3.3540 | 0.6075 | |

| 0.04 | 14.55 | 0.7808 | 0.4838 | |

| 0.06 | 45.03 | 2.4159 | 0.4271 | |

| 7.25 | 0.3892 | 0.3892 | ||

| 0.12 | 7.07 | 0.3792 | 0.3792 | |

| 0.08 | 8.16 | 0.4376 | 0.3166 | |

| 0.16 | 16.86 | 0.9044 | 0.3028 | |

| 0.26 | 5.30 | 0.2843 | 0.2843 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 11.54 | 0.6193 | -0.3834 | |

| 0.24 | 49.76 | 2.6695 | -0.3774 | |

| 0.01 | 1.71 | 0.0919 | -0.3525 | |

| 0.48 | 22.33 | 1.1977 | -0.3363 | |

| 0.03 | 7.47 | 0.4007 | -0.3280 | |

| 0.06 | 4.99 | 0.2675 | -0.3161 | |

| 0.03 | 4.75 | 0.2546 | -0.2825 | |

| 0.02 | 9.13 | 0.4899 | -0.2588 | |

| 0.10 | 8.65 | 0.4638 | -0.2520 | |

| 0.08 | 5.15 | 0.2763 | -0.2378 |

13F and Fund Filings

This form was filed on 2025-08-22 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.53 | -1.11 | 82.98 | 44.16 | 4.4514 | 1.2322 | |||

| MSFT / Microsoft Corporation | 0.13 | -3.92 | 62.52 | 27.32 | 3.3540 | 0.6075 | |||

| AAPL / Apple Inc. | 0.24 | -1.11 | 49.76 | -8.66 | 2.6695 | -0.3774 | |||

| GOOGL / Alphabet Inc. | 0.26 | -1.11 | 46.42 | 12.70 | 2.4902 | 0.1866 | |||

| META / Meta Platforms, Inc. | 0.06 | -1.11 | 45.03 | 26.64 | 2.4159 | 0.4271 | |||

| AMZN / Amazon.com, Inc. | 0.17 | -7.26 | 36.87 | 6.94 | 1.9779 | 0.0497 | |||

| BMY / Bristol-Myers Squibb Company | 0.48 | 7.24 | 22.33 | -18.60 | 1.1977 | -0.3363 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -4.12 | 21.84 | 20.49 | 1.1718 | 0.1579 | |||

| CVX / Chevron Corporation | 0.15 | 10.84 | 20.83 | -5.12 | 1.1174 | -0.1105 | |||

| C / Citigroup Inc. | 0.24 | -1.11 | 20.50 | 18.58 | 1.0996 | 0.1328 | |||

| CRM / Salesforce, Inc. | 0.07 | 12.96 | 19.27 | 14.78 | 1.0339 | 0.0948 | |||

| MDT / Medtronic plc | 0.20 | -11.54 | 17.57 | -14.19 | 0.9428 | -0.2027 | |||

| 19766H239 / COLUMBIA SHORT TERM CASH FUND | 17.44 | -9.94 | 17.44 | -9.94 | 0.9355 | -0.1475 | |||

| QCOM / QUALCOMM Incorporated | 0.11 | -1.11 | 17.40 | 2.53 | 0.9332 | -0.0157 | |||

| MO / Altria Group, Inc. | 0.29 | -7.68 | 17.19 | -9.81 | 0.9223 | -0.1439 | |||

| BLK / BlackRock, Inc. | 0.02 | -1.11 | 16.90 | 9.64 | 0.9064 | 0.0445 | |||

| ANET / Arista Networks Inc | 0.16 | 18.70 | 16.86 | 56.73 | 0.9044 | 0.3028 | |||

| FI / Fiserv, Inc. | 0.10 | 13.42 | 16.63 | -11.46 | 0.8924 | -0.1583 | |||

| SYF / Synchrony Financial | 0.25 | 7.01 | 16.54 | 34.91 | 0.8872 | 0.2015 | |||

| XOM / Exxon Mobil Corporation | 0.15 | 4.80 | 16.51 | -5.01 | 0.8857 | -0.0863 | |||

| PANW / Palo Alto Networks, Inc. | 0.08 | -14.28 | 16.21 | 2.80 | 0.8696 | -0.0123 | |||

| JCI / Johnson Controls International plc | 0.15 | 15.96 | 0.8564 | 0.8564 | |||||

| MMC / Marsh & McLennan Companies, Inc. | 0.07 | -1.11 | 15.74 | -11.39 | 0.8444 | -0.1492 | |||

| ADP / Automatic Data Processing, Inc. | 0.05 | 8.64 | 15.63 | 9.66 | 0.8387 | 0.0414 | |||

| ABBV / AbbVie Inc. | 0.08 | 3.96 | 15.29 | -7.90 | 0.8200 | -0.1082 | |||

| V / Visa Inc. | 0.04 | 170.55 | 14.55 | 174.09 | 0.7808 | 0.4838 | |||

| CME / CME Group Inc. | 0.05 | 8.17 | 13.18 | 12.38 | 0.7071 | 0.0511 | |||

| RL / Ralph Lauren Corporation | 0.05 | -1.11 | 13.12 | 22.87 | 0.7040 | 0.1067 | |||

| CF / CF Industries Holdings, Inc. | 0.14 | -1.11 | 12.93 | 16.41 | 0.6937 | 0.0725 | |||

| CVS / CVS Health Corporation | 0.18 | 27.15 | 12.50 | 29.46 | 0.6705 | 0.1305 | |||

| SNA / Snap-on Incorporated | 0.04 | 32.28 | 11.83 | 22.14 | 0.6345 | 0.0929 | |||

| JPM / JPMorgan Chase & Co. | 0.04 | -45.52 | 11.54 | -35.61 | 0.6193 | -0.3834 | |||

| ADBE / Adobe Inc. | 0.03 | 65.59 | 11.24 | 67.03 | 0.6029 | 0.2266 | |||

| HPE.PRC / Hewlett Packard Enterprise Company - Preferred Security | 0.18 | 12.12 | 10.96 | 37.90 | 0.5881 | 0.1435 | |||

| BA.PRA / The Boeing Company - Preferred Security | 0.16 | 0.00 | 10.92 | 15.61 | 0.5857 | 0.0575 | |||

| MS / Morgan Stanley | 0.07 | 7.14 | 10.56 | 29.37 | 0.5667 | 0.1100 | |||

| MTB / M&T Bank Corporation | 0.05 | 0.00 | 10.18 | 8.53 | 0.5464 | 0.0215 | |||

| USB / U.S. Bancorp | 0.23 | 0.00 | 10.18 | 7.18 | 0.5462 | 0.0149 | |||

| CSCO / Cisco Systems, Inc. | 0.15 | 21.76 | 10.14 | 36.88 | 0.5438 | 0.1296 | |||

| AVGO / Broadcom Inc. | 0.04 | -0.50 | 10.10 | 63.81 | 0.5421 | 0.1971 | |||

| NTAP / NetApp, Inc. | 0.09 | -19.72 | 10.00 | -2.62 | 0.5365 | -0.0379 | |||

| GLW / Corning Incorporated | 0.19 | -5.00 | 9.99 | 9.13 | 0.5360 | 0.0240 | |||

| KKR.PRD / KKR & Co. Inc. - Preferred Stock | 0.18 | -7.50 | 9.91 | 1.41 | 0.5319 | -0.0149 | |||

| TPR / Tapestry, Inc. | 0.11 | 9.57 | 9.89 | 36.64 | 0.5308 | 0.1258 | |||

| T / AT&T Inc. | 0.34 | -2.86 | 9.84 | -0.60 | 0.5279 | -0.0257 | |||

| US431318AY04 / Hilcorp Energy I LP | 9.74 | 2.49 | 0.5225 | -0.0090 | |||||

| BAC.PRL / Bank of America Corporation - Preferred Stock | 0.01 | 0.00 | 9.71 | -1.86 | 0.5209 | -0.0325 | |||

| US31556TAC36 / Fertitta Entertainment LLC / Fertitta Entertainment Finance Co Inc | 9.70 | 6.67 | 0.5202 | 0.0117 | |||||

| US53627NAE13 / Lions Gate Capital Holdings LLC | 9.56 | 2.93 | 0.5130 | -0.0066 | |||||

| AMGN / Amgen Inc. | 0.03 | -18.24 | 9.55 | -26.73 | 0.5124 | -0.2166 | |||

| US337932AM94 / FIRSTENERGY CORP 3.4% 03/01/2050 | 9.51 | 26.13 | 0.5099 | 0.0884 | |||||

| PHM / PulteGroup, Inc. | 0.09 | -1.11 | 9.47 | 1.45 | 0.5082 | -0.0140 | |||

| US18453HAC07 / Clear Channel Outdoor Holdings Inc | 9.46 | 10.25 | 0.5077 | 0.0276 | |||||

| US70932AAF03 / PENNYMAC CORP | 9.39 | -0.11 | 0.5038 | -0.0220 | |||||

| VLO / Valero Energy Corporation | 0.07 | -7.16 | 9.28 | -5.50 | 0.4978 | -0.0514 | |||

| US80874DAA46 / Scientific Games Holdings LP/Scientific Games US FinCo Inc | 9.15 | -1.96 | 0.4909 | -0.0311 | |||||

| TT / Trane Technologies plc | 0.02 | -47.46 | 9.13 | -31.78 | 0.4899 | -0.2588 | |||

| ALL / The Allstate Corporation | 0.04 | 39.08 | 8.99 | 35.22 | 0.4824 | 0.1104 | |||

| US57763RAC16 / Mauser Packaging Solutions Holding Co. | 8.93 | 5.29 | 0.4792 | 0.0048 | |||||

| BAX / Baxter International Inc. | 0.29 | -1.11 | 8.69 | -12.52 | 0.4660 | -0.0893 | |||

| CL / Colgate-Palmolive Company | 0.10 | -30.37 | 8.65 | -32.45 | 0.4638 | -0.2520 | |||

| MCK / McKesson Corporation | 0.01 | 25.18 | 8.64 | 36.31 | 0.4636 | 0.1090 | |||

| TSLA / Tesla, Inc. | 0.03 | -1.11 | 8.41 | 21.21 | 0.4512 | 0.0631 | |||

| TGT / Target Corporation | 0.08 | 395.51 | 8.16 | 261.69 | 0.4376 | 0.3166 | |||

| MARA / MARA Holdings, Inc. | 8.13 | 19.99 | 0.4360 | 0.0572 | |||||

| PCG / PG&E Corporation | 0.58 | -1.11 | 8.08 | -19.76 | 0.4336 | -0.1298 | |||

| US60337JAA43 / Minerva Merger Sub Inc | 7.87 | 4.71 | 0.4223 | 0.0018 | |||||

| MCHPP / Microchip Technology Incorporated - Preferred Stock | 0.12 | 17.50 | 7.83 | 56.60 | 0.4201 | 0.1404 | |||

| TXN / Texas Instruments Incorporated | 0.04 | -6.25 | 7.79 | 8.31 | 0.4177 | 0.0157 | |||

| DAL / Delta Air Lines, Inc. | 0.15 | -1.11 | 7.55 | 11.55 | 0.4050 | 0.0265 | |||

| US913017BT50 / United Technologies Corp 4.50% 06/01/42 | 7.53 | 55.52 | 0.4038 | 0.1331 | |||||

| STWD / Starwood Property Trust, Inc. | 0.38 | 0.00 | 7.53 | 1.52 | 0.4038 | -0.0109 | |||

| AMT / American Tower Corporation | 0.03 | -43.56 | 7.47 | -42.67 | 0.4007 | -0.3280 | |||

| ARCC / Ares Capital Corporation | 0.34 | 4.62 | 7.47 | 3.67 | 0.4005 | -0.0023 | |||

| US00404AAP49 / Acadia Healthcare Co., Inc. | 7.47 | 2.51 | 0.4005 | -0.0068 | |||||

| MET / MetLife, Inc. | 0.09 | 5.71 | 7.44 | 5.88 | 0.3991 | 0.0061 | |||

| WISCONSIN ELECTRIC POWER COMPANY / DBT (US976656CT37) | 7.38 | 48.72 | 0.3957 | 0.1183 | |||||

| US77314EAA64 / Rocket Software Inc | 7.36 | 3.14 | 0.3950 | -0.0043 | |||||

| HPQ / HP Inc. | 0.30 | 33.33 | 7.34 | 17.78 | 0.3937 | 0.0452 | |||

| MRK / Merck & Co., Inc. | 0.09 | 76.19 | 7.32 | 55.39 | 0.3928 | 0.1293 | |||

| W1EC34 / WEC Energy Group, Inc. - Depositary Receipt (Common Stock) | 7.25 | 0.3892 | 0.3892 | ||||||

| MDLZ / Mondelez International, Inc. | 0.11 | -2.27 | 7.25 | -2.87 | 0.3889 | -0.0285 | |||

| BXSL / Blackstone Secured Lending Fund | 0.23 | 4.44 | 7.23 | -0.76 | 0.3877 | -0.0196 | |||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 7.21 | 48.22 | 0.3869 | 0.1147 | |||||

| US855170AA41 / Star Parent Inc | 7.16 | 3.51 | 0.3842 | -0.0028 | |||||

| VZ / Verizon Communications Inc. | 0.17 | -10.81 | 7.14 | -14.92 | 0.3830 | -0.0863 | |||

| US911163AA17 / UNFI 6 3/4 10/15/28 | 7.09 | -0.01 | 0.3805 | -0.0163 | |||||

| QXO.PRB / QXO, Inc. - Preferred Security | 0.12 | 7.07 | 0.3792 | 0.3792 | |||||

| US640695AA01 / Neptune Bidco US Inc | 7.06 | 12.27 | 0.3789 | 0.0271 | |||||

| US674599CJ22 / Occidental Petroleum Corp | 7.05 | -1.99 | 0.3784 | -0.0241 | |||||

| PRIMO WATER HOLDINGS INC / DBT (US74168RAC79) | 7.05 | -5.75 | 0.3783 | -0.0401 | |||||

| VTRS / Viatris Inc. | 0.79 | 6.23 | 7.03 | 8.93 | 0.3770 | 0.0161 | |||

| US681639AB60 / Olympus Water US Holding Corp | 6.97 | 8.55 | 0.3739 | 0.0148 | |||||

| US674599DK85 / Occidental Petroleum Corp | 6.82 | -2.40 | 0.3659 | -0.0249 | |||||

| KVUE / Kenvue Inc. | 0.31 | 16.98 | 6.49 | 2.11 | 0.3481 | -0.0073 | |||

| BTSGU / BrightSpring Health Services, Inc. | 0.08 | -3.12 | 6.37 | 20.61 | 0.3419 | 0.0464 | |||

| MAS / Masco Corporation | 0.10 | -26.12 | 6.20 | -31.62 | 0.3328 | -0.1746 | |||

| US749772AD11 / RWT Holdings Inc | 5.98 | 0.20 | 0.3209 | -0.0130 | |||||

| TAP / Molson Coors Beverage Company | 0.12 | -1.11 | 5.88 | -21.88 | 0.3154 | -0.1055 | |||

| PNR / Pentair plc | 0.06 | 17.07 | 5.69 | 37.38 | 0.3052 | 0.0736 | |||

| GALAXY DIGITAL HOLDINGS LP / DBT (US36317GAB23) | 5.50 | 19.77 | 0.2951 | 0.0382 | |||||

| US143658BV39 / CONV. NOTE | 5.50 | 31.81 | 0.2950 | 0.0617 | |||||

| CAG / Conagra Brands, Inc. | 0.26 | 5.30 | 0.2843 | 0.2843 | |||||

| PEP / PepsiCo, Inc. | 0.04 | 5.28 | 0.2833 | 0.2833 | |||||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | -1.10 | 5.27 | -9.18 | 0.2825 | -0.0418 | |||

| MSTRD / Strategy Inc - Depositary Receipt (Common Stock) | 5.19 | -28.47 | 0.2784 | -0.1273 | |||||

| O / Realty Income Corporation | 0.09 | 0.00 | 5.18 | -0.69 | 0.2781 | -0.0138 | |||

| UNP / Union Pacific Corporation | 0.02 | 4.65 | 5.18 | 1.91 | 0.2777 | -0.0064 | |||

| ARES.PRB / Ares Management Corporation - Preferred Security | 0.10 | -5.00 | 5.17 | 8.33 | 0.2771 | 0.0104 | |||

| IBM / International Business Machines Corporation | 0.02 | -12.50 | 5.16 | 3.72 | 0.2767 | -0.0014 | |||

| IP / International Paper Company | 0.11 | 0.00 | 5.15 | -12.22 | 0.2763 | -0.0519 | |||

| HOLX / Hologic, Inc. | 0.08 | -46.89 | 5.15 | -43.98 | 0.2763 | -0.2378 | |||

| US10806XAD49 / BRIDGEBIO PHARMA INC | 5.12 | -36.54 | 0.2747 | -0.1766 | |||||

| UGI / UGI Corporation | 0.14 | -6.67 | 5.10 | 2.78 | 0.2735 | -0.0039 | |||

| SWK / Stanley Black & Decker, Inc. | 0.07 | 25.00 | 5.08 | 10.17 | 0.2726 | 0.0146 | |||

| M1TB34 / M&T Bank Corporation - Depositary Receipt (Common Stock) | 5.08 | 1.50 | 0.2723 | -0.0074 | |||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 5.06 | 3.02 | 0.2713 | -0.0032 | |||||

| UPS / United Parcel Service, Inc. | 0.05 | 17.65 | 5.05 | 7.98 | 0.2708 | 0.0093 | |||

| US854502AJ02 / Stanley Black & Decker Inc. | 5.04 | 12.64 | 0.2705 | 0.0201 | |||||

| DUK / Duke Energy Corporation | 0.04 | -5.56 | 5.01 | -8.62 | 0.2690 | -0.0379 | |||

| PM / Philip Morris International Inc. | 0.03 | -42.11 | 5.01 | -33.57 | 0.2687 | -0.1530 | |||

| US459200KZ37 / International Business Machines Corp | 5.01 | -0.60 | 0.2686 | -0.0131 | |||||

| 29364W405 / Entergy Louisiana LLC, 5.875% Series First Mortgage Bonds due 6/15/2041 | 5.01 | 0.56 | 0.2685 | -0.0098 | |||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 5.00 | -0.91 | 0.2682 | -0.0140 | |||||

| PLD / Prologis, Inc. | 0.05 | 0.00 | 4.99 | -5.97 | 0.2679 | -0.0291 | |||

| ETR / Entergy Corporation | 0.06 | -50.85 | 4.99 | -52.21 | 0.2675 | -0.3161 | |||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 4.99 | 0.2675 | 0.2675 | ||||||

| US59156RCC07 / MetLife, Inc. | 4.99 | -0.20 | 0.2675 | -0.0119 | |||||

| UNPD / Union Pacific Corporation - Depositary Receipt (Common Stock) | 4.98 | -6.79 | 0.2672 | -0.0317 | |||||

| US20848VAA35 / Consensus Cloud Solutions, Inc. | 4.98 | -0.06 | 0.2669 | -0.0116 | |||||

| VICI / VICI Properties Inc. | 0.15 | 0.00 | 4.97 | -0.06 | 0.2667 | -0.0115 | |||

| NTR / Nutrien Ltd. | 0.09 | -19.05 | 4.95 | -5.08 | 0.2656 | -0.0261 | |||

| US55916AAB08 / Magic Mergeco Inc | 4.94 | 21.65 | 0.2652 | 0.0379 | |||||

| HCXY / Hercules Capital, Inc. - Corporate Bond/Note | 4.93 | -1.62 | 0.2644 | -0.0158 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 4.93 | 0.78 | 0.2644 | -0.0091 | |||||

| LYB / LyondellBasell Industries N.V. | 0.09 | 25.93 | 4.92 | 3.49 | 0.2638 | -0.0019 | |||

| FOUR.PRA / Shift4 Payments, Inc. - Preferred Stock | 0.04 | 4.91 | 0.2635 | 0.2635 | |||||

| US11135FBJ93 / Broadcom Inc | 4.91 | 1.01 | 0.2631 | -0.0085 | |||||

| DRI / Darden Restaurants, Inc. | 0.02 | -18.18 | 4.90 | -14.16 | 0.2631 | -0.0564 | |||

| US46647PCE43 / JPMorgan Chase & Co | 4.90 | 1.01 | 0.2630 | -0.0085 | |||||

| LCII / LCI Industries | 4.89 | 1.98 | 0.2625 | -0.0059 | |||||

| BXP / Boston Properties, Inc. | 0.07 | 3.57 | 4.89 | 4.00 | 0.2624 | -0.0006 | |||

| RIVIAN AUTOMOTIVE INC / DBT (US76954AAB98) | 4.88 | -13.74 | 0.2617 | -0.0546 | |||||

| A1ES34 / The AES Corporation - Depositary Receipt (Common Stock) | 4.87 | -1.46 | 0.2614 | -0.0152 | |||||

| 03077JAA8 / Amerigas Finance Llc 6.75% 05/20/20 | 4.87 | 0.2613 | 0.2613 | ||||||

| E1TR34 / Entergy Corporation - Depositary Receipt (Common Stock) | 4.86 | 1.89 | 0.2609 | -0.0061 | |||||

| NEE.PRT / NextEra Energy, Inc. - Debt/Equity Composite Units | 0.11 | 0.00 | 4.86 | -2.08 | 0.2608 | -0.0168 | |||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 4.86 | -4.12 | 0.2607 | -0.0228 | |||||

| XS2066744231 / Carnival PLC | 4.86 | 0.27 | 0.2605 | -0.0104 | |||||

| C.PRN / Citigroup Capital XIII - Preferred Security | 0.17 | 0.00 | 4.85 | -1.46 | 0.2604 | -0.0151 | |||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 4.85 | -7.18 | 0.2601 | -0.0320 | |||||

| PFE / Pfizer Inc. | 0.20 | 5.26 | 4.85 | 0.71 | 0.2601 | -0.0092 | |||

| INVITATION HOMES OPERATING PARTNER / DBT (US46188BAG77) | 4.84 | 1.28 | 0.2599 | -0.0076 | |||||

| 1261229 B.C. LTD. / DBT (US68288AAA51) | 4.84 | 1.42 | 0.2598 | -0.0073 | |||||

| M / Macy's, Inc. | 0.41 | 10.67 | 4.84 | 2.72 | 0.2596 | -0.0038 | |||

| US694308JN86 / PACIFIC GAS and ELECTRIC CO 4.95% 07/01/2050 | 4.83 | -3.38 | 0.2594 | -0.0204 | |||||

| FE / FirstEnergy Corp. | 0.12 | -4.00 | 4.83 | -4.37 | 0.2592 | -0.0234 | |||

| US248019AU57 / DELUXE CORP | 4.83 | 6.11 | 0.2590 | 0.0045 | |||||

| ALB.PRA / Albemarle Corporation - Preferred Stock | 0.15 | 15.38 | 4.83 | 3.14 | 0.2589 | -0.0028 | |||

| HERTZ CORPORATION (THE) / DBT (US428040DC08) | 4.81 | 15.88 | 0.2581 | 0.0259 | |||||

| US85571BBA26 / STARWOOD PROPERTY TRUST INC | 4.81 | 1.20 | 0.2578 | -0.0078 | |||||

| MARS INC / DBT (US571676BB09) | 4.80 | -6.01 | 0.2577 | -0.0281 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 4.80 | -2.89 | 0.2574 | -0.0190 | |||||

| US023771T329 / American Airlines Inc | 4.80 | 14.82 | 0.2574 | 0.0237 | |||||

| EIX / Edison International | 0.09 | -1.11 | 4.79 | -13.39 | 0.2568 | -0.0523 | |||

| EOG / EOG Resources, Inc. | 0.04 | 0.00 | 4.78 | -6.73 | 0.2567 | -0.0302 | |||

| MIRM / Mirum Pharmaceuticals, Inc. | 4.78 | 9.17 | 0.2567 | 0.0116 | |||||

| US393657AM33 / GBX 2 7/8 04/15/28 | 4.78 | 7.91 | 0.2562 | 0.0087 | |||||

| INVH / Invitation Homes Inc. | 0.14 | 0.00 | 4.76 | -5.88 | 0.2551 | -0.0275 | |||

| RTX / RTX Corporation | 0.03 | -55.17 | 4.75 | -50.59 | 0.2546 | -0.2825 | |||

| US88632QAE35 / Picard Midco, Inc. | 4.74 | -2.45 | 0.2544 | -0.0174 | |||||

| US89386MAA62 / Transocean Titan Financing Ltd | 4.73 | 0.08 | 0.2538 | -0.0106 | |||||

| CSGS / CSG Systems International, Inc. | 4.73 | -0.21 | 0.2538 | -0.0113 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0.12 | 0.00 | 4.72 | -14.18 | 0.2532 | -0.0544 | |||

| NEE.PRS / NextEra Energy, Inc. - Debt/Equity Composite Units | 0.10 | 0.00 | 4.71 | -2.06 | 0.2528 | -0.0163 | |||

| PROLOGIS LP / DBT (US74340XCK54) | 4.69 | -9.80 | 0.2518 | -0.0393 | |||||

| US18912UAA07 / Cloud Software Group Inc | 4.67 | 3.97 | 0.2503 | -0.0007 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 4.65 | -7.68 | 0.2495 | -0.0322 | |||||

| US46272EAA10 / IRIS HOLDINGS INC PIK | 4.65 | -2.76 | 0.2492 | -0.0180 | |||||

| CMCSA / Comcast Corporation | 0.13 | 0.00 | 4.64 | -3.29 | 0.2489 | -0.0194 | |||

| W1EL34 / Welltower Inc. - Depositary Receipt (Common Stock) | 4.64 | -11.47 | 0.2489 | -0.0442 | |||||

| PRGS / Progress Software Corporation | 4.64 | -2.13 | 0.2488 | -0.0162 | |||||

| US58933YBM66 / MERCK & CO INC | 4.60 | -0.45 | 0.2466 | -0.0117 | |||||

| LVS / Las Vegas Sands Corp. - Depositary Receipt (Common Stock) | 4.59 | 0.2463 | 0.2463 | ||||||

| US57767XAB64 / Mav Acquisition Corp. | 4.58 | 2.95 | 0.2456 | -0.0031 | |||||

| SBAC / SBA Communications Corporation | 0.02 | -1.11 | 4.56 | 5.55 | 0.2449 | 0.0030 | |||

| BBY / Best Buy Co., Inc. | 0.07 | 0.00 | 4.53 | -8.80 | 0.2431 | -0.0348 | |||

| US629571AB69 / Nabors Industries Ltd | 4.53 | -3.41 | 0.2430 | -0.0193 | |||||

| INEOS FINANCE PLC / DBT (US44984WAJ62) | 4.51 | 0.69 | 0.2421 | -0.0086 | |||||

| US786514BA67 / Safeway Inc 7.250% Debentures 02/01/31 | 4.48 | 2.64 | 0.2403 | -0.0038 | |||||

| NOW / ServiceNow, Inc. | 0.00 | -11.22 | 4.47 | 14.66 | 0.2396 | 0.0217 | |||

| FANG / Diamondback Energy, Inc. | 0.03 | 0.00 | 4.47 | -14.07 | 0.2396 | -0.0511 | |||

| PCG.PRX / PG&E Corporation - Preferred Security | 4.47 | -6.08 | 0.2395 | -0.0264 | |||||

| US410345AQ54 / Hanesbrands Inc | 4.45 | 0.41 | 0.2385 | -0.0091 | |||||

| BE / Bloom Energy Corporation | 4.44 | 13.22 | 0.2380 | 0.0188 | |||||

| US893790AA34 / Transocean Aquila Ltd | 4.28 | -10.94 | 0.2298 | -0.0392 | |||||

| NBR / Nabors Industries Ltd. | 4.10 | -14.35 | 0.2197 | -0.0477 | |||||

| FTNT / Fortinet, Inc. | 0.04 | -1.11 | 3.88 | 8.62 | 0.2082 | 0.0084 | |||

| LMT / Lockheed Martin Corporation | 0.01 | -1.11 | 3.68 | 2.54 | 0.1972 | -0.0033 | |||

| EQIX / Equinix, Inc. | 0.00 | 3.66 | 0.1963 | 0.1963 | |||||

| QRVO / Qorvo, Inc. | 0.04 | -42.72 | 3.65 | -32.83 | 0.1959 | -0.1082 | |||

| US651229AY21 / Newell Brands Inc | 3.58 | -2.96 | 0.1918 | -0.0143 | |||||

| OGN / Organon & Co. | 3.52 | -7.20 | 0.1888 | -0.0233 | |||||

| US651229AX48 / Newell Brands Inc | 3.26 | 68.16 | 0.1749 | 0.0665 | |||||

| BBIO / BridgeBio Pharma, Inc. | 3.26 | 0.1748 | 0.1748 | ||||||

| NWL / Newell Brands Inc. | 0.60 | 0.00 | 3.24 | -12.90 | 0.1738 | -0.0342 | |||

| US74911NAA00 / QUOTIENT LTD PIK | 3.20 | 2.99 | 0.1718 | -0.0021 | |||||

| US78500AAA60 / SWF Escrow Issuer Corp | 2.95 | -12.32 | 0.1581 | -0.0299 | |||||

| FOXA / Fox Corporation | 0.05 | 24.20 | 2.91 | 22.99 | 0.1561 | 0.0238 | |||

| IQV / IQVIA Holdings Inc. | 0.02 | -1.11 | 2.90 | -11.63 | 0.1554 | -0.0279 | |||

| EOS ENERGY ENTERPRISES INC / DBT (US29415CAA99) | 2.81 | 0.1509 | 0.1509 | ||||||

| US126650CN80 / CVS Health Corp | 2.65 | 1.41 | 0.1423 | -0.0040 | |||||

| UAL / United Airlines Holdings, Inc. | 0.03 | -1.11 | 2.64 | 14.06 | 0.1415 | 0.0121 | |||

| US577081BF84 / Mattel Inc | 2.59 | 1.13 | 0.1388 | -0.0043 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 2.52 | 3.36 | 0.1352 | -0.0012 | |||||

| US071734AQ04 / Bausch Health Cos Inc | 2.49 | 3.75 | 0.1338 | -0.0007 | |||||

| EXC / Exelon Corporation | 0.06 | 2.48 | 0.1330 | 0.1330 | |||||

| EXPE / Expedia Group, Inc. | 0.01 | -1.11 | 2.47 | -0.76 | 0.1327 | -0.0067 | |||

| RIVIAN HOLDINGS LLC / DBT (US76954LAD10) | 2.46 | 0.1317 | 0.1317 | ||||||

| US62886HBG56 / NCL Corp Ltd | 2.34 | -50.11 | 0.1255 | -0.1367 | |||||

| NEM / Newmont Corporation | 0.04 | -63.66 | 2.33 | -48.86 | 0.1249 | -0.1411 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -1.11 | 2.21 | -18.14 | 0.1184 | -0.0324 | |||

| ASTS / AST SpaceMobile, Inc. | 2.18 | -64.90 | 0.1170 | -0.2304 | |||||

| UBER / Uber Technologies, Inc. | 0.02 | 2.07 | 0.1113 | 0.1113 | |||||

| EMN / Eastman Chemical Company | 0.03 | 2.07 | 0.1109 | 0.1109 | |||||

| TELSAT / Telesat Canada / Telesat LLC | 2.02 | -15.47 | 0.1082 | -0.0253 | |||||

| MPC / Marathon Petroleum Corporation | 0.01 | -1.11 | 1.74 | 12.78 | 0.0933 | 0.0070 | |||

| CI / The Cigna Group | 0.01 | -78.54 | 1.71 | -78.44 | 0.0919 | -0.3525 | |||

| AES / The AES Corporation | 0.16 | 1.70 | 0.0912 | 0.0912 | |||||

| PANTHER ESCROW ISSUER LLC / DBT (US69867RAA59) | 1.64 | -64.30 | 0.0878 | -0.1685 | |||||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 1.54 | 0.0825 | 0.0825 | |||||

| US577081AU60 / Mattel Inc | 1.44 | 1.41 | 0.0771 | -0.0021 | |||||

| VRSN / VeriSign, Inc. | 0.00 | -81.69 | 1.43 | -69.55 | 0.0766 | -0.2328 | |||

| US68622TAB70 / Organon Finance 1 LLC | 1.39 | 91.32 | 0.0745 | 0.0339 | |||||

| HST / Host Hotels & Resorts, Inc. | 0.09 | -1.11 | 1.33 | 6.94 | 0.0711 | 0.0018 | |||

| STLD / Steel Dynamics, Inc. | 0.01 | -70.43 | 1.30 | -69.74 | 0.0698 | -0.1707 | |||

| AATRL / Amg Capital Trust II - Preferred Security | 0.02 | -32.31 | 1.26 | -26.83 | 0.0674 | -0.0287 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | -4.17 | 1.20 | -13.14 | 0.0642 | -0.0128 | |||

| BMRN / BioMarin Pharmaceutical Inc. | 0.02 | -1.11 | 1.17 | -23.11 | 0.0627 | -0.0223 | |||

| VORTEX OPCO LLC FUNGIBLE / DBT (US92905YAD04) | 1.12 | 1.27 | 0.0599 | -0.0018 | |||||

| US758075AF22 / REDWOOD TRUST INC | 0.99 | 0.30 | 0.0530 | -0.0021 | |||||

| VORTEX OPCO LLC / DBT (US92905YAA64) | 0.80 | -34.05 | 0.0430 | -0.0250 | |||||

| US577081AW27 / Mattel Inc | 0.66 | -3.07 | 0.0356 | -0.0027 | |||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.37 | 0.0201 | 0.0201 | ||||||

| US18936A3068 / CLOVIS LIQUIDATION TRUST UNITS | 9.37 | 0.00 | 0.33 | -12.57 | 0.0176 | -0.0034 | |||

| US00191AAD81 / ARD Finance SA | 0.25 | -34.21 | 0.0134 | -0.0079 | |||||

| US30744WAD92 / Farfetch Ltd | 0.05 | -66.67 | 0.0028 | -0.0060 | |||||

| QTNT / Quotient Ltd | 0.18 | 0.00 | 0.0000 | 0.0000 | |||||

| WEWORK COS LLC / DBT (US962ESCAA73) | 0.00 | 0.0000 | -0.0000 | ||||||

| QTNT / Quotient Ltd | 0.04 | 0.00 | 0.0000 | 0.0000 | |||||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1955 |