Basic Stats

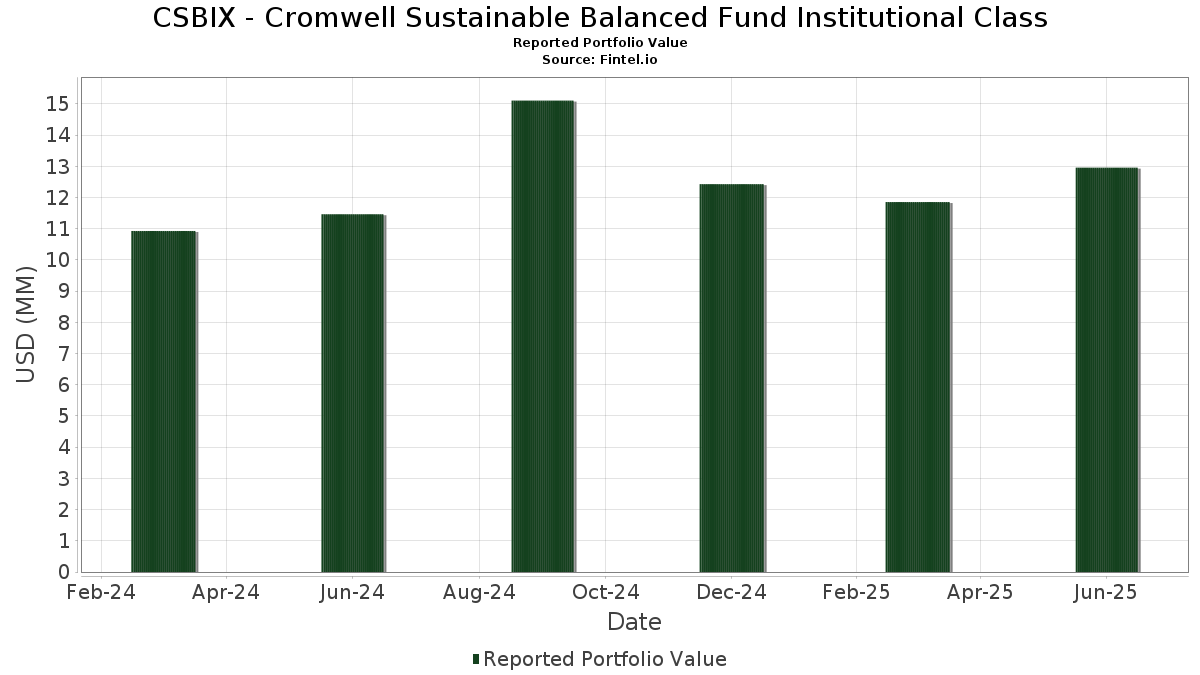

| Portfolio Value | $ 12,960,078 |

| Current Positions | 74 |

Latest Holdings, Performance, AUM (from 13F, 13D)

CSBIX - Cromwell Sustainable Balanced Fund Institutional Class has disclosed 74 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 12,960,078 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). CSBIX - Cromwell Sustainable Balanced Fund Institutional Class’s top holdings are DREYFUS TREASURY PRIME CASH MANAGEMENT/ CLASS A (XX:US2619081076) , Amazon.com, Inc. (US:AMZN) , Microsoft Corporation (US:MSFT) , Talen Energy Corporation (US:TLN) , and Meta Platforms, Inc. (US:META) . CSBIX - Cromwell Sustainable Balanced Fund Institutional Class’s new positions include LPL Financial Holdings Inc. (US:LPLA) , Elevance Health, Inc. (US:ELV) , Fair Isaac Corporation (US:FICO) , Markel Group Inc. (GB:0JYM) , and BAC 3.846 03/08/37 (US:US06051GKL22) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.84 | 0.84 | 6.4762 | 2.4909 | |

| 0.00 | 0.28 | 2.1560 | 2.1560 | |

| 0.00 | 0.40 | 3.0956 | 1.8115 | |

| 0.00 | 0.17 | 1.3466 | 1.3466 | |

| 0.00 | 0.17 | 1.2996 | 1.2996 | |

| 0.00 | 0.12 | 0.9416 | 0.9416 | |

| 0.00 | 0.59 | 4.5321 | 0.8087 | |

| 0.10 | 0.7741 | 0.7741 | ||

| 0.00 | 0.09 | 0.6801 | 0.6801 | |

| 0.00 | 0.37 | 2.8961 | 0.5762 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.20 | 1.5548 | -1.8358 | ||

| 0.00 | 0.00 | -1.8267 | ||

| 0.30 | 2.2950 | -1.0251 | ||

| 0.00 | 0.00 | -0.9937 | ||

| 0.76 | 5.8995 | -0.4852 | ||

| 0.00 | 0.25 | 1.9039 | -0.4162 | |

| 0.00 | 0.33 | 2.5601 | -0.3321 | |

| 0.45 | 3.5045 | -0.3056 | ||

| 0.27 | 2.1156 | -0.2632 | ||

| 0.00 | 0.16 | 1.2592 | -0.2469 |

13F and Fund Filings

This form was filed on 2025-08-27 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US2619081076 / DREYFUS TREASURY PRIME CASH MANAGEMENT/ CLASS A | 0.84 | 76.90 | 0.84 | 77.17 | 6.4762 | 2.4909 | |||

| United States Treasury Note/Bond / DBT (US91282CKD29) | 0.76 | 0.66 | 5.8995 | -0.4852 | |||||

| AMZN / Amazon.com, Inc. | 0.00 | 0.00 | 0.60 | 15.33 | 4.6574 | 0.2605 | |||

| MSFT / Microsoft Corporation | 0.00 | 0.00 | 0.59 | 32.58 | 4.5321 | 0.8087 | |||

| TLN / Talen Energy Corporation | 0.00 | -20.40 | 0.56 | 15.88 | 4.3481 | 0.2645 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.48 | 28.07 | 3.7019 | 0.5550 | |||

| United States Treasury Note/Bond / DBT (US91282CKE02) | 0.45 | 0.22 | 3.5045 | -0.3056 | |||||

| NVDA / NVIDIA Corporation | 0.00 | -16.44 | 0.44 | 21.88 | 3.4016 | 0.3617 | |||

| GEV / GE Vernova Inc. | 0.00 | 51.40 | 0.40 | 163.16 | 3.0956 | 1.8115 | |||

| United States Treasury Note/Bond / DBT (US91282CLM19) | 0.39 | 0.77 | 3.0403 | -0.2418 | |||||

| FERG / Ferguson Enterprises Inc. | 0.00 | 0.00 | 0.37 | 36.00 | 2.8961 | 0.5762 | |||

| DHR / Danaher Corporation | 0.00 | 0.00 | 0.33 | -3.50 | 2.5601 | -0.3321 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | 0.00 | 0.32 | 20.07 | 2.4987 | 0.2305 | |||

| United States Treasury Note/Bond / DBT (US91282CJZ59) | 0.30 | -24.87 | 2.2950 | -1.0251 | |||||

| INTU / Intuit Inc. | 0.00 | 0.00 | 0.29 | 28.44 | 2.2400 | 0.3391 | |||

| LPLA / LPL Financial Holdings Inc. | 0.00 | 0.28 | 2.1560 | 2.1560 | |||||

| United States Treasury Note/Bond / DBT (US912810TX63) | 0.27 | -3.19 | 2.1156 | -0.2632 | |||||

| MLM / Martin Marietta Materials, Inc. | 0.00 | 0.00 | 0.26 | 15.18 | 1.9939 | 0.1034 | |||

| SHW / The Sherwin-Williams Company | 0.00 | 0.00 | 0.25 | -1.93 | 1.9689 | -0.2109 | |||

| TMUS / T-Mobile US, Inc. | 0.00 | 0.00 | 0.25 | -10.55 | 1.9039 | -0.4162 | |||

| CSGP / CoStar Group, Inc. | 0.00 | 0.00 | 0.23 | 1.75 | 1.7932 | -0.1305 | |||

| VEEV / Veeva Systems Inc. | 0.00 | 0.00 | 0.23 | 23.91 | 1.7693 | 0.2201 | |||

| GTLB / GitLab Inc. | 0.00 | 47.97 | 0.21 | 42.36 | 1.5904 | 0.3713 | |||

| United States Treasury Note/Bond / DBT (US91282CKQ32) | 0.20 | 0.50 | 1.5702 | -0.1355 | |||||

| United States Treasury Note/Bond / DBT (US91282CKY65) | 0.20 | -50.12 | 1.5548 | -1.8358 | |||||

| CRM / Salesforce, Inc. | 0.00 | 0.00 | 0.18 | 1.15 | 1.3677 | -0.0976 | |||

| ELV / Elevance Health, Inc. | 0.00 | 0.17 | 1.3466 | 1.3466 | |||||

| FICO / Fair Isaac Corporation | 0.00 | 0.17 | 1.2996 | 1.2996 | |||||

| ENTG / Entegris, Inc. | 0.00 | 4.03 | 0.17 | -4.05 | 1.2864 | -0.1737 | |||

| PGR / The Progressive Corporation | 0.00 | 0.00 | 0.17 | -5.71 | 1.2807 | -0.1979 | |||

| EXPE / Expedia Group, Inc. | 0.00 | -9.30 | 0.16 | -9.50 | 1.2592 | -0.2469 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | 0.00 | 0.14 | -4.86 | 1.0659 | -0.1474 | |||

| NKE / NIKE, Inc. | 0.00 | 0.00 | 0.13 | 11.86 | 1.0255 | 0.0279 | |||

| 0JYM / Markel Group Inc. | 0.00 | 0.12 | 0.9416 | 0.9416 | |||||

| United States Treasury Note/Bond / DBT (US91282CNC19) | 0.10 | 0.7741 | 0.7741 | ||||||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.09 | 13.75 | 0.7096 | 0.0318 | |||

| US06051GKL22 / BAC 3.846 03/08/37 | 0.09 | 2.25 | 0.7074 | -0.0479 | |||||

| THC / Tenet Healthcare Corporation | 0.00 | 0.09 | 0.6801 | 0.6801 | |||||

| ACN / Accenture plc | 0.00 | 0.00 | 0.06 | -4.55 | 0.4897 | -0.0668 | |||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0.05 | 1.96 | 0.4050 | -0.0311 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0.05 | 0.4013 | 0.4013 | ||||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0.05 | 0.3996 | 0.3996 | ||||||

| US74251VAT98 / Principal Financial Group Inc | 0.05 | 2.00 | 0.3977 | -0.0305 | |||||

| METB34 / MetLife, Inc. - Depositary Receipt (Common Stock) | 0.05 | 0.3975 | 0.3975 | ||||||

| CMCS34 / Comcast Corporation - Depositary Receipt (Common Stock) | 0.05 | 0.3948 | 0.3948 | ||||||

| L1EN34 / Lennar Corporation - Depositary Receipt (Common Stock) | 0.05 | 0.3938 | 0.3938 | ||||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0.05 | 0.00 | 0.3936 | -0.0286 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 0.05 | 0.3936 | 0.3936 | ||||||

| A1DC34 / Agree Realty Corporation - Depositary Receipt (Common Stock) | 0.05 | 0.3935 | 0.3935 | ||||||

| I1EX34 / IDEX Corporation - Depositary Receipt (Common Stock) | 0.05 | 0.00 | 0.3929 | -0.0287 | |||||

| CDW LLC / CDW Finance Corp / DBT (US12513GBK40) | 0.05 | 2.04 | 0.3894 | -0.0309 | |||||

| Host Hotels & Resorts LP / DBT (US44107TBB17) | 0.05 | 0.00 | 0.3891 | -0.0320 | |||||

| US24703TAE64 / Dell International LLC / EMC Corp | 0.05 | 0.00 | 0.3882 | -0.0341 | |||||

| NDSN / Nordson Corporation | 0.05 | 2.04 | 0.3868 | -0.0276 | |||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 0.05 | 2.04 | 0.3868 | -0.0304 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0.05 | 0.00 | 0.3846 | -0.0316 | |||||

| US38141GWV21 / Goldman Sachs Group Inc/The | 0.05 | 2.08 | 0.3803 | -0.0305 | |||||

| L1CA34 / Labcorp Holdings Inc. - Depositary Receipt (Common Stock) | 0.05 | 0.00 | 0.3779 | -0.0273 | |||||

| US00914AAM45 / Air Lease Corp | 0.05 | 0.00 | 0.3757 | -0.0294 | |||||

| US337738AU25 / Fiserv Inc | 0.05 | 2.13 | 0.3723 | -0.0278 | |||||

| ANTX / AN2 Therapeutics, Inc. | 0.05 | 0.00 | 0.3717 | -0.0343 | |||||

| US031162DJ62 / Amgen Inc | 0.05 | 2.13 | 0.3711 | -0.0279 | |||||

| KO / The Coca-Cola Company - Depositary Receipt (Common Stock) | 0.05 | -2.08 | 0.3702 | -0.0355 | |||||

| US49338LAF04 / Keysight Technologies Inc. | 0.05 | 2.17 | 0.3637 | -0.0251 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0.05 | 0.00 | 0.3522 | -0.0294 | |||||

| US172967NE72 / Citigroup Inc | 0.04 | 2.38 | 0.3379 | -0.0214 | |||||

| US49271VAR15 / Keurig Dr Pepper, Inc. | 0.04 | 0.00 | 0.3186 | -0.0325 | |||||

| US98419MAK62 / Xylem Inc/NY | 0.04 | 0.00 | 0.3177 | -0.0340 | |||||

| US548661EF07 / Lowe's Cos., Inc. | 0.04 | 0.00 | 0.3002 | -0.0273 | |||||

| US92343VGK44 / Verizon Communications Inc | 0.04 | 0.00 | 0.2982 | -0.0258 | |||||

| US832696AX63 / J M Smucker Co. | 0.03 | -50.94 | 0.2075 | -0.2407 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 0.1988 | -0.0145 | |||||

| US11120VAA17 / Brixmor Operating Partnership LP | 0.03 | 0.00 | 0.1986 | -0.0152 | |||||

| Equinix Europe 2 Financing Corp LLC / DBT (US29390XAA28) | 0.02 | 0.00 | 0.1584 | -0.0132 | |||||

| JEF / Jefferies Financial Group Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9937 | ||||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -1.8267 |