Basic Stats

| Portfolio Value | $ 180,986,000 |

| Current Positions | 111 |

Latest Holdings, Performance, AUM (from 13F, 13D)

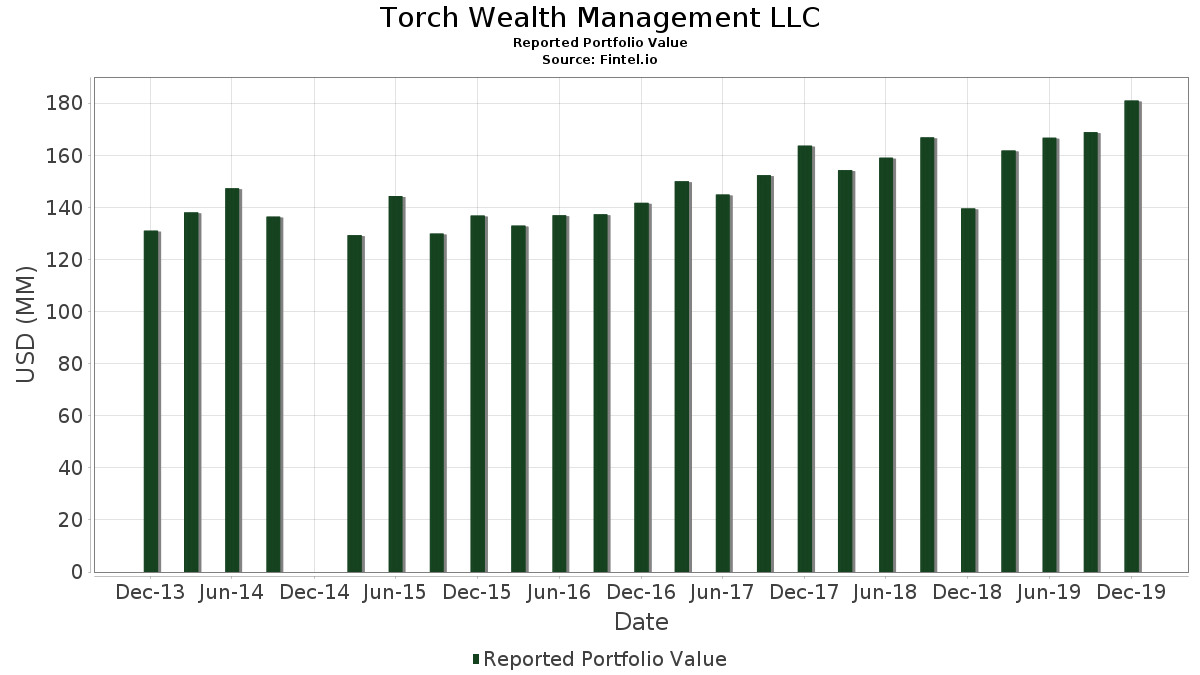

Torch Wealth Management LLC has disclosed 111 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 180,986,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Torch Wealth Management LLC’s top holdings are The Procter & Gamble Company (US:PG) , Apple Inc. (US:AAPL) , iShares Trust - iShares Core S&P Mid-Cap ETF (US:IJH) , iShares Trust - iShares Core S&P Small-Cap ETF (US:IJR) , and The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund (US:XLK) . Torch Wealth Management LLC’s new positions include Marvell Technology, Inc. (US:MRVL) , SPDR Series Trust - SPDR Portfolio S&P 500 Value ETF (US:SPYV) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 11.33 | 6.2624 | 1.0533 | |

| 0.01 | 1.31 | 0.7266 | 0.7266 | |

| 0.01 | 3.24 | 1.7924 | 0.4416 | |

| 0.01 | 0.31 | 0.1735 | 0.1735 | |

| 0.06 | 5.20 | 2.8709 | 0.1409 | |

| 0.03 | 3.80 | 2.0985 | 0.1359 | |

| 0.01 | 0.22 | 0.1238 | 0.1238 | |

| 0.00 | 0.22 | 0.1193 | 0.1193 | |

| 0.01 | 0.20 | 0.1122 | 0.1122 | |

| 0.01 | 1.66 | 0.9155 | 0.1096 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.11 | 13.31 | 7.3564 | -0.6070 | |

| 0.03 | 1.92 | 1.0598 | -0.3515 | |

| 0.02 | 2.65 | 1.4653 | -0.2272 | |

| 0.04 | 2.66 | 1.4686 | -0.2180 | |

| 0.06 | 3.24 | 1.7880 | -0.2143 | |

| 0.01 | 1.98 | 1.0912 | -0.2075 | |

| 0.01 | 2.03 | 1.1211 | -0.1942 | |

| 0.02 | 2.51 | 1.3846 | -0.1498 | |

| 0.03 | 1.10 | 0.6067 | -0.1484 | |

| 0.01 | 1.48 | 0.8150 | -0.1456 |

13F and Fund Filings

This form was filed on 2020-02-25 for the reporting period 2019-12-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| PG / The Procter & Gamble Company | 0.11 | -1.40 | 13.31 | -0.99 | 7.3564 | -0.6070 | |||

| AAPL / Apple Inc. | 0.04 | -1.72 | 11.33 | 28.85 | 6.2624 | 1.0533 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.04 | -1.40 | 8.82 | 5.03 | 4.8733 | -0.1000 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.10 | -0.40 | 8.00 | 7.30 | 4.4191 | 0.0048 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.06 | -0.97 | 5.20 | 12.71 | 2.8709 | 0.1409 | |||

| DIS / The Walt Disney Company | 0.03 | 1.08 | 4.22 | 12.16 | 2.3344 | 0.1036 | |||

| V / Visa Inc. | 0.02 | -2.55 | 3.81 | 6.45 | 2.1073 | -0.0145 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | -3.22 | 3.80 | 14.60 | 2.0985 | 0.1359 | |||

| IAU / iShares Gold Trust | 0.23 | 0.27 | 3.29 | 3.10 | 1.8178 | -0.0719 | |||

| NEE / NextEra Energy, Inc. | 0.01 | -1.53 | 3.27 | 2.34 | 1.8095 | -0.0855 | |||

| HUM / Humana Inc. | 0.01 | -0.75 | 3.24 | 42.22 | 1.7924 | 0.4416 | |||

| ORCL / Oracle Corporation | 0.06 | -0.59 | 3.24 | -4.29 | 1.7880 | -0.2143 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | 2.23 | 3.02 | 10.87 | 1.6675 | 0.0556 | |||

| USB / U.S. Bancorp | 0.05 | -1.66 | 2.92 | 5.35 | 1.6112 | -0.0280 | |||

| MSFT / Microsoft Corporation | 0.02 | -0.27 | 2.90 | 13.12 | 1.6051 | 0.0843 | |||

| PEP / PepsiCo, Inc. | 0.02 | -0.05 | 2.89 | -0.38 | 1.5990 | -0.1213 | |||

| VGK / Vanguard International Equity Index Funds - Vanguard FTSE Europe ETF | 0.05 | 0.00 | 2.81 | 9.29 | 1.5537 | 0.0300 | |||

| WMT / Walmart Inc. | 0.02 | -0.55 | 2.67 | -0.41 | 1.4725 | -0.1122 | |||

| XOM / Exxon Mobil Corporation | 0.04 | -5.53 | 2.66 | -6.67 | 1.4686 | -0.2180 | |||

| JNJ / Johnson & Johnson | 0.02 | -17.68 | 2.65 | -7.21 | 1.4653 | -0.2272 | |||

| EW / Edwards Lifesciences Corporation | 0.01 | -0.69 | 2.54 | 5.32 | 1.4012 | -0.0248 | |||

| MRK / Merck & Co., Inc. | 0.03 | 3.94 | 2.52 | 12.28 | 1.3940 | 0.0634 | |||

| CB / Chubb Limited | 0.02 | 0.35 | 2.51 | -3.28 | 1.3846 | -0.1498 | |||

| MCHP / Microchip Technology Incorporated | 0.02 | -0.63 | 2.46 | 11.98 | 1.3581 | 0.0582 | |||

| EFG / iShares Trust - iShares MSCI EAFE Growth ETF | 0.03 | -3.42 | 2.32 | 3.67 | 1.2797 | -0.0433 | |||

| IGSB / iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF | 0.04 | 8.81 | 2.29 | 8.75 | 1.2642 | 0.0182 | |||

| ABT / Abbott Laboratories | 0.03 | -2.61 | 2.26 | 1.07 | 1.2509 | -0.0756 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -1.01 | 2.22 | 7.77 | 1.2266 | 0.0067 | |||

| RTX / RTX Corporation | 0.01 | -0.92 | 2.12 | 8.65 | 1.1725 | 0.0159 | |||

| TJX / The TJX Companies, Inc. | 0.03 | 1.52 | 2.04 | 11.20 | 1.1244 | 0.0407 | |||

| MCD / McDonald's Corporation | 0.01 | -0.74 | 2.03 | -8.64 | 1.1211 | -0.1942 | |||

| NOC / Northrop Grumman Corporation | 0.01 | -1.88 | 1.98 | -9.94 | 1.0912 | -0.2075 | |||

| EPR / EPR Properties | 0.03 | -12.42 | 1.92 | -19.51 | 1.0598 | -0.3515 | |||

| VZ / Verizon Communications Inc. | 0.03 | -1.11 | 1.91 | 0.58 | 1.0559 | -0.0693 | |||

| DUK / Duke Energy Corporation | 0.02 | 0.02 | 1.81 | -4.84 | 0.9984 | -0.1262 | |||

| PGX / Invesco Exchange-Traded Fund Trust II - Invesco Preferred ETF | 0.12 | -0.25 | 1.77 | -0.39 | 0.9780 | -0.0744 | |||

| LLY / Eli Lilly and Company | 0.01 | 0.30 | 1.75 | 17.82 | 0.9680 | 0.0874 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 1.70 | 8.85 | 0.9376 | 0.0144 | |||

| COP / ConocoPhillips | 0.03 | -0.67 | 1.69 | 13.33 | 0.9349 | 0.0507 | |||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.01 | 0.55 | 1.66 | 21.75 | 0.9155 | 0.1096 | |||

| PFE / Pfizer Inc. | 0.04 | -1.10 | 1.61 | 7.81 | 0.8923 | 0.0052 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.02 | 7.07 | 1.59 | 14.04 | 0.8796 | 0.0529 | |||

| COR / Cencora, Inc. | 0.01 | -1.09 | 1.48 | -9.06 | 0.8150 | -0.1456 | |||

| TRV / The Travelers Companies, Inc. | 0.01 | -0.47 | 1.46 | -8.40 | 0.8072 | -0.1373 | |||

| COF / Capital One Financial Corporation | 0.01 | -0.52 | 1.39 | 12.47 | 0.7675 | 0.0361 | |||

| CVX / Chevron Corporation | 0.01 | 5.75 | 1.39 | 7.44 | 0.7658 | 0.0019 | |||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.02 | -1.85 | 1.37 | -2.07 | 0.7586 | -0.0716 | |||

| MMM / 3M Company | 0.01 | 1.31 | 0.7266 | 0.7266 | |||||

| INTC / Intel Corporation | 0.02 | 1.99 | 1.30 | 18.38 | 0.7188 | 0.0680 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.43 | 1.30 | 6.82 | 0.7183 | -0.0024 | |||

| AFL / Aflac Incorporated | 0.02 | -1.50 | 1.22 | -0.41 | 0.6735 | -0.0513 | |||

| FDX / FedEx Corporation | 0.01 | -3.42 | 1.21 | 0.25 | 0.6675 | -0.0461 | |||

| BKLN / Invesco Exchange-Traded Fund Trust II - Invesco Senior Loan ETF | 0.05 | -5.32 | 1.20 | -4.39 | 0.6614 | -0.0801 | |||

| ODFL / Old Dominion Freight Line, Inc. | 0.01 | -0.82 | 1.15 | 10.66 | 0.6365 | 0.0200 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.02 | -3.02 | 1.13 | 3.28 | 0.6266 | -0.0237 | |||

| OXY / Occidental Petroleum Corporation | 0.03 | -6.98 | 1.10 | -13.88 | 0.6067 | -0.1484 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.01 | 5.06 | 1.03 | 13.72 | 0.5680 | 0.0326 | |||

| WY / Weyerhaeuser Company | 0.03 | -0.35 | 1.02 | 8.51 | 0.5636 | 0.0069 | |||

| VLO / Valero Energy Corporation | 0.01 | -0.58 | 0.97 | 9.13 | 0.5348 | 0.0096 | |||

| EWJ / iShares, Inc. - iShares MSCI Japan ETF | 0.02 | -2.25 | 0.90 | 1.93 | 0.4967 | -0.0256 | |||

| T / AT&T Inc. | 0.02 | 6.59 | 0.86 | 9.99 | 0.4746 | 0.0121 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.43 | 0.85 | 12.04 | 0.4680 | 0.0203 | |||

| CAT / Caterpillar Inc. | 0.01 | -3.54 | 0.82 | 12.69 | 0.4514 | 0.0221 | |||

| AMN / AMN Healthcare Services, Inc. | 0.01 | -6.14 | 0.76 | 1.47 | 0.4205 | -0.0237 | |||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 0.01 | 0.00 | 0.74 | 4.79 | 0.4111 | -0.0094 | |||

| ABC / Amerisource Bergen Corp. | 0.01 | -2.20 | 0.73 | 0.97 | 0.4017 | -0.0247 | |||

| GE / General Electric Company | 0.06 | -0.94 | 0.65 | 23.48 | 0.3602 | 0.0476 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.01 | 5.22 | 0.62 | 6.68 | 0.3442 | -0.0016 | |||

| GLD / SPDR Gold Trust | 0.00 | -4.44 | 0.61 | -1.76 | 0.3393 | -0.0309 | |||

| SKX / Skechers U.S.A., Inc. | 0.01 | 0.00 | 0.59 | 15.46 | 0.3260 | 0.0234 | |||

| IVE / iShares Trust - iShares S&P 500 Value ETF | 0.00 | 0.00 | 0.57 | 9.06 | 0.3127 | 0.0054 | |||

| ABBV / AbbVie Inc. | 0.01 | 25.92 | 0.56 | 47.11 | 0.3089 | 0.0838 | |||

| XLC / The Select Sector SPDR Trust - The Communication Services Select Sector SPDR Fund | 0.01 | 2.11 | 0.52 | 10.43 | 0.2868 | 0.0084 | |||

| C.WSA / Citigroup, Inc. | 0.00 | -2.18 | 0.50 | 10.22 | 0.2741 | 0.0076 | |||

| AMGN / Amgen Inc. | 0.00 | 0.00 | 0.46 | 24.46 | 0.2531 | 0.0351 | |||

| CSX / CSX Corporation | 0.01 | -3.11 | 0.45 | 1.13 | 0.2481 | -0.0149 | |||

| MBB / iShares Trust - iShares MBS ETF | 0.00 | 0.00 | 0.42 | -0.24 | 0.2326 | -0.0173 | |||

| XLB / The Select Sector SPDR Trust - The Materials Select Sector SPDR Fund | 0.01 | 3.03 | 0.42 | 8.59 | 0.2304 | 0.0030 | |||

| OGE / OGE Energy Corp. | 0.01 | 0.90 | 0.41 | -1.21 | 0.2260 | -0.0192 | |||

| XLP / The Select Sector SPDR Trust - The Consumer Staples Select Sector SPDR Fund | 0.01 | 2.49 | 0.39 | 4.85 | 0.2149 | -0.0048 | |||

| HD / The Home Depot, Inc. | 0.00 | 1.02 | 0.39 | -5.15 | 0.2138 | -0.0278 | |||

| MNST / Monster Beverage Corporation | 0.01 | -2.97 | 0.36 | 6.14 | 0.2006 | -0.0020 | |||

| IGIB / iShares Trust - iShares 5-10 Year Investment Grade Corporate Bond ETF | 0.01 | 0.00 | 0.36 | -0.28 | 0.1989 | -0.0149 | |||

| WMS / Advanced Drainage Systems, Inc. | 0.01 | -1.64 | 0.35 | 17.97 | 0.1923 | 0.0176 | |||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.00 | -0.39 | 0.34 | 6.88 | 0.1890 | -0.0005 | |||

| HON / Honeywell International Inc. | 0.00 | 0.26 | 0.34 | 4.67 | 0.1856 | -0.0044 | |||

| BA / The Boeing Company | 0.00 | 0.10 | 0.33 | -14.36 | 0.1812 | -0.0456 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 0.00 | 0.32 | -3.28 | 0.1790 | -0.0194 | |||

| MRVL / Marvell Technology, Inc. | 0.01 | 0.31 | 0.1735 | 0.1735 | |||||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.00 | 0.31 | 35.50 | 0.1729 | 0.0361 | |||

| AEP / American Electric Power Company, Inc. | 0.00 | 0.64 | 0.31 | 1.30 | 0.1718 | -0.0100 | |||

| HYS / PIMCO ETF Trust - PIMCO 0-5 Year High Yield Corporate Bond Index Exchange-Traded Fund | 0.00 | 0.00 | 0.29 | 0.00 | 0.1624 | -0.0117 | |||

| D / Dominion Energy, Inc. | 0.00 | 0.55 | 0.27 | 2.63 | 0.1508 | -0.0067 | |||

| NVDA / NVIDIA Corporation | 0.00 | 0.00 | 0.27 | 34.65 | 0.1503 | 0.0307 | |||

| GNRC / Generac Holdings Inc. | 0.00 | 0.00 | 0.27 | 27.83 | 0.1497 | 0.0242 | |||

| FLS / Flowserve Corporation | 0.01 | 0.00 | 0.27 | 6.43 | 0.1464 | -0.0010 | |||

| SNX / TD SYNNEX Corporation | 0.00 | 0.00 | 0.26 | 13.79 | 0.1459 | 0.0085 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.00 | 0.26 | 7.98 | 0.1420 | 0.0011 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.01 | 1.92 | 0.25 | 11.95 | 0.1398 | 0.0060 | |||

| PM / Philip Morris International Inc. | 0.00 | -14.60 | 0.25 | -4.62 | 0.1370 | -0.0169 | |||

| MDLZ / Mondelez International, Inc. | 0.00 | -6.28 | 0.25 | -6.82 | 0.1359 | -0.0204 | |||

| KO / The Coca-Cola Company | 0.00 | 1.56 | 0.23 | 3.08 | 0.1293 | -0.0051 | |||

| IGV / iShares Trust - iShares Expanded Tech-Software Sector ETF | 0.00 | 0.00 | 0.23 | 9.91 | 0.1287 | 0.0032 | |||

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | 0.00 | -8.39 | 0.23 | -8.03 | 0.1265 | -0.0209 | |||

| SPYV / SPDR Series Trust - SPDR Portfolio S&P 500 Value ETF | 0.01 | 0.22 | 0.1238 | 0.1238 | |||||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.00 | 0.00 | 0.22 | -0.88 | 0.1238 | -0.0101 | |||

| CTAS / Cintas Corporation | 0.00 | 2.39 | 0.22 | 2.82 | 0.1210 | -0.0051 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.00 | 0.22 | 0.1193 | 0.1193 | |||||

| CINF / Cincinnati Financial Corporation | 0.00 | 0.00 | 0.21 | -9.87 | 0.1160 | -0.0220 | |||

| KR / The Kroger Co. | 0.01 | 0.20 | 0.1122 | 0.1122 | |||||

| MMAT / Meta Materials Inc. | 0.05 | 0.00 | 0.04 | -35.59 | 0.0210 | -0.0139 | |||

| BGS / B&G Foods, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1190 | ||||

| VVR / Invesco Senior Income Trust | 0.00 | -100.00 | 0.00 | -100.00 | -0.0272 |