Basic Stats

| Portfolio Value | $ 32,041 |

| Current Positions | 13 |

Latest Holdings, Performance, AUM (from 13F, 13D)

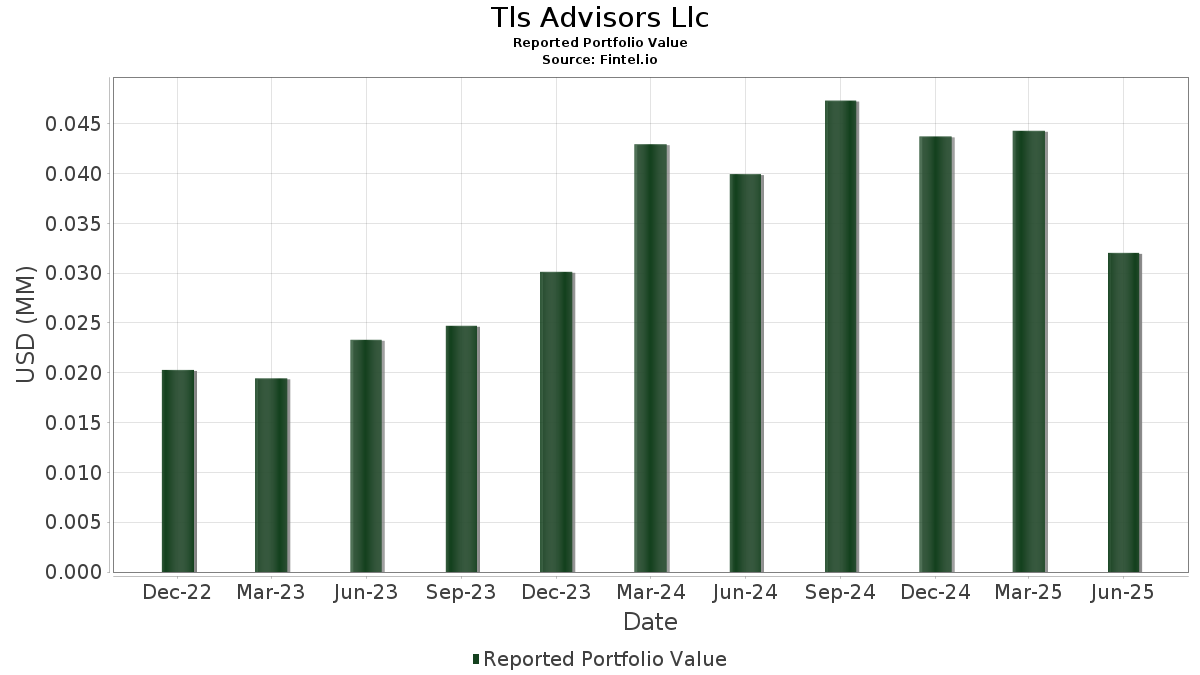

Tls Advisors Llc has disclosed 13 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 32,041 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Tls Advisors Llc’s top holdings are EQT Corporation (US:EQT) , Meta Platforms, Inc. (US:META) , Rio Tinto Group - Depositary Receipt (Common Stock) (US:RIO) , iShares, Inc. - iShares MSCI Global Metals & Mining Producers ETF (US:PICK) , and XOMA Royalty Corporation (US:XOMA) . Tls Advisors Llc’s new positions include Singularity Future Technology Ltd. (US:SGLY) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 0.01 | 24.3937 | 10.6166 | |

| 0.14 | 0.01 | 24.7183 | 8.3384 | |

| 0.12 | 0.00 | 9.3630 | 4.0061 | |

| 0.05 | 0.00 | 6.0828 | 1.7621 | |

| 0.03 | 0.00 | 3.2209 | 0.7241 | |

| 0.01 | 0.00 | 1.1017 | 0.3726 | |

| 0.00 | 0.00 | 1.2640 | 0.3497 | |

| 0.68 | 0.00 | 0.7022 | 0.2214 | |

| 0.01 | 0.00 | 0.0437 | 0.0437 | |

| 0.25 | 0.00 | 1.3576 | 0.0032 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 0.00 | 2.9181 | -10.4640 | |

| 0.10 | 0.00 | 11.8504 | -4.3083 | |

| 0.07 | 0.00 | 12.9834 | -3.0332 |

13F and Fund Filings

This form was filed on 2025-08-13 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| EQT / EQT Corporation | 0.14 | 0.00 | 0.01 | 0.00 | 24.7183 | 8.3384 | |||

| META / Meta Platforms, Inc. | 0.01 | 0.00 | 0.01 | 16.67 | 24.3937 | 10.6166 | |||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.07 | -39.61 | 0.00 | -42.86 | 12.9834 | -3.0332 | |||

| PICK / iShares, Inc. - iShares MSCI Global Metals & Mining Producers ETF | 0.10 | -49.38 | 0.00 | -57.14 | 11.8504 | -4.3083 | |||

| XOMA / XOMA Royalty Corporation | 0.12 | 0.00 | 0.00 | 50.00 | 9.3630 | 4.0061 | |||

| RRC / Range Resources Corporation | 0.05 | 0.00 | 0.00 | 0.00 | 6.0828 | 1.7621 | |||

| XENE / Xenon Pharmaceuticals Inc. | 0.03 | 0.00 | 0.00 | 0.00 | 3.2209 | 0.7241 | |||

| VALE / Vale S.A. - Depositary Receipt (Common Stock) | 0.10 | -83.78 | 0.00 | -100.00 | 2.9181 | -10.4640 | |||

| OABI / OmniAb, Inc. | 0.25 | 0.00 | 0.00 | 1.3576 | 0.0032 | ||||

| HOV / Hovnanian Enterprises, Inc. | 0.00 | 0.00 | 0.00 | 1.2640 | 0.3497 | ||||

| EWS / iShares, Inc. - iShares MSCI Singapore ETF | 0.01 | 0.00 | 0.00 | 1.1017 | 0.3726 | ||||

| OVID / Ovid Therapeutics Inc. | 0.68 | 0.00 | 0.00 | 0.7022 | 0.2214 | ||||

| SGLY / Singularity Future Technology Ltd. | 0.01 | 0.00 | 0.0437 | 0.0437 | |||||

| WY / Weyerhaeuser Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BHP / BHP Group Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VAL / Valaris Limited | 0.00 | -100.00 | 0.00 | 0.0000 |