Basic Stats

| Portfolio Value | $ 541,677,000 |

| Current Positions | 66 |

Latest Holdings, Performance, AUM (from 13F, 13D)

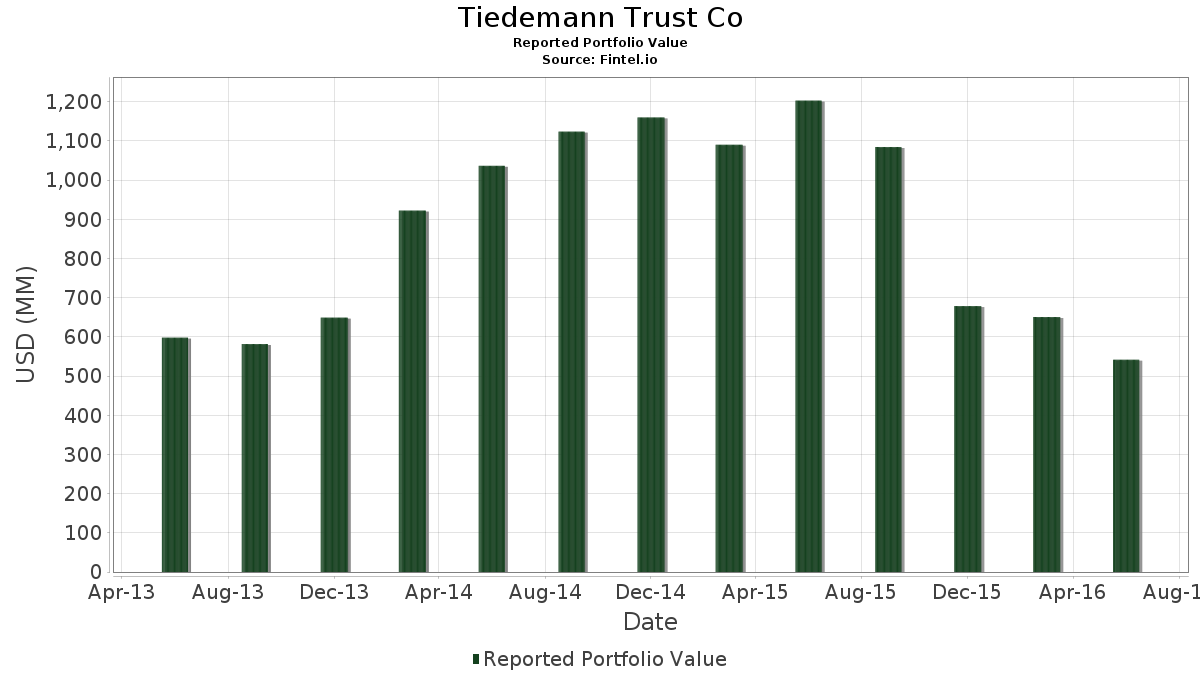

Tiedemann Trust Co has disclosed 66 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 541,677,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Tiedemann Trust Co’s top holdings are Deep Value ETF (US:DVP) , The Select Sector SPDR Trust - The Consumer Staples Select Sector SPDR Fund (US:XLP) , Enterprise Products Partners L.P. - Limited Partnership (US:EPD) , iShares Trust - iShares Core 40/60 Moderate Allocation ETF (US:AOM) , and iShares Trust - iShares Core S&P Mid-Cap ETF (US:IJH) . Tiedemann Trust Co’s new positions include First Trust Exchange-Traded Fund IV - First Trust North American Energy Infrastructure Fund (US:EMLP) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.25 | 51.92 | 9.5849 | 1.4383 | |

| 1.14 | 40.08 | 7.3987 | 1.3189 | |

| 1.41 | 41.30 | 7.6237 | 1.0025 | |

| 0.93 | 21.56 | 3.9804 | 0.8259 | |

| 0.60 | 16.47 | 3.0400 | 0.6375 | |

| 0.26 | 14.70 | 2.7129 | 0.5577 | |

| 1.13 | 16.94 | 3.1273 | 0.4076 | |

| 0.56 | 14.21 | 2.6241 | 0.4011 | |

| 0.36 | 16.70 | 3.0825 | 0.3892 | |

| 1.03 | 16.06 | 2.9647 | 0.3741 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.89 | 48.93 | 9.0325 | -3.5234 | |

| 0.15 | 17.91 | 3.3055 | -2.5819 | |

| 0.21 | 31.02 | 5.7276 | -2.5151 | |

| 1.03 | 18.95 | 3.4988 | -0.8082 | |

| 0.12 | 5.73 | 1.0578 | -0.1141 | |

| 0.13 | 2.79 | 0.5141 | -0.1050 | |

| 0.00 | 0.00 | -0.0948 | ||

| 0.01 | 0.50 | 0.0918 | -0.0804 | |

| 0.00 | 0.00 | -0.0480 | ||

| 0.00 | 0.00 | -0.0350 |

13F and Fund Filings

This form was filed on 2016-08-12 for the reporting period 2016-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| DVP / Deep Value ETF | 2.25 | -1.53 | 51.92 | -2.05 | 9.5849 | 1.4383 | |||

| XLP / The Select Sector SPDR Trust - The Consumer Staples Select Sector SPDR Fund | 0.89 | -42.38 | 48.93 | -40.11 | 9.0325 | -3.5234 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 1.41 | 80,549.09 | 41.30 | -4.14 | 7.6237 | 1.0025 | |||

| AOM / iShares Trust - iShares Core 40/60 Moderate Allocation ETF | 1.14 | -0.12 | 40.08 | 1.32 | 7.3987 | 1.3189 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.21 | -44.16 | 31.02 | -42.15 | 5.7276 | -2.5151 | |||

| SEP / Spectra Energy Partners LP | 0.47 | -12.90 | 22.03 | -14.60 | 4.0672 | 0.1020 | |||

| EEP / Enbridge Energy Partners, L.P. | 0.93 | -17.04 | 21.56 | 5.05 | 3.9804 | 0.8259 | |||

| MMP / Magellan Midstream Partners L.P. | 0.27 | -19.03 | 20.53 | -10.55 | 3.7897 | 0.2623 | |||

| DSL / DoubleLine Income Solutions Fund | 1.03 | -38.04 | 18.95 | -32.37 | 3.4988 | -0.8082 | |||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.15 | -53.53 | 17.91 | -53.26 | 3.3055 | -2.5819 | |||

| CPPL / Columbia Pipeline Partners LP | 1.13 | -6.82 | 16.94 | -4.27 | 3.1273 | 0.4076 | |||

| TRP / TC Energy Corporation | 0.00 | -99.92 | 16.79 | -8.52 | 3.1004 | 0.2787 | |||

| TEP / Tallgrass Energy Partners, LP | 0.36 | -20.66 | 16.70 | -4.71 | 3.0825 | 0.3892 | |||

| PAA / Plains All American Pipeline, L.P. - Limited Partnership | 0.60 | 80,303.09 | 16.47 | 5.35 | 3.0400 | 0.6375 | |||

| US26885B1008 / EQT Midstream Partners LP | 0.20 | -18.97 | 16.37 | -12.58 | 3.0225 | 0.1440 | |||

| FEI / First Trust MLP and Energy Income Fund | 1.03 | -17.10 | 16.06 | -4.72 | 2.9647 | 0.3741 | |||

| HEP / Holly Energy Partners L.P. - Unit | 0.45 | 85,496.03 | 15.69 | -12.41 | 2.8966 | 0.1435 | |||

| US87233Q1085 / TC Pipelines, LP | 0.26 | -11.74 | 14.70 | 4.80 | 2.7129 | 0.5577 | |||

| FEN / First Trust Energy Income and Growth Fund | 0.56 | -10.05 | 14.21 | -1.72 | 2.6241 | 0.4011 | |||

| URTH / iShares, Inc. - iShares MSCI World ETF | 0.13 | -6.47 | 9.21 | -6.53 | 1.7005 | 0.1857 | |||

| SRE / Sempra | 0.08 | -20.76 | 8.72 | -13.16 | 1.6104 | 0.0665 | |||

| NEP / XPLR Infrastructure, LP - Limited Partnership | 0.28 | -9.26 | 8.63 | 1.40 | 1.5938 | 0.2852 | |||

| APU / AmeriGas Partners, L.P. | 0.16 | -21.32 | 7.27 | -15.47 | 1.3421 | 0.0202 | |||

| NEE / NextEra Energy, Inc. | 0.04 | -9.69 | 5.80 | -0.48 | 1.0700 | 0.1749 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.12 | -24.00 | 5.73 | -24.85 | 1.0578 | -0.1141 | |||

| SCU / Sculptor Capital Management Inc - Class A | 0.06 | -9.77 | 4.22 | -2.70 | 0.7791 | 0.1125 | |||

| IGM / iShares Trust - iShares Expanded Tech Sector ETF | 0.04 | 0.00 | 3.89 | -0.61 | 0.7181 | 0.1166 | |||

| ATO / Atmos Energy Corporation | 0.05 | -20.64 | 3.78 | -13.10 | 0.6971 | 0.0293 | |||

| MLPN / Credit Suisse Cushing 30 MLP Index ETN due on 4/20/2020 | 0.13 | -46.31 | 2.79 | -30.86 | 0.5141 | -0.1050 | |||

| COP / ConocoPhillips | 0.05 | 0.00 | 2.28 | 8.28 | 0.4202 | 0.0971 | |||

| GLD / SPDR Gold Trust | 0.02 | 0.00 | 2.09 | 7.53 | 0.3851 | 0.0869 | |||

| AMJ / JPMorgan Alerian MLP Index ETN - Corporate Bond/Note | 0.06 | -7.03 | 1.94 | 9.12 | 0.3580 | 0.0848 | |||

| EFV / iShares Trust - iShares MSCI EAFE Value ETF | 0.04 | 0.00 | 1.62 | -4.31 | 0.2989 | 0.0388 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.02 | 0.00 | 1.49 | 10.27 | 0.2754 | 0.0675 | |||

| AAPL / Apple Inc. | 0.01 | -2.41 | 1.21 | -14.35 | 0.2237 | 0.0063 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -25.48 | 1.11 | -16.44 | 0.2055 | 0.0007 | |||

| GE / General Electric Company | 0.03 | -15.67 | 0.83 | -16.50 | 0.1542 | 0.0005 | |||

| MO / Altria Group, Inc. | 0.01 | -1.11 | 0.75 | 8.82 | 0.1390 | 0.0327 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 27.64 | 0.68 | 53.71 | 0.1263 | 0.0579 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.01 | 0.00 | 0.66 | 5.80 | 0.1213 | 0.0258 | |||

| RPV / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Pure Value ETF | 0.01 | -18.06 | 0.53 | -17.32 | 0.0969 | -0.0007 | |||

| DXJ / WisdomTree Trust - WisdomTree Japan Hedged Equity Fund | 0.01 | -50.00 | 0.50 | -55.62 | 0.0918 | -0.0804 | |||

| MSFT / Microsoft Corporation | 0.01 | -2.14 | 0.47 | -9.32 | 0.0862 | 0.0071 | |||

| JNJ / Johnson & Johnson | 0.00 | -4.02 | 0.47 | 7.62 | 0.0860 | 0.0195 | |||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.47 | -4.12 | 0.0860 | 0.0113 | |||

| PFE / Pfizer Inc. | 0.01 | 2.95 | 0.46 | 22.28 | 0.0851 | 0.0272 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.43 | 1.64 | 0.0801 | 0.0145 | |||

| WFC / Wells Fargo & Company | 0.01 | 0.00 | 0.41 | -2.12 | 0.0766 | 0.0114 | |||

| GOOG / Alphabet Inc. | 0.00 | 0.00 | 0.41 | -6.95 | 0.0766 | 0.0081 | |||

| ABBV / AbbVie Inc. | 0.01 | 0.00 | 0.41 | 8.29 | 0.0748 | 0.0173 | |||

| RTX / RTX Corporation | 0.00 | 0.00 | 0.39 | 2.60 | 0.0727 | 0.0137 | |||

| CAG / Conagra Brands, Inc. | 0.01 | 0.00 | 0.39 | 7.24 | 0.0711 | 0.0159 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | -28.17 | 0.37 | -24.70 | 0.0687 | -0.0073 | |||

| FGEN / FibroGen, Inc. | 0.02 | 0.00 | 0.36 | -23.01 | 0.0661 | -0.0054 | |||

| CVX / Chevron Corporation | 0.00 | 0.00 | 0.30 | 9.85 | 0.0556 | 0.0135 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.28 | -7.62 | 0.0515 | 0.0051 | |||

| EMLP / First Trust Exchange-Traded Fund IV - First Trust North American Energy Infrastructure Fund | 0.01 | 0.27 | 0.0495 | 0.0495 | |||||

| PM / Philip Morris International Inc. | 0.00 | -48.53 | 0.26 | -46.60 | 0.0478 | -0.0267 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.25 | 0.00 | 0.0469 | 0.0079 | |||

| KO / The Coca-Cola Company | 0.01 | -37.38 | 0.25 | -38.89 | 0.0467 | -0.0169 | |||

| MMM / 3M Company | 0.00 | -17.16 | 0.25 | -12.80 | 0.0465 | 0.0021 | |||

| RDS.A / Shell Plc - ADR (Representing Ordinary Shares - Class A) | 0.00 | 0.00 | 0.25 | 14.03 | 0.0465 | 0.0126 | |||

| ALL / The Allstate Corporation | 0.00 | 0.00 | 0.22 | 3.81 | 0.0402 | 0.0080 | |||

| ABT / Abbott Laboratories | 0.01 | 0.00 | 0.21 | -6.28 | 0.0386 | 0.0043 | |||

| ORCL / Oracle Corporation | 0.00 | 0.00 | 0.20 | 0.50 | 0.0375 | 0.0064 | |||

| US02261WAB54 / Alza Corp Bond | 0.01 | 0.00 | 0.02 | 5.26 | 0.0037 | 0.0008 | |||

| RSG / Republic Services, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0315 | ||||

| IBM / International Business Machines Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0480 | ||||

| PG / The Procter & Gamble Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0948 | ||||

| FPL / First Trust New Opportunities MLP & Energy Fund | 0.00 | -100.00 | 0.00 | -100.00 | -0.0344 | ||||

| AFL / Aflac Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.0350 |