Basic Stats

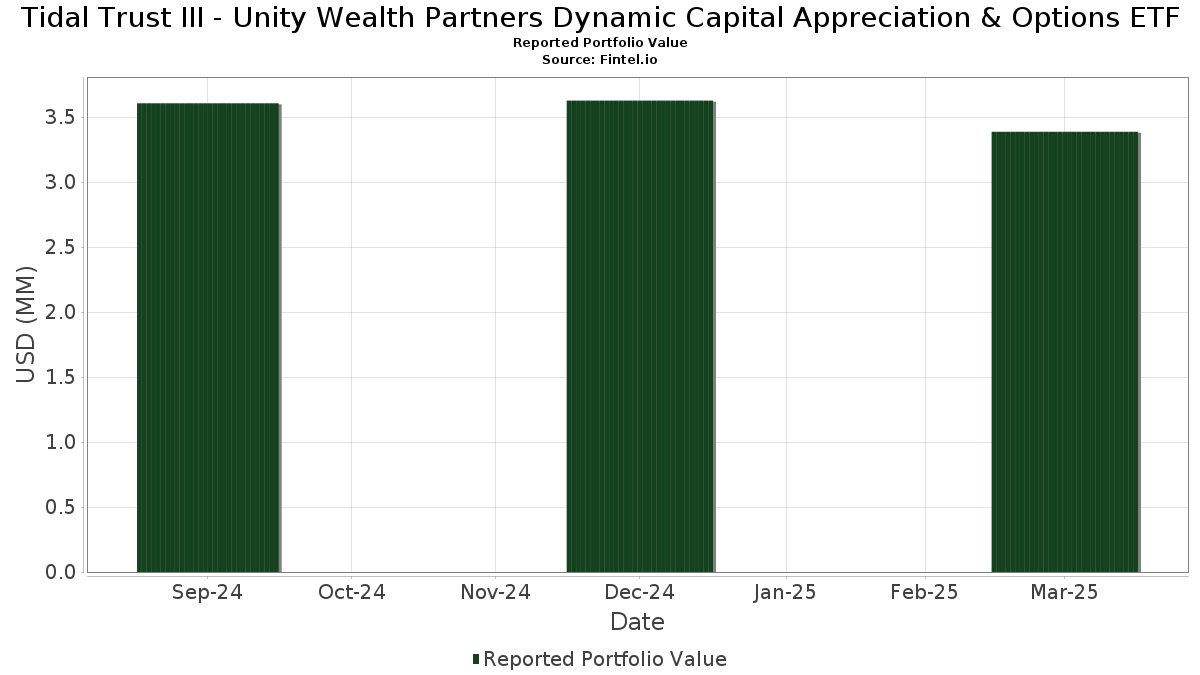

| Portfolio Value | $ 3,388,110 |

| Current Positions | 77 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Tidal Trust III - Unity Wealth Partners Dynamic Capital Appreciation & Options ETF has disclosed 77 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 3,388,110 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Tidal Trust III - Unity Wealth Partners Dynamic Capital Appreciation & Options ETF’s top holdings are SPDR S&P 500 ETF (US:SPY) , Invesco QQQ Trust, Series 1 (US:QQQ) , First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , Amazon.com, Inc. (CL:AMZN) , and Meta Platforms, Inc. (US:META) . Tidal Trust III - Unity Wealth Partners Dynamic Capital Appreciation & Options ETF’s new positions include Amazon.com, Inc. (CL:AMZN) , Netflix, Inc. (US:NFLX) , Alphabet Inc. (US:GOOGL) , Costco Wholesale Corporation (US:COST) , and CrowdStrike Holdings, Inc. (US:CRWD) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 1.05 | 30.9073 | 5.4849 | |

| 0.00 | 0.50 | 14.7480 | 4.5824 | |

| 0.00 | 0.08 | 2.2307 | 2.2307 | |

| 0.00 | 0.06 | 1.8040 | 1.8040 | |

| 0.00 | 0.07 | 2.1793 | 1.6794 | |

| 0.00 | 0.06 | 1.6454 | 1.6454 | |

| 0.00 | 0.04 | 1.3029 | 1.3029 | |

| 0.00 | 0.05 | 1.4744 | 0.9636 | |

| 0.00 | 0.03 | 0.8061 | 0.8061 | |

| 0.00 | 0.04 | 1.2951 | 0.7587 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| -0.02 | -0.6668 | -0.6668 | ||

| -0.02 | -0.6668 | -0.6668 | ||

| -0.01 | -0.2341 | -0.2341 | ||

| -0.01 | -0.2341 | -0.2341 | ||

| 0.00 | 0.03 | 0.8993 | -0.1952 | |

| -0.01 | -0.1603 | -0.1603 | ||

| -0.01 | -0.1603 | -0.1603 | ||

| 0.00 | 0.02 | 0.6970 | -0.0623 | |

| -0.00 | -0.0501 | -0.0501 | ||

| -0.00 | -0.0501 | -0.0501 |

13F and Fund Filings

This form was filed on 2025-05-30 for the reporting period 2025-03-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | 0.00 | 19.68 | 1.05 | 14.19 | 30.9073 | 5.4849 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 48.61 | 0.50 | 36.31 | 14.7480 | 4.5824 | |||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 0.20 | -2.03 | 0.20 | -1.96 | 5.8746 | 0.2404 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.08 | 2.2307 | 2.2307 | |||||

| META / Meta Platforms, Inc. | 0.00 | 316.13 | 0.07 | 311.11 | 2.1793 | 1.6794 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.06 | 1.8040 | 1.8040 | |||||

| GOOGL / Alphabet Inc. | 0.00 | 0.06 | 1.6454 | 1.6454 | |||||

| JPM / JPMorgan Chase & Co. | 0.00 | 33.93 | 0.06 | 37.50 | 1.6178 | 0.5087 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 33.80 | 0.05 | 27.50 | 1.5212 | 0.4015 | |||

| MSFT / Microsoft Corporation | 0.00 | 204.55 | 0.05 | 177.78 | 1.4744 | 0.9636 | |||

| HOOD / Robinhood Markets, Inc. | 0.00 | 27.14 | 0.05 | 41.18 | 1.4285 | 0.4834 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.04 | 1.3029 | 1.3029 | |||||

| CMG / Chipotle Mexican Grill, Inc. | 0.00 | 172.45 | 0.04 | 131.58 | 1.2951 | 0.7587 | |||

| DELL / Dell Technologies Inc. | 0.00 | 22.96 | 0.04 | -2.33 | 1.2450 | 0.0421 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.00 | 0.04 | 5.26 | 1.1821 | 0.1093 | |||

| COIN / Coinbase Global, Inc. | 0.00 | 223.19 | 0.04 | 123.53 | 1.1258 | 0.6539 | |||

| JNJ / Johnson & Johnson | 0.00 | 0.00 | 0.04 | 15.63 | 1.0937 | 0.1976 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.04 | -7.89 | 1.0527 | 0.0029 | |||

| C / Citigroup Inc. | 0.00 | 23.34 | 0.04 | 25.00 | 1.0446 | 0.2556 | |||

| UBER / Uber Technologies, Inc. | 0.00 | 84.41 | 0.04 | 133.33 | 1.0358 | 0.5989 | |||

| BLK / BlackRock, Inc. | 0.00 | 37.04 | 0.04 | 29.63 | 1.0265 | 0.2642 | |||

| SBUX / Starbucks Corporation | 0.00 | 0.00 | 0.03 | 6.45 | 0.9862 | 0.1242 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 36.73 | 0.03 | 32.00 | 0.9772 | 0.2752 | |||

| ACN / Accenture plc | 0.00 | 106.00 | 0.03 | 88.24 | 0.9421 | 0.4576 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | 144.09 | 0.03 | 106.67 | 0.9335 | 0.5111 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | 93.75 | 0.03 | 82.35 | 0.9303 | 0.4492 | |||

| TGT / Target Corporation | 0.00 | 0.00 | 0.03 | -23.08 | 0.8993 | -0.1952 | |||

| MS / Morgan Stanley | 0.00 | 0.00 | 0.03 | -6.45 | 0.8652 | -0.0108 | |||

| DIS / The Walt Disney Company | 0.00 | 0.00 | 0.03 | -12.90 | 0.8100 | -0.0486 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.00 | 0.03 | 0.8061 | 0.8061 | |||||

| QCOM / QUALCOMM Incorporated | 0.00 | 0.00 | 0.03 | 0.00 | 0.7924 | 0.0478 | |||

| TMUS / T-Mobile US, Inc. | 0.00 | 0.00 | 0.03 | 23.81 | 0.7661 | 0.1704 | |||

| HON / Honeywell International Inc. | 0.00 | 0.00 | 0.03 | -7.41 | 0.7448 | -0.0017 | |||

| PYPL / PayPal Holdings, Inc. | 0.00 | 67.87 | 0.02 | 33.33 | 0.7096 | 0.1901 | |||

| NVDA / NVIDIA Corporation | 0.00 | 0.02 | 0.7052 | 0.7052 | |||||

| ORCL / Oracle Corporation | 0.00 | 222.64 | 0.02 | 187.50 | 0.7008 | 0.4575 | |||

| ADBE / Adobe Inc. | 0.00 | 0.00 | 0.02 | -14.81 | 0.6970 | -0.0623 | |||

| DECK / Deckers Outdoor Corporation | 0.00 | 0.02 | 0.6850 | 0.6850 | |||||

| V / Visa Inc. | 0.00 | 0.00 | 0.02 | 10.00 | 0.6574 | 0.1004 | |||

| NKE / NIKE, Inc. | 0.00 | 50.00 | 0.02 | 29.41 | 0.6475 | 0.1640 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.02 | 5.00 | 0.6269 | 0.0625 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.00 | 0.02 | 17.65 | 0.6080 | 0.1235 | |||

| WM / Waste Management, Inc. | 0.00 | 0.02 | 0.5972 | 0.5972 | |||||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.02 | 18.75 | 0.5620 | 0.1126 | |||

| AAPL / Apple Inc. | 0.00 | 0.02 | 0.5274 | 0.5274 | |||||

| DKS / DICK'S Sporting Goods, Inc. | 0.00 | 0.00 | 0.02 | -15.00 | 0.5258 | -0.0351 | |||

| LRCX / Lam Research Corporation | 0.00 | 0.00 | 0.02 | 0.00 | 0.5050 | 0.0336 | |||

| WMT / Walmart Inc. | 0.00 | 0.02 | 0.5018 | 0.5018 | |||||

| CRM / Salesforce, Inc. | 0.00 | 0.02 | 0.4877 | 0.4877 | |||||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 0.02 | -5.88 | 0.4737 | -0.0159 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 0.02 | -5.88 | 0.4714 | -0.0104 | |||

| MSFT US 04/17/25 P375 / DE (N/A) | 0.02 | 0.4704 | 0.4704 | ||||||

| MSFT US 04/17/25 P375 / DE (N/A) | 0.02 | 0.4704 | 0.4704 | ||||||

| AMGN / Amgen Inc. | 0.00 | 0.00 | 0.02 | 15.38 | 0.4566 | 0.0977 | |||

| BBY / Best Buy Co., Inc. | 0.00 | 0.00 | 0.01 | -12.50 | 0.4250 | -0.0405 | |||

| FDX / FedEx Corporation | 0.00 | 0.00 | 0.01 | -13.33 | 0.4001 | -0.0337 | |||

| AXP / American Express Company | 0.00 | 0.00 | 0.01 | -10.00 | 0.2760 | -0.0101 | |||

| DPZ / Domino's Pizza, Inc. | 0.00 | 0.00 | 0.01 | 12.50 | 0.2693 | 0.0381 | |||

| ULTA / Ulta Beauty, Inc. | 0.00 | 0.00 | 0.01 | -22.22 | 0.2256 | -0.0259 | |||

| SPY US 04/17/25 P530 / DE (N/A) | 0.01 | 0.1832 | 0.1832 | ||||||

| SPY US 04/17/25 P530 / DE (N/A) | 0.01 | 0.1832 | 0.1832 | ||||||

| QQQ US 04/17/25 P435 / DE (N/A) | 0.00 | 0.1249 | 0.1249 | ||||||

| QQQ US 04/17/25 P435 / DE (N/A) | 0.00 | 0.1249 | 0.1249 | ||||||

| AAPL US 04/17/25 P190 / DE (N/A) | 0.00 | 0.0165 | 0.0165 | ||||||

| AAPL US 04/17/25 P190 / DE (N/A) | 0.00 | 0.0165 | 0.0165 | ||||||

| Johnson & Johnson / DE (N/A) | -0.00 | -0.0213 | -0.0213 | ||||||

| Johnson & Johnson / DE (N/A) | -0.00 | -0.0213 | -0.0213 | ||||||

| AAPL US 04/17/25 P195 / DE (N/A) | -0.00 | -0.0224 | -0.0224 | ||||||

| AAPL US 04/17/25 P195 / DE (N/A) | -0.00 | -0.0224 | -0.0224 | ||||||

| ABBV US 04/17/25 C202.5 / DE (N/A) | -0.00 | -0.0501 | -0.0501 | ||||||

| ABBV US 04/17/25 C202.5 / DE (N/A) | -0.00 | -0.0501 | -0.0501 | ||||||

| QQQ US 04/17/25 P440 / DE (N/A) | -0.01 | -0.1603 | -0.1603 | ||||||

| QQQ US 04/17/25 P440 / DE (N/A) | -0.01 | -0.1603 | -0.1603 | ||||||

| SPDR S&P 500 ETF Trust / DE (N/A) | -0.01 | -0.2341 | -0.2341 | ||||||

| SPDR S&P 500 ETF Trust / DE (N/A) | -0.01 | -0.2341 | -0.2341 | ||||||

| MSFT US 04/17/25 P380 / DE (N/A) | -0.02 | -0.6668 | -0.6668 | ||||||

| MSFT US 04/17/25 P380 / DE (N/A) | -0.02 | -0.6668 | -0.6668 |