Basic Stats

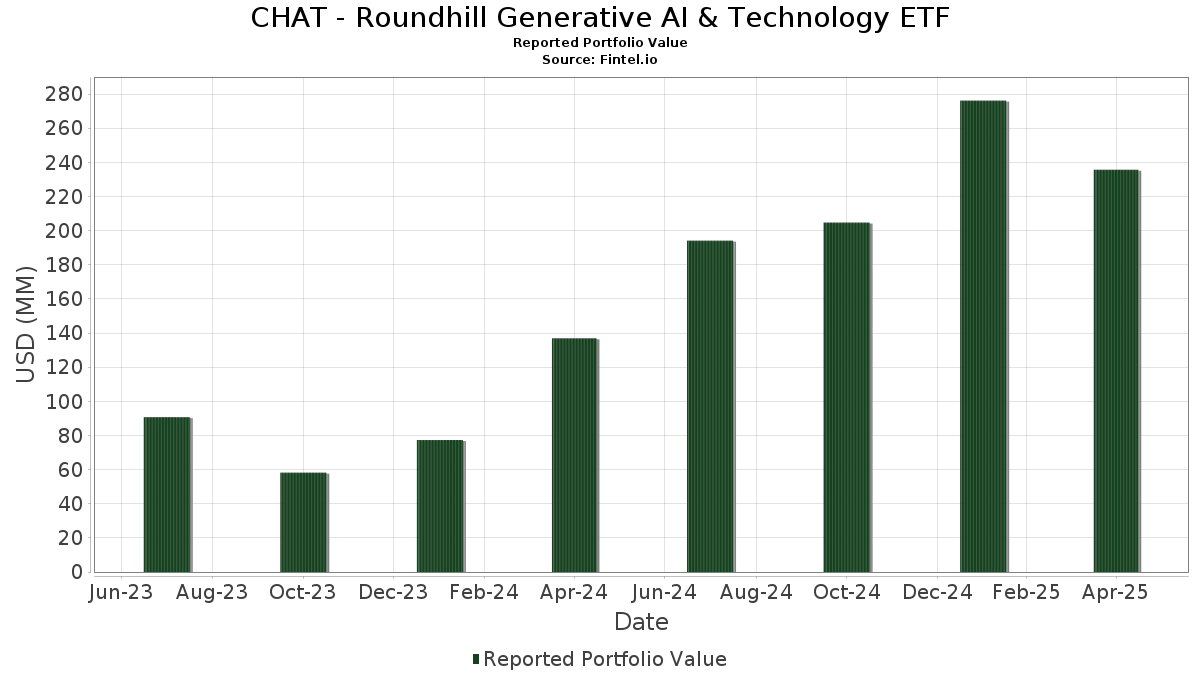

| Portfolio Value | $ 235,657,277 |

| Current Positions | 34 |

Latest Holdings, Performance, AUM (from 13F, 13D)

CHAT - Roundhill Generative AI & Technology ETF has disclosed 34 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 235,657,277 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). CHAT - Roundhill Generative AI & Technology ETF’s top holdings are NVIDIA Corporation (US:NVDA) , Alphabet Inc. (US:GOOGL) , Palantir Technologies Inc. (US:PLTR) , Microsoft Corporation (US:MSFT) , and Arm Holdings plc - Depositary Receipt (Common Stock) (US:ARM) . CHAT - Roundhill Generative AI & Technology ETF’s new positions include CoreWeave, Inc. (US:CRWV) , SoftBank Group Corp. (JP:9984) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.17 | 7.05 | 2.9931 | 2.9931 | |

| 0.14 | 6.94 | 2.9448 | 2.9448 | |

| 0.08 | 9.07 | 3.8499 | 2.3254 | |

| 0.11 | 12.50 | 5.3054 | 2.1458 | |

| 0.18 | 20.01 | 8.4925 | 1.9139 | |

| 0.45 | 6.89 | 2.9256 | 1.7566 | |

| 0.14 | 8.56 | 3.6349 | 1.5019 | |

| 0.10 | 6.64 | 2.8199 | 1.4289 | |

| 0.92 | 5.92 | 2.5113 | 1.4025 | |

| 30.92 | 5.98 | 2.5387 | 1.3390 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.26 | 2.93 | 1.2437 | -1.4876 | |

| 0.01 | 7.81 | 3.3164 | -1.4324 | |

| 0.35 | 0.35 | 0.1483 | -1.2943 | |

| 0.00 | 0.00 | -1.2526 | ||

| 0.00 | 0.00 | -1.1200 | ||

| 0.02 | 9.34 | 3.9660 | -1.0931 | |

| 0.00 | 0.00 | -1.0595 | ||

| 0.00 | 0.00 | -1.0023 | ||

| 0.00 | 0.00 | -0.9998 | ||

| 0.00 | 0.00 | -0.9397 |

13F and Fund Filings

This form was filed on 2025-06-26 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.18 | 21.58 | 20.01 | 10.29 | 8.4925 | 1.9139 | |||

| GOOGL / Alphabet Inc. | 0.09 | 8.04 | 13.90 | -15.91 | 5.8996 | -0.0938 | |||

| PLTR / Palantir Technologies Inc. | 0.11 | -0.09 | 12.50 | 43.46 | 5.3054 | 2.1458 | |||

| MSFT / Microsoft Corporation | 0.02 | -29.67 | 9.34 | -33.03 | 3.9660 | -1.0931 | |||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | 0.08 | 201.81 | 9.07 | 115.77 | 3.8499 | 2.3254 | |||

| ORCL / Oracle Corporation | 0.06 | 30.20 | 8.60 | 7.74 | 3.6513 | 0.7560 | |||

| NNND / Tencent Holdings Limited | 0.14 | 21.82 | 8.56 | 45.58 | 3.6349 | 1.5019 | |||

| DELL / Dell Technologies Inc. | 0.09 | 10.25 | 8.28 | -2.35 | 3.5165 | 0.4399 | |||

| AVGO / Broadcom Inc. | 0.04 | 23.82 | 8.22 | 7.70 | 3.4893 | 0.7216 | |||

| ANET / Arista Networks Inc | 0.10 | 35.64 | 8.17 | -3.15 | 3.4690 | 0.4088 | |||

| MRVL / Marvell Technology, Inc. | 0.14 | 98.25 | 7.96 | 2.54 | 3.3809 | 0.5639 | |||

| META / Meta Platforms, Inc. | 0.01 | -25.10 | 7.81 | -40.34 | 3.3164 | -1.4324 | |||

| CRWV / CoreWeave, Inc. | 0.17 | 7.05 | 2.9931 | 2.9931 | |||||

| AAPL / Apple Inc. | 0.03 | 7.35 | 6.95 | -3.34 | 2.9518 | 0.3429 | |||

| 9984 / SoftBank Group Corp. | 0.14 | 6.94 | 2.9448 | 2.9448 | |||||

| 2RR / Alibaba Group Holding Limited | 0.45 | 59.91 | 6.89 | 113.84 | 2.9256 | 1.7566 | |||

| 000660 / SK hynix Inc. | 0.05 | -13.97 | 6.82 | -21.64 | 2.8939 | -0.2612 | |||

| ALAB / Astera Labs, Inc. | 0.10 | 168.94 | 6.64 | 73.22 | 2.8199 | 1.4289 | |||

| NOW / ServiceNow, Inc. | 0.01 | 31.93 | 6.42 | 23.73 | 2.7266 | 0.8439 | |||

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 0.22 | -21.06 | 6.11 | -35.38 | 2.5923 | -0.8346 | |||

| AMZN / Amazon.com, Inc. | 0.03 | 13.20 | 6.09 | -12.17 | 2.5865 | 0.0707 | |||

| AMD / Advanced Micro Devices, Inc. | 0.06 | 18.10 | 6.07 | -0.85 | 2.5785 | 0.3568 | |||

| 20 / SenseTime Group Inc. | 30.92 | 93.13 | 5.98 | 80.77 | 2.5387 | 1.3390 | |||

| 002230 / iFLYTEK CO.,LTD | 0.92 | 108.90 | 5.92 | 93.52 | 2.5113 | 1.4025 | |||

| HPE / Hewlett Packard Enterprise Company | 0.36 | -11.57 | 5.86 | -32.31 | 2.4858 | -0.6517 | |||

| CRM / Salesforce, Inc. | 0.02 | 24.29 | 5.40 | -2.26 | 2.2923 | 0.2886 | |||

| SNOW / Snowflake Inc. | 0.03 | 7.26 | 5.23 | -5.77 | 2.2191 | 0.2075 | |||

| NBIS / Nebius Group N.V. | 0.20 | 82.02 | 4.44 | 26.71 | 1.8826 | 0.6130 | |||

| QCOM / QUALCOMM Incorporated | 0.03 | 1.08 | 3.83 | -13.23 | 1.6260 | 0.0252 | |||

| 2382 / Quanta Computer Inc. | 0.40 | 23.70 | 3.01 | 12.02 | 1.2779 | 0.3034 | |||

| MU / Micron Technology, Inc. | 0.04 | -5.08 | 2.93 | -19.96 | 1.2444 | -0.0836 | |||

| 9888 / Baidu, Inc. | 0.26 | -60.68 | 2.93 | -61.11 | 1.2437 | -1.4876 | |||

| 3778 / SAKURA Internet Inc. | 0.06 | 11.13 | 1.36 | -16.08 | 0.5761 | -0.0106 | |||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 0.35 | -91.22 | 0.35 | -91.23 | 0.1483 | -1.2943 | |||

| 4180 / Appier Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6805 | ||||

| CRDO / Credo Technology Group Holding Ltd | 0.00 | -100.00 | 0.00 | -100.00 | -1.1200 | ||||

| 3231 / Wistron Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.0023 | ||||

| NRG / NRG Energy, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.2526 | ||||

| 2356 / Inventec Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.9998 | ||||

| 6669 / Wiwynn Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.9397 | ||||

| RDDT / Reddit, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0595 |