Basic Stats

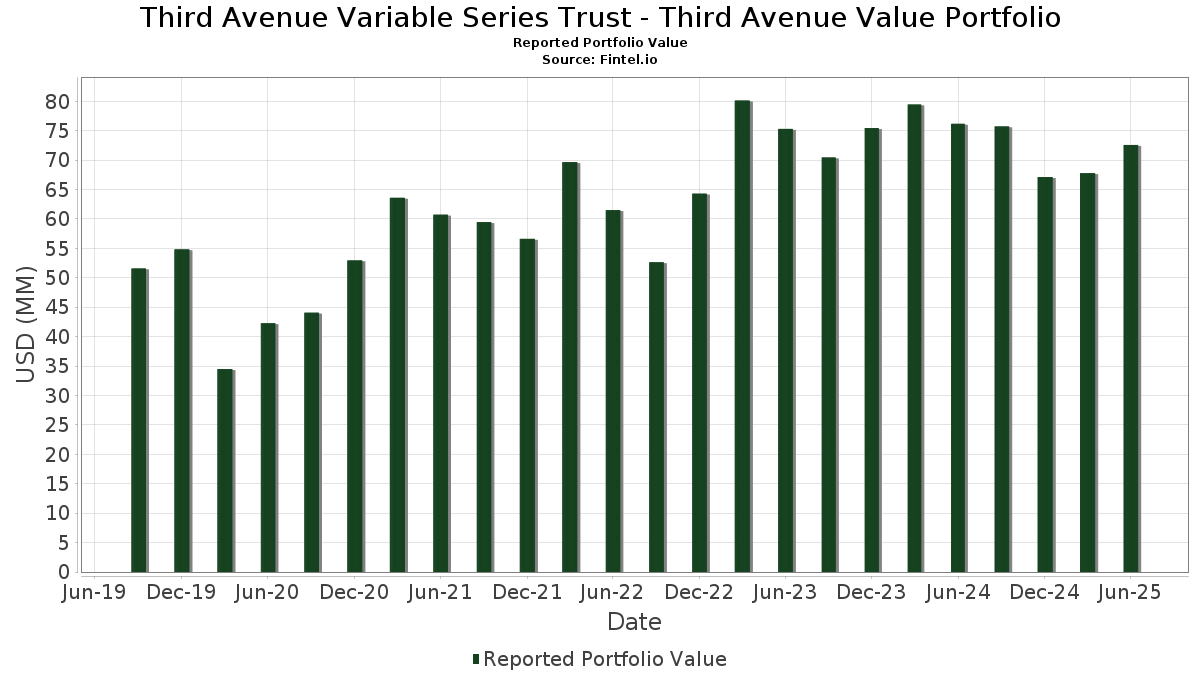

| Portfolio Value | $ 72,569,340 |

| Current Positions | 33 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Third Avenue Variable Series Trust - Third Avenue Value Portfolio has disclosed 33 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 72,569,340 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Third Avenue Variable Series Trust - Third Avenue Value Portfolio’s top holdings are Dreyfus Treasury Securities Cash Management - Dreyfus Treasury Securities Cash Management Institutional Shares (US:DIRXX) , Capstone Copper Corp. (US:CSCCF) , Bank of Ireland Group plc (IE:BIRG) , Bayerische Motoren Werke Aktiengesellschaft (DE:BMW) , and Tidewater Inc. (US:TDW) . Third Avenue Variable Series Trust - Third Avenue Value Portfolio’s new positions include Conduit Holdings Limited (GB:CRE) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.20 | 1.05 | 1.4281 | 1.4281 | |

| 0.22 | 2.36 | 3.1990 | 0.9372 | |

| 0.64 | 3.94 | 5.3434 | 0.6736 | |

| 0.36 | 1.82 | 2.4625 | 0.5749 | |

| 0.07 | 3.13 | 4.2443 | 0.4608 | |

| 0.03 | 2.61 | 3.5301 | 0.3440 | |

| 0.48 | 1.09 | 1.4802 | 0.3247 | |

| 5.90 | 5.90 | 7.9944 | 0.2840 | |

| 0.06 | 3.09 | 4.1864 | 0.2823 | |

| 0.10 | 1.81 | 2.4515 | 0.2071 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 0.29 | 0.3919 | -1.2627 | |

| 0.02 | 0.93 | 1.2591 | -0.9636 | |

| 0.09 | 2.61 | 3.5363 | -0.8033 | |

| 0.32 | 2.36 | 3.1943 | -0.6409 | |

| 4.10 | 1.43 | 1.9375 | -0.4679 | |

| 0.09 | 2.33 | 3.1625 | -0.3254 | |

| 0.75 | 2.01 | 2.7246 | -0.2461 | |

| 0.17 | 2.94 | 3.9804 | -0.2280 | |

| 0.06 | 2.57 | 3.4829 | -0.2276 | |

| 0.08 | 0.76 | 1.0288 | -0.2187 |

13F and Fund Filings

This form was filed on 2025-08-25 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| DIRXX / Dreyfus Treasury Securities Cash Management - Dreyfus Treasury Securities Cash Management Institutional Shares | 5.90 | 11.44 | 5.90 | 11.44 | 7.9944 | 0.2840 | |||

| CSCCF / Capstone Copper Corp. | 0.64 | 3.16 | 3.94 | 22.98 | 5.3434 | 0.6736 | |||

| BIRG / Bank of Ireland Group plc | 0.26 | -9.61 | 3.71 | 9.02 | 5.0286 | 0.0705 | |||

| BMW / Bayerische Motoren Werke Aktiengesellschaft | 0.04 | -5.46 | 3.68 | 4.40 | 4.9818 | -0.1462 | |||

| TDW / Tidewater Inc. | 0.07 | 10.48 | 3.13 | 20.59 | 4.2443 | 0.4608 | |||

| BZU / Air New Zealand Limited | 0.06 | 0.00 | 3.09 | 15.26 | 4.1864 | 0.2823 | |||

| FUH / Subaru Corporation | 0.17 | 5.02 | 2.94 | 1.66 | 3.9804 | -0.2280 | |||

| DBK / Deutsche Bank Aktiengesellschaft | 0.09 | -29.57 | 2.61 | -12.42 | 3.5363 | -0.8033 | |||

| 6856 / HORIBA, Ltd. | 0.03 | 2.76 | 2.61 | 19.10 | 3.5301 | 0.3440 | |||

| 1 / CK Hutchison Holdings Limited | 0.42 | 2.14 | 2.59 | 11.58 | 3.5123 | 0.1288 | |||

| HCC / Warrior Met Coal, Inc. | 0.06 | 5.05 | 2.57 | 0.90 | 3.4829 | -0.2276 | |||

| LUNMF / Lundin Mining Corporation | 0.22 | 17.13 | 2.36 | 52.03 | 3.1990 | 0.9372 | |||

| EZJ / easyJet plc | 0.32 | -29.66 | 2.36 | -10.48 | 3.1943 | -0.6409 | |||

| 5233 / Taiheiyo Cement Corporation | 0.09 | 2.84 | 2.33 | -2.55 | 3.1625 | -0.3254 | |||

| VAL / Valaris Limited | 0.05 | 3.46 | 2.17 | 10.99 | 2.9423 | 0.0924 | |||

| UGPA3 / Ultrapar Participações S.A. | 0.66 | 0.00 | 2.13 | 6.34 | 2.8853 | -0.0320 | |||

| HBR / Harbour Energy plc | 0.75 | 0.00 | 2.01 | -1.42 | 2.7246 | -0.2461 | |||

| 8283 / Paltac Corporation | 0.07 | 2.49 | 1.96 | 7.70 | 2.6548 | 0.0057 | |||

| CYC / Jardine Cycle & Carriage Limited | 0.10 | 3.05 | 1.94 | 0.73 | 2.6320 | -0.1770 | |||

| CS3 / Close Brothers Group plc | 0.36 | 0.00 | 1.82 | 40.20 | 2.4625 | 0.5749 | |||

| SOC / Subsea 7 S.A. | 0.10 | 0.00 | 1.81 | 17.39 | 2.4515 | 0.2071 | |||

| JEL / JEOL Ltd. | 0.06 | 14.48 | 1.80 | 12.40 | 2.4442 | 0.1075 | |||

| 36T / Genting Singapore Limited | 3.07 | 8.57 | 1.73 | 10.06 | 2.3422 | 0.0546 | |||

| MBG / Mercedes-Benz Group AG | 0.03 | 0.00 | 1.70 | -1.34 | 2.2963 | -0.2062 | |||

| SFOR / S4 Capital plc | 4.10 | 8.74 | 1.43 | -13.44 | 1.9375 | -0.4679 | |||

| VAPORES / Compañía Sud Americana de Vapores S.A. | 27.92 | 5.18 | 1.43 | -1.79 | 1.9331 | -0.1833 | |||

| 081660 / Misto Holdings Corp. | 0.05 | 0.00 | 1.38 | 2.15 | 1.8671 | -0.0976 | |||

| QUINENCO / Quiñenco SA | 0.33 | 0.00 | 1.30 | 0.62 | 1.7612 | -0.1210 | |||

| BOLSAA / Bolsa Mexicana de Valores SAB de CV | 0.48 | 0.00 | 1.09 | 37.70 | 1.4802 | 0.3247 | |||

| CRE / Conduit Holdings Limited | 0.20 | 1.05 | 1.4281 | 1.4281 | |||||

| CMA / Comerica Incorporated | 0.02 | -39.72 | 0.93 | -39.12 | 1.2591 | -0.9636 | |||

| IFSPF / Interfor Corporation | 0.08 | 0.00 | 0.76 | -11.33 | 1.0288 | -0.2187 | |||

| ORI / Old Republic International Corporation | 0.01 | -74.02 | 0.29 | -74.56 | 0.3919 | -1.2627 |