Basic Stats

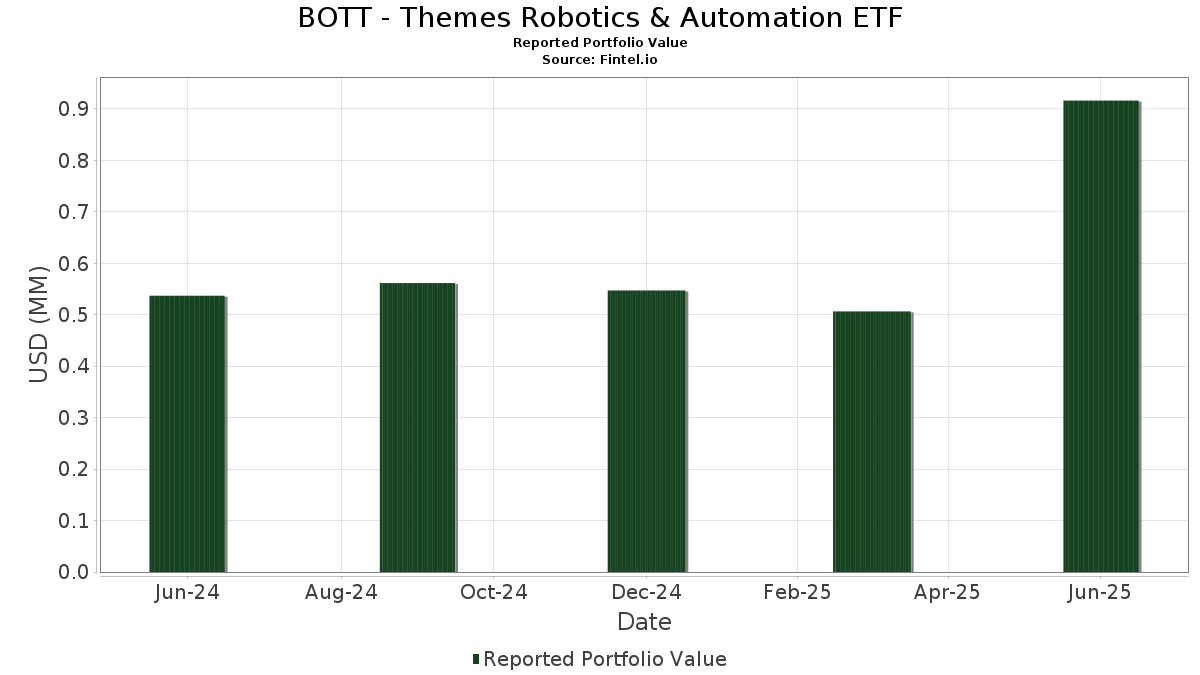

| Portfolio Value | $ 916,294 |

| Current Positions | 32 |

Latest Holdings, Performance, AUM (from 13F, 13D)

BOTT - Themes Robotics & Automation ETF has disclosed 32 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 916,294 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). BOTT - Themes Robotics & Automation ETF’s top holdings are Credo Technology Group Holding Ltd (US:CRDO) , Semtech Corporation (US:SMTC) , Ambarella, Inc. (US:AMBA) , MACOM Technology Solutions Holdings, Inc. (US:MTSI) , and The Japan Steel Works, Ltd. (JP:5631) . BOTT - Themes Robotics & Automation ETF’s new positions include Okuma Corporation (JP:6103) , Kennametal Inc. (US:KMT) , Ralliant Corporation (US:RAL) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.06 | 6.2305 | 4.2807 | |

| 0.00 | 0.03 | 3.3300 | 3.3300 | |

| 0.00 | 0.03 | 3.1275 | 3.1275 | |

| 0.01 | 0.03 | 2.9428 | 2.9428 | |

| 0.00 | 0.04 | 4.4383 | 2.5856 | |

| 0.00 | 0.04 | 3.9061 | 1.4724 | |

| 0.00 | 0.03 | 3.7601 | 1.0373 | |

| 0.00 | 0.03 | 3.3345 | 0.8236 | |

| 0.00 | 0.03 | 3.6642 | 0.8096 | |

| 0.00 | 0.01 | 0.6441 | 0.6441 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.5724 | ||

| 0.00 | 0.02 | 2.6109 | -1.9772 | |

| 0.00 | 0.02 | 2.7165 | -1.5505 | |

| 0.00 | 0.02 | 2.0775 | -1.4323 | |

| 0.00 | 0.03 | 3.0704 | -1.3851 | |

| 0.00 | 0.02 | 1.8368 | -1.3820 | |

| 0.00 | 0.03 | 3.0957 | -1.1998 | |

| 0.00 | 0.03 | 2.8449 | -1.1661 | |

| 0.00 | 0.02 | 2.5924 | -0.9836 | |

| 0.00 | 0.02 | 2.7171 | -0.9239 |

13F and Fund Filings

This form was filed on 2025-08-27 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| CRDO / Credo Technology Group Holding Ltd | 0.00 | 150.20 | 0.06 | 533.33 | 6.2305 | 4.2807 | |||

| SMTC / Semtech Corporation | 0.00 | 229.56 | 0.04 | 344.44 | 4.4383 | 2.5856 | |||

| AMBA / Ambarella, Inc. | 0.00 | 120.73 | 0.04 | 191.67 | 3.9061 | 1.4724 | |||

| MTSI / MACOM Technology Solutions Holdings, Inc. | 0.00 | 74.64 | 0.03 | 161.54 | 3.7601 | 1.0373 | |||

| 5631 / The Japan Steel Works, Ltd. | 0.00 | 20.00 | 0.03 | 100.00 | 3.7523 | 0.3215 | |||

| ROK / Rockwell Automation, Inc. | 0.00 | 63.49 | 0.03 | 100.00 | 3.7254 | 0.5068 | |||

| TYIDY / Toyota Industries Corporation - Depositary Receipt (Common Stock) | 0.00 | 50.00 | 0.03 | 106.25 | 3.6975 | 0.3675 | |||

| NVDA / NVIDIA Corporation | 0.00 | 58.96 | 0.03 | 135.71 | 3.6642 | 0.8096 | |||

| 6841 / Yokogawa Electric Corporation | 0.00 | 33.33 | 0.03 | 88.24 | 3.4978 | 0.0857 | |||

| KCR / Konecranes Plc | 0.00 | 37.46 | 0.03 | 72.22 | 3.4554 | -0.1814 | |||

| H11 / Halma plc | 0.00 | 26.16 | 0.03 | 72.22 | 3.3910 | -0.2920 | |||

| ANDR / Andritz AG | 0.00 | 51.47 | 0.03 | 130.77 | 3.3345 | 0.8236 | |||

| 6103 / Okuma Corporation | 0.00 | 0.03 | 3.3300 | 3.3300 | |||||

| FANUY / Fanuc Corporation - Depositary Receipt (Common Stock) | 0.00 | 57.14 | 0.03 | 66.67 | 3.2770 | -0.4474 | |||

| JBTM / JBT Marel Corporation | 0.00 | 65.56 | 0.03 | 66.67 | 3.2737 | -0.3533 | |||

| KMT / Kennametal Inc. | 0.00 | 0.03 | 3.1275 | 3.1275 | |||||

| VALMT / Valmet Oyj | 0.00 | 44.15 | 0.03 | 40.00 | 3.1134 | -0.5345 | |||

| AA2 / Amada Co., Ltd. | 0.00 | 30.00 | 0.03 | 47.37 | 3.0973 | -0.6966 | |||

| 6383 / Daifuku Co., Ltd. | 0.00 | 22.22 | 0.03 | 33.33 | 3.0957 | -1.1998 | |||

| HEXAB / Hexagon AB | 0.00 | 52.08 | 0.03 | 64.71 | 3.0830 | -0.1314 | |||

| G1A / GEA Group Aktiengesellschaft | 0.00 | 7.47 | 0.03 | 27.27 | 3.0704 | -1.3851 | |||

| 1882 / Haitian International Holdings Limited | 0.01 | 0.03 | 2.9428 | 2.9428 | |||||

| QCOM / QUALCOMM Incorporated | 0.00 | 45.69 | 0.03 | 52.94 | 2.9307 | -0.5718 | |||

| TDY / Teledyne Technologies Incorporated | 0.00 | 24.39 | 0.03 | 30.00 | 2.8449 | -1.1661 | |||

| ESAB / ESAB Corporation | 0.00 | 30.19 | 0.02 | 33.33 | 2.7171 | -0.9239 | |||

| 7732 / Topcon Corporation | 0.00 | 10.00 | 0.02 | 14.29 | 2.7165 | -1.5505 | |||

| 6135 / Makino Milling Machine Co., Ltd. | 0.00 | 0.00 | 0.02 | 0.00 | 2.6109 | -1.9772 | |||

| KAI / Kadant Inc. | 0.00 | 38.89 | 0.02 | 27.78 | 2.5924 | -0.9836 | |||

| FTV / Fortive Corporation | 0.00 | 50.00 | 0.02 | 11.76 | 2.0775 | -1.4323 | |||

| 6861 / Keyence Corporation | 0.00 | 0.00 | 0.02 | 0.00 | 1.8368 | -1.3820 | |||

| RAL / Ralliant Corporation | 0.00 | 0.01 | 0.6441 | 0.6441 | |||||

| FXFXX / First American Funds Inc - First American Treasury Obligations Fund Class X | 0.00 | 378.14 | 0.00 | 300.00 | 0.5384 | 0.3351 | |||

| 6526 / Socionext Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.5724 |