Basic Stats

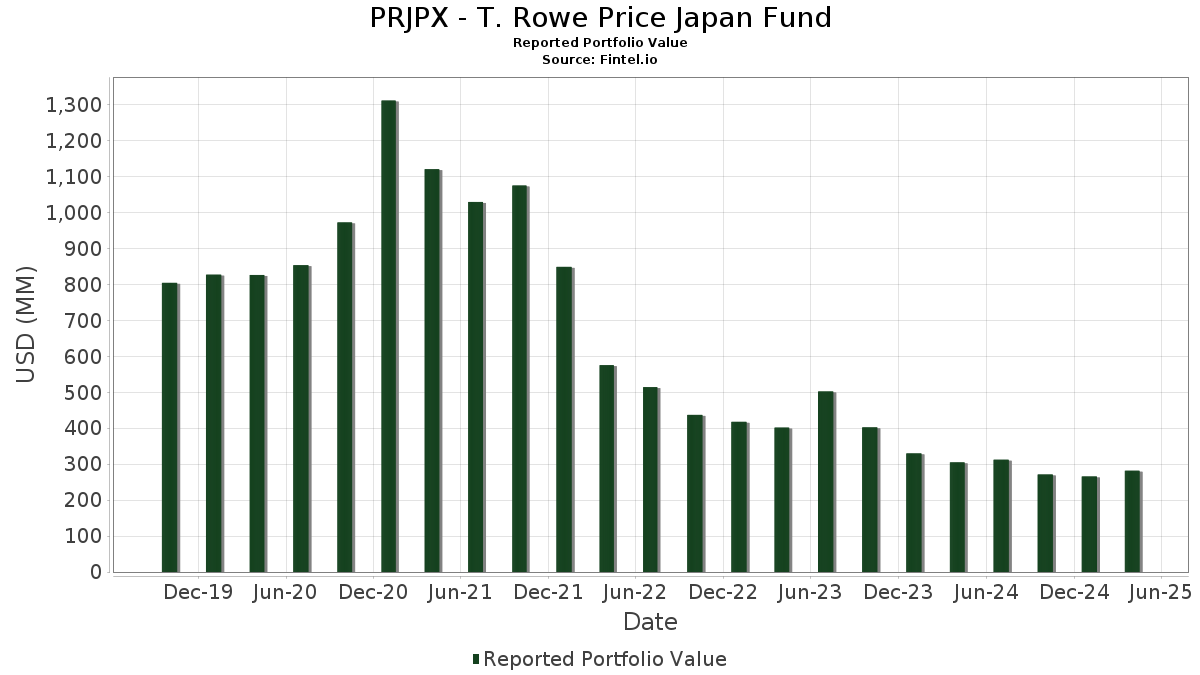

| Portfolio Value | $ 281,617,971 |

| Current Positions | 79 |

Latest Holdings, Performance, AUM (from 13F, 13D)

PRJPX - T. Rowe Price Japan Fund has disclosed 79 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 281,617,971 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). PRJPX - T. Rowe Price Japan Fund’s top holdings are Sony Group Corporation (US:SNEJF) , Mitsubishi UFJ Financial Group, Inc. (DE:MFZ) , ITOCHU Corporation (US:ITOCF) , Shin-Etsu Chemical Co., Ltd. (DE:SEH) , and T ROWE PRICE GOVERNMENT RESERVE INVESTMENT FUND - Collateral (US:76105YYY8) . PRJPX - T. Rowe Price Japan Fund’s new positions include Yokogawa Electric Corporation (US:YOKEF) , CKD Corporation (JP:6407) , Rakuten Bank, Ltd. (JP:5838) , Rigaku Holdings Corporation (US:RGAKF) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 9.57 | 9.57 | 3.4852 | 2.2977 | |

| 0.21 | 4.45 | 1.6217 | 1.6217 | |

| 0.32 | 9.64 | 3.5116 | 1.6065 | |

| 0.11 | 6.59 | 2.3998 | 0.9126 | |

| 0.12 | 1.78 | 0.6470 | 0.6470 | |

| 0.58 | 2.76 | 1.0037 | 0.5771 | |

| 2.72 | 2.72 | 0.9897 | 0.5717 | |

| 0.03 | 1.39 | 0.5069 | 0.5069 | |

| 0.04 | 5.02 | 1.8277 | 0.4331 | |

| 0.66 | 17.49 | 6.3693 | 0.4186 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.07 | 4.02 | 1.4650 | -1.5962 | |

| 0.09 | 7.40 | 2.6935 | -0.9783 | |

| 0.63 | 9.25 | 3.3695 | -0.5575 | |

| 0.28 | 1.67 | 0.6079 | -0.4486 | |

| 0.01 | 1.94 | 0.7070 | -0.3366 | |

| 0.03 | 2.10 | 0.7644 | -0.2971 | |

| 0.30 | 6.02 | 2.1935 | -0.2891 | |

| 0.25 | 4.33 | 1.5780 | -0.2505 | |

| 0.75 | 6.05 | 2.2024 | -0.2319 | |

| 0.21 | 1.33 | 0.4826 | -0.2227 |

13F and Fund Filings

This form was filed on 2025-06-25 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SNEJF / Sony Group Corporation | 0.66 | -6.38 | 17.49 | 11.91 | 6.3693 | 0.4186 | |||

| MFZ / Mitsubishi UFJ Financial Group, Inc. | 1.20 | 2.27 | 15.07 | 1.89 | 5.4883 | -0.1442 | |||

| ITOCF / ITOCHU Corporation | 0.22 | -2.70 | 11.45 | 8.07 | 4.1678 | 0.1357 | |||

| SEH / Shin-Etsu Chemical Co., Ltd. | 0.32 | 96.34 | 9.64 | 92.74 | 3.5116 | 1.6065 | |||

| 76105YYY8 / T ROWE PRICE GOVERNMENT RESERVE INVESTMENT FUND - Collateral | 9.57 | 206.87 | 9.57 | 206.96 | 3.4852 | 2.2977 | |||

| MH6 / Tokio Marine Holdings, Inc. | 0.24 | -2.67 | 9.48 | 18.28 | 3.4518 | 0.4002 | |||

| S6M / Seven & i Holdings Co., Ltd. | 0.63 | -2.71 | 9.25 | -10.29 | 3.3695 | -0.5575 | |||

| NTDOY N / Nintendo Co., Ltd. | 0.09 | -39.39 | 7.40 | -23.29 | 2.6935 | -0.9783 | |||

| IPXHY / Inpex Corporation - Depositary Receipt (Common Stock) | 0.54 | -2.69 | 6.79 | 2.00 | 2.4721 | -0.0620 | |||

| TAK / Takeda Pharmaceutical Company Limited - Depositary Receipt (Common Stock) | 0.22 | -2.72 | 6.71 | 9.39 | 2.4430 | 0.1079 | |||

| 4519 N / Chugai Pharmaceutical Co., Ltd. | 0.11 | 26.27 | 6.59 | 68.71 | 2.3998 | 0.9126 | |||

| RNECY / Renesas Electronics Corporation - Depositary Receipt (Common Stock) | 0.52 | 26.94 | 6.06 | 11.22 | 2.2050 | 0.1319 | |||

| RSNHF / Resona Holdings, Inc. | 0.75 | -12.47 | 6.05 | -5.40 | 2.2024 | -0.2319 | |||

| ORXCF / ORIX Corporation | 0.30 | -2.72 | 6.02 | -7.61 | 2.1935 | -0.2891 | |||

| MIELF / Mitsubishi Electric Corporation | 0.29 | -2.70 | 5.65 | 14.84 | 2.0576 | 0.1842 | |||

| TYIDY / Toyota Industries Corporation - Depositary Receipt (Common Stock) | 0.04 | -2.51 | 5.02 | 37.06 | 1.8277 | 0.4331 | |||

| TOYOF / Toyota Motor Corporation | 0.24 | -2.72 | 4.64 | -2.05 | 1.6886 | -0.1141 | |||

| TYR / Toyo Tire Corporation | 0.24 | -2.75 | 4.57 | 10.61 | 1.6625 | 0.0911 | |||

| YOKEF / Yokogawa Electric Corporation | 0.21 | 4.45 | 1.6217 | 1.6217 | |||||

| MITEF / Mitsubishi Estate Co., Ltd. | 0.25 | -25.36 | 4.33 | -9.77 | 1.5780 | -0.2505 | |||

| TIE / Taiheiyo Cement Corporation | 0.16 | -13.37 | 4.33 | -7.39 | 1.5756 | -0.2032 | |||

| AIFLF / Aiful Corporation | 1.71 | -2.69 | 4.28 | 11.67 | 1.5581 | 0.0995 | |||

| RCRUY / Recruit Holdings Co., Ltd. - Depositary Receipt (Common Stock) | 0.07 | -36.98 | 4.02 | -49.96 | 1.4650 | -1.5962 | |||

| KMTUY / Komatsu Ltd. - Depositary Receipt (Common Stock) | 0.14 | -2.79 | 3.93 | -6.78 | 1.4322 | -0.1745 | |||

| MIURF / Miura Co., Ltd. | 0.17 | 30.25 | 3.71 | 15.13 | 1.3527 | 0.1242 | |||

| HNWAF / Hanwa Co., Ltd. | 0.11 | -2.76 | 3.63 | 4.37 | 1.3208 | -0.0024 | |||

| NISTF / Nippon Steel Corporation | 0.16 | -2.77 | 3.40 | -1.42 | 1.2378 | -0.0750 | |||

| OLY1 / Olympus Corporation | 0.25 | 27.59 | 3.21 | 10.15 | 1.1694 | 0.0595 | |||

| TYHOF / Toyota Tsusho Corporation | 0.16 | -2.77 | 3.21 | 14.40 | 1.1687 | 0.1006 | |||

| HNDAF / Honda Motor Co., Ltd. | 0.31 | -2.72 | 3.17 | 4.59 | 1.1541 | 0.0002 | |||

| KHE / Kawasaki Heavy Industries, Ltd. | 0.05 | -2.69 | 3.02 | 28.52 | 1.1013 | 0.2053 | |||

| NXAGF / NEXTAGE Co., Ltd. | 0.23 | -2.70 | 2.91 | 25.66 | 1.0611 | 0.1780 | |||

| 01H / HORIBA, Ltd. | 0.04 | -2.33 | 2.86 | 6.51 | 1.0429 | 0.0192 | |||

| OJI / Oji Holdings Corporation | 0.58 | 110.49 | 2.76 | 146.07 | 1.0037 | 0.5771 | |||

| US76105Y1091 / T. Rowe Price Government Reserve Fund | 2.72 | 147.54 | 2.72 | 147.54 | 0.9897 | 0.5717 | |||

| 7202 / Isuzu Motors Limited | 0.20 | -2.71 | 2.70 | -2.70 | 0.9838 | -0.0732 | |||

| MDIKF / MODEC, Inc. | 0.09 | -2.80 | 2.64 | 43.55 | 0.9603 | 0.2606 | |||

| 4041 / Nippon Soda Co., Ltd. | 0.14 | -16.06 | 2.63 | -15.12 | 0.9571 | -0.2219 | |||

| 9WM / Nifco Inc. | 0.10 | -2.71 | 2.59 | 0.98 | 0.9417 | -0.0337 | |||

| NGKSF / Niterra Co., Ltd. | 0.08 | -2.71 | 2.57 | -8.18 | 0.9365 | -0.1296 | |||

| TKCBF / Tokai Carbon Co., Ltd. | 0.36 | -2.72 | 2.31 | 12.73 | 0.8417 | 0.0609 | |||

| SGAMF / Sega Sammy Holdings Inc. | 0.11 | -10.67 | 2.23 | -3.13 | 0.8124 | -0.0645 | |||

| KYCCF / Keyence Corporation | 0.01 | -1.92 | 2.13 | -4.78 | 0.7764 | -0.0763 | |||

| KNCAF / Konica Minolta, Inc. | 0.69 | 10.94 | 2.13 | -15.88 | 0.7755 | -0.1885 | |||

| IWJ / IHI Corporation | 0.03 | -42.49 | 2.10 | -24.69 | 0.7644 | -0.2971 | |||

| DACHF / Daicel Corporation | 0.25 | 96.08 | 2.09 | 88.79 | 0.7603 | 0.3389 | |||

| TKTYF / Tokyo Kiraboshi Financial Group, Inc. | 0.05 | 14.69 | 2.07 | 46.60 | 0.7528 | 0.2159 | |||

| 3941 / Rengo Co., Ltd. | 0.37 | 12.14 | 2.05 | 10.80 | 0.7472 | 0.0418 | |||

| 7SN / Suntory Beverage & Food Limited | 0.06 | -27.32 | 2.03 | -18.24 | 0.7379 | -0.2058 | |||

| TKSHF / Takashimaya Company, Limited | 0.26 | -2.70 | 1.98 | -11.63 | 0.7193 | -0.1318 | |||

| HKTGF / Hikari Tsushin, Inc. | 0.01 | -41.67 | 1.94 | -29.19 | 0.7070 | -0.3366 | |||

| XSZ / Shimizu Corporation | 0.18 | -2.69 | 1.93 | 19.93 | 0.7037 | 0.0900 | |||

| PO6 / Penta-Ocean Construction Co., Ltd. | 0.33 | -1.44 | 1.88 | 34.05 | 0.6841 | 0.1504 | |||

| 6407 / CKD Corporation | 0.12 | 1.78 | 0.6470 | 0.6470 | |||||

| JP3480470008 / Daiei Kankyo Co Ltd | 0.08 | -16.48 | 1.71 | -6.24 | 0.6237 | -0.0716 | |||

| DWBOF / Daiwabo Holdings Co., Ltd. | 0.10 | -2.79 | 1.71 | -15.43 | 0.6228 | -0.1471 | |||

| SNK / Sankyu Inc. | 0.04 | -15.75 | 1.68 | 3.19 | 0.6136 | -0.0079 | |||

| MTWTF / METAWATER Co., Ltd. | 0.12 | -2.74 | 1.67 | 16.69 | 0.6087 | 0.0633 | |||

| NMEHF / Nomura Real Estate Holdings, Inc. | 0.28 | 168.87 | 1.67 | -39.83 | 0.6079 | -0.4486 | |||

| 7729 / Tokyo Seimitsu Co., Ltd. | 0.03 | -2.61 | 1.67 | 14.80 | 0.6076 | 0.0542 | |||

| UN4 / Unicharm Corporation | 0.17 | 6.31 | 1.58 | 26.42 | 0.5751 | 0.0994 | |||

| 5FY / Resorttrust, Inc. | 0.15 | 94.55 | 1.54 | -4.52 | 0.5621 | -0.0532 | |||

| NTULF / BIPROGY Inc. | 0.05 | -2.99 | 1.49 | 2.48 | 0.5411 | -0.0107 | |||

| 5838 / Rakuten Bank, Ltd. | 0.03 | 1.39 | 0.5069 | 0.5069 | |||||

| TKUGF / Takeuchi Mfg. Co., Ltd. | 0.04 | 7.62 | 1.37 | -3.72 | 0.4992 | -0.0432 | |||

| 6652 / IDEC Corporation | 0.08 | -2.88 | 1.35 | -5.32 | 0.4924 | -0.0514 | |||

| JP3635510005 / TRYT INC | 0.40 | -2.72 | 1.35 | 20.66 | 0.4915 | 0.0656 | |||

| RNDOF / Round One Corporation | 0.21 | -2.73 | 1.33 | -28.46 | 0.4826 | -0.2227 | |||

| 6SN / Nakanishi Inc. | 0.10 | 21.14 | 1.30 | -4.13 | 0.4740 | -0.0429 | |||

| YAMCF / Yamaha Corporation | 0.18 | -2.73 | 1.30 | 0.46 | 0.4737 | -0.0190 | |||

| TC8UWNIO3 / DATAX SERIES E CVT PFD STOCK PP | 0.01 | 0.00 | 1.28 | 2.08 | 0.4654 | -0.0114 | |||

| KUBTF / Kubota Corporation | 0.11 | 52.45 | 1.23 | 41.26 | 0.4477 | 0.1162 | |||

| 4368 / Fuso Chemical Co.,Ltd. | 0.05 | 27.95 | 1.13 | 44.15 | 0.4126 | 0.1132 | |||

| 648 / Kyoritsu Maintenance Co., Ltd. | 0.05 | -2.81 | 1.10 | 4.27 | 0.4003 | -0.0012 | |||

| O4H / Open House Group Co., Ltd. | 0.02 | -3.00 | 1.00 | 31.50 | 0.3649 | 0.0747 | |||

| RGAKF / Rigaku Holdings Corporation | 0.12 | 0.75 | 0.2735 | 0.2735 | |||||

| NSC / Nissan Chemical Corporation | 0.02 | -3.27 | 0.69 | -5.97 | 0.2524 | -0.0282 | |||

| TC2TJ1ZX6 / ANDPAD INC SERIES D CVT PFD STK PP | 0.02 | 0.00 | 0.62 | 2.15 | 0.2250 | -0.0054 | |||

| TC7BECVT4 / FINC TECHNOLOGIES INC SR E CVT PFD PP | 0.23 | 0.00 | 0.52 | 8.51 | 0.1905 | 0.0069 |