Basic Stats

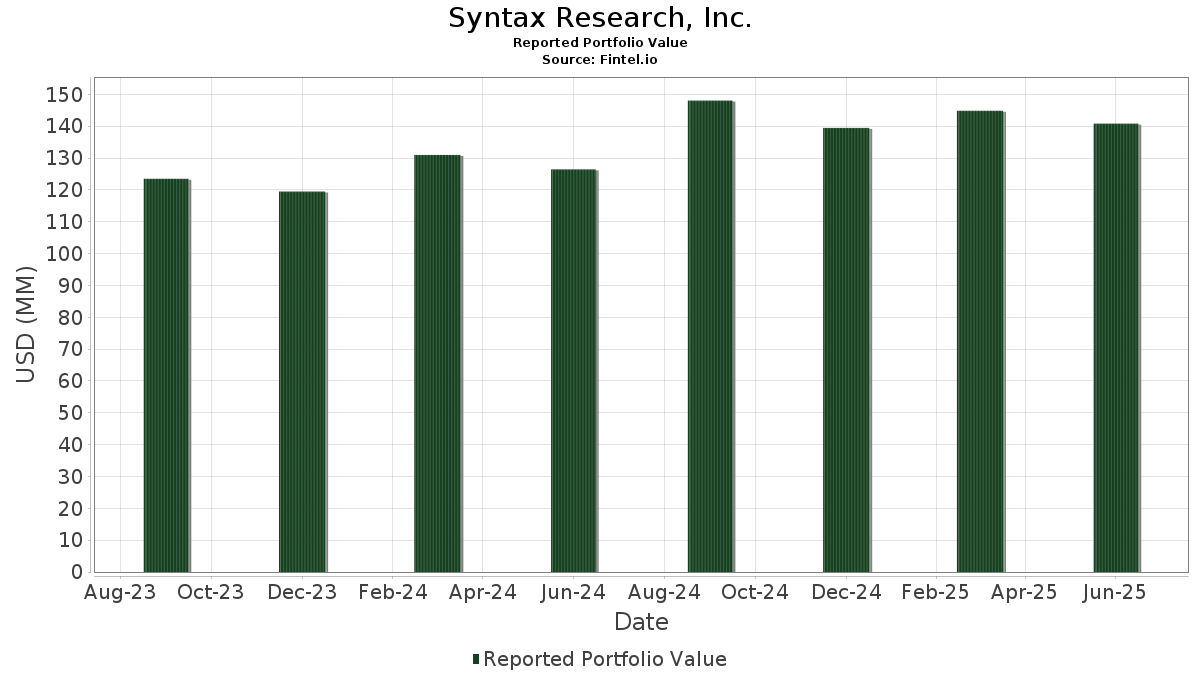

| Portfolio Value | $ 140,798,432 |

| Current Positions | 171 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Syntax Research, Inc. has disclosed 171 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 140,798,432 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Syntax Research, Inc.’s top holdings are iShares Trust - iShares Core S&P 500 ETF (US:IVV) , iShares Trust - iShares MSCI USA Value Factor ETF (US:VLUE) , iShares Trust - iShares 7-10 Year Treasury Bond ETF (US:IEF) , iShares Trust - iShares 1-3 Year Treasury Bond ETF (US:SHY) , and Apple Inc. (US:AAPL) . Syntax Research, Inc.’s new positions include Palo Alto Networks, Inc. (US:PANW) , Zoetis Inc. (US:ZTS) , Willis Towers Watson Public Limited Company (US:WTW) , Occidental Petroleum Corporation (US:OXY) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 2.38 | 1.6927 | 1.6927 | |

| 0.01 | 2.32 | 1.6446 | 1.6144 | |

| 0.01 | 2.17 | 1.5416 | 1.5416 | |

| 0.01 | 2.14 | 1.5212 | 1.5212 | |

| 0.01 | 1.99 | 1.3120 | 1.3120 | |

| 0.02 | 2.14 | 1.5188 | 1.1692 | |

| 0.00 | 1.50 | 0.9891 | 0.9891 | |

| 0.07 | 7.15 | 5.0793 | 0.9590 | |

| 0.02 | 15.02 | 9.9032 | 0.9278 | |

| 0.03 | 3.17 | 2.0898 | 0.9129 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.05 | 0.0343 | -2.3078 | |

| 0.00 | 0.02 | 0.0115 | -2.0604 | |

| 0.00 | 0.11 | 0.0719 | -1.9926 | |

| 0.00 | 0.32 | 0.2252 | -1.8840 | |

| 0.00 | 0.04 | 0.0272 | -1.8546 | |

| 0.05 | 1.82 | 1.1994 | -1.0124 | |

| 0.03 | 2.20 | 1.4532 | -0.9079 | |

| 0.04 | 2.67 | 1.7623 | -0.8980 | |

| 0.14 | 1.36 | 0.8964 | -0.6884 | |

| 0.08 | 6.84 | 4.5085 | -0.5944 |

13F and Fund Filings

This form was filed on 2025-07-21 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.02 | 4.55 | 15.02 | 15.53 | 9.9032 | 0.9278 | |||

| VLUE / iShares Trust - iShares MSCI USA Value Factor ETF | 0.07 | 15.47 | 7.88 | 22.57 | 5.1972 | 0.7577 | |||

| IEF / iShares Trust - iShares 7-10 Year Treasury Bond ETF | 0.07 | 19.34 | 7.15 | 19.84 | 5.0793 | 0.9590 | |||

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.08 | -7.64 | 6.84 | -7.48 | 4.5085 | -0.5944 | |||

| AAPL / Apple Inc. | 0.03 | -0.29 | 5.91 | -7.90 | 3.8974 | -0.5333 | |||

| NOBL / ProShares Trust - ProShares S&P 500 Dividend Aristocrats ETF | 0.05 | 9.44 | 5.52 | 7.86 | 3.6394 | 0.1063 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | 0.67 | 5.02 | 11.19 | 3.3089 | 0.1928 | |||

| AVGO / Broadcom Inc. | 0.02 | -11.67 | 4.22 | 45.40 | 2.7859 | 0.7801 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.06 | -0.87 | 3.97 | 5.36 | 2.8217 | 0.2185 | |||

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | 0.03 | 13.91 | 3.78 | 14.87 | 2.4912 | 0.2204 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.03 | -1.20 | 3.55 | 3.26 | 2.5196 | 0.1476 | |||

| GOOG / Alphabet Inc. | 0.02 | -4.76 | 3.51 | 8.12 | 2.4965 | 0.2523 | |||

| MSFT / Microsoft Corporation | 0.01 | 0.03 | 3.41 | 32.56 | 2.2475 | 0.4723 | |||

| ANET / Arista Networks Inc | 0.03 | 40.80 | 3.17 | 85.97 | 2.0898 | 0.9129 | |||

| PLD / Prologis, Inc. | 0.03 | -11.59 | 2.98 | -16.85 | 1.9652 | -0.5098 | |||

| QCOM / QUALCOMM Incorporated | 0.02 | 22.89 | 2.90 | 27.37 | 1.9155 | 0.3413 | |||

| FCX / Freeport-McMoRan Inc. | 0.06 | -24.38 | 2.74 | -13.42 | 1.8079 | -0.3784 | |||

| ORCL / Oracle Corporation | 0.01 | 13.65 | 2.73 | 77.81 | 1.9411 | 0.8793 | |||

| ACWX / iShares Trust - iShares MSCI ACWI ex U.S. ETF | 0.04 | -36.89 | 2.67 | -30.65 | 1.7623 | -0.8980 | |||

| PANW / Palo Alto Networks, Inc. | 0.01 | 2.38 | 1.6927 | 1.6927 | |||||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | 6,389.77 | 2.32 | 5,283.72 | 1.6446 | 1.6144 | |||

| FDX / FedEx Corporation | 0.01 | 0.05 | 2.26 | -6.73 | 1.4907 | -0.1824 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 1.43 | 2.24 | 19.88 | 1.4751 | 0.1866 | |||

| IEUR / iShares Trust - iShares Core MSCI Europe ETF | 0.03 | -41.44 | 2.20 | -35.57 | 1.4532 | -0.9079 | |||

| ZTS / Zoetis Inc. | 0.01 | 2.17 | 1.5416 | 1.5416 | |||||

| WTW / Willis Towers Watson Public Limited Company | 0.01 | 2.14 | 1.5212 | 1.5212 | |||||

| TLT / iShares Trust - iShares 20+ Year Treasury Bond ETF | 0.02 | 335.67 | 2.14 | 322.53 | 1.5188 | 1.1692 | |||

| ACN / Accenture plc | 0.01 | 1.99 | 1.3120 | 1.3120 | |||||

| SLB / Schlumberger Limited | 0.05 | -29.78 | 1.82 | -43.21 | 1.1994 | -1.0124 | |||

| QUAL / iShares Trust - iShares MSCI USA Quality Factor ETF | 0.01 | 8.54 | 1.76 | 16.15 | 1.1619 | 0.1142 | |||

| NOC / Northrop Grumman Corporation | 0.00 | 1.50 | 0.9891 | 0.9891 | |||||

| VALE / Vale S.A. - Depositary Receipt (Common Stock) | 0.14 | -39.13 | 1.36 | -40.78 | 0.8964 | -0.6884 | |||

| USMV / iShares Trust - iShares MSCI USA Min Vol Factor ETF | 0.01 | 116.41 | 1.34 | 116.96 | 0.9540 | 0.5264 | |||

| ELV / Elevance Health, Inc. | 0.00 | 1.17 | 0.7694 | 0.7694 | |||||

| FMC / FMC Corporation | 0.03 | -35.32 | 1.09 | -36.03 | 0.7158 | -0.4552 | |||

| COP / ConocoPhillips | 0.01 | -2.16 | 0.99 | -16.33 | 0.6522 | -0.1645 | |||

| BA / The Boeing Company | 0.00 | -5.21 | 0.95 | 16.38 | 0.6237 | 0.0629 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.00 | 0.94 | 15.28 | 0.6221 | 0.0572 | |||

| OXY / Occidental Petroleum Corporation | 0.02 | 0.84 | 0.5967 | 0.5967 | |||||

| RTX / RTX Corporation | 0.01 | -4.41 | 0.76 | 5.42 | 0.5391 | 0.0418 | |||

| CVX / Chevron Corporation | 0.01 | 15.75 | 0.74 | -0.94 | 0.4870 | -0.0277 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | 19.06 | 0.68 | 13.95 | 0.4473 | 0.0361 | |||

| UPS / United Parcel Service, Inc. | 0.01 | 11.68 | 0.66 | 2.50 | 0.4329 | -0.0094 | |||

| MDT / Medtronic plc | 0.01 | 10.99 | 0.57 | 7.58 | 0.3750 | 0.0103 | |||

| GOVT / iShares Trust - iShares U.S. Treasury Bond ETF | 0.02 | -2.46 | 0.51 | -2.47 | 0.3393 | -0.0250 | |||

| BLK / BlackRock, Inc. | 0.00 | 7.62 | 0.50 | 19.19 | 0.3323 | 0.0407 | |||

| TIP / iShares Trust - iShares TIPS Bond ETF | 0.00 | 1.39 | 0.50 | 0.40 | 0.3293 | -0.0140 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.50 | -8.81 | 0.3280 | -0.0485 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.01 | -54.88 | 0.50 | -50.20 | 0.3267 | -0.3601 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.10 | 0.48 | 3.65 | 0.3435 | 0.0217 | |||

| V / Visa Inc. | 0.00 | 0.08 | 0.45 | 1.35 | 0.2974 | -0.0098 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.12 | 0.45 | 17.54 | 0.2967 | 0.0329 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.04 | 0.39 | 13.95 | 0.2586 | 0.0211 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 0.39 | 4.86 | 0.2559 | -0.0001 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | 0.00 | 0.38 | 10.62 | 0.2473 | 0.0132 | |||

| INTC / Intel Corporation | 0.01 | 0.00 | 0.34 | -1.18 | 0.2386 | 0.0034 | |||

| MRK / Merck & Co., Inc. | 0.00 | -88.23 | 0.32 | -89.62 | 0.2252 | -1.8840 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.25 | 0.30 | 0.34 | 0.2114 | 0.0064 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | 0.33 | 0.27 | 36.50 | 0.1807 | 0.0424 | |||

| PAYX / Paychex, Inc. | 0.00 | 0.00 | 0.27 | -5.69 | 0.1886 | -0.0059 | |||

| BAC / Bank of America Corporation | 0.01 | 0.13 | 0.27 | 13.73 | 0.1883 | 0.0271 | |||

| VOT / Vanguard Index Funds - Vanguard Mid-Cap Growth ETF | 0.00 | 0.00 | 0.24 | 16.67 | 0.1570 | 0.0156 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.00 | 0.23 | 43.56 | 0.1545 | 0.0419 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.18 | 27.66 | 0.1192 | 0.0217 | |||

| WFC / Wells Fargo & Company | 0.00 | 0.00 | 0.16 | 11.64 | 0.1159 | 0.0149 | |||

| CSCO / Cisco Systems, Inc. | 0.00 | -21.51 | 0.16 | -12.15 | 0.1136 | -0.0116 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.00 | 0.00 | 0.16 | 5.44 | 0.1023 | 0.0008 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | 0.00 | 0.13 | -17.42 | 0.0848 | -0.0225 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.11 | 13.13 | 0.0742 | 0.0056 | |||

| ED / Consolidated Edison, Inc. | 0.00 | 0.00 | 0.11 | -9.76 | 0.0737 | -0.0113 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 0.11 | -5.22 | 0.0720 | -0.0079 | |||

| NEM / Newmont Corporation | 0.00 | -96.98 | 0.11 | -96.35 | 0.0719 | -1.9926 | |||

| BXP / Boston Properties, Inc. | 0.00 | -13.89 | 0.10 | -13.16 | 0.0654 | -0.0138 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.00 | 0.00 | 0.09 | 4.65 | 0.0600 | 0.0002 | |||

| PECO / Phillips Edison & Company, Inc. | 0.00 | 0.00 | 0.09 | -4.35 | 0.0584 | -0.0053 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 0.08 | 31.15 | 0.0530 | 0.0107 | |||

| CMCSA / Comcast Corporation | 0.00 | 0.33 | 0.07 | -3.90 | 0.0494 | -0.0039 | |||

| DRI / Darden Restaurants, Inc. | 0.00 | 0.00 | 0.07 | 4.29 | 0.0484 | 0.0001 | |||

| AMGN / Amgen Inc. | 0.00 | 0.00 | 0.07 | -9.59 | 0.0436 | -0.0073 | |||

| TSLA / Tesla, Inc. | 0.00 | -45.33 | 0.07 | -32.99 | 0.0463 | -0.0208 | |||

| JNJ / Johnson & Johnson | 0.00 | 0.00 | 0.06 | -8.82 | 0.0446 | -0.0025 | |||

| DIS / The Walt Disney Company | 0.00 | 0.00 | 0.06 | 25.53 | 0.0390 | 0.0065 | |||

| GMED / Globus Medical, Inc. | 0.00 | 0.00 | 0.06 | -19.18 | 0.0419 | -0.0086 | |||

| NEE / NextEra Energy, Inc. | 0.00 | 0.00 | 0.06 | -1.79 | 0.0368 | -0.0025 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 0.05 | 18.18 | 0.0372 | 0.0065 | |||

| AMT / American Tower Corporation | 0.00 | -98.49 | 0.05 | -98.47 | 0.0343 | -2.3078 | |||

| IYF / iShares Trust - iShares U.S. Financials ETF | 0.00 | 0.00 | 0.05 | 6.67 | 0.0322 | 0.0008 | |||

| HPQ / HP Inc. | 0.00 | 0.00 | 0.05 | -11.54 | 0.0306 | -0.0057 | |||

| HON / Honeywell International Inc. | 0.00 | 0.00 | 0.04 | 10.00 | 0.0293 | 0.0014 | |||

| IWO / iShares Trust - iShares Russell 2000 Growth ETF | 0.00 | 0.00 | 0.04 | 10.81 | 0.0275 | 0.0018 | |||

| DOW / Dow Inc. | 0.00 | -98.01 | 0.04 | -98.50 | 0.0272 | -1.8546 | |||

| HPE / Hewlett Packard Enterprise Company | 0.00 | 0.00 | 0.04 | 31.03 | 0.0256 | 0.0054 | |||

| VZ / Verizon Communications Inc. | 0.00 | 0.00 | 0.04 | -5.00 | 0.0252 | -0.0025 | |||

| EMR / Emerson Electric Co. | 0.00 | -93.46 | 0.03 | -92.14 | 0.0221 | -0.2686 | |||

| KR / The Kroger Co. | 0.00 | 0.00 | 0.03 | 6.90 | 0.0205 | 0.0002 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.00 | 0.00 | 0.03 | 7.14 | 0.0202 | 0.0004 | |||

| GD / General Dynamics Corporation | 0.00 | 0.00 | 0.03 | 7.41 | 0.0192 | 0.0004 | |||

| SCHF / Schwab Strategic Trust - Schwab International Equity ETF | 0.00 | 0.72 | 0.03 | 12.50 | 0.0184 | 0.0013 | |||

| SBUX / Starbucks Corporation | 0.00 | 0.00 | 0.03 | -6.90 | 0.0181 | -0.0022 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.00 | 0.00 | 0.03 | 4.00 | 0.0175 | -0.0004 | |||

| KLAC / KLA Corporation | 0.00 | 0.00 | 0.03 | 31.58 | 0.0171 | 0.0035 | |||

| NOW / ServiceNow, Inc. | 0.00 | 0.00 | 0.03 | 31.58 | 0.0169 | 0.0032 | |||

| CVS / CVS Health Corporation | 0.00 | 0.00 | 0.03 | 0.00 | 0.0169 | -0.0005 | |||

| NVDA / NVIDIA Corporation | 0.00 | 0.00 | 0.03 | 47.06 | 0.0167 | 0.0047 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.00 | 0.00 | 0.02 | 4.55 | 0.0156 | -0.0002 | |||

| CBOE / Cboe Global Markets, Inc. | 0.00 | 0.00 | 0.02 | 4.55 | 0.0166 | 0.0009 | |||

| GM / General Motors Company | 0.00 | 0.00 | 0.02 | 4.76 | 0.0151 | -0.0000 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.00 | 0.02 | -4.35 | 0.0150 | -0.0011 | |||

| IWP / iShares Trust - iShares Russell Mid-Cap Growth ETF | 0.00 | 0.00 | 0.02 | 15.79 | 0.0148 | 0.0017 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.00 | 0.02 | -4.35 | 0.0158 | -0.0003 | |||

| ALC / Alcon Inc. | 0.00 | 0.00 | 0.02 | -4.35 | 0.0146 | -0.0018 | |||

| PFE / Pfizer Inc. | 0.00 | 0.00 | 0.02 | -4.55 | 0.0139 | -0.0013 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.00 | 0.02 | -42.86 | 0.0138 | -0.0104 | |||

| ADBE / Adobe Inc. | 0.00 | 0.00 | 0.02 | 5.26 | 0.0143 | 0.0005 | |||

| HDV / iShares Trust - iShares Core High Dividend ETF | 0.00 | 0.00 | 0.02 | 0.00 | 0.0127 | -0.0010 | |||

| MDLZ / Mondelez International, Inc. | 0.00 | 0.00 | 0.02 | 0.00 | 0.0120 | -0.0006 | |||

| NTR / Nutrien Ltd. | 0.00 | -99.50 | 0.02 | -99.43 | 0.0115 | -2.0604 | |||

| XOM / Exxon Mobil Corporation | 0.00 | 0.00 | 0.02 | -11.11 | 0.0108 | -0.0017 | |||

| T / AT&T Inc. | 0.00 | 0.00 | 0.02 | 0.00 | 0.0102 | -0.0002 | |||

| C / Citigroup Inc. | 0.00 | 0.00 | 0.02 | 25.00 | 0.0100 | 0.0013 | |||

| CL / Colgate-Palmolive Company | 0.00 | 0.00 | 0.01 | -6.67 | 0.0107 | -0.0000 | |||

| USB / U.S. Bancorp | 0.00 | 0.00 | 0.01 | 7.69 | 0.0097 | 0.0002 | |||

| MO / Altria Group, Inc. | 0.00 | 0.00 | 0.01 | -6.67 | 0.0097 | -0.0007 | |||

| VTR / Ventas, Inc. | 0.00 | 0.00 | 0.01 | -6.67 | 0.0096 | -0.0013 | |||

| KO / The Coca-Cola Company | 0.00 | 0.00 | 0.01 | 0.00 | 0.0093 | -0.0006 | |||

| DE / Deere & Company | 0.00 | 0.00 | 0.01 | 8.33 | 0.0098 | 0.0010 | |||

| SHW / The Sherwin-Williams Company | 0.00 | 0.00 | 0.01 | 0.00 | 0.0095 | 0.0001 | |||

| PEP / PepsiCo, Inc. | 0.00 | 0.00 | 0.01 | -7.14 | 0.0087 | -0.0016 | |||

| MELI / MercadoLibre, Inc. | 0.00 | 0.00 | 0.01 | 44.44 | 0.0086 | 0.0019 | |||

| MNST / Monster Beverage Corporation | 0.00 | 0.00 | 0.01 | 9.09 | 0.0083 | 0.0002 | |||

| CRSP / CRISPR Therapeutics AG | 0.00 | 0.00 | 0.01 | 50.00 | 0.0086 | 0.0028 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.01 | 9.09 | 0.0079 | -0.0003 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 0.00 | 0.01 | 22.22 | 0.0076 | 0.0013 | |||

| SJM / The J. M. Smucker Company | 0.00 | 0.00 | 0.01 | -23.08 | 0.0073 | -0.0019 | |||

| CSX / CSX Corporation | 0.00 | 0.00 | 0.01 | 11.11 | 0.0070 | 0.0004 | |||

| GH / Guardant Health, Inc. | 0.00 | 0.00 | 0.01 | 25.00 | 0.0069 | 0.0010 | |||

| CWB / SPDR Series Trust - SPDR Bloomberg Convertible Securities ETF | 0.00 | -47.19 | 0.01 | -41.18 | 0.0067 | -0.0056 | |||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | 0.00 | 0.00 | 0.01 | 12.50 | 0.0062 | 0.0005 | |||

| AMAT / Applied Materials, Inc. | 0.00 | 0.00 | 0.01 | 14.29 | 0.0059 | 0.0010 | |||

| CARR / Carrier Global Corporation | 0.00 | 0.00 | 0.01 | 14.29 | 0.0057 | 0.0005 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 0.00 | 0.01 | 33.33 | 0.0056 | 0.0011 | |||

| WYNN / Wynn Resorts, Limited | 0.00 | 0.00 | 0.01 | 14.29 | 0.0055 | 0.0004 | |||

| UAL / United Airlines Holdings, Inc. | 0.00 | 0.00 | 0.01 | 16.67 | 0.0053 | 0.0005 | |||

| PFF / iShares Trust - iShares Preferred and Income Securities ETF | 0.00 | -52.43 | 0.01 | -56.25 | 0.0056 | -0.0058 | |||

| CCJ / Cameco Corporation | 0.00 | 0.00 | 0.01 | 75.00 | 0.0049 | 0.0021 | |||

| CCL / Carnival Corporation & plc | 0.00 | 0.00 | 0.01 | 40.00 | 0.0048 | 0.0013 | |||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.01 | 0.00 | 0.0048 | -0.0006 | |||

| DD / DuPont de Nemours, Inc. | 0.00 | 0.00 | 0.01 | -14.29 | 0.0045 | -0.0006 | |||

| BX / Blackstone Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0044 | 0.0001 | |||

| MGM / MGM Resorts International | 0.00 | 0.00 | 0.01 | 20.00 | 0.0043 | 0.0004 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.01 | -16.67 | 0.0039 | -0.0003 | |||

| OTIS / Otis Worldwide Corporation | 0.00 | 0.00 | 0.01 | -16.67 | 0.0041 | -0.0001 | |||

| ALL / The Allstate Corporation | 0.00 | 0.00 | 0.01 | 0.00 | 0.0040 | 0.0000 | |||

| LVS / Las Vegas Sands Corp. | 0.00 | 0.00 | 0.01 | 25.00 | 0.0037 | 0.0003 | |||

| HE / Hawaiian Electric Industries, Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0036 | -0.0003 | |||

| VKTX / Viking Therapeutics, Inc. | 0.00 | 0.00 | 0.01 | 25.00 | 0.0038 | 0.0004 | |||

| SHYG / iShares Trust - iShares 0-5 Year High Yield Corporate Bond ETF | 0.00 | -35.45 | 0.01 | -37.50 | 0.0035 | -0.0021 | |||

| IGSB / iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF | 0.00 | 0.00 | 0.01 | 0.00 | 0.0034 | -0.0001 | |||

| DAL / Delta Air Lines, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0032 | 0.0002 | |||

| WMT / Walmart Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0032 | 0.0002 | |||

| LUV / Southwest Airlines Co. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0030 | -0.0002 | |||

| QCLN / First Trust Exchange-Traded Fund - First Trust NASDAQ Clean Edge Green Energy Index Fund | 0.00 | 0.00 | 0.00 | 50.00 | 0.0022 | 0.0002 | |||

| AIA / iShares Trust - iShares Asia 50 ETF | 0.00 | 0.00 | 0.00 | 0.00 | 0.0019 | 0.0001 | |||

| MRNA / Moderna, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0018 | -0.0001 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0017 | -0.0002 | |||

| DXC / DXC Technology Company | 0.00 | 0.00 | 0.00 | 0.00 | 0.0018 | -0.0001 | |||

| AAL / American Airlines Group Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0015 | 0.0000 | |||

| CCCC / C4 Therapeutics, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0010 | -0.0001 | |||

| QS / QuantumScape Corporation | 0.00 | 0.00 | 0.00 | 0.0007 | 0.0002 | ||||

| LXRX / Lexicon Pharmaceuticals, Inc. | 0.00 | 0.00 | 0.00 | 0.0001 | 0.0000 | ||||

| ITA / iShares Trust - iShares U.S. Aerospace & Defense ETF | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | -0.0167 | |||

| CME / CME Group Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CLX / The Clorox Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CUBE / CubeSmart | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LDOS / Leidos Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CRED / Columbia ETF Trust I - Columbia Research Enhanced Real Estate ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WM / Waste Management, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XLRE / The Select Sector SPDR Trust - The Real Estate Select Sector SPDR Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| COLD / Americold Realty Trust, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IEMG / iShares, Inc. - iShares Core MSCI Emerging Markets ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DLR / Digital Realty Trust, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WY / Weyerhaeuser Company | 0.00 | -100.00 | 0.00 | 0.0000 |