Basic Stats

| Portfolio Value | $ 51,802,000 |

| Current Positions | 44 |

Latest Holdings, Performance, AUM (from 13F, 13D)

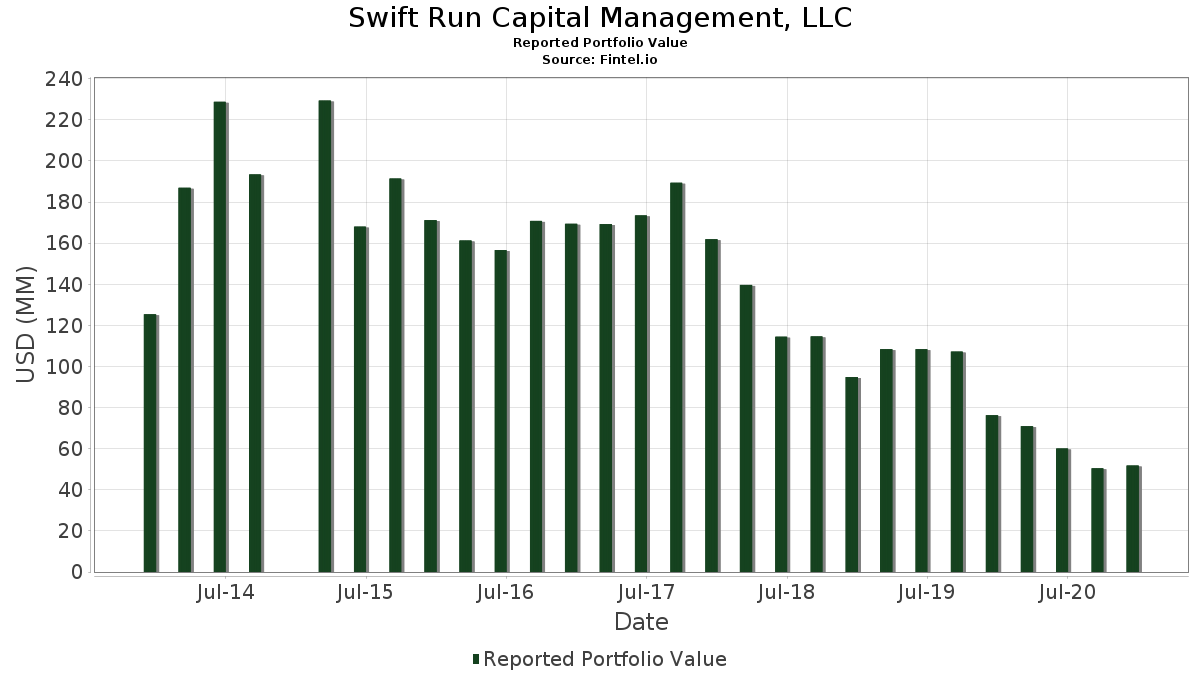

Swift Run Capital Management, LLC has disclosed 44 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 51,802,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Swift Run Capital Management, LLC’s top holdings are Berkshire Hathaway Inc. (US:BRK.B) , Vanguard Scottsdale Funds - Vanguard Short-Term Treasury Index Fund Institutional Shares (US:VSBIX) , Comcast Corporation (US:CMCSA) , Liberty Media Corp. (New Liberty SiriusXM) Series C (US:LSXMK) , and Huntsman Corporation (US:HUN) . Swift Run Capital Management, LLC’s new positions include SPDR S&P 500 ETF (US:SPY) , Starbucks Corporation (US:SBUX) , Colony Capital, Inc. Bond (US:US19624RAA41) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.07 | 1.10 | 2.1273 | 1.3844 | |

| 0.01 | 0.76 | 1.4575 | 0.8809 | |

| 0.03 | 6.51 | 12.5632 | 0.8381 | |

| 0.02 | 1.30 | 2.5057 | 0.7444 | |

| 0.04 | 1.84 | 3.5520 | 0.7128 | |

| 0.06 | 2.64 | 5.0963 | 0.6068 | |

| 0.03 | 1.16 | 2.2354 | 0.5633 | |

| 0.00 | 0.29 | 0.5521 | 0.5521 | |

| 0.01 | 1.05 | 2.0212 | 0.5451 | |

| 0.01 | 0.27 | 0.5270 | 0.5270 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.9342 | ||

| 0.00 | 0.00 | -1.0659 | ||

| 0.09 | 5.38 | 10.3799 | -0.6398 | |

| 0.05 | 0.71 | 1.3745 | -0.5771 | |

| 0.19 | 0.3629 | -0.5603 | ||

| 0.00 | 0.49 | 0.9382 | -0.5596 | |

| 0.00 | 0.00 | -0.4854 | ||

| 0.00 | 0.00 | -0.4359 | ||

| 0.01 | 1.56 | 3.0134 | -0.1982 | |

| 0.06 | 1.17 | 2.2528 | -0.1564 |

13F and Fund Filings

This form was filed on 2021-02-02 for the reporting period 2020-12-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BRK.B / Berkshire Hathaway Inc. | 0.03 | 1.00 | 6.51 | 9.97 | 12.5632 | 0.8381 | |||

| VSBIX / Vanguard Scottsdale Funds - Vanguard Short-Term Treasury Index Fund Institutional Shares | 0.09 | -2.56 | 5.38 | -3.33 | 10.3799 | -0.6398 | |||

| CMCSA / Comcast Corporation | 0.08 | -4.80 | 4.38 | 7.82 | 8.4630 | 0.4072 | |||

| LSXMK / Liberty Media Corp. (New Liberty SiriusXM) Series C | 0.06 | -11.41 | 2.64 | 16.50 | 5.0963 | 0.6068 | |||

| HUN / Huntsman Corporation | 0.10 | -9.65 | 2.46 | 2.28 | 4.7546 | -0.0162 | |||

| LSXMA / Liberty Media Corp. (New Liberty SiriusXM) Series A | 0.04 | -1.38 | 1.84 | 28.40 | 3.5520 | 0.7128 | |||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 0.07 | -11.23 | 1.72 | 14.02 | 3.3281 | 0.3324 | |||

| MSFT / Microsoft Corporation | 0.01 | -8.89 | 1.56 | -3.70 | 3.0134 | -0.1982 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.88 | 1.49 | 4.35 | 2.8725 | 0.0472 | |||

| GRA / W.R. Grace & Co. | 0.03 | -9.04 | 1.46 | 23.79 | 2.8223 | 0.4824 | |||

| LIN / Linde plc | 0.01 | 0.53 | 1.44 | 11.27 | 2.7837 | 0.2160 | |||

| BX / Blackstone Inc. | 0.02 | 17.62 | 1.30 | 46.01 | 2.5057 | 0.7444 | |||

| BSV / Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF | 0.01 | 0.00 | 1.22 | -0.16 | 2.3532 | -0.0659 | |||

| HHC / Howard Hughes Corporation | 0.02 | -10.87 | 1.19 | 22.15 | 2.2991 | 0.3674 | |||

| VRT / Vertiv Holdings Co | 0.06 | -11.04 | 1.17 | -4.03 | 2.2528 | -0.1564 | |||

| MPC / Marathon Petroleum Corporation | 0.03 | -2.68 | 1.16 | 37.20 | 2.2354 | 0.5633 | |||

| US30224P2002 / Extended Stay America Inc | 0.07 | 137.31 | 1.10 | 193.87 | 2.1273 | 1.3844 | |||

| HCA / HCA Healthcare, Inc. | 0.01 | 6.56 | 1.05 | 40.54 | 2.0212 | 0.5451 | |||

| AAPL / Apple Inc. | 0.01 | 19.85 | 0.94 | 37.35 | 1.8243 | 0.4611 | |||

| JNJ / Johnson & Johnson | 0.01 | 4.59 | 0.88 | 10.58 | 1.6949 | 0.1218 | |||

| KO / The Coca-Cola Company | 0.02 | -5.81 | 0.84 | 4.58 | 1.6293 | 0.0304 | |||

| WSFS / WSFS Financial Corporation | 0.02 | -29.22 | 0.83 | 17.82 | 1.6080 | 0.2073 | |||

| V / Visa Inc. | 0.00 | -3.02 | 0.83 | 6.01 | 1.6003 | 0.0510 | |||

| GM / General Motors Company | 0.02 | 8.72 | 0.83 | 52.96 | 1.5945 | 0.5247 | |||

| DIS / The Walt Disney Company | 0.00 | 0.00 | 0.76 | 46.07 | 1.4691 | 0.4368 | |||

| VLO / Valero Energy Corporation | 0.01 | 98.81 | 0.76 | 159.45 | 1.4575 | 0.8809 | |||

| KMI / Kinder Morgan, Inc. | 0.05 | -34.82 | 0.71 | -27.72 | 1.3745 | -0.5771 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.01 | 0.00 | 0.55 | 0.54 | 1.0695 | -0.0222 | |||

| DXCM / DexCom, Inc. | 0.00 | -28.39 | 0.49 | -35.71 | 0.9382 | -0.5596 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.00 | 0.00 | 0.39 | 13.24 | 0.7432 | 0.0696 | |||

| MRK / Merck & Co., Inc. | 0.00 | 0.00 | 0.37 | -1.34 | 0.7085 | -0.0286 | |||

| MKL / Markel Group Inc. | 0.00 | 0.00 | 0.34 | 6.17 | 0.6641 | 0.0221 | |||

| APO / Apollo Global Management, Inc. | 0.01 | 0.00 | 0.33 | 9.54 | 0.6428 | 0.0405 | |||

| ABT / Abbott Laboratories | 0.00 | 20.83 | 0.32 | 21.84 | 0.6139 | 0.0968 | |||

| ABBV / AbbVie Inc. | 0.00 | 20.83 | 0.31 | 48.10 | 0.6004 | 0.1843 | |||

| VZ / Verizon Communications Inc. | 0.01 | 0.00 | 0.31 | -1.29 | 0.5907 | -0.0235 | |||

| AMGN / Amgen Inc. | 0.00 | 0.00 | 0.31 | -9.73 | 0.5907 | -0.0809 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.29 | 0.5521 | 0.5521 | |||||

| PFE / Pfizer Inc. | 0.01 | 0.27 | 0.5270 | 0.5270 | |||||

| WBA / Walgreens Boots Alliance, Inc. | 0.01 | 0.00 | 0.27 | 11.30 | 0.5135 | 0.0400 | |||

| SBUX / Starbucks Corporation | 0.00 | 0.21 | 0.4035 | 0.4035 | |||||

| USIG / iShares Trust - iShares Broad USD Investment Grade Corporate Bond ETF | 0.00 | 0.00 | 0.21 | 1.95 | 0.4035 | -0.0027 | |||

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | 0.00 | 0.00 | 0.21 | 2.48 | 0.3996 | -0.0006 | |||

| US19624RAA41 / Colony Capital, Inc. Bond | 0.19 | -59.66 | 0.3629 | -0.5603 | |||||

| FOX / Fox Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.4854 | ||||

| DFFN / Diffusion Pharmaceuticals Inc | 0.00 | -100.00 | 0.00 | -100.00 | -0.0337 | ||||

| DAL / Delta Air Lines, Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -1.0659 | |||

| FOXA / Fox Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.4359 | ||||

| HON / Honeywell International Inc. | Call | 0.00 | -100.00 | 0.00 | -100.00 | -2.9342 |